Summary:

- Bank of America’s stock declined 14% in December.

- The central bank raised interest rates again this month, adding pressure on bank stocks.

- Higher interest rates and inflation are going to be a formidable headwind to bank valuations going forward.

tupungato

Bank of America Corporation (NYSE:BAC) suffered a significant valuation cut in December, causing the bank’s stock price to fall 14% just this month.

However, as economic risks and interest rate headwinds increase into 2023, I believe investors should avoid buying the drop in Bank of America stock due to the risk of asset quality issues during a recession.

The bank’s stock is still trading at a premium valuation, though I believe a combination of higher interest rates and a recession in 2023 will result in a discount valuation next year.

The Central Bank Did It Again

This month, the central bank raised interest rates by 50 basis points. Even though the increase was not as large as the previous four (when rates were raised by 75 basis points), the central bank remains committed to doing whatever it takes to combat inflation. As a result, the new key interest rate range is 4.25% to 4.50%.

Interest Rates (Tradingeconomics.com)

Higher interest rates benefit Bank of America to some extent because the bank can charge higher interest rates on its loans. The deposit base, on the other hand, becomes more expensive.

However, higher interest rates on personal loans, mortgages, and auto loans, increase the risk of default, which typically rises at the end of the economic cycle as the economy enters a slump.

Time To Worry About Asset Quality

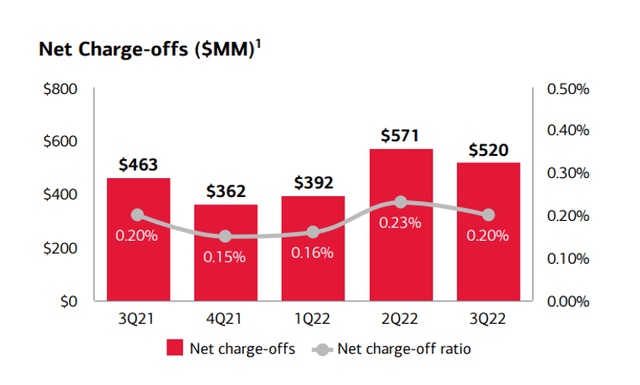

Bank of America’s credit provisions increased in the last two quarters, indicating deteriorating asset quality on the bank’s balance sheet. The extent to which the bank’s asset quality has deteriorated is not yet significant, but the last two quarters could be the start of a trend that will last many more quarters, especially if a recession begins in 2023.

Bank of America’s net charge-off ratio was 0.2% in 3Q-22, but I believe it is reasonable to expect Bank of America’s credit quality to deteriorate further during a recession.

Net Charge-Offs (Bank Of America Corp)

During recessions, the number of problematic loans increases, and more consumers default on their loan commitments than during upswings when economic prospects are better.

With a recession looking increasingly likely in 2023 and the Fed continuing to raise interest rates, I believe Bank of America will continue to see higher consumer net charge-offs and credit provisions.

Why Buy Bank of America At The End Of The Economic Cycle?

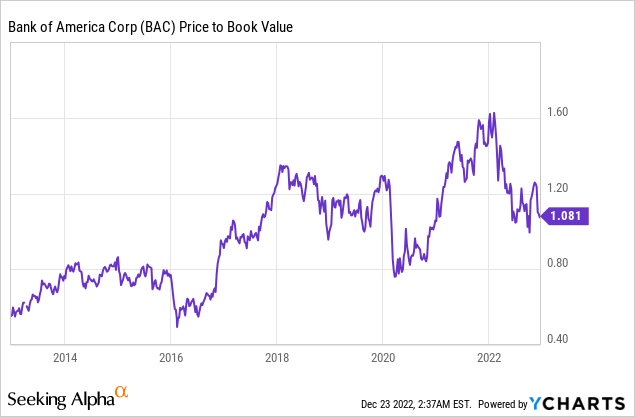

During previous recessions, investors had the opportunity to purchase bank stocks, including Bank of America, at significant discounts to book value.

The issue of asset and loan quality, which affects a bank’s prospects for book value growth, is why bank stocks typically sell at a discount during recessions. Higher net charge-off ratios and a greater number of customers struggling to pay bills frequently cause problems in the financial sector, especially if lending standards deteriorated during the previous upswing.

Given the risks to the U.S. economy and the threat that inflation (which was 7.1% in November) poses to consumers, I believe the odds favor deteriorating overall asset quality, higher credit provisions, and potentially negative book value growth during the next recession.

In my opinion, at this point in the economic cycle, investors should not be willing to pay a premium to book value (currently 1.1x).

Bank of America And The Possibility Of A Higher Valuation

In theory, Bank of America could keep its premium valuation if the U.S. economy avoids a recession and the bank’s balance sheet remains in good shape. This necessitates that the bank’s provisions for problematic loans and net charge-off ratio remain unchanged, which, in my opinion, will be impossible given that high inflation and interest rates, in particular, risk triggering a recession in 2023.

In 2023, investors should pay close attention to Bank of America’s asset quality/net charge-offs/credit provisions.

My Conclusion

I do not believe that Bank of America’s stock price correction represents an opportunity for investors to purchase the bank at a lower price.

Bank of America is primarily a cyclical banking bet, with a book value multiple that expands during times of strong economic growth and contracts during times of weak economic growth.

With 2023 rapidly approaching, I believe investors should anticipate an increase in Bank of America’s net charge-off ratio, as well as an increase in troubled loans in general. Investors appear to be bullish on Bank of America, as its stock continues to trade at a premium valuation.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.