Summary:

- Disney’s growth strategy toward streaming was successful for its revenue growth, but at the expense of profitability.

- Its new pricing strategy and ad-supported tier are good steps to improve profitability in DTC, but reaching breakeven is not an easy task.

- Disney needs to control costs and reduce debt levels, plus its valuation is not particularly cheap, thus investors should avoid DIS stock.

Charley Gallay

The Walt Disney Company (NYSE:DIS) has pursued a growth strategy in its direct-to-consumer offerings, which was successful for its top-line growth, but quite negative for its profitability and indebtedness. Disney needs to change this profile rapidly and reach breakeven in streaming fast, which is not an easy task.

Background

I’ve covered Disney about five years ago, when the company was facing some structural issues and was changing its business growth strategy toward streaming services. As I’m a “growth” investor and the company’s growth strategy had plenty of execution risks, I didn’t buy its shares for my personal portfolio.

However, as “growth” stocks are currently in a downtrend, I’m again looking for other types of investments to balance my portfolio, looking for companies that have a leadership position in their industry that’s not easy to challenge and also may have some upside potential over the medium to long term.

Disney fits quite well this description, considering that it’s the world’s largest media conglomerate and has one of the most valuable brands worldwide, thus I think it’s now a good time to revisit its investment case to see if its shares offer value for long-term investors or not.

Walt Disney Overview

The Walt Disney Company is an entertainment company with a very good business diversification, considering that it has operations across media networks, studio entertainment, theme parks, consumer products, direct-to-consumer services, and interactive media. Disney has some of the most valuable assets and franchises in the media industry, and has one of the world’s most valuable brands, valued at some $50 billion, according to Interbrand.

Disney has a very long history, given that it was founded in 1924 and has been listed since 1940, being traded on the New York Stock Exchange and has a market capitalization of about $168 billion.

Its business operations are divided across two major segments, namely Disney Media and Entertainment Distribution, and Disney Parks, Experiences and Products. In its last fiscal year 2022 (FY 2022), which ended last Oct. 1, Disney’s total revenue amounted to close to $84 billion. Its largest segment, measured by revenue, was Disney Media with a weight of about 66%, while Disney Parks had a weight of 34%. Within the Disney Media segment, DTC offerings generated revenue of $19.5 billion during the last fiscal year, or some 23% of total revenue.

This business profile is not much different from about five years ago, even though its total revenue increased from about $55 billion in FY 2017 to $83.7 billion last year. Nevertheless, Disney was quite exposed to its parks & resorts segment (which represented about 30% of total revenue in 2017), which means that Disney was quite affected by COVID-19, as the company’s theme parks, resorts, and cruises were closed during the pandemic, affecting negatively its revenue and earnings over the past three fiscal years.

On the other hand, Disney’s DTC offerings increased their weight on total revenue in a very significant way and it’s now its main growth engine. Indeed, in the last FY, DTC’s revenue increased by 20% YoY, while overall Disney Media revenue increased by 8% YoY, as Linear Networks reported an increase of only 1% YoY and content sales/licensing increased by 11% YoY. While its Disney Parks, Experiences and Products segment reported revenue growth of 73% YoY in FY 2022, this comes from a low base in the previous year due to the pandemic (revenue of $16.5 billion in FY 2021 vs. $26.2 billion in FY 2019) and therefore growth rates should normalize in the coming quarters.

While Disney has a relatively good business diversification, one of its most important assets still remains cable networks, especially ESPN. In the last fiscal year, linear networks were responsible for $28.3 billion in revenue (34% of total revenue), and this segment is one of the company’s most profitable ones, with an operating margin of about 30% (vs. an overall operating margin of 14.5% for Disney). However, this is a business segment that continues to be in structural decline, and not surprisingly Disney’s growth strategy has shifted to direct-to-consumer offerings during the past few years.

Growth Strategy

While ESPN was one of the company’s most valuable assets, it was losing subscribers due to some structural changes in the media industry, as more people were moving from cable to streaming services. This was creating a lot of pressure on Disney’s business model, as the company was not in a position to compete with streaming competitors, particularly given that it had an output deal with Netflix (NFLX).

However, the company acknowledged that its leadership position in the media industry was at risk, and decided to take some risks by starting its own direct-to-consumer offerings and ending its output deal, losing about $300 million in annual revenue derived from Netflix.

Disney’s growth strategy was then shifted to debut its own online ESPN service, which was launched in April 2018 (ESPN+), showing that Disney was adapting itself to the evolving landscape of the media industry, which is seeing much more competition than a few years ago as consumers were leaving traditional distribution platforms at a rapid pace.

At the end of 2019, Disney then launched the Disney+ DTC service, first in the U.S., Canada, and The Netherlands, but was rapidly expanded worldwide. Disney+ can be considered a success story, as the streaming service has a very good subscriber growth history, reaching some 164 million subscribers as of Oct. 1, 2022. In addition to Disney+ subscribers, Disney has some 24 million ESPN+ subscribers and some 47.2 million Hulu subscribers. This means that Disney’s DTC offerings have some 235 million subscribers, which is slightly higher than Netflix’s current number of subscribers.

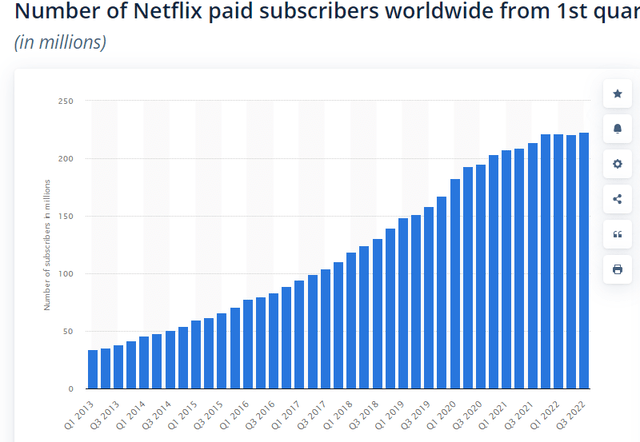

This is an outstanding achievement during a very short period of time, which also can be explained by the pandemic, which boosted demand for these types of services, but shows that Disney’s strategy to launch its own DTC offerings was the right one, as its popular brands and franchises were a strong competitive advantage to gain a strong position in the streaming industry. As can be seen in the next graph, Netflix took much more time to reach the same number of customers, showing that Disney’s growth strategy was very successful in reaching a large size and generating a significant revenue stream for the overall company.

Netflix subscribers (Statista)

However, this rapid growth is also justified by Disney’s lower pricing strategy than its competitor, which can be seen by its average revenue per user (ARPU). While Disney’s+ streaming service has an ARPU of only $3.91 and its average ARPU in North America has been only $6.10 since the end of 2019, Netflix’s ARPU in North America was higher than $16 in Q3 2022.

What this lower pricing strategy means is that Disney was seeking growth rather than profitability, which was good for the top line, but quite impacted quite badly its bottom line. While Disney’s operating margin in linear networks was 30% in FY 2022, in DTC it lost more than $4 billion in the last fiscal year. More badly, since the end of 2019, cumulative losses of its DTC segment are higher than $8.6 billion, which is quite worrisome particularly when considering that Netflix is profitable.

This means that Disney’s losses in its DTC segment are a combination of betting on growth and also due to bad management. In fact, these losses are largely explained by increasing operating expenses that were not offset by rising revenue, a trend that only got worse over the past 12 months. Indeed, to maintain positive subscriber growth rates, Disney has performed promotions which led to lower ARPU, while at the same time operating expenses increased by 32% YoY during FY 2022, to more than $17.4 billion. Selling, general and administrative expenses also increased by 30% YoY, to more than $5.7 billion, leading to a much higher operating loss in FY 2022 ($4 billion vs. $1.7 billion in FY 2021) as revenues only increased by 20% YoY.

Therefore, Disney clearly needs to control its expenses and increase prices, given that it’s now the same size as Netflix by number of subscribers and further growth is not likely to be achieved in a profitable way. While investors were not much worried about losses before 2022, the current equity bear market and the slowing pace of subscriber growth in the streaming industry have changed investors’ perception and they are now more worried about monetization rather than growth.

This backdrop explains why Disney’s CEO was recently replaced and the company changed its strategy and has very recently started to offer an ad-supported Disney+ tier in the U.S. The cost with ads is $7.99 per month, while the ad-free service saw a price increase to $10.99. Note that Netflix also changed its strategy, after saying for many years that its platform would be ad-free forever, and has recently launched the “basic with ads” service at $6.99 per months, targeting directly Disney+.

While this is a positive step for Disney to improve its profitability in the DTC segment, this makes it more difficult for the company to reach its goal of 230-260 Disney+ subscribers worldwide by fiscal year 2024 (vs. 164 million in October). However, I think this target should be scrapped by new management, as growing the subscriber count should not be a top priority, but rather reach breakeven in the next couple of years and turn the streaming business profitable over the medium to long term.

Moreover, competition in the streaming industry is fierce and this landscape is not expected to change over the next few years, which means that subscriber churn is likely to increase in the coming quarters, both due to more competitive pricing from Netflix and also the negative macroeconomic environment across the world. Thus, it’s possible that Disney will report declines in the number of subscribers during the coming quarters, but more importantly, investors should look into its profitability and see if Disney is moving in the right direction to make DTC services profitable in a sustainable way.

Disney’s Balance Sheet and Valuation

Another issue that is related to Disney’s streaming push, which led to significant investments and higher costs, is its relatively high level of indebtedness. This has changed considerably since my previous analysis back in 2017, when the company had a conservative financial leverage profile, while now its net debt-to-EBITDA ratio is 3.25x (vs. 1.29 in FY 2017). This is a relatively high level of financial leverage (for instance Netflix has a ratio of 1.7x) and is not in line with its credit rating, which means credit downgrades are likely if Disney does not reduce its debt levels over the coming years.

This also means that Disney is not in a position to distribute dividends or perform share buybacks for the time being. This is another negative factor for Disney’s investment case, as the company is mature and profitable, thus it should be rewarding shareholders, at least, through the payment of dividends.

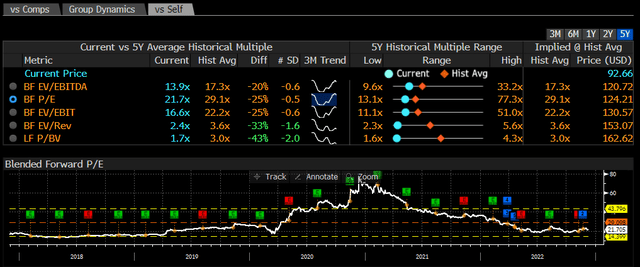

Regarding its valuation, Disney is currently trading at some 21.7x forward earnings, which is lower than its historical average over the past five years, but this metric is clearly boosted by 2020/2021 when Disney’s valuation skyrocketed due to lower earnings and a higher share price. This has corrected somewhat during the past few months, as shown in the next graph, but I still see Disney as overvalued right now considering the fundamental issues it has to fix.

Before the pandemic, Disney usually traded in a range of 10-15x forward earnings, which I think is more appropriate for a company that has a cyclical business profile. Even considering the top of its previous range, at some 15x forward earnings, its fair value would be about $63 per share, or 30% lower than its current share price.

Conclusion

While Disney was able to rapidly increase the number of subscribers in its DTC offerings, this was done at the expense of earnings and this has to change rapidly. Disney should turn its focus to profitability rather than growth, and reduce its debt levels to a more appropriate level.

Given that the streaming business requires significant, recurring, investments in content, it’s not an easy task to reach breakeven in its DTC segment, not boding well for its financial figures in the coming years. Moreover, its shares don’t look particularly cheap, thus for me personally Disney is a stock to avoid right now.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you are a long-term investor and want to be exposed to several secular growth trends, check out my marketplace service focused on different secular growth themes, namely: Digital Payments/FinTech, Semiconductors, 5G/IoT/Big Data, Electric Vehicles, and the Metaverse. If this is something that you may be interested in sign up today.