GameStop Q3 Earnings: There Is No Short Squeeze Coming

Summary:

- GameStop’s Q3 earnings showed further deterioration.

- Revisions in the coming weeks will be negative.

- The chart is ugly, the company has issues, and GME stock’s valuation is still too expensive.

Michael M. Santiago

With the third quarter earnings season drawing to a close, retailers have had a rough go of it. Inventory bloat, supply chain constraints, and heavy inflationary pressures have combined with cautious consumer spending to create a perfect storm of ugliness when it comes to retailer earnings.

The GameStop (NYSE:GME) saga from early 2021 will be an epic story for all-time when it comes to market history. But those clinging to the hope that – two years on – we’re going to have another massive short squeeze rally are sadly mistaken, in my view.

If that’s the case, and no “MOASS” version two is coming, what’s left for GameStop? As far as I can tell, not much. The last time I covered GameStop, I said the second quarter report highlighted longer-term issues, and that the stock was a sell in response. Nothing about the Q3 report changed my mind in that regard.

In this article, we’ll take a look at the beleaguered retailer’s third quarter earnings, and the outlook for the stock.

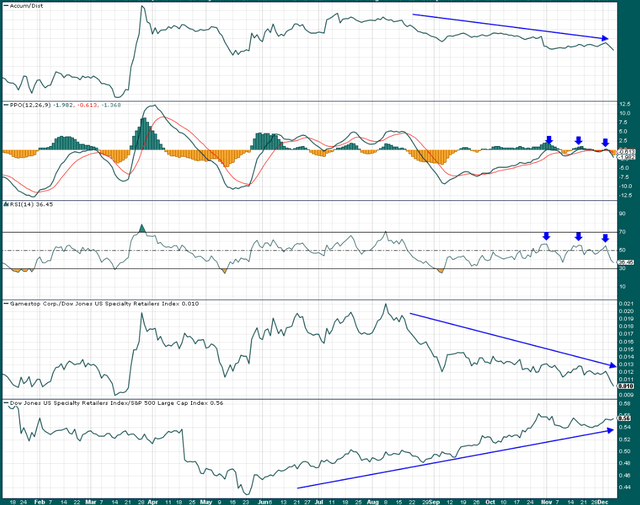

GameStop stock chart highlights continued weakness

We’ll begin with a chart, as I always do, to get a lay of the land in terms of price action and momentum. GameStop was weak heading into the Q3 report, and barring a massive reversal today, it looks like a breakdown is occurring that could see the stock test its 2022 lows, or worse.

I’ve annotated support from the September/October consolidation range, which formed its bottom at just under $24 (roughly). That level was tested several times and resulted in a bunch of bounces of 10%+, so it looked pretty solid. There was a breakdown in November but that was quickly reversed, which is a bullish sign. However, the stock broke through that level decidedly a couple of days ago, and with the stock looking weak pre-market today, the bulls need a miracle to avoid some nasty technical damage.

If the stock remains below the line on the chart just under $24, I’m looking for a test of the lows from this year of $19.40. That level was hit twice so far, so how the stock behaves if/when it gets there will be critical. For now, the price chart is showing me absolutely nothing bullish. On the contrary, the stock looks like a compelling short based on this evidence, so long as it remains under that former line of support near $24.

Let’s now turn our attention to some momentum indicators to see if there are signs of a turnaround coming.

The accumulation/distribution line is first, and that’s an indicator I like because it tells us if a stock is generally finishing the day near the highs (A/D line up over time), or the lows (A/D line down). The higher the better for this one, but as we can see, GameStop’s A/D line has fallen quite steadily this year, indicating there’s more intraday selling than buying. Not a good sign.

The PPO is a longer-term indicator of momentum and one that I use to help identify trend changes. I’ve annotated points where GME tested the centerline but ultimately failed. We had another one of those early in December, so certainly no evidence of a trend change at the moment.

The 14-day RSI shows a similar story, with the 60 level being a brick wall for momentum. Another test in December, another failure.

Finally, the bottom two panels show relative strength; the first being GameStop’s strength against its peers, and the second being the peer group against the S&P 500. GameStop’s relative strength has been awful, while its peer group is flying against the S&P 500. In other words, specialty retailers have been a great place to be, but GameStop is among the very worst in that group. Why choose a terrible house in a great neighborhood?

A slow, painful decline

The headline from the earnings report is that GameStop missed on both the top and bottom lines, and not by small margins. Adjusted EPS was a loss of 31 cents, which was three cents light against expectations. Revenue was down 8.5% year-over-year to $1.19 billion and missed by a whopping $160 million, or about 12%.

Perhaps most concerning is that software sales plummeted from $435 million to $352 million year-over-year, which meant that the share of this category in terms of total revenue fell from 33.5% to 29.7% year-over-year. On the plus side from a margin perspective, Collectibles revenue was up from 14.8% of revenue to 17.5%, which left the declining hardware business to take the rest of the share at 52.8% of revenue, from 51.7% a year ago.

GameStop needs Collectibles and software revenue to have any kind of shot at sustainable profitability, but try as they might, management cannot seem to stem the tide of falling sales. GameStop is a relic of a bygone era where consumers had to shop for physical video games, and consoles and physical discs were the only real way to game. There are countless ways to game today, and literally none of them require shopping in a video game store. That irrefutable fact is the most damaging assessment of GameStop’s future, and at this point, I honestly don’t think it matters what the company tries; it is like a buggy maker competing with companies making automobiles. There are things GameStop can do to drag out the inevitable outcome, but it’s still inevitable.

There are things the company is doing to slow the decline while it desperately tries to figure out how to make people come into its stores, including SG&A savings. That’s fine and the management team should absolutely pursue those things, but cutting costs will not fix the company’s demand problem.

Inventory has actually been kept well under control, which is a credit to the management team. Inventory was basically flat year-over-year, but given the reduction in revenue, that means that on a days-of-sales basis, inventory still rose somewhat. However, we’ve seen retailers with inventory increases of 30% or 40% year-over-year, so GameStop deserves some credit for prudent management.

The obvious question for a retailer that is in decline is around how long the company can continue to operate at a loss. GameStop issued a bunch of (quite overvalued) shares a few quarters back and its balance sheet is actually in excellent shape because of it. I’m generally against dilution for shareholders but in the case where a stock is very expensive, it’s a great way to raise capital. Again, very smart move by the management team. Long-term debt is just $29 million, so GameStop is at no risk of any sort of liquidity/bankruptcy event for the foreseeable future.

Let’s value GME

If a company is struggling to generate demand, you generally see very cheap valuations to account for that. In the case of GameStop, despite the fact that the stock is off ~40% this year, in no way do I think it is cheaply valued.

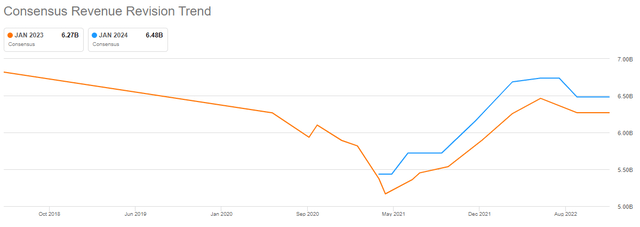

Revenue estimates topped several months ago and have turned materially lower. With Q3 results quite weak, I fully expect these lines to move lower once more into the end of the year. Revenue is going the wrong way, and Q3 should only serve to exacerbate that.

In addition, there are no earnings, and as far as I can tell, no prospects for earnings.

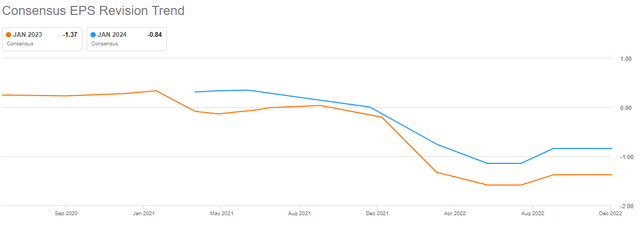

Again, lots of weaknesses and downward sloping lines, but worse for earnings than revenue. With profitability a constant concern, and yet another earnings miss for Q3, these should come down in the weeks ahead as well.

With this in mind, the stock’s valuation is likely to worsen because if estimates come down, the share price needs to fall commensurately just to leave the valuation where it is today. Obviously, we cannot value the stock based upon earnings because there aren’t any, but we have price-to-sales below for the past year.

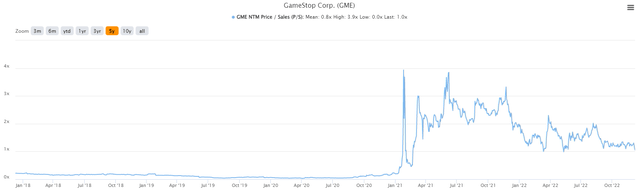

A reasonable person could look at this chart and say the stock is indeed cheap, given the P/S ratio is right at the bottom of the range at 1X sales. In fact, that’s much lower than the 1.5X sales the stock has averaged in the past year.

However, let’s look at a five-year chart of the same thing.

The average now goes to 0.8X sales, as we can see the very point when GameStop became a meme stock. In my opinion, the time for GameStop being a meme/short interest stock ended in 2021, so just as we can see a very clear decline in the valuations investors are willing to assign this stock, I see no reason we will not get back to pre-short squeeze valuations. That’s extremely bad news for the stock if I’m right.

The company has seemingly no way to stem the constant decline in demand, and while cost-cutting measures can help with margins, there is a point where further cutting cannot occur. GameStop has to find a way to operate profitably in a sustainable way, and there simply isn’t a path to that, as far as I can tell.

The stock isn’t cheap, there’s no short squeeze coming, and the chart is ugly. When you couple these with the fundamental issues the company has, I’m reiterating my sell rating with first target being the $19.40 low. We’ll see what happens if/when we get there, but my guess is that level is going to fail in 2023 as well.

Risks

Shorting anything is risky. It costs money to borrow shares in order to short them, and as many investors found out in early 2021, shorting something that is already heavily-shorted like GameStop can result in a parabolic move that can wipe 100% of your position or more. For these reasons, I do not short directly, be it GameStop or anything else. The odds of success are simply too low given the inherent risk, so I’m certainly not going to recommend that anyone else do it.

When I short something, I use puts, generally. Options are expensive with GameStop because of the volatile nature of the stock, but the potential reward is higher as a result. If you want to short but reduce risk (and cap potential reward), you can use a put spread. For instance, using my target of $19.40 as the bottom and the current price as the top, you could buy puts that expire in January or February at the $22 strike, and sell puts at the $19 strike. That limits your downside in case you’re wrong, and uses less capital in the process. It also limits your potential profit if GameStop goes to $18 or $15 or $12. That tradeoff of risk/reward is something each investor must decide for themselves. I also recognize shorting isn’t for everyone, so in that case, I simply recommend wholeheartedly that you carefully consider not buying this stock.

Finally, there is a risk that GameStop pulls it together and that it is not going to slowing fade into oblivion. In that case, you’ll get some clues, not the least of which is that the share price will almost certainly rise. That’s why using stops is so important, and my short thesis is invalid above $24. That would materially change the outlook for me from a price perspective, but I think that is unlikely barring a big improvement in the fundamentals. Obviously, I don’t think that’s going to happen but using stops is critical to limit risk, particularly if you’re shorting a volatile name like GameStop.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in GME over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.