Summary:

- Bank of America Corporation just released its first quarter earnings, beating on revenue and EPS.

- While the dual beat was welcome, the absolute results were less good: revenue and earnings declined.

- The bank still has a massive unrealized loss, although liquidity coverage is excellent.

- The growth in investment banking fees in Q1 was very rapid.

- In this article, I explain why I’m downgrading my Bank of America rating to hold for the first time ever.

Bank of America sign against blue sky J. Michael Jones

Bank of America Corporation (NYSE:BAC) just released its first quarter earnings. The release beat expectations on revenue and on earnings per share (“EPS”). Before the release came out, analysts expected BAC to do $25.39 billion in revenue and $0.77 in EPS. Actual figures came in at $25.8 billion in revenue, a decrease of 2%, and $0.83 in adjusted EPS, with no comparable figure reported in the year-ago quarter.

Going into the release, I was pretty confident that Bank of America would beat estimates. JPMorgan (JPM) and Goldman Sachs (GS) both beat on earnings when they put their releases out, and both share similarities to Bank of America. So, I was expecting good things.

I got about what I expected. In addition to its beating on revenue and earnings, Bank of America showed an incredible 35% gain in investment banking fees. The Q1 release also showed that the unrealized loss shrank to $112 billion from a whopping $133 billion at its peak last year. BAC’s unrealized loss contributed heavily to its selling off during the 2023 banking crisis because it seemed to indicate liquidity problems. As my articles around the time of the banking crisis said, the unrealized loss situation was a mirage. Bank of America had more liquidity after subtracting unrealized losses from assets than even JPMorgan had. Seeing this whole situation as a buying opportunity, I bought BAC. I bought it again during the treasury yield panic of October 2022. Those buys worked out well.

Today I’m less enthusiastic about Bank of America than I was when I was buying it. I’m still going to hold the vast majority of my shares, although I might trim the position today. Obviously, the company is growing and thriving, and there is a good chance that its stock will rise further from here. However, this was my largest position for over a year, overtaken recently by Google (GOOG) when that stock rallied. It’s still pretty close to my top position, and one of the biggest winners in my portfolio. I’d say trimming a small percentage is wise.

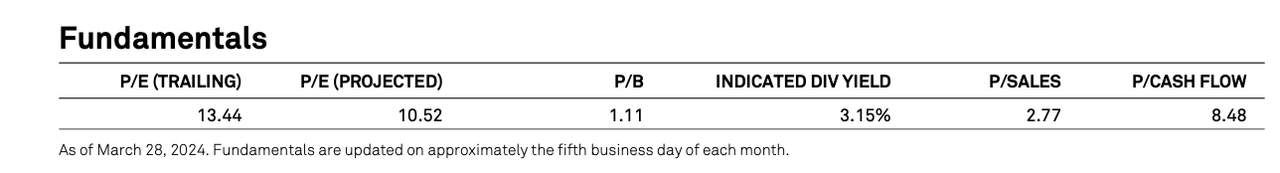

What about those for whom BAC is a small position, or who are just now thinking about buying the stock? It’s a mixed picture. By the standards of U.S. equities overall, BAC is cheap, trading at 11.7 times earnings. However, the S&P 500 banks index trades at 10.5 times forward earnings. Arguably, BAC is getting a little pricey on a sector-relative basis. Seeking Alpha Quant agrees, giving the stock a C- on valuation.

S&P 500 bank index multiples (S&P Global (SPGI))

I’ve always thought that BAC was a great company, and I still think it is today. However, the stock is today trading at the higher end of its 52-week range, while earnings are declining slightly. Although the earnings beat was welcome, the release nevertheless showed negative growth. As someone who prefers absolute valuations to relative ones, the declining revenue and earnings were not positives.

To be sure, there were some bright spots in BAC’s Q1 earnings release–the growth in investment banking fees, for example. On the whole, though, the stock has gained enough in my view, and the release was “ho-hum” enough, that I just consider BAC a Hold today.

Earnings Recap

Bank of America’s Q1 earnings release beat on both the top and bottom lines. Some standout metrics included:

-

$25.8 billion in revenue (net of interest expense), down 2%.

-

$0.83 in adjusted EPS (not reported in last year’s first quarter).

-

$0.76 in GAAP EPS, down 19%.

-

$952 billion in deposits, down 7%.

-

A $112 billion unrealized loss.

Overall, the results were better than what analysts expected. Personally, I felt they were just “so-so.” There were some truly stellar figures reported within individual segments, but the headline numbers all declined.

One unambiguous positive in the release was the rapid growth in investment banking fees. Not only did those fees grow 35%, BAC gained market share in investment banking as well! That was nice to see.

Another bright spot was the addition of 245,000 net new checking accounts in the quarter.

On the whole, though, the release didn’t show any growth in the headline metrics. Unless management strikes an upbeat tone about the year ahead on the upcoming earnings call, I would expect today’s trading to be underwhelming.

The Dreaded Unrealized Loss

Bank of America’s unrealized loss is worth exploring in detail. It was one of the contributors to the selling in the stock last year, so it’s worth examining whether it is still a risk factor today.

The unrealized loss sat at $112 billion at the end of Q1, higher than the same period last year, though lower than the absolute peak last year. The treasury portfolio at fair value (i.e., after subtracting unrealized losses) was worth $800.8 billion. Shareholder’s equity was reported at $277 billion per share. Subtract the unrealized loss from equity, and you’re at $165 billion in equity, or $20.54 per share. Thus, BAC’s price/book ratio, after making the fair value adjustment, is 1.75, as opposed to the lower and more commonly reported figure based on accounting book value.

BAC’s book value per share being lower than reported is a little disappointing, but we’ve known about the unrealized loss issue for a while now. The problem that people were concerned about last year had more to do with the bank’s liquidity than its asset-based valuation. The thinking at the time was that ever-dwindling treasury values would leave the bank without enough liquidity in a bank run, as happened at Silicon Valley Bank and First Republic.

That issue actually isn’t as big as it appears. The truth is that Bank of America still has more liquidity after subtracting unrealized losses than most banks do. It has $2.072 trillion in deposits, $800.8 billion in fair value treasuries, and $273 billion in cash. This leaves BAC with highly liquid assets that cover 51.8% of deposits. So, the bank is not at risk of failing in a hypothetical bank run. The kind of bank run that would be needed to cause that to happen would be unprecedented.

Valuation

Having looked at Bank of America’s latest release along with some risk factors, it’s time to determine what the stock is really worth. I alluded to the price/earnings and price/book ratios already, so I won’t go over them again. Instead, I’ll value the bank using a modified discounted cash flow, or DCF, model, with earnings in place of free cash flow. I’m using earnings here because free cash flow is not usually a relevant metric for banks.

In the most recent quarter, BAC earned $0.83 per share. The same amounts for the previous three quarters were $0.70, $0.90 and $0.73. That gives us $3.16 in earnings per share for the TTM period. Normally, when building a DCF model, you’d build out a modelled income/cash flow statement showing forecasted growth in revenue and expenses for the years ahead. However, Bank of America has no obvious growth catalysts right now, so it makes sense to value it on a 0% growth assumption.

If you assume that it won’t grow, then BAC’s $3.16 in EPS at a 7% discount rate is worth $45. That’s 25% upside to today’s price. I chose a comparatively low discount rate because my earnings assumption was ultra-conservative. Another scenario I considered was 5% growth for five years before slowing to 0%, with a 10% discount rate. In that scenario, the fair value estimate is just $38, which still entails some upside, but nothing to get excited about. Therefore, I only consider BAC stock a hold today.

The Bottom Line

For me, Bank of America stock is a hold because it is no longer all that compelling compared to lower-risk alternatives. It was very compelling a year ago, it is less so today. You can put $10,000 into the 10-year treasury (US10Y), hold it to maturity, and get a 4.6% yield on the investment these days. There are term deposits available that yield 5%. Both of these investments beat the dividend return you’re likely to get on Bank of America shares. On the other hand, my discounted cash flow calculations do imply that Bank of America Corporation stock has some upside, so it is far from the worst place to put your money today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.