AT&T: Cautious Optimism

Summary:

- Focused AT&T Inc. may earn some trust back.

- And that focus actually opens up growth prospects in previously “blind” spots.

- AT&T stock’s technical setup is strong as we head into 2023.

- AT&T debt and management track record remain areas to be monitored.

Justin Sullivan

You can’t fault AT&T Inc. (NYSE:T) investors for pinching themselves over the past few days (or even the entire year, actually) given the strength shown by the stock. We were all used to the stock selling off on good news, bad news, good market days, and bad market days alike. What changed? One word. Focus. After failing miserably in trying to be a Jack of all trades, it appears AT&T is finally back on track to challenge being the Master of one, as covered in this analyst coverage on Seeking Alpha. Argus Research argues there that AT&T is a more focused company now, and as a result is resilient to the current economic challenges. I agree with this analysis and present a few reasons to be optimistic about AT&T as we head into 2023.

But before that, a quick recap on AT&T’s 2022. AT&T investors can mark 2022 as the year of turnaround, as:

- the inevitable dividend reduction is out of the way (Yea, you can call it a spinoff if you want).

- the media distraction (fantasy in hindsight) is out of the way.

- the stock has outperformed the market significantly: flat year-to-date vs. the S&P 500’s -17% so far.

How does the stock look as we head into 2023?

Focus

Progressive and organic growth leading to multiple revenue streams is always welcome. But, in hindsight, AT&T just went on an acquisition spree aided by massive leverage, thanks to the low cost of borrowing. Actually, that is not really hindsight, as many called out AT&T for its debt during each of those acquisitions.

However, as indicated in the Argus Research upgrade, the “new” AT&T is focused on Communications. Isn’t that ironic? The missteps were so monumental that a telecommunications company focusing on its core business is being applauded. The business world has rarely seen a “Jack of all trades” thump those who are Masters in a niche.

Fundamental Strength

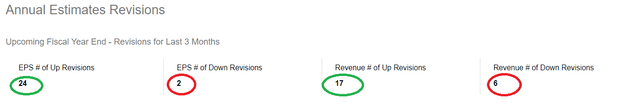

- With focus comes the results. In an market environment where earnings estimates are being revised down almost daily, AT&T has had many upward revisions as shown below.

ATT EPS Revisions (Seekingalpha.com)

- AT&T is basically a utility company. Almost every individual and certainly every business is using and upgrading their services. Even in the current high inflationary environment, the “basic” nature of their products and services are underscored, as recently highlighted by AT&T’s COO:

“I mean while you’ve got high inflation and certainly maybe some stress in the economy, you’re seeing high demand for products and services like which we offer and our industry offers in broadband connectivity via wireless or fiber,” McElfresh said. “And so it’s an interesting dichotomy, John, when you’re in a business like we’re in as you mentioned, it’s large scale.”

- AT&T is showing unexpected strength in Wireless, while improving Average Revenue Per User (“ARPU”) and reducing churn, as indicated in the Seeking Alpha news items linked above. Who would have thought?

- It is no secret that Metaverse is the next growth driver for many companies. Whether it is Meta Platforms (META) or Microsoft Corporation (MSFT) or a surprise winner like Tesla (TSLA), a reliable, strong, and growing network is key. Enter 5G. AT&T is very well aware of this and positioning itself to succeed here, as evidenced by the expanding 5G coverage.

- Did you observe the commonalities in the four bullets above? Every single one of these growth drivers is in AT&T’s core business. Have you ever searched for a lost item for a long time, only to find it in the first place that you supposedly looked? Focus does open up opportunities in previous blind spots.

Technical Strength

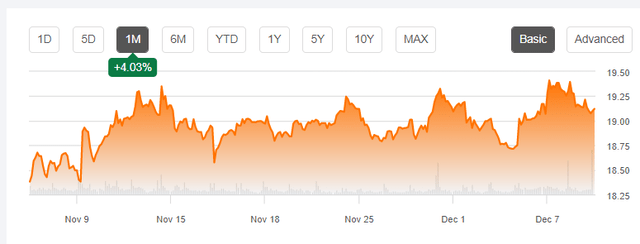

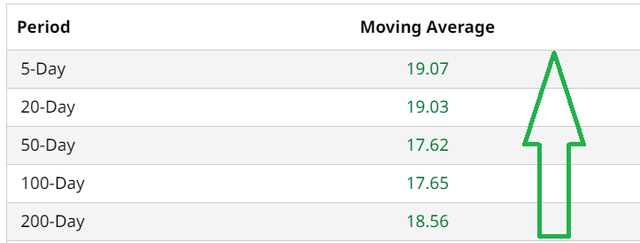

In a down-trending market, it is rare to see a stock showing the technical strength that AT&T is currently exhibiting. The stock is acting extremely strong recently, as supported by the 5- and 20-Day moving averages. In addition, AT&T has also taken out the longer term averages including the most important 200-Day moving average. That shows a stock in overall accumulation that is accelerating.

ATT Chart (Seekingalpha.com) ATT Moving Avg (www.barchart.com)

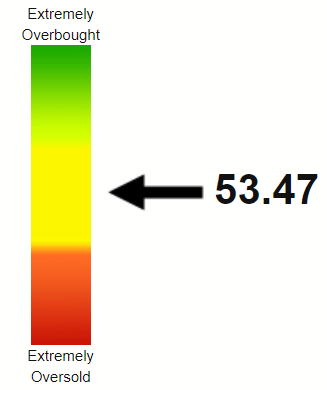

But does that mean the stock is overbought here? Not quite, as shown by a Relative Strength Index (“RSI”) of 53.47. That’s in the sweet spot, as the stock is far from overbought levels, suggesting more technical room to the upside.

ATT RSI (stockrsi.com)

Macro

No matter how well a company does, the stock’s performance is influenced by the general market conditions. For a change, AT&T is in a favorable position here, too. With high-risk and high multiple names out of favor, a stock yielding 6% trading at a forward multiple of 7 sounds much safer.

AT&T does have a high-debt problem, but unless the company taps into the new credit facility, this is a known situation and should not worsen the fundamentals.

Conclusion

The sections covered in the article show there are reasons to be optimistic about AT&T here. However, there are caution signs as well, especially around the debt situation. And the less spoken about the management, the better. It is not an overstatement to say they don’t have the trust of the average retail investor.

AT&T still retains a large position in my portfolio, and I continue reinvesting the dividends as we head into 2023, but I am not adding more as yet due to the heavy allocation as is. However, if you believe you don’t have enough exposure to the stock, adding in the $18 to $20 range may not be a bad idea. Using Argus Research’s 2023 EPS of $2.62 and AT&T’s five year median P/E of ~9, we arrive at a price target of $23.58, which is a nice 24% gain, not including the near 6% yield.

Does AT&T stock deserve a higher multiple, say 10? Perhaps not. But does AT&T deserve its little moment of glory in 2022, and would it welcome one more in 2023 after years of pain? Absolutely yes.

Disclosure: I/we have a beneficial long position in the shares of T, META, TSLA, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.