Summary:

- The withdrawal of liquidity from the system will take a new turn when the TGA runs out of funds and Congress raises the national debt ceiling.

- The expected recession will be difficult for retailers as the consumer is now the weakest since 2005.

- Amazon.com, Inc.’s long-term outlook looks good, as the company is poised to build on international expansion and revenue growth from Amazon Web Services.

- It is quite difficult to predict the exact price of Amazon with the S&P at 3500.

RiverNorthPhotography/iStock Unreleased via Getty Images

Main thesis

Amazon.com, Inc. (NASDAQ:AMZN) stock spiked 16.3% from its 3-year lows of $81.43. This was caused by general market trends, as the S&P 500 (SP500) consolidated above the important level of 4000 points, as well as positive news for investors about cost optimization.

However, for a year now, the Sell The Rally rule has been working almost perfectly. I expect further withdrawal of liquidity from the system, which will greatly affect the stock market. And the likely ensuing recession, and the resulting reduction in corporate earnings due to the weakening consumer market, should send the markets to the bottom with Amazon taking a hit as an e-commerce retail segment representative.

Why is S&P 500 heading to 3,500?

While the eyes of most market participants are fixed on the Fed rate, very little attention is paid to the balance sheet. However, it is a hidden but powerful market management tool. After getting hooked on liquidity by the Fed, the S&P 500 is consistently correlated with balance sheet numbers.

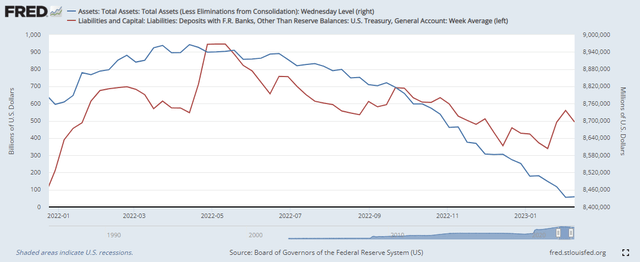

The Fed has already shrunk its portfolio by $0.5 trillion since the start of the QT program. At the same time, the system’s liquidity keeps at a high level as TGA’s funds have been decreasing since May 2022. There will be local fluctuations here, but the basic process will not change: the U.S. Treasury will borrow little, and the Fed will continue QT, but the overall supply of government debt will be low. The Treasury will spend the rest of the cash, adding liquidity, and the Fed will withdraw it.

Treasury general account balance (red) vs Fed’s balance (blue) (fred.stlouisfed.org)

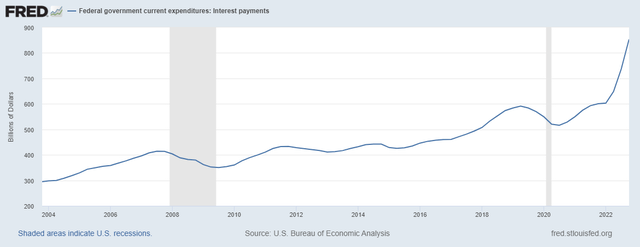

In other words, there is still a lot of money in the economy, and this is one of the main reasons why the stock market valuation is still so high. This will continue until Janet Yellen runs out of cash and the Congress raises the national debt ceiling. Thus, there will be no liquidity injecting no more. Most likely we will see the fastest withdrawal of funds from the system ever. Net interest expenses on an annualized basis increased to $0.82 trillion (3.1% of GDP), which is 77% higher than the level of Q4 2021. The U.S. Treasury is set to take massive amounts from the system by issuing new bonds.

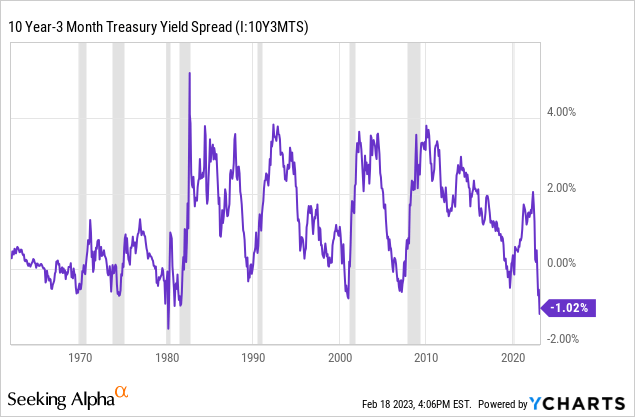

At the same time, the inverted yield curve continues to scream about an upcoming recession. 10-year – 3 months yield spread is already >1%.

One might say that it only represents the market’s reaction and doesn’t mean that we are going into a recession. Well, firstly, the inversion predicted 11 of 11 of the past economic slowdowns. Secondly, you should not treat the inversion as some kind of market event that does not affect the general state of the economy. Lending is built on the fact that the lender borrowed cheaply and lent expensively while taking on a certain risk. Inversion means that everything works exactly the other way around. This reduces incentives to lend and causes deleveraging, which can and will lead to a downward spiral in the economy as the credit market begins to contract. And the deeper this inversion, the more severe the consequences for financial institutions.

S&P 500 at 3,500 would represent a fall of ∼27% from all-time highs, which is a good correction considering everything that the economy has been going through. Although there is a relatively high risk to go lower on a more-than-expected prolonged recession.

Amazon’s only problem is the weak consumer

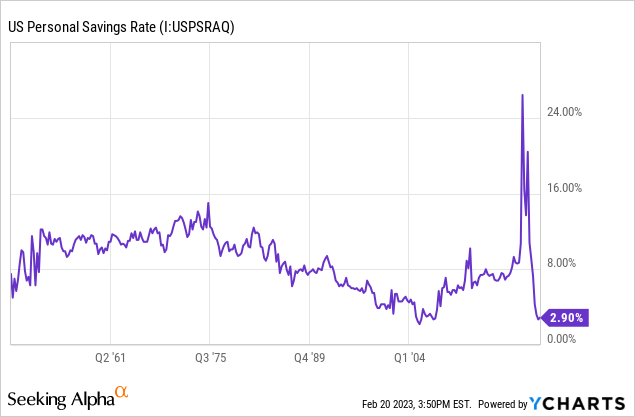

Consumers refuse to save money: the U.S. personal savings rate is now at its lowest since 2005. This is the reason why retailers and especially e-commerce players, are facing a massive drop in sales in 2023. As soon as the labor market starts to cool and high rates hit the economy harder, this consumer, who refused to cut spending due to inflation, will no longer be able to take out consumer loans. And the first thing consumers will save on is discretionary goods.

While there are no real signs of sharply weakening consumer demand right now, Walmart’s (WMT) executives have already shared their concerns with investors on the Q4 earnings call.

The consumer is still very pressured, and if you look at economic indicators, balance sheets are running thinner and savings rates are declining relative to previous periods

Walmart CFO John Rainey.

———

We’ve not been in a position where we’ve seen the Fed tighten this shortly. We see issues where delinquencies are up and things like auto loans, you’ve got savings rates that are coming down. And there’s a lot of unknowns in the back half of the year.

Walmart CEO Doug McMillon .

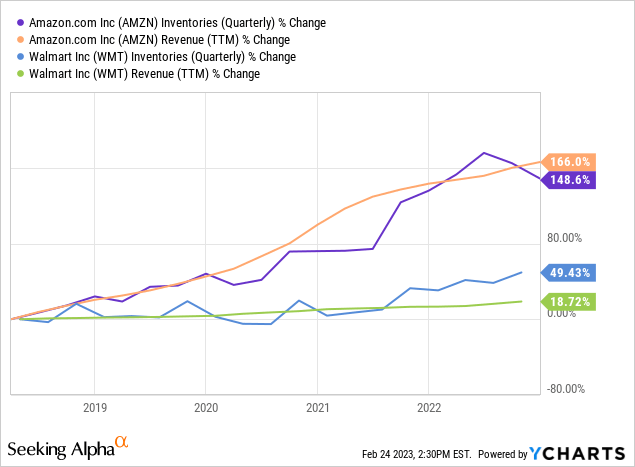

Changing consumer behavior is bad news for Amazon, but there is nothing to worry about. The economy is going through a new cycle – this is a normal phenomenon. It would be bad if there were structural problems in the business, such as ballooning inventory. We can see no such thing here, as the inventory change is in line with the general growth trend.

Look past the recession: massive opportunities ahead

E-commerce

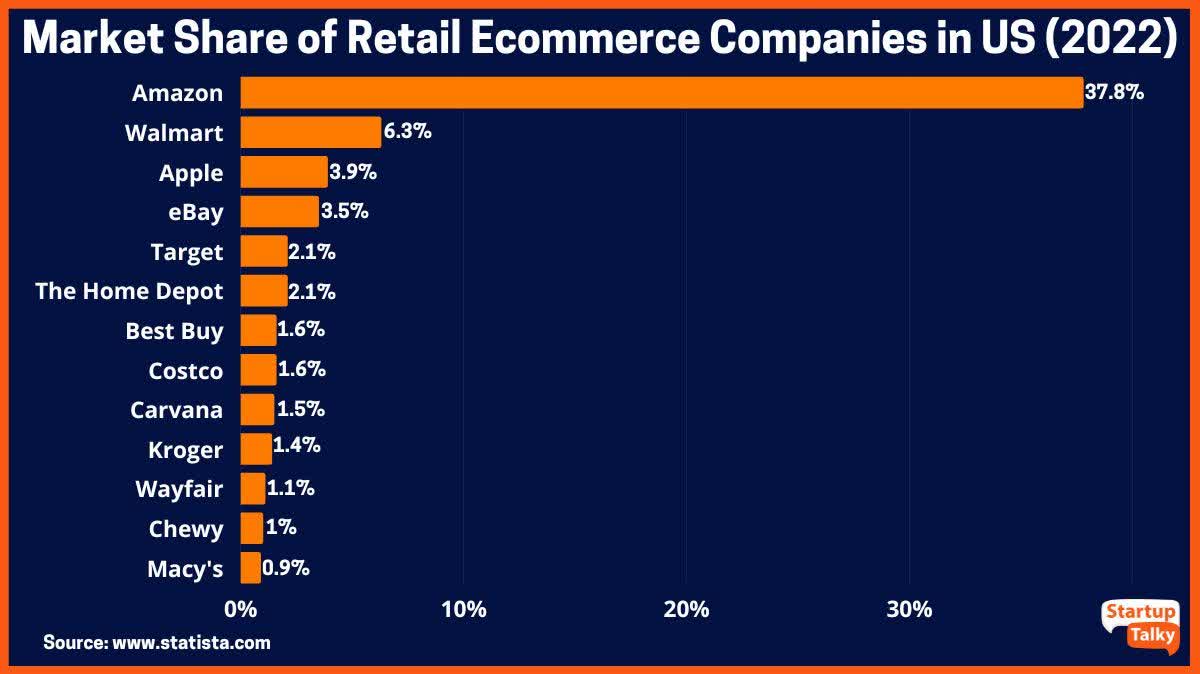

In the e-commerce retail market, Amazon still holds the lead by a wide margin. 38 cents of every dollar spent online in the U.S. is spent at Amazon.com. According to Statista, the e-commerce market in the U.S. is expected to grow

startuptalky.com

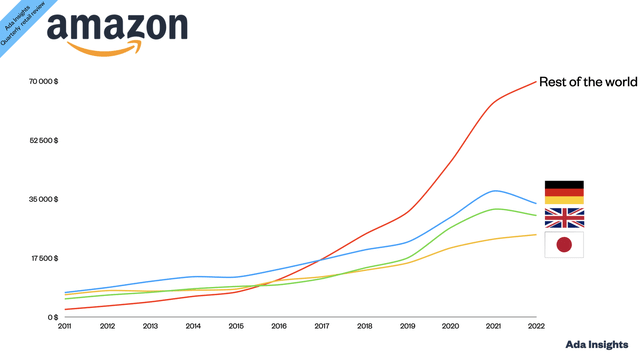

In 2022, more than two dozen countries around the world have their own Amazon marketplace, and the company provides delivery services in more than 100 countries. Last year, international sales decreased by 8% YoY. However, this was fully offset by UK and Germany, the second and the third biggest market for Amazon. The rest of the world’s net sales were up 10% YoY.

So there is a massive demand in non-U.S. countries. Currently, this demand is achieved at the expense of huge operating costs. And that makes sense since Amazon has to take a decent market share and provide the best customer service possible in these regions. The unique opportunity for international expansion is that local players are incredibly weak as there are only grocery giants like Tesco and Edeka that make more revenue than Amazon from the e-commerce segment.

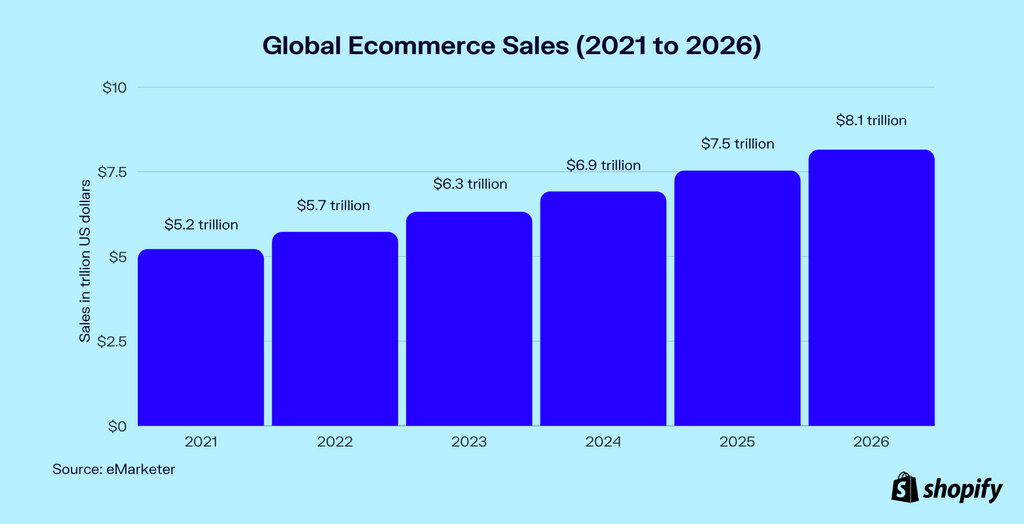

Amazon’s worldwide market share in the global e-commerce market was around 7.5% in 2022. If, thanks to the ongoing trend of taking away share from eBay (EBAY) and Walmart in the home market and active expansion in the international market, Amazon would take 9% of the entire market, then by 2026, this will result in revenue of $700 billion meaning a CAGR of 14-15%.

Shopify

AWS

Reducing dependence on the retail business allows the company to drive revenue growth through the fast-growing Amazon Web Services (“AWS”) segment and advertising. TechNavio estimates that Infrastructure as a Service (IaaS) could grow at a CAGR of 28.2% during 2022-2026. AWS, which occupies about 40% of the global IaaS segment, has grown faster than the market for years.

AWS’ share of total sales grows, and operating income and cash flow will grow much faster than the company’s total sales. With such a fast pace and high margins, the division could be worth more in a few years than the entire company is valued today. If the segment will maintain similar growth rates (28%), AWS could reach net sales of $165 billion by 2025. Thus, taking into account an average industry EV/Sales multiple of 7x, the Amazon Cloud would be worth $1.15 trillion.

Valuations

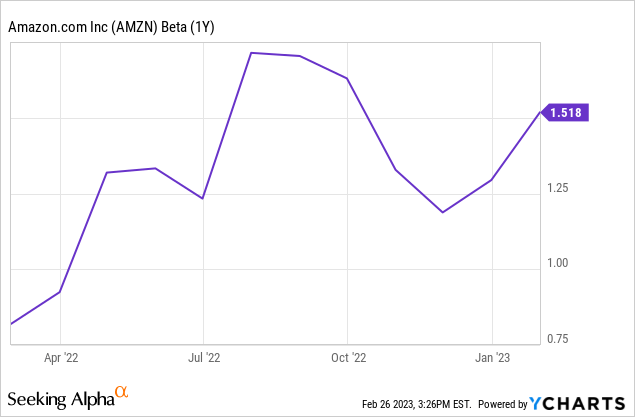

Amazon’s beta of 1.5 suggests an 18% drop from current levels with the S&P 500 at 3,500. However, it’s hard to say whether such volatility will continue in stocks like Amazon, Meta Platforms (META), and Alphabet (GOOG, GOOGL), given that they’ve suffered far more than the market as a whole and giants Apple (AAPL) and Microsoft (MSFT) over the past year.

It is also quite possible that we will see the final sale of “problem” techs before starting a new cycle. In this scenario, the fall could be 20-25%. One thing is for sure: Amazon will be dirt cheap with the S&P 500 at 3,500.

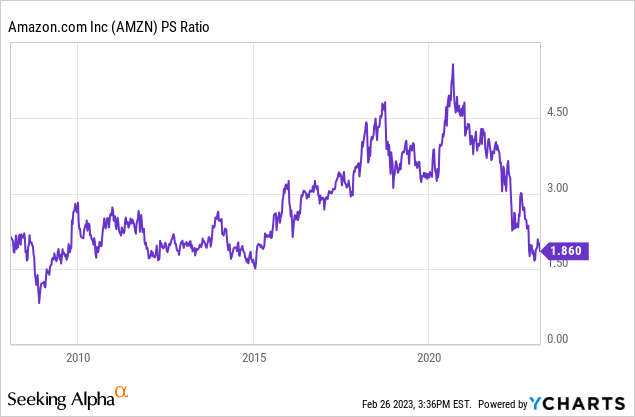

The P/S ratio might get closer to 1.5x, which is a massive bargain sign considering massive opportunities for Amazon.

Conclusions

Summing up, Amazon.com, Inc. is one of those troubled post-COVID stories with falling margins and negative free cash flow. Things are not getting better in the economy: we appear on the verge of a recession, where retailers will feel the pain of weak consumer cost cutting. However, I believe the S&P 500 at 3,500 is close to the peak of trouble. This will be followed by Fed easing and a new economic cycle, as well as incredible opportunities for further expansion of Amazon.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.