Summary:

- Bitfarms has shown improved revenue and margins in Q1 2024, with a 67% YoY increase in revenue and a 50% increase in adjusted EBITDA.

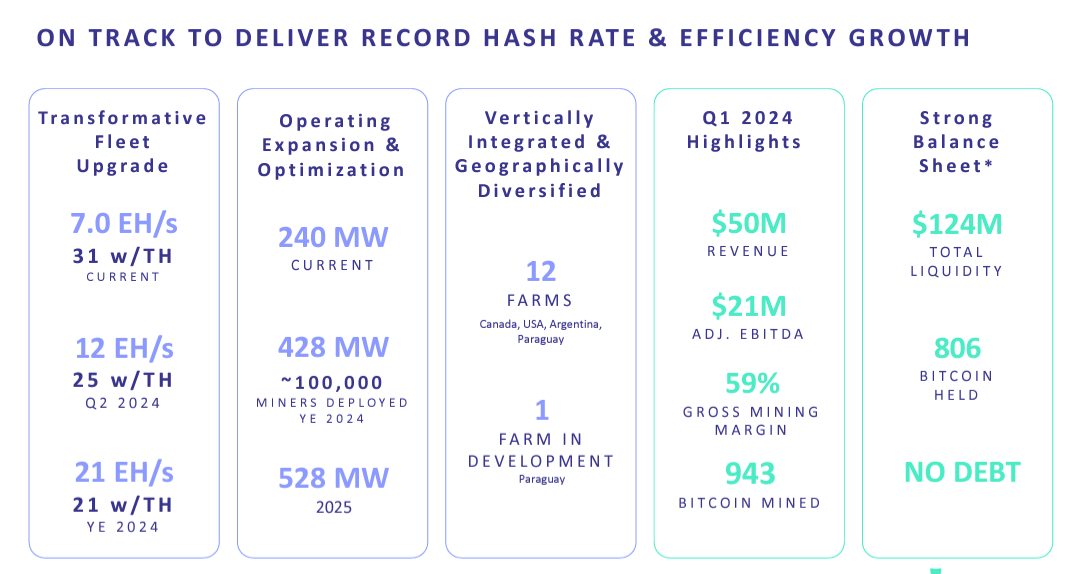

- The company aims to triple its hashrate, increase operating capacity, and improve fleet efficiency by the end of 2024.

- Bitfarms has drawn the attention of mining giant Riot, which has proposed a takeover bid, but Bitfarms has rejected the initial offer.

da-kuk

Beyond the core operational hashrate power and ability to win blocks, every miner strives to maintain its strong points and unique operational strategies to differentiate itself and maintain attractiveness to investors. Miners like Marathon Digital (MARA) and Riot Platforms (RIOT) hold a significant amount of Bitcoin (BTC-USD) on their balance sheets for portfolio attractiveness and liquidity. Hut 8 (HUT) engages in high-performance computing (HPC) infrastructure and managed services provisioning as a diversified business strategy.

Bitfarms’ (NASDAQ:BITF) big selling points have been its geographical diversification and expansion, and its focus on Bitcoin mining using low-cost and renewable energy. Bitfarms conducts Bitcoin mining operations in Canada, the U.S., and South America (Argentina and Paraguay). Bitfarms can be considered one of the most attractive vertically integrated Bitcoin miners today.

Q1 operations highlight (Bitfarms)

Bitfarms showed improved revenue and margins in its Q1 2024 result released two weeks ago. Revenue came in at $50 million, a 67% YoY increase and a 9% sequential increase, while adjusted EBITDA increased 50% sequentially. Two main highlights from the earnings report were the company’s total deleveraging of its balance sheet and the healthy liquidity. The company currently has 806 BTC in its portfolio and received a favor in Quebec’s VAT treatment, securing a $23.7 million tax refund; this has boosted Bitfarms’ liquidity position.

In running a business tied to a volatile asset like Bitcoin, it is important for teams to be able to control as many variables as possible for efficient capital management. I believe that in this run-up to the Bitcoin halving and the ensuing Bitcoin supply reduction, qualitative factors like management proactiveness and miners’ operational efficiency hold equal weight alongside financial metrics.

Excerpt from my April Cleanspark article

Bitfarms is on a path to expansion, and I believe the timing of this expansion will be favorable for the company and its shareholders. In most of the Bitcoin miner stocks I’ve covered on Seeking Alpha, I often reiterate how strategic timing of equipment and facility upgrades based on the Bitcoin market cycle is paramount for the optimum success of miners. Beyond a strong financial statement and ample cash or credit facility for expansion, one very important qualitative factor I look for in a Bitcoin mining company is its management’s experience in the Bitcoin mining business. That ability to strategically plan to capitalize on the momentum and market sentiment of Bitcoin only comes with some experience of past market cycles, in my view.

So why are we growing so aggressively right now? In 2023, we analyzed over six years of purchase history for every miner, evaluating the following: the price we paid, the time we plugged them in, how much revenue was generated, the cost and profit, what the payback was, and the cost-effectiveness of each purchase. What we found is that the most important factor for determining a good miner investment is timing. As timing ultimately determined costs.

Ben Gagnon, Chief mining officer, during the Q1 earnings call

Bitfarms’ 2024 expansion goals include tripling the hashrate to 21 exahash by EoY, increasing operating capacity by 83% to 440 MW, and improving fleet efficiency by about 40% to 21 w/Terahash. Efficiency has already improved by about 9% since the start of this year and is currently at ~31 w/Terahash. The company is on track to meet its Q2 guidance of 12 exahash. There is no doubt about the company’s expansion because of its zero debt and $124 million in total liquidity, comprising $66 million in cash and 806 BTC stash (~$58 million).

Despite operational efficiency and growth potential, BIFT has seen a ~23% price decline YTD. The internal management conflicts currently going on at Bitfarms might have contributed to a little bearish sentiment for the stock. Bitfarms fired its then-CEO Geoffrey Murphy in March after the CEO filed a $27 million lawsuit claiming damages for breach of contract. The share price fell about 6% following the announcement of the CEO’s termination. This latest CEO saga is happening just a little over a year after Bitfarms’ former CEO Emiliano Grodzki suddenly resigned in December 2022. These CEO sudden departures are not a good look for the company.

Another FUD came with the temporary crypto mining ban proposed in Paraguay, where Bitfarms currently runs and is still expanding its mining operations. The Paraguay mining ban is intended to be temporary and was recently proposed by lawmakers to curb power theft. Just yesterday, Paraguayan authorities seized 2,738 ASIC miners after unmetered power connection was detected. Moving forward, I believe proper regulation will come into play in that region and legit miners like Bitfarms will be better off for it.

The Budding Bidding War

…the post-halving period presents opportunities for M&As, with miners that face challenges in keeping up with reduced block rewards and increased network difficulty likely to be targeted for acquisition by peers with enough dry powder…

Excerpt from my April CleanSpark article

The anticipated post-halving takeover bids have begun in the Bitcoin mining sector. Some of the reasons bigger miners acquire other miners could range from the ease of scaling that comes with a takeover, where the acquirer does not have to build from scratch to expand into other regions or to easily plug in other energy sources. In some other scenarios, takeovers are motivated to bail out a struggling miner.

Bitfarms looks attractive at the moment (zero debt and ample liquidity) and has drawn the attention of mining giant Riot, with Riot proposing a takeover of Bitfarms at $2.30 per share and at a total equity value of $950 million. Following the announced takeover proposal, Bitfarms in a statement released on May 29 termed Riot’s proposal as “unsolicited,” saying the proposal significantly undervalues the company – a stance I agree with, and I believe many shareholders agree with this.

Moving forward, there are some likely interesting scenarios I foresee in this takeover frenzy. Firstly is Bitfarms’ outright rejection of the initial proposed deal – this has already happened. Another scenario is one in which Riot will double down on its offer and come up with a higher equity valuation. If this happens, it’ll still be a win for shareholders, depending on how much Riot will be willing to lay down.

Another likely scenario is one in which Riot could choose to pursue a more aggressive strategy and accumulate enough BITF shares (over 50% stake) to become a majority stakeholder in the company in an acquisition by hostile takeover bid. If this scenario plays out, I believe it will be in the favor of current shareholders because Riot would need to offer a high premium price for most BITF shareholders to part with their shares. Such a bid could potentially attract competing bids from other interested parties, further driving up Bitfarms’ stock price as a bidding war ensues.

Bottom Line

I think the stock price is going to be in the $2 – $2.3 price range for a while until this whole frenzy blows over. Either the buyout takes place at the proposed $2.30 share price (very unlikely in my view), or Riot moves to buy over 50% of Bitfarms’ shares on the open market – a move which would most likely drive BITF prices higher, or Riot doubles down and comes up with a higher offer. In my view, even if none of these outcomes play out, Bitfarms remains a promising Bitcoin miner going into the imminent Bitcoin bull run, and I believe shareholders will have the utmost value from this stock.

Investors need to stay abreast of Bitfarms’ new CEO choice. Riot currently holds 9.25% of Bitfarms shares, and Riot seems to be playing chess, not checkers with the Bitfarms acquisition move. This initial offer seems like a deliberate lowballing. The operational and financial advantage of acquiring Bitfarms is obvious, and I won’t be surprised if Riot tries to exert some influence on the board in a bid to get the best offer possible.

Finally, as Bitfarms’ board has rejected Riot’s initial bid, I expect them to put their money where their mouth is and engage in substantial insider buying (not trading) of BITF shares to show their alignment of interest and bolster shareholder confidence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BITF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.