Summary:

- Worldwide internet users and usage is growing.

- Google advertising revenue is still growing.

- More and more data about users’ behavioral interests continue to be gathered and analyzed, giving advertisers an ever-improving way to reach potential customers.

- GOOGL trends in EPS and P/E Ratio provide good indications for stock price appreciation.

- Even if GOOGL’s stock price only moves from $88.50 to $90.00 by June 16th, a 24.7% potential annualized return is possible, including a covered call premium.

brightstars

Investment Thesis

Google (NASDAQ:GOOGL) (GOOG) should see higher stock prices due to expanding internet usage and advertising revenue. GOOGL can provide an excellent return from the covered call premium even if the stock price does not move much.

Alphabet is a holding company that some say has over 80% to 90% of the world’s internet search market and is the world’s largest generator of advertising revenue. Google generates 99% of Alphabet’s revenue, more than 70% from online ads. Google’s other revenue is from sales of apps and content on Google Play and YouTube, cloud service fees, and other licensing revenue.

According to IDC, Google’s Android OS powers more than 85% of smartphones worldwide, compared with Apple iOS’ slightly below 15%.

Google is a cash-flow cow, in my opinion. They have $116B in cash and cash equivalents on the balance sheet and very little debt.

Google has annual sales of $282B with 186K employees. They are 78.5% owned by institutions, with only 0.8% short interest. Their return on equity is 26.4%, and they have a 23.9% return on invested capital. The free cash flow yield per share is 5.3%, and their buyback yield per share is 5.0%. Their Piotroski F-score is five, indicating some strength. Google’s S&P credit rating is AA+. Only 8.7% of total assets are considered intangible hard-to-value, non-physical assets. They have a price-to-book ratio of 4.5.

Potential Positive Impacts

- Worldwide internet users and usage is growing.

- Their expertise in search algorithms and machine learning, plus access to and accumulation of data, is considered valuable to advertisers.

- More and more data about users’ behavioral interests continues to be gathered and analyzed, giving advertisers an ever-improving way to reach potential customers.

- It is difficult for competitors to replicate Google’s ability due to their large scale.

- One of their high-risk ventures, such as autonomous vehicles, quantum computing, and drone delivery, may eventually pay off big.

Potential Negative Impacts

- A recession may temporarily reduce overall advertising spending.

- While Google is the number one stop for online advertising, there is some risk that advertisers may eventually move more of their dollars to other forms of advertising.

- Forex will continue to be a headwind.

- Google’s strength in user behavior data may become somewhat of a weakness due to public attitude toward data privacy and security risks, as data can be misused. There is also some regulatory risk in the USA and Europe. Congress is also aiming for Big Tech with several bipartisan bills looking to curtail the capabilities of their online businesses that kill competition.

- Some competition may emerge from an Artificial Intelligence platform called ChatGPT and TikTok.

Q3 Quarterly Results

Google announced Q3 earnings in their October 25th press release.

- Revenue of $69.1B, up 6% vs. LY (or up 11% in constant currency)

- Advertising Revenue $54.5B vs. $53.1B LY (up 2.5%)

- Total Services Revenue $61.4B vs. $59.9B LY (up 2.5%)

- Cloud Revenue $6.9B vs. $5B LY (up 37.6%)

- Hedging Revenue $638B vs. $62B LY (up more than ten times)

- Operating Margin of 25% vs. 32% LY

- Diluted EPS of $1.06 vs. $1.40 LY

- Total Acquisition Costs $11.8B vs. $11.5B (up 2.85%)

- Employees 186,779 vs. 150,028 (up 24.5%)

Here is some of what CEO Sundar Pichai said on the conference call.

In September, we closed our acquisition of Mandiant and are proud to welcome more than 2,600 colleagues to Google. With Mandiant, we add industry-leading threat intelligence and incident response capabilities to help customers stay protected at every stage of the security lifecycle.

The shift to hybrid work continues, with organizations evolving to support an increasingly distributed workforce. I’m proud to share that Google Workspace is now used by more than eight million businesses and organizations worldwide. That includes Korean Air and the U.S. Army, which is transitioning 250,000 personnel to our secure communication and collaboration platform.

Here is some of what SVP Phillip Schindler said on the conference call.

In Search and Other, the largest factor in the deceleration in Q3 was lapping the outsized performance in 2021. In the third quarter, we did see a pullback in spending by some advertisers in certain areas of Search ads. For example, in Financial Services, we saw a pullback in the insurance, loan, mortgage, and crypto subcategories.

Here is some of what CFO Ruth Porat said on the conference call.

Our total cost of revenues was $31.2 billion, up 13%, primarily driven by Other Costs of Revenues, which was $19.3 billion, up 20%. The biggest factor here was costs associated with data centers and other operations, followed by hardware costs.

Operating expenses were $20.8 billion, up 26%, reflecting the following:

First, the increases in R&D and G&A expenses, which were driven primarily by headcount growth; and second, the growth in Sales & Marketing expenses, which was driven primarily by increased spending on ads and promotions, followed by headcount growth.

We delivered Free Cash Flow of $16.1 billion in the quarter and $63 billion for the trailing 12 months. We ended the quarter with $116 billion in cash and marketable securities.

Looking to the fourth quarter, based on the strengthening of the U.S. dollar quarter to date, we expect an even larger headwind from foreign exchange.

Good Technical Entry Point

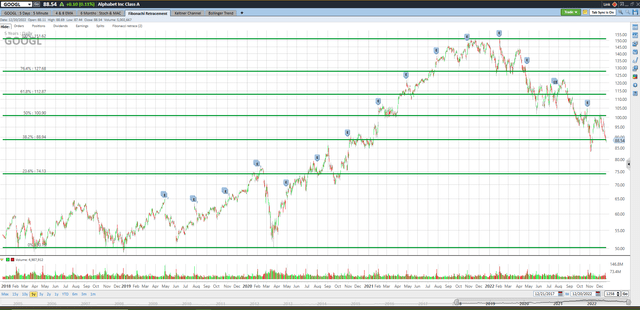

The share price of GOOGL traded at $88.50 on December 20th. I’ve added the green Fibonacci lines, using the high and low of the past five years for GOOGL. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where the stock price may be headed. GOOGL is slightly below the 38.2% Fibonacci retracement level but could go lower. However, I believe that GOOGL will trade above $90.00 by June for the reasons in this article.

Schwab Streetsmart Edge

The nineteen most accurate analysts have an average one-year price target of $127.21, indicating a 42.9% potential upside from the December 20th trading price of $88.50 if they are correct. Their ratings are nineteen buys, no holds, and no sells. Analysts are just one of my indicators, and they are not perfect, but they are usually in the ballpark with estimates or at least headed in the right direction. They often seem a bit optimistic, so I suspect prices may end up lower than their one-year targets to be on the safe side.

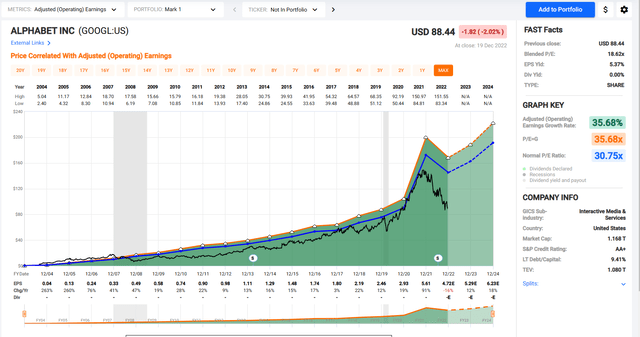

Trends In Earnings Per Share and P/E Ratio

The black line shows GOOGL’s stock price for the past nineteen years. Look at the chart of numbers below the graph to see that GOOGL’s adjusted earnings were $2.46 in 2019, $2.93 in 2020, and $5.61 in 2021. They are projected to earn $4.72 in 2022, $5.29 in 2023, and $6.23 in 2024.

The P/E ratio for GOOGL is currently at 17, but the average ratio over the past ten years is 26. I don’t think the P/E will rally back to 26 anytime soon. If GOOGL earns $5.29 in 2023, the stock could trade at $89.93 if the market assigns a 17 P/E ratio. GOOGL’s earnings growth rate is so strong that it would not surprise me to see GOOGL trading above $90.00 in 2023.

FastGraphs.com

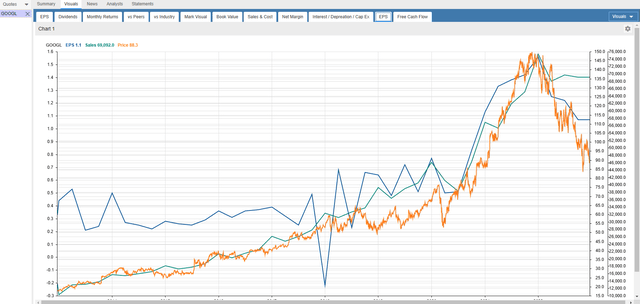

The stock price has not yet caught up with the increasing sales and EPS.

StockRover.com

Sell Covered Calls

My answer to uncertainty is to sell covered calls on GOOGL six months out. GOOGL traded at $88.50 on December 20th, and June’s $90.00 covered calls are at or near $9.30. One covered call requires 100 shares of stock to be purchased. The stock will be called away if it trades above $90.00 on June 16th. It may even be called away sooner if the price exceeds $90.00, but that’s fine since capital is returned sooner.

The investor can earn $930 from call premium and $150 from stock price appreciation. This totals $1,080 in estimated profit on an $8,950 investment, a 24.7% annualized return since the period is 178 days.

If the stock is below $90.00 on June 16th, investors will still make a profit on this trade down to the net stock price of $79.20. Selling covered calls reduces your risk.

Takeaway

GOOGL should see higher stock prices due to expanding internet usage and advertising revenue. Even if GOOGL’s stock price only moves from $88.50 to $90.00 by June 16th, a 24.7% potential annualized return is possible, including the covered call premium.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.