Summary:

- AT&T reported mixed Q4’22 results with weak ’23 EPS guidance.

- The wireless company continues to fail to extract higher economics from a very expensive 5G network.

- The stock is fairly valued, trading at 8.5x updated ’23 EPS targets.

jetcityimage

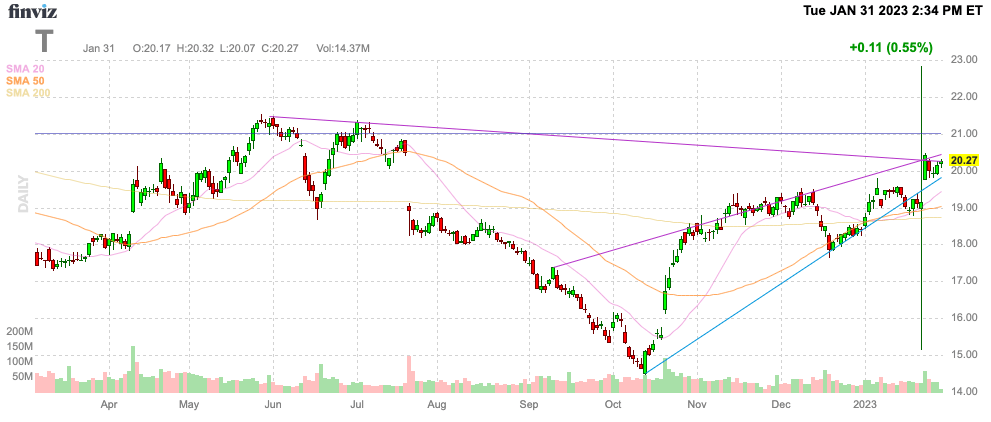

A few months ago, AT&T (NYSE:T) plunged to a low below $15 and the bottom was set in the process. The wireless giant is much better poised to produce consistent results with the spinoff of the media business, but the company faces a tough wireless market now. My investment thesis is more Neutral on the stock after the big rally back to $20 and signs the 5G network continues to lag.

Source: FinViz

Same Issues

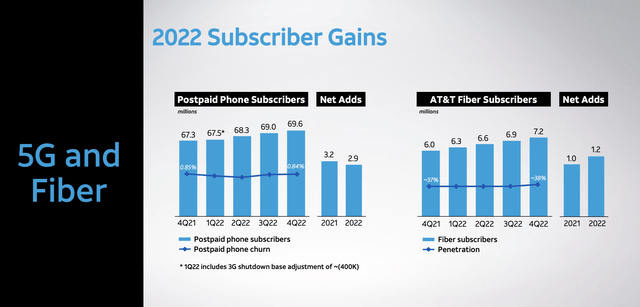

In Q4’22, AT&T faced the same issues hitting Verizon Communications (VZ). The wireless giants continued to generate subscriber growth in both wireless and fiber, but the company isn’t seeing any financial benefits due to the high capex costs for these networks and inflationary costs.

Source: AT&T Q4’22 presentation

AT&T had several nice quarters in 2022 where the company added over 600K net postpaid phone subscribers. In total, the wireless giant ended the year adding 2.9 million subs last year despite losing ~400K with the shutdown of the 3G network.

Along with the 1.2 million fiber subscribers added in 2022, AT&T added a combined 4.1 million high-value subscribers in the year. The stock hit a multi-year low in October in a sign of how new subscribers aren’t matching the amount of money spent on the 5G network upgrade and the spectrum.

One of the areas where AT&T confuses the market is discussion of solid phone ARPU. The company reported a Q4’22 ARPU of $55.43, up 2.5% from $53.06 last Q4.

The problem is that AT&T spent over $24 billion on capex and another $33 billion on midband 5G spectrum over 2 prior auctions, yet the company only boosted ARPU by a minimal $1 per nearly 70 million subscribers. All those billions in spending only contributed to $70 million of additional monthly revenues, probably hardly above the higher costs due to inflation alone.

Total revenues only grew 0.8% in the quarter despite AT&T adding all of these customers and spending $24.3 billion on capex last year. The wireless giant spent aggressively on capex and 5G spectrum to produce meager revenue growth in a huge sign of the problems facing the business.

The company guided to very weak adjusted EPS of just $2.40 even in a year where key wireless services and broadband revenues will grow in the 4% to 5% range. The AT&T forecast is for EPS to fall from $2.57 in 2022.

5G Network Falling Behind

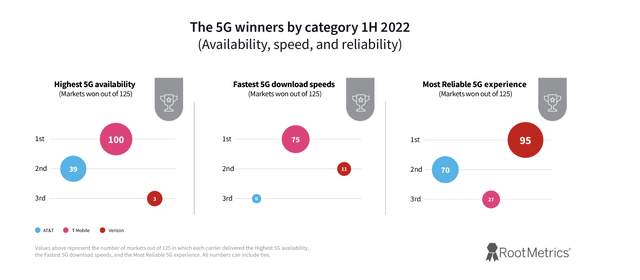

The most recent RootMetrics 5G wireless network test found T-Mobile (TMUS) had the best 5G mobile experience. The once after thought in the U.S. wireless space was the leader in 5G Availability and Speed while Verizon won the 5G Reliability case with AT&T nowhere to be found in the leadership positions.

Now, AT&T had a solid second place finish in Reliability, but the wireless giant had no network markets with the fastest 5G download speed. The company trailed T-Mobile in 5G availability by a wide margin.

In reality, wireless service is local. Consumers want the best available 5G network with the highest speed in their market. Reliability is likely the third most important requirement due to high levels of general reliability in wireless networks for years now.

The 2023 EPS forecast confirms the major problems facing AT&T. The company is facing much higher costs, but the business has no leverage to price services to account for the higher costs.

The stock trades at about 8.5x adjusted EPS targets for 2023 with the company having limited growth. Analysts forecast minimal EPS growth in the years ahead suggesting the current multiple is very fair.

The wireless giant would need to exert a leadership position in the domestic 5G wireless network in order for investors to view the stock as having the potential for additional value. The stock offers an appealing 5.5% dividend yield, but the large debt levels of $132 billion make the dividend payout less appealing knowing any slip-up in cash flows would pressure the current $8 billion annual payout.

Takeaway

The key investor takeaway is that AT&T is no longer a cheap, beaten down stock like the lows in October. The wireless giant faces a very competitive wireless market with T-Mobile driving pricing pressure when the sector should be attempting to capture higher economics from 5G subscribers. The stock offers an appealing 5.5% dividend yield, but AT&T has too much debt outstanding to invest for this yield alone.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.