Summary:

- US Consumer Credit stability is faltering as default rates and provisions for loan losses begin to rise.

- Household financial health and consumer sentiment surveys suggest consumer financial conditions are deteriorating rapidly.

- Immense yield curve inversion suggests a more significant prolonged economic contraction may be around the corner.

- Capital One is heavily exposed to a significant potential rise in credit card default rates, particularly if unemployment eventually rises.

- Regardless of recessionary potential, Capital One’s profitability will likely be strained in 2023 due to a sharp rise in bank borrowing costs.

Adam Gault/OJO Images via Getty Images

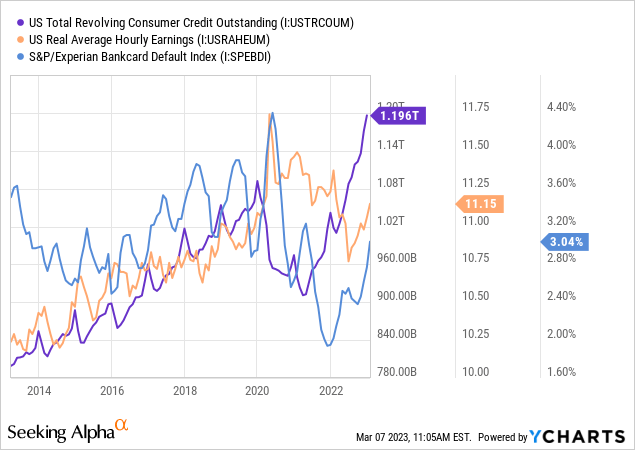

Over the past two years, rising living costs have caused many people to become more reliant on debt financing. Since March of 2021, the total US consumer credit outstanding has increased by 13%, while revolving consumer debt has grown by 31%. Over the same period, real wages have declined, and personal savings levels have plummeted. The initial “shock” appears to be the rise in inflation, which is now partially moderated, but the increase in interest rates seems to be causing default rates to rise. See below:

Surprisingly, 2020 was an outstanding year for the consumer credit market due to immense government stimulus and a “forced decline” in extraneous spending levels (vacations, etc.). During that time, real hourly earnings rose (due to stimulus payments and extra unemployment benefits), and credit default rates plummeted. Consumer credit-oriented banks such as Capital One (NYSE:COF) soared in value, with that bank rising to ~70% above its pre-COVID level by 2021.

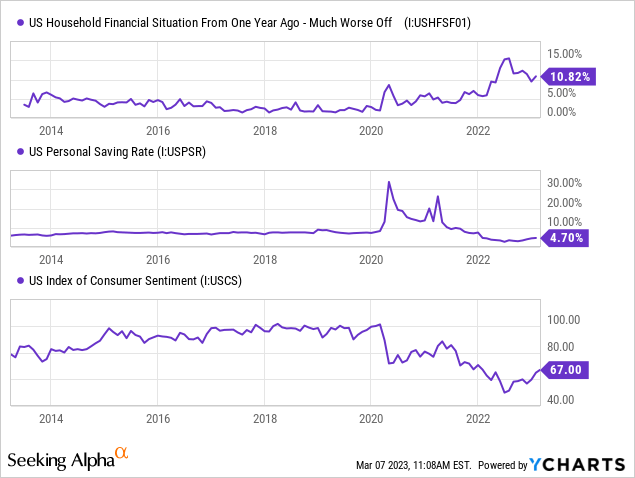

However, “there is no free lunch” as the massive inflation caused by the stimulus quickly caused the household economic situation to sour by 2021. Rising living costs and stagnating wages caused savings to decline, creating excess demand for credit card debt. Initially, this situation was great for Capital One as demand for its products rose, and its net interest margins increased on higher APR rates. However, the rapid decline in consumer sentiment and savings over the past year has caused default rates and expected loan losses to increase. While many investors seem to discount this risk factor, consumer sentiment surveys and savings levels paint a challenging picture of personal lending stability. See below:

This data indicates Capital One and its peers will face challenging headwinds in 2023. Default rates are not yet high enough that the bank will likely suffer significant losses. Still, consumer sentiment, savings, and household financial health data indicate default rates may only be starting to rise. Further, banks are finally being forced to raise deposit and CD rates to maintain deposits, implying net interest margins are likely to plummet this year. In my view, Capital One is likely to face a significant decline in earnings this year back to pre-COVID levels. However, if a recession occurs and unemployment rises amid pre-existing weakness in household financial stability, Capital One could suffer much larger losses.

Red Flags Mounting in Consumer Credit

We must answer three critical questions to assess Capital One’s investment viability. First, what is the likely change in macroeconomic fundamentals this year? Second, what are Capital One’s income and balance sheet exposure to those macroeconomic fundamentals? Third, what should Capital One be worth considering for its risk-reward profile? Behind these questions, we must consider that Capital One is unique among US banks due to its immense exposure to credit card debt. At the end of last year, Capital One had $138B in credit card loans outstanding, or ~44% of its total loan book, so a rise in defaults or borrowing costs is a significant risk to the firm’s stability.

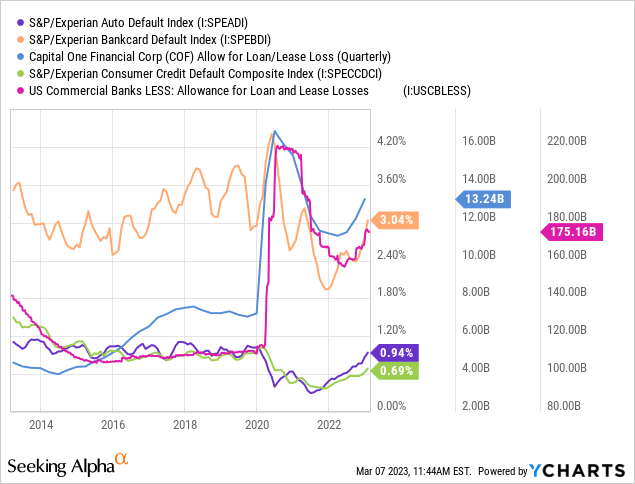

The first question regards the macroeconomic situation at large. Today, Capital One’s allowance for losses is elevated, but overall defaults are back in normal ranges. Default rates on auto loans and credit cards are rising quickly but are no higher than before 2020. Credit card defaults remain slightly below pre-pandemic levels. See below:

At this point, we can undoubtedly say that the consumer credit situation is deteriorating, but it is not “bad” by any measure and remains in very healthy ranges. Capital One’s provision for loan losses has risen, taking a bite out of the company’s EPS but far below “recessionary” levels. However, we must remember that default rates considerably lag other economic measures. Indeed, during a recession, default rates are usually the last to rise, following increases in unemployment. Of course, unemployment lags behind the GDP, which itself is predicted by the yield curve and business survey data like the PMI.

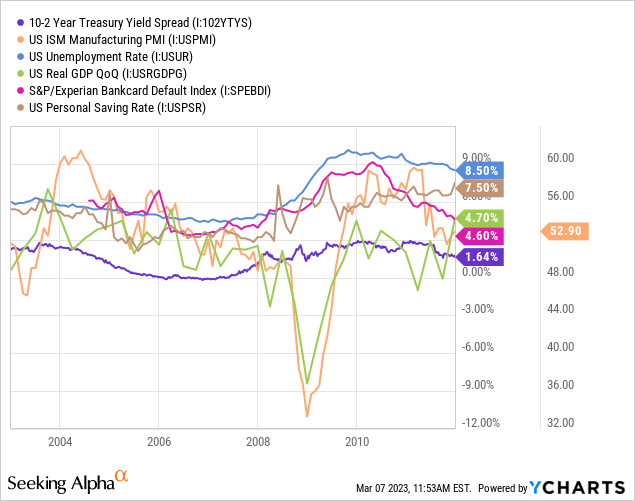

To illustrate, see the pattern from the last large credit cycle during the 2000s:

During this period, the yield curve inverted around early 2006. At the same time, the manufacturing PMI was trending lower, and personal savings levels fell to relatively extreme lows. However, the GDP did not enter a recession until two years later, in 2008. It was not until 2009-2010 that the credit card default rate began to soar.

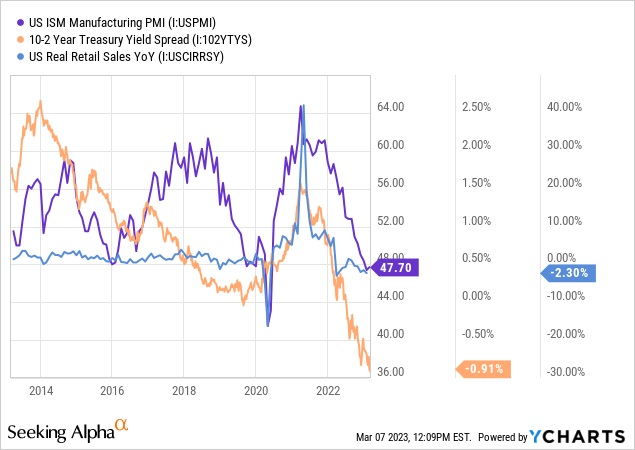

During this cycle, the yield curve inverted last year, while the manufacturing PMI has been decorating since late 2021. More recently, annual real retail sales growth turned negative, suggesting households are forced to reduce spending as credit capabilities are tapped out. Further, the yield curve has reached a multi-decade record inversion level and continues to decline, suggesting a large potential economic storm could be around the corner. See below:

Based on this data, it may still be a year or more before default rates rise above normal levels. I believe this will likely occur soon after unemployment starts to increase. Employment levels today remain firm on the surface, but the ongoing sharp increase in significant corporate layoffs suggests it will grow and that, while overall employment data is “good,” higher-paying middle-class jobs are disappearing quite quickly.

Each economic cycle is unique, so we cannot know precisely what the future will hold concerning consumer credit. However, historically strong economic indicators such as the yield curve and manufacturing PMI suggest that a significant and potentially prolonged economic slowdown is likely. Additionally, consumer credit indicators, such as savings levels, consumer sentiment, and the percentage of households reporting worsening financial conditions, all indicate a considerable strain for the consumer credit sector. The sharp increase in interest rates may exacerbate this issue as many households see mortgage and auto loan costs increase quickly.

Investing is largely about probabilities and expectations. Investors should weigh the probability of a significant and sustained increase in credit card defaults, potentially up to the ~8% level from ~2010. Indeed, in 2008-2010, consumer stability was greatly aided by massive interest rate cuts, QE, and government bailouts. Considering the Federal Reserve played those cards in 2020, creating massive inflation and monetary instability, I believe they will likely be unable to save the market through these supportive policies should the economy continue to deteriorate. The fact that inflation continues to be “above expectations” despite an economic slowdown implies the Fed cannot easily stimulate the economy if needed.

How Will Capital One Be Impacted?

Based on the Atlanta Fed’s “Stress Test tool” model, using Q1 2022 bank data, a “moderate” recession would likely cause Capital One’s CET1 ratio to decline from 12.7% to 6.9%, just below the required levels. Of course, this uses old data, and Capital One has a slightly lower CET1 ratio of 12.5% today, and its credit card loans are around 20% higher, so its exposure may be more significant. Interest rates were also much lower than when the model was made. It may be possible that interest rates remain high during a recession (the model assumes they’ll decline rapidly) due to supply-side inflation issues.

Based on the same model, a more extreme recession with a nearly 10% GDP reduction over two quarters would push Capital One’s CET ratio to ~5%. This target declines to 4.6% after stress testing an “extreme recession” with sustained higher short-term interest rates. Overall, I believe it is clear that Capital One has decent exposure to a recession that could cause its balance sheet equity value to slide by 50% or more, even under moderated assumptions.

Of course, I am not a massive fan of the Federal Reserve’s stress test model to assess economic risk exposure. For one, the model is a “black box,” and it is unclear how it equates unemployment rates to implied default levels. In my view, because the household financial strain levels are already so elevated before a rise in unemployment, the impact on default rates from a recession could be significantly more significant than the Fed’s model supposes.

Secondly, the Federal Reserve’s model implies recessions only last for two quarters, and real GDP will rebound entirely within a year following a recession. In my view, that is a major error in the stress-testing model because the economy may be in a more prolonged period of strain. The real GDP declined for two-quarters last year, and expectations are trimming again after the Q3-Q4 rebound. Considering the US and global economy appears to be in a multi-year stagnation, the potential impact on household and business financial stability could be considerably greater than suggested in the Fed’s “two-quarter crash” model.

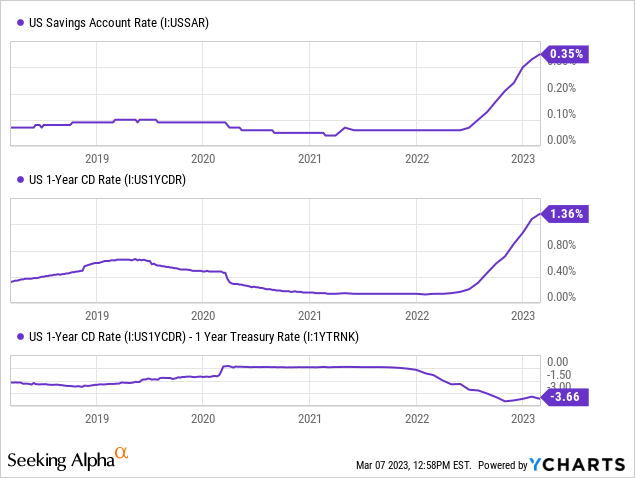

Of course, while a recession is not guaranteed, Capital One will likely see its net interest margins compress this year due to rising CD and savings rates. Capital One boasts very high net-interest margins of ~6.85% due to the rise in credit card loans and interest rates. As shown below, there is an immense discrepancy between bank CD rates and Treasury bond rates:

More recently, banks have finally begun to compete for deposits by increasing rates, with Capital One offering a one-year CD at a 5% yield. Last year was a “goldilocks” period where Capital One could charge much higher credit cards (auto loans, etc.) APR rates but did not need to pay proportionately higher interest costs. Preliminary data suggest that Capital One’s interest costs are rising more quickly. I expect Capital One will continue to increase APR rates proportionately to maintain its NIM, but eventually, higher interest rates may increase default rates and expose competitive risks.

What is Capital One Worth?

It is entirely possible that the US economy will rebound and that the many recessionary indications are false signals. Indeed, the shocking decline and rise in economic prospects in 2020-2021 have created ripple effects that may alter the effectiveness of historical economic indicators. However, I believe the economic story facing consumers is relatively straightforward: rising living costs and excessive consumer spending (on credit) have caused many households to suffer significant declines in stability.

Going into 2023, people are forced to reduce spending or face default as higher interest costs exacerbate elevated credit levels. Further, as consumer spending slows, some businesses face strains promoting layoffs. As layoffs begin to cause unemployment to increase, the problems in the consumer credit sector could rise tremendously and may not be “saved” by dovish monetary policies as in 2009 and 2020.

While this outcome is not guaranteed, investors would be wise to discount Capital One according to its probability and likely impact on the company’s stability and income. Fortunately, Capital One has erased almost all of its “pandemic bubble” gains, and its price-to-book ratio has fallen back to ~77%, well within the 60-90% range it held from 2014 to 2019. With this in mind, it appears COF is valued as if its EPS and overall stability will return to pre-pandemic levels. Accordingly, I do not believe Capital One is significantly overvalued, so it is certainly not a short opportunity. However, I also think it is not “discounted” since it is no longer valued on the unreasonable expectations of 2021.

Still, I am generally bearish on COF overall and believe it will likely continue declining in value this year. My sentiment is primarily based on the alarming figures surrounding the strength and stability of US consumer credit. Most of the data suggest credit card and auto loan default rates will rise significantly and could remain high for a prolonged period – potentially wiping out over half of Capital One’s core equity. Despite the recessionary potential, rising deposit costs may seriously hamper its profitability this year. Thus, I believe COF offers little upside in a “best case scenario” and significant downside in a “worst case scenario,” making for a poor risk-reward investment profile.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.