Summary:

- Capital One posted solid revenue growth in 2022 due to the rising rate environment.

- But provision for losses took a bite out of net income, returning to pre-pandemic levels.

- This is a change from prior years, as credit metrics worsen.

- Although the trend is clear, I think these metrics and operations are reverting to the average.

Win McNamee/Getty Images News

Introduction

Capital One Financial (NYSE:COF) has posted outstanding results for the fiscal year 2022, but the trends in credit metrics have overshadowed them. The credit metrics, specifically charge-offs & delinquencies, have seen upward trends. That being said, it seems to be just a return to normal, pre-pandemic levels. Charge-offs and delinquencies have yet to surpass the pre-pandemic averages, so there isn’t too much to worry about yet. I have been adding more to my position at around $100 a share, in the belief, the bank will see results like 2022’s for the next few years.

2022 Results

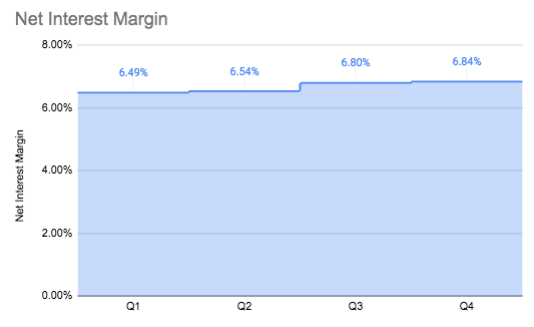

Capital One Net Interest Margin (SEC.gov)

Capital One has had another good performance this year. Net revenue increased by 13%, powered by a 21% growth in interest income. This is due to the rising rates of the past year. Net interest margin increased by 46 basis points this year and increased each and every quarter. The rate increase has helped propel top-line growth, but Capital One has also seen an 11% increase in purchase volume for the year.

But the bottom line was down by 41% compared to last year. Why is this? Well, the bank increased the provision for losses from -$1.944 billion to $5.847 billion. But this is in line with pre-pandemic levels. And despite net income declining, it was still at $7.360 billion or $17.91 per share this year. Overall, another very solid year in the books for Capital One.

A Clear Trend In Credit Metrics

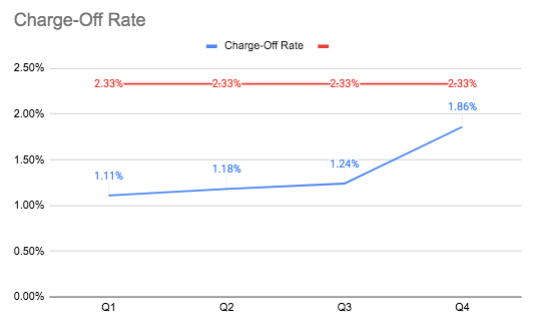

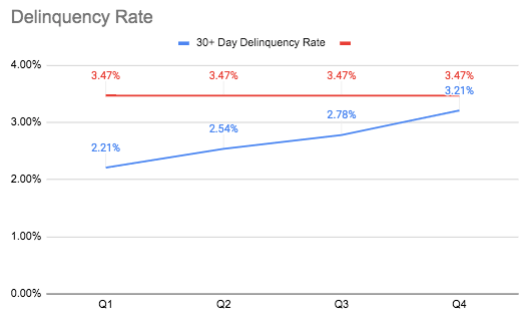

Capital One Charge-Off Rates (SEC.gov) Capital One Delinquency Rates (SEC.gov)

With 2022 showing good results, the bank did increase provision for credit losses to build up a reserve, when just a few years ago they were trying to lower the reserve after overshooting pandemic losses. So what changed? A historically strong consumer has started to weaken back to normalcy. This can be seen in the clear upward trends of charge-off and delinquency rates. Just in 2022, the charge-off rate increased by 48 basis points, while the 30+ day delinquency rate went up by 80 basis points.

While the trend is clearly showing slowly worsening credit metrics, I don’t believe this will persist into troubling territory. It seems that this is a troubling trend on the surface, but the metrics are still well below normalcy periods. With a 1.36% charge-off rate and a 3.21% delinquency rate, there is still room with the 2015-2019 averages of 2.33% and 3.47%. The delinquency rate will need to keep an eye on, but overall the bank is still very healthy. On top of that, the allowance ratio is almost 2% higher than pre-pandemic levels, so excess provision for losses won’t be an issue to earnings.

Valuation

As of writing, Capital One is trading around the $110 price point. At this price, the bank is trading at a trailing P/E of 6.14x. But financial companies are not best valued on earnings. Looking at the P/BV, we have 0.80x and with a tangible book value of $86.11, 1.28x. With these two book value ratios, it seems the company is fairly close to book value. I have been adding to my position at below $100 per share, as I believe this is a good price point to dollar cost average.

Conclusion

While credit metrics have been on the rise, Capital One is still performing better than in pre-pandemic times. The charge-off and delinquency rates have climbed each quarter this year, but are still below the average before 2020. I foresee the bank operating at normal levels, such as a provision for credit loss of around $4-5 billion a year, charge-off rates of about 2.5%, and delinquency rates of about 3.5%. Therefore, I think at 1.28x tangible book value, Capital One is trading about fair value.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in COF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.