Summary:

- AT&T’s shares are trading at a steep discount compared to industry levels, especially once we factor in its growth rate.

- Its management is making the right moves to drive multi-year sustainable growth.

- This presents a generational buying opportunity for investors with a long-term time horizon.

Justin Sullivan

Even though the markets have been crashing and the macroeconomic turmoil is intensifying, AT&T’s (NYSE:T) shares are up nearly 35% from October lows on the back of resilient results. But the rally might not be over yet. The telecom giant is proactively investing in key growth areas, it’s prioritizing debt repayments to reduce its interest burden and its shares are trading at a steep discount compared to industry levels. These factors, collectively, lead me to believe that AT&T will outperform its telecom peers and that it makes for a compelling buy in the current investing landscape. Let’s take a closer look at it all.

Focusing on Growth

Let me start by saying that AT&T has a debt burden of roughly $152.5 billion which is 11.1-times its trailing twelve-month free cash flow. The interest expense on this gargantuan pile of debt amounted to $6.43 billion in the last 4 quarters alone. Although the company can cover its interest expenses 4.7-times over with its EBITDA for the time being, the general concern is that rising interest rates will push the company’s debt servicing costs higher which will hinder its growth-related capital investments and weigh down on its margin profile over the coming quarters.

But contrary to what the bears might expect, AT&T’s management is tactfully navigating through muddy waters with a two-prong approach. First, they’ve slashed dividends in a bid to gradually pare down debt to 2.5-times the adjusted EBITDA, down from the current level of 3.22 times. This will reduce the interest burden on the income statement and free up capital for growth-related investments. This was no doubt a tough decision – infuriating income investors to fix financial position and drive growth – but it was also a much needed one to initiate a company-wide transformation.

From the company’s Q3 earnings call:

We are very comfortable with our cash levels after paying our dividend commitment, and this should only increase in the future years as we expect cash conversion to improve from here… We also plan to continue to use excess cash after dividends to reduce debt with a goal of reaching a net debt to adjusted EBITDA range of 2.5x.

Secondly, AT&T is aggressively investing towards the rapid ramp of its 5G wireless and fiber broadband services in a bid to win market share from its peers and to catapult its growth along the way. From its last earnings call:

…we’ve achieved our already increased year-end target of 100 million mid-band 5G POPs and now expect to reach more than 130 million people by the end of the year, nearly double our expectations when we entered the year… We’re also approaching 1 million AT&T Fiber net adds for the year, and we’ve added nearly 2.3 million fiber locations through 3 quarters to bring our total customer locations to 18.5 million.

Essentially, AT&T is prioritizing growth-related investments over paying dividends to boost its competitiveness. Meanwhile, most of the other telecom companies have a relatively traditional approach of prioritizing dividend sustainability over boosting growth capital expenditure. This difference in approaches, in my opinion, is what’s going to catapult AT&T’s business in the coming years.

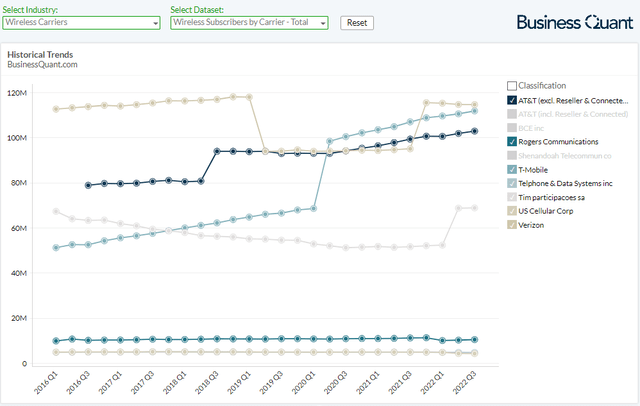

Note in the chart below that AT&T’s wireless subscriber count has grown at the fastest pace amongst all the other major pan-US competitors in the last 2 quarters. This did not happen by fluke but rather came to fruition due to consistent investments geared towards enhancing the value proposition of its wireless service (such as network uptime, coverage, speed, stability, cost etc.).

I expect this trend of rapid subscriber adds to continue in the coming quarters as well, as AT&T continues on with its growth plan to bolster its wireless 5G services.

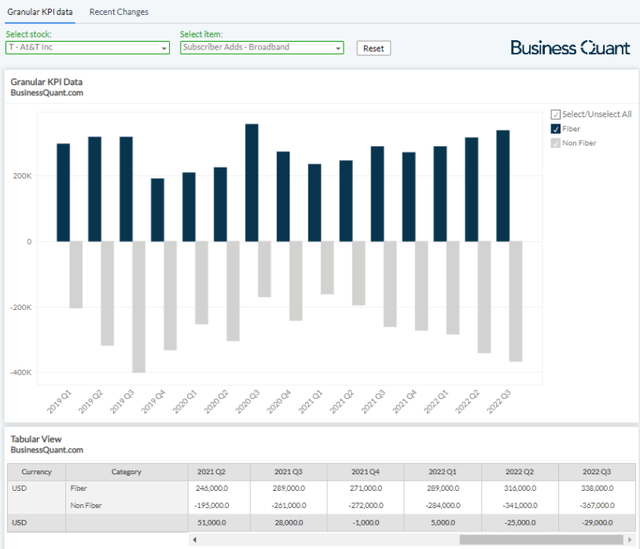

The telecom giant’s broadband subscriber adds don’t look appealing at the first glance overall. But the company’s management is deliberately dropping low-ARPU and low-speed non-fiber broadband business and focusing more on high-ARPU and high-speed fiber business with its investments. For the uninitiated, APRU stands for Average Revenue Per User.

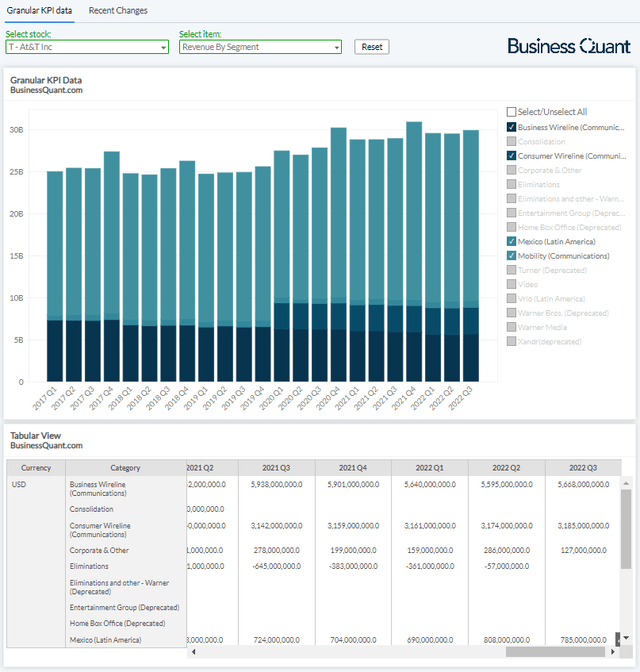

I expect this churn between fiber and non-fiber customers to continue for the time being until it stabilizes and results in net broadband adds sometime in 2023. This, coupled with continued subscriber adds in the wireless business, should bring along material financial growth for AT&T in the next 2 to 3 years at the very least. The two segments, combined, account for over 97% of AT&T’s revenue and any fluctuation in their results is bound to impact the company’s financials.

This is the first part of my bull thesis on the telecom giant, let’s now shift attention to the second half that focuses on the relative industry valuation.

Attractive Valuation

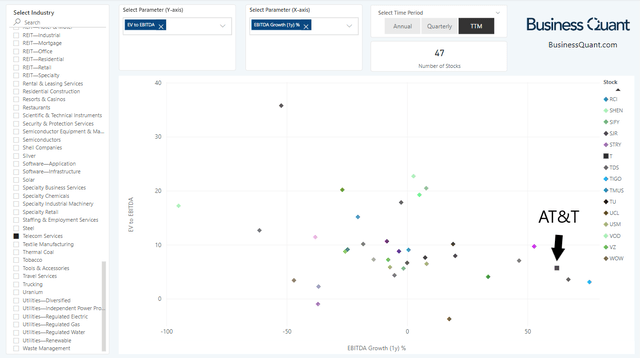

AT&T’s valuation is a hot topic of debate in investing forums and the chart below should put things in perspective. The Y-axis plots the EV to EBITDA multiples for over 40 telecom stocks listed on US bourses. Note how AT&T is vertically positioned much lower than a broad swath of its peers, indicating that its shares are trading at a considerable discount.

Now, let’s shift attention to the X-axis, which plots the EBITDA growth rates for the same set of companies. Note how AT&T is horizontally positioned towards the right-extreme of the chart, indicating that its pace of EBITDA growth is much faster than most of the other stocks in our study group.

The collective takeaway from both the axes here is that AT&T’s EBITDA is growing at an exceptional pace compared to industry levels, yet its shares are trading at a steep discount. There are only 2 other stocks in our study group that are growing faster than AT&T and trading at a relative discount. All this indicates that AT&T’s shares will have to rally to reach parity with industry comparables before reaching fair value in the coming months.

Final Thoughts

The takeaway here is that AT&T’s management is focusing on the right levers to reinvigorate company-wide growth that could last multiple years and maybe even a decade. This makes the telecom giant an attractive name for contrarian and growth investing. Besides, its shares are trading at a steep discount compared to industry levels, which only improves the risk-reward ratio for long-term investing. So, investors with a multi-year time horizon, may want to consider accumulating AT&T’s shares on potential price corrections. This is one of the rare stocks that offers ample upside potential in the currently-challenging macroeconomic environment. Good Luck!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.