Buying A Tesla Could Become A Political Decision

Summary:

- Tesla’s CEO has likely been pulled into the U.S. culture war with his acquisition of Twitter.

- There is some early evidence that this might be impacting the favorability ratings of the Tesla brand.

- The worst-case scenario for bulls would be this leading to partisanship to cause a weakening of Tesla sales in future quarters.

jetcityimage

I’ve always been a Tesla, Inc. (NASDAQ:TSLA) bull. My first article on the company: Charge Forward, Together: Tesla. It spelt out how integral the company has been for the global transition to electric vehicles (“EVs”), which is important if we are to reach carbon net-zero. However, it’s important to flag the potential risks that could arise from Tesla CEO Elon Musk entering the highly frayed U.S. culture wars with his $44 billion acquisition of Twitter. Elon Musk’s Twitter has been rapidly and very publicly rebuilt around First Amendment protections

This entrance into political theater has thrust Tesla into the limelight of the highly partisan debate on the role tech platforms have to play in content moderation. A lot of changes have been instituted, including a blanket removal of permabans that has brought back previously de-platformed accounts, including that of Donald Trump, the 45th U.S. President. Aggregated with the significant relaxation of content moderation policies, Elon Musk has suddenly found himself becoming a polarizing figure in an era where consumers are increasingly influenced by the politics of the brands they buy.

Indeed, in a 2020 academic paper, the authors state that, “The importance of consumers’ political identity in the consumer journey has grown in recent years.” In this, purchases are somewhat of a reflection of the individuals, and Tesla’s shift to become a partisan brand against more neutral competitors could impact sales in its future quarters.

The Impact Of The Politics

Charles Gaba

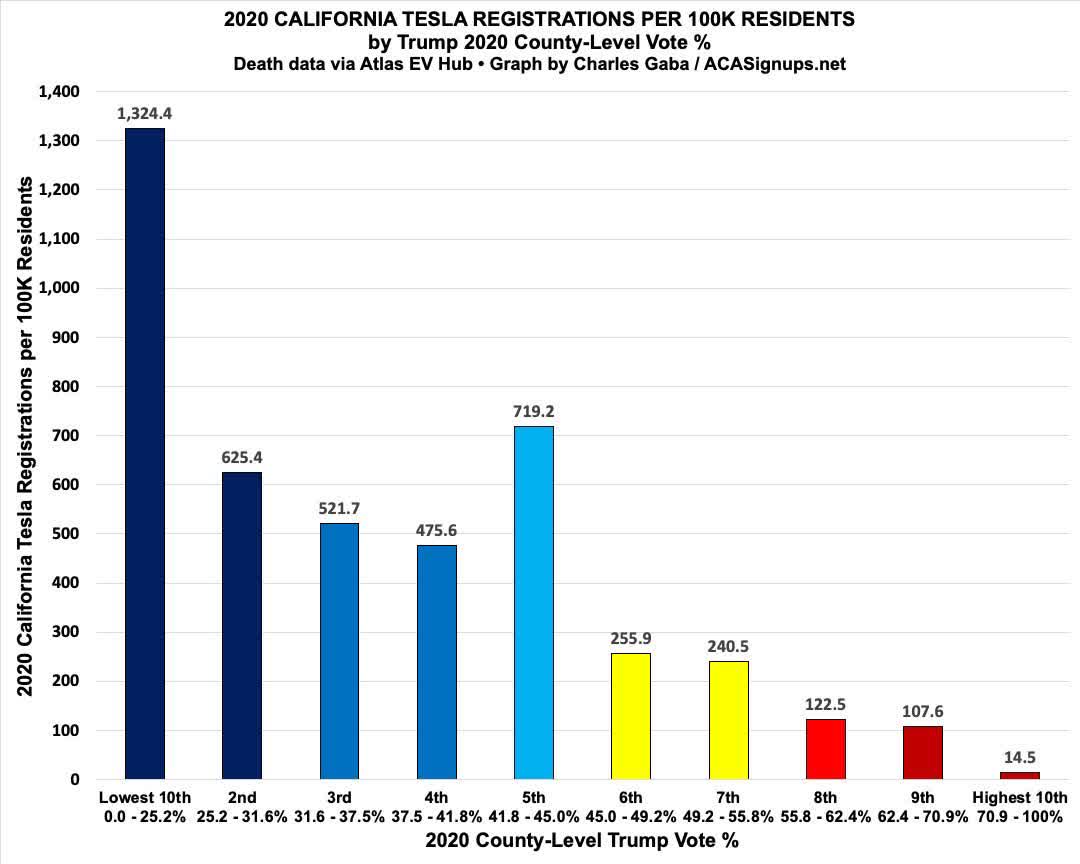

A few highly likely assumptions predate this article. Firstly, Elon Musk and Tesla are intrinsically interchangeable from a public perception perspective. Secondly, Democrats are more likely to purchase a Tesla than Republicans. This is reflected in Californian Tesla registrations per 100k residents by 2020 county-level votes for Donald Trump, as shown above. At 1,324 Tesla registration per 100k residents, the lowest decile of county-level Trump votes was 91x more likely to have registered a Tesla than the highest decile.

California is currently the company’s largest market in the U.S., and continued sales in the state are important to Tesla’s North American growth plans. The bearish argument here is that the historical tilt towards Tesla purchases by the quartile of residents across the U.S. who lean more heavily towards the Democrats is fraying. These households will be less likely to buy a Tesla on the back of the politics of its CEO than at any time in the company’s history. Almost all other automobile CEOs are not actively involved in the U.S. culture wars, and Elon’s entrance into this represents a risk against what has been described as an increasingly partisan landscape.

A New Partisan Future Would Form Headwinds

According to Electrek, Tesla is on its way to becoming a partisan brand, with its net favorability among Democrats dropping to 10.4% in December from 24.8% in October. This material drop reflects recent media coverage and Elon’s very open shift into politics.

However, favorability has also risen with Republicans, so there could be a level of counterbalance if sales to individuals in these groups rise. Critically, sustainability should not be a partisan struggle but a global one for the future of the planet. This partisanship, set against the rising tide of new electric vehicle (“EV”) competition and Tesla already losing market share in the U.S., can’t possibly be a tailwind for its U.S. sales. The company’s political affinity is shifting away from its historically more Democratic base, and the most near-term impact could be a softening of sales.

A recent YouGov survey found that whilst consumers have typically had an overall positive view of Tesla, in an observed trend seen for the first half of 2022, Tesla’s approval rating had fallen to -1.4% in November, from 5.9% in January. This comes as Tesla is already losing market share in the U.S. Tesla’s share of the US EV market was 79% in 2020, but already had fallen to 69.95% in 2021 and currently stands at 68% for the first half of 2022.

It’s important to note that a raft of new EV models from competitors have started production and are set for deliveries starting early next year. This includes the Fisker Ocean (FSR), the Cadillac Lyriq, the Genesis GV60, and Lexus RZ, among others. The risk is that the surge in competing offerings, the highest level of competition Tesla has ever faced, will intersect with a drop in favorability amongst the groups that have so far broadly driven a significant amount of its sales in the U.S. The risk this poses to sales is heightened by the rising specter of a recession.

Bulls would be right to flag that it’s unlikely that this partisan dynamic will play out in other core markets such as China and Europe. Indeed, sales for Tesla’s Model Y just broke Norway’s best-selling car record, which had been in place since 1969. That said, the intersection of increasing partisanship and competition cannot be described as anything other than a headwind. Tesla has historically allayed competition concerns, but becoming a partisan brand introduces an unknown and unexplored dynamic into the company’s future. Consumers tend to lead boycotts of brands they see as diverging materially from their political values, with Netflix (NFLX), Nike (NKE), and Disney (DIS) previously being subject to boycotts by Republicans.

There are already rising calls in Democratic circles to boycott Tesla. Whilst these look to be small and relatively isolated calls, they could quickly grow as the Twitter story evolves. I remain neutral on Tesla stock here.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.