Challenging Times Ahead: A Critical Assessment Of Micron Technology’s Outlook

Summary:

- Micron Technology stock has risen by nearly 70% in 2023 despite a decline in revenue of nearly 40%.

- The company faces challenges such as loss of market share and overly optimistic growth expectations.

- The stock is overvalued compared to Wall Street analysts’ projections and is underpricing headwinds in the semiconductor industry.

vzphotos

Thesis

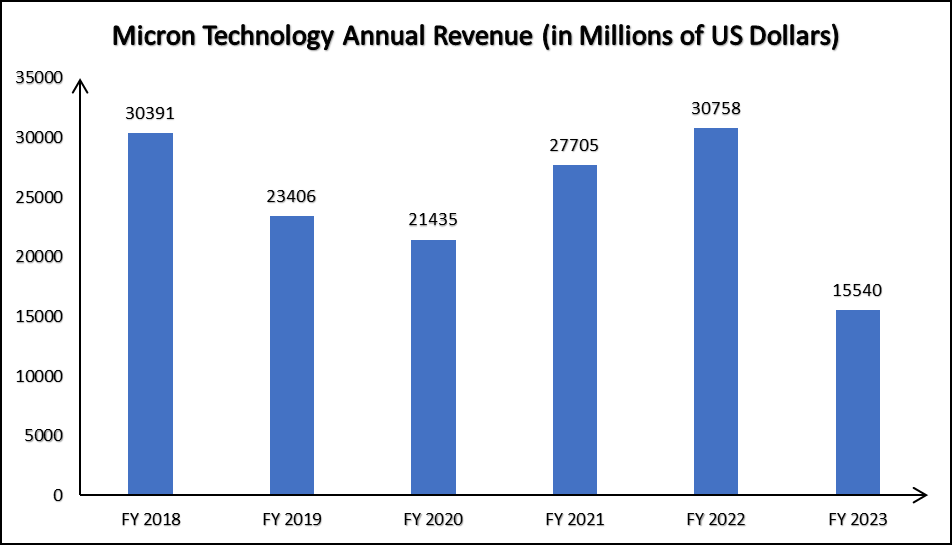

Micron Technology, Inc. (NASDAQ:MU) is an American producer of computer memory and computer data storage including dynamic random-access memory, flash memory, and USB flash drives. It is headquartered in Boise, Idaho. The stock has risen by nearly 70% in 2023, while revenue has declined by nearly 40% in the same time. What is puzzling is that the stock has nearly tripled in the last 5 years without any growth in revenues. The below graph shows the company’s revenues over the last few years.

Micron Quarterly Report

The company faces several challenges in the near term such as loss of market share and I also argue how the management’s expectations of even the slightest of growth in volumes might be a bit too optimistic. I expect these headwinds to play a large role in curtailing the company’s growth prospects over the coming year. The DCF valuation puts these catalysts into numbers, and we discover how overvalued the company is despite my optimistic projections compared to Wall Street Analysts. This shows how the market is underpricing headwinds and overpricing tailwinds, thanks to loose financial conditions and the AI-led frenzy in Semiconductor stocks, which have propelled the stock to grow 70% with halving revenue in FY 2023.

Catalysts

Low Growth Expectations in 2024 might still be too optimistic

The company’s management’s guidance seems very optimistic regarding the coming year. This is largely based on the belief that the excess supply will subside and the demand-supply balance will be restored, leading to an increase in chip prices. It does not consider the possibility of slowing growth in the demand for the final goods, which use their products as inputs. For the upcoming calendar year, the company expects mid-single-digit growth in its Data Center segment, and low/mid-single-digit growth in the PC segment, modest growth in the mobile segment. The company also expects gross margin expansion in the near term owing to price hikes rather than increases in shipments.

However, I believe that the management’s analysis might be and likely is incorrect. Firstly, in the Dynamic Random Access Memory (DRAM) segment, prices are sliding as there is a glut of DDR4 chips which is putting downward pressure on prices. There is an existing oversupply plus an influx of used chips, which is leading to the supply glut.

The company also faces problems in China, owing to the sour trade relationship between the United States and China. The U.S. Government barred Micron from selling its memory chips to the Chinese tech giant Huawei in 2020 as the trade war escalated. China struck back earlier this year by barring its key infrastructure providers from buying Micron’s chips. This will have a major impact on the company’s growth prospects, as has been acknowledged by the company in its 2023 Annual Report. Unfortunately, it’s tough to put an exact figure since there is no list of the companies that have been designated as critical information infrastructure operators published by the Chinese government or otherwise available to the company. Therefore, the full impact of the CAC decision on Micron’s business remains uncertain. To top it all off, the U.S. Commerce Department is mulling new restrictions that could prevent domestic chipmakers like Micron from receiving subsidies if they expand their overseas operations in China, Russia, Iran, or North Korea. Those rules haven’t been approved yet, but they could impact Micron’s overseas foundries (including one in China), and make it much more difficult for Micron to overcome its cyclical challenges and stabilize its business.

A major market for the company’s DRAM products is the Personal Computers (PC) industry and the Smartphone industry. DRAM accounted for 71% of the company’s revenue in Fiscal Year 2023. If we go by what major players in the PC and smartphone industries are guiding, then growth prospects seem bleak. Dell mentioned that large corporations are being cautious with their spending, and they are yet to see a broader recovery in the PC segment. “We saw more cautiousness from our customers. We saw them being more selective, particularly large commercial customers, enterprise customers and particularly in North America.” is what the COO of Dell had to say. Even Hewlett Packard (HPE) warned of soft demand, and that they expect the macro-environment to remain challenging in the coming quarter or two.

Decreasing Market Share in the Semiconductor Industry

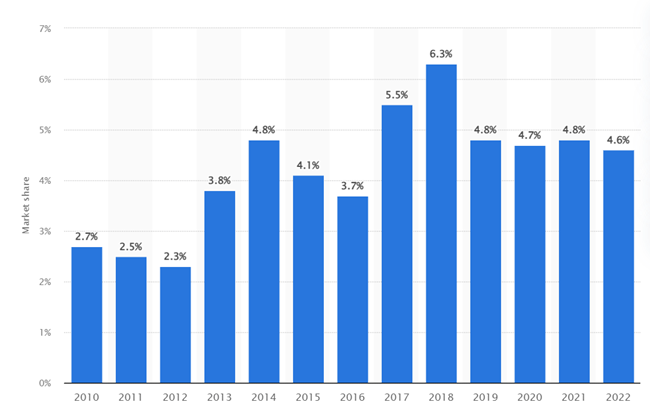

Micron failed to gain substantial market share from the AI wave that led to higher demand for Data Centers and related products in late 2022 and throughout 2023. The company’s has nearly halved in the latest fiscal year, compared to the previous fiscal. At the same time, its rivals in the semiconductor industry have gained market share.

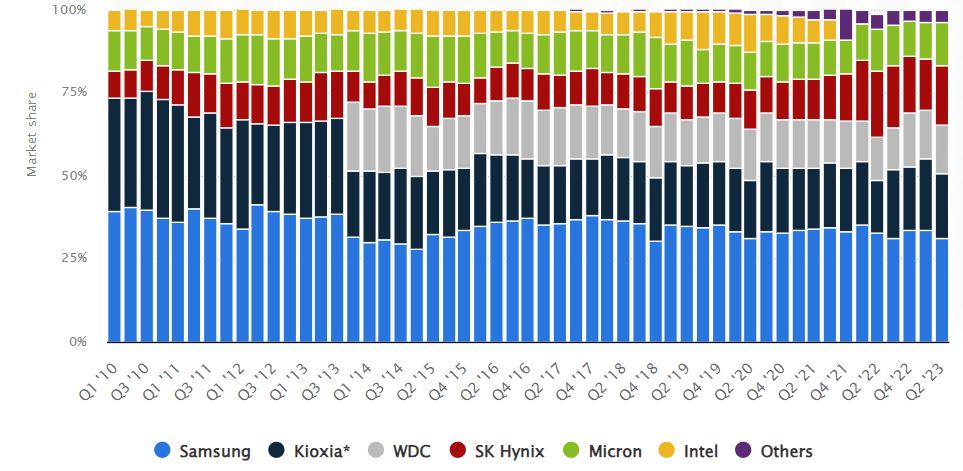

The below graph, sourced from Statista, shows the share of Micron in the semiconductor industry over the years. While data for 2023 isn’t available, it seems obvious that the company has lost market share when its revenue has nearly halved while others such as Analog Devices, Microchip Technology, and Infineon Technologies have grown revenue.

Statistica

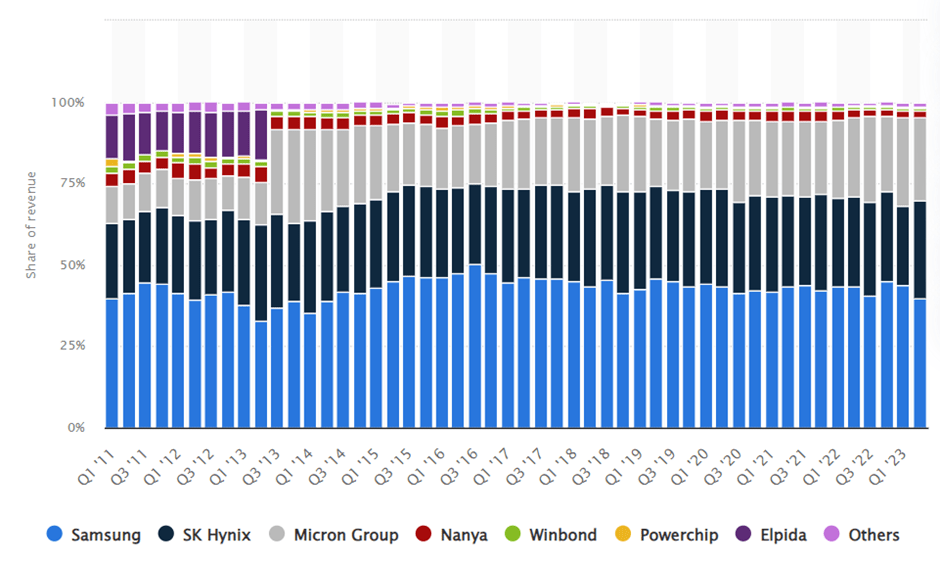

Even in the Dynamic Random Access Memory (DRAM) segment which accounts for 71% of its revenue, it has lost market share in Q2 2023 on a sequential basis with its share going down from 26.9% in Q1 2023 to 25.8% in Q2 2023.

Statistica

Source: Statista – Global Market Share of DRAM Chip Vendors

Valuation

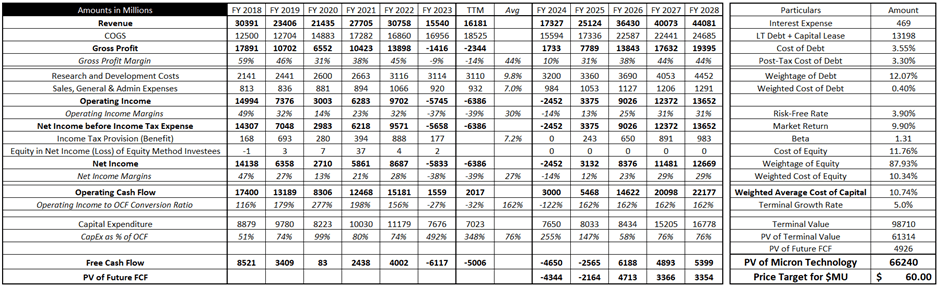

The Analysts’ consensus estimates for Micron’s revenue is for revenue to grow ~48% in FY 2024 and then another 38% in FY 25, and 8% beyond that. I would disagree with that consensus because I believe the headwinds (both macro and company-specific) I mentioned in the catalysts section will get stronger towards the second half of the next fiscal year. This is why I’ve assumed 11.5% growth in FY 24, but for the next two years I’ve assumed 45% compounded growth because of the PC Refresh Cycle (as mentioned by Dell in their earnings call) which is expected to see the introduction of AI PCs and I believe Micron stands to benefit from that. Beyond that. I’ve assumed a 10% revenue CAGR for FY 2027 and FY 2028.

Profit Margins – right from the Gross Profit level to Net Income Margins are expected to improve gradually and reach the long-term average observed between FY 2018 and FY 2022, by assuming costs to grow at their long-term average rate of increase.

Operating Cash Flow was estimated in the long term using the long-term average conversation ratio of Operating Income to Operating Cash Flow. Capital Expenditure for 2024 was taken using the management’s guidance. Capital Expenditure is assumed to grow at 5% for the next couple of years (till FY 26) before reversion to average Operating Cash Flow spent on Capital Expenditure. This is how Free Cash Flow was estimated and then discounted using the CAPM Model.

My Financial Projections

Based on these estimates, I received a fair value estimate of Micron Technology of $66.24 billion, or the equivalent of $60.00 per share of Micron Technology. This represents a nearly 30% downside from the closing price on 27th December 2023.

Risks

NAND Manufacturing – Gaining Market Share

While Micron has lost market share among all semiconductor companies and the DRAM chips sector as well, it has gained market share in the NAND Manufacturing sector. The company’s share has increased from 10.9% in Q1 CY 2023 to 13% in Q2 CY 2023. If this trend continues, the company’s growth will be much higher than what I have estimated in my DCF Valuation model. Additionally

However, I do not see this as much of a risk since the gain in market share has been a consequence of a shrinkage in the overall market size. Micron’s NAND revenue was $886 million from January to March 2023, with a total market share of 10.9%, which is a market size of $8.128 billion. Between April to June 2023, the company’s NAND revenue was nearly $1 billion with a market share of 13%, which is a total market size of $7.692 billion. So, while it is good news that the company is gaining market share, it is not a good sign that the market share has shrunk.

The below graph shows the market share in the NAND Manufacturing sector over the years.

Statistica

NAND Prices have bottomed out at some point in the middle of 2023 and are estimated to have increased in Q4 2023. This can largely be attributed to the production and supply controls implemented by suppliers as a measure to resolve the issue of excess supply in the markets. It’s too soon to project price changes into 2024, but sustained action from Samsung and other manufacturers (in limiting production and supply) and a recovery in enterprise SSD sales could see them move upward.

However, without solid demand, the momentum of this price surge could falter in the upcoming year, impacting the industry and consumers. Samsung expects the smartphone market to grow, but that is very reliant on increased anticipation/ expectations of a soft landing. I do not expect a soft landing based on multiple factors, so I do not see growth in the NAND segment as a large risk.

Conclusion

Based on all the catalysts – loss of market share, and a reality check to the over-optimistic expectations of the company’s management, outweighing the risks to my sell thesis – growth in NAND markets, I would like to place a Sell Recommendation on Micron Technology stock. Based on my valuation model, the fair value of Micron Technology stock is $60, representing nearly 30% downside compared to closing prices on 27th December 2023.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.