Summary:

- AT&T Inc. has recently seen share price weakness, which has boosted the dividend yield to 6.2%.

- Given that AT&T confirmed its free cash flow outlook for FY 2022, dividend risks are not high.

- There is the possibility of a dividend increase in FY 2023.

- Easing inflation is taking pressure off consumers.

Brandon Bell

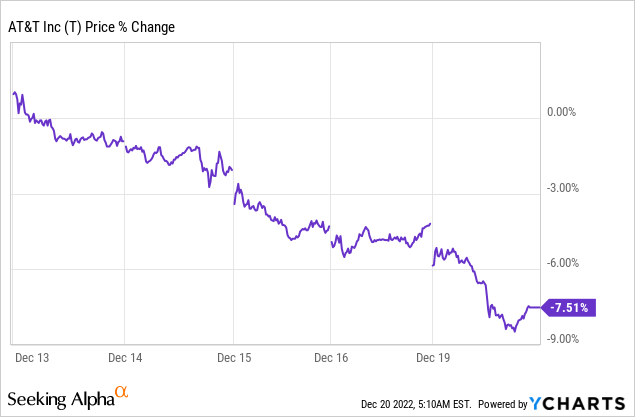

Shares of AT&T Inc. (NYSE:T) have experienced some renewed share price weakness in recent days, creating, for me at least, a buying opportunity. I believe AT&T has become more attractive as a dividend play on the drop because the telecom confirmed its FY 2022 free cash flow outlook. This strongly indicates that AT&T can (and likely will) maintain its current dividend, and the company benefits from growing momentum in its fiber business. Additionally, inflationary pressures are easing, providing relief to consumers. Since free cash flow risks have declined and the valuation is also more attractive, AT&T is a buy!

AT&T’s free cash flow and dividend risks have declined lately

Recent share price weakness for AT&T has resulted in a more attractive valuation for investors that are on the lookout for a high-yield telecom play that generates strong free cash flow.

The telecom projected $14B in free cash flow in FY 2022, and AT&T did not downgrade its free cash flow forecast in the third-quarter, meaning AT&T implicitly expects to generate approximately $8B in free cash flow in Q4-22. AT&T’s dividend costs the company about $2.0B each quarter, so AT&T is looking at a Q4’22 free cash flow payout ratio of around 25%.

For the full year, the payout metrics are not going to look not as great as for the fourth quarter. However, they are still solid enough to suggest that AT&T will continue to pay a $1.11 per-share annual dividend to shareholders. With $14B in free cash flow still expected for FY 2022 and considering $8B in total dividend payments, the estimated full-year free cash flow payout ratio is just 57%… so I believe investors’ fears about a potential dividend cut couldn’t be more unjustified.

Some of those fears were fueled in the second-quarter, which is when AT&T warned of risks to its free cash flow due to inflation that caused some customers to miss their payment dates.

My opinion on AT&T’s free cash flow situation is that the confirmed guidance for FY 2022 strongly indicates that the telecom will continue paying its dividend at the current rate of $0.2775 per share. Additionally, I believe that because inflation is receding, AT&T’s free cash flow risks have declined in the last 2-3 months and the telecom could actually raise its dividend next year.

Possibility of a dividend raise in 2023

Considering the continual momentum AT&T sees with its fiber rollout and accelerating strength in its broadband subscription business, I believe there is even the possibility of a dividend raise in FY 2023, assuming that we are not seeing a reacceleration in inflation next year.

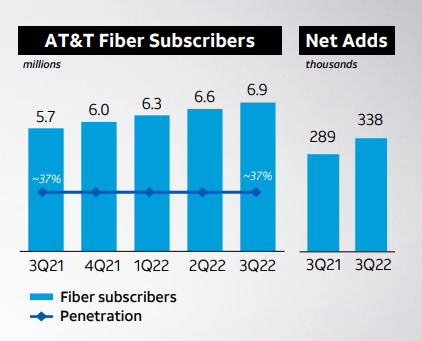

AT&T added 338 thousand new fiber subscribers to its business in the third quarter, on a net basis. This shows an acceleration of growth compared to the year-earlier period, which is when AT&T acquired 289 thousand new fiber subscribers. I estimate that AT&T could add 1.25-1.30M new customers to its fiber business just this year and a potential 1.40-1.45M in FY 2023.

Source: AT&T

AT&T has a more attractive valuation

With AT&T’s shares skidding about 8% in a week, I believe AT&T is in a buy-the-dip situation. Even without assuming any free cash flow (“FCF”) growth in FY 2023, shares of AT&T are cheap: they are selling for a P/FCF ratio of 9.1 X.

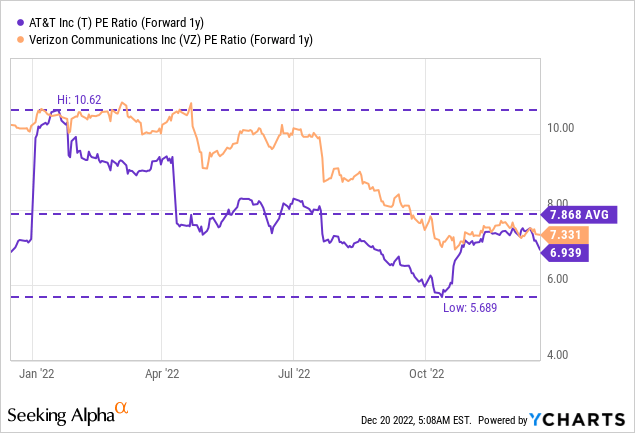

AT&T is also cheap using an earnings-based multiplier factor. The telecom currently trades at a forward P/E ratio of 6.9 X, which is below the 1-year average P/E ratio of 7.9 X. Due to the recent drop in pricing, shares of AT&T are now also cheaper again than Verizon (VZ) shares, which have a forward P/E ratio of 7.3 X.

Risks with AT&T

AT&T has top line risks rather than EPS risks because telecom firms operate in a mature market that leaves very little room for broad-scale top line growth. Two growth areas for telecoms are 5G and broadband, and AT&T is doing well in both of them. However, analysts only project a 2% top line decline for FY 2023, which means AT&T will remain chiefly a free cash flow and dividend play for investors.

Final thoughts

The drop in AT&T’s share price is a buying opportunity, and I will continue to add more along the way. Because of the strength in the fiber subscription business, receding inflationary pressures, and declining free cash flow risks, I believe AT&T should be considered on the drop. The company’s free cash flow in Q4’22 as well as for the full year should be more than sufficient to allow AT&T to keep paying its $1.11 per-share annual dividend. Considering that the free cash flow payout ratio is less than 60% (for FY 2022), and that AT&T’s fiber business is crushing it regarding subscriber acquisition, I believe AT&T could actually raise its dividend payout in FY 2023!

Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.