Summary:

- Meta is positioned as a key player in digital advertising alongside major tech giants, with a robust compound annual growth rate in ad revenue.

- The upcoming US election cycle presents a significant opportunity for increased revenue, with substantial growth projected in political ad spending.

- Meta’s revenue diversification beyond traditional advertising channels, such as WhatsApp and reels, signifies its resilience and ability to tap into various revenue streams.

- Meta’s substantial investment in AI technology and recommendation systems drives user engagement and ad performance.

- Meta’s close above $375 in early 2024 is necessary to confirm the bullish trend.

Douglas Rissing/iStock via Getty Images

Investment Thesis

In 2024, Meta Platforms, Inc. (NASDAQ:META) is set for a promising market outlook, positioned as a key player in digital advertising alongside major tech giants. With a robust compound annual growth rate (CAGR) in ad revenue, Meta’s success is rooted in its effective use of AI-driven advertising tools and user targeting strategies.

The upcoming US election cycle presents a significant opportunity for increased revenue, with substantial growth projected in political ad spending. This aligns with the broader trend of escalating digital advertising, where Meta’s diverse platforms, such as Facebook, Instagram, and WhatsApp, play a critical role. Positioned to capitalize on these trends, Meta is geared to reinforce its dominance in the digital advertising market.

Favorable Market Outlook for Meta in 2024

Meta is one of the top global platforms for digital ads (others are Alibaba (BABA), Amazon (AMZN), Bytedance, and Google (GOOG) (GOOGL)). There is a significant growth trajectory in ad revenue for these top players, with a CAGR of 25.4% from 2016 to 2022, surpassing the overall ad market’s growth rate of 9.3%.

Fundamentally, this growth reflects Meta’s solid performance in leveraging its advertising tools and platforms, including AI-driven tools, user targeting capabilities, and optimized ad-buying systems. Election years typically increase political advertising spending significantly, benefiting Meta’s revenue as political campaigns leverage its targeted advertising capabilities.

Looking forward, the forecasted trends from Magna indicate the continuous growth of digital advertising spending, supporting Meta’s growth potential. A projected 9.4% increase in digital pure-play media spending for 2024 indicates the ad industry’s reliance on digital platforms, and Meta, with its broad social network, is a key beneficiary of this favorable trend. Specifically, Meta has a lead position along with TikTok in capturing global social media ad spending ($182 billion), which grew by 15.2% year-over-year in 2023.

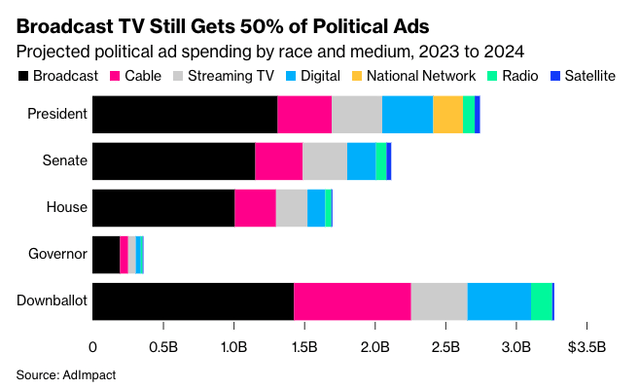

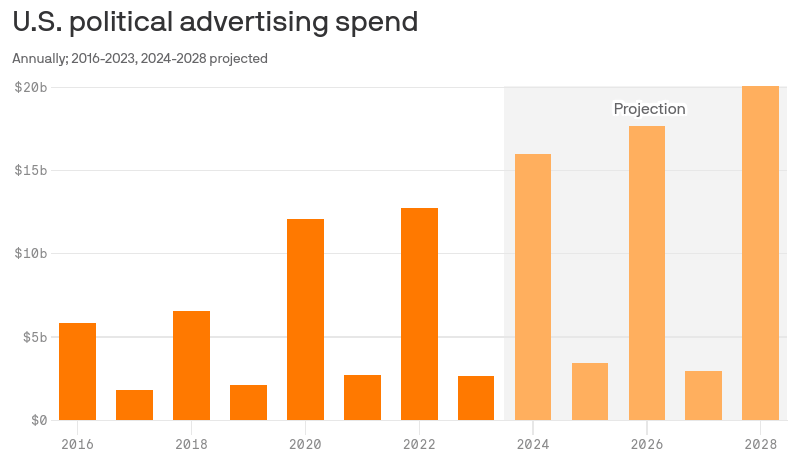

The exponential growth in political advertising spending, especially in the context of the upcoming 2024 US election cycle, fuels Meta’s earnings growth. The projected $15.9 billion in political ad spending next year is favorable for Meta’s topline growth. More specifically, the political ad spending of the 2024 election cycle is 31% higher than that of the 2020 election cycle. Under the trend, by the 2028 cycle, ad spending may hit $20 billion.

www.axios.com

Not surprisingly, a positive correlation exists between Meta’s earnings and political ads during US election periods. Additionally, elections tend to heighten user activity on social media platforms, leading to increased ad impressions and further revenue growth for Meta. Lastly, shifting US advertising budgets from traditional media to digital channels presents an opportunity for Meta to capture a larger share of the expanding digital ad market.

According to Bloomberg, the 2024 US presidential election is forecasted to drive a record $10.2 billion in political ad spending, with digital platforms like Meta expected to garner around $1.2 billion. However, other sources project much higher political spending, close to $16 billion.

This influx, dominated by broadcast TV but significantly inclusive of social media, presents a substantial revenue opportunity for Meta. Increased political advertising and content on Meta’s platforms could enhance user engagement and ad revenue, influencing its financial performance and stock value.

Meta’s Multi-Faceted Mastery: Diversifying Revenue Beyond Ads

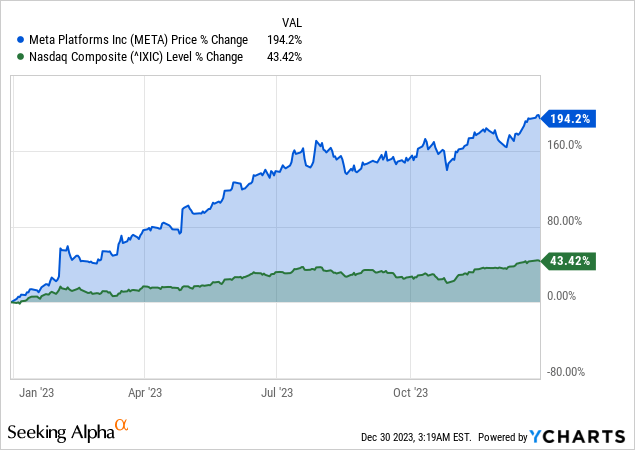

Meta’s exceptional performance has supported its stock valuation’s rapid growth and relative outperformance in 2023. To begin with, Meta’s progressive earnings are not limited to its core advertising platforms like Facebook and Instagram. Interestingly, WhatsApp, Reels, and Threads are leading the revenue growth that may become the core value drivers for Meta over the long term.

Meta’s revenue diversification beyond traditional advertising channels indicates its resilience and ability to tap into various revenue streams. For instance, the Family of Apps’ other revenue reached $293 million in Q3 2023, with a significant 53% year-over-year growth derived from the WhatsApp Business Platform. The notable growth in revenue from business messaging on the WhatsApp Business Platform demonstrates Meta’s strategy to monetize various functionalities beyond conventional advertising methods.

At a broader level, the accelerated spending from Chinese advertisers in the online commerce vertical Q3 and broader growth across advertiser regions reflect Meta’s capability to attract advertisers from diverse geographical markets. Favorable business factors for advertisers, such as lower shipping costs and easing regulations in the gaming industry in China, have contributed to this growth.

Similarly, the exponential growth in business messaging across Meta’s platforms reflects the company’s lead in fostering interactions between targeted individuals and businesses. With over 600 million daily conversations between people and businesses on its platforms, Meta has created a robust ecosystem for commerce and customer engagement.

For instance, 60% of people on WhatsApp in India engage with business app accounts weekly, illustrating the widespread adoption of business messaging for commercial purposes. The doubling of revenue from click-to-message ads in India year-over-year substantiates the revenue potential derived from business messaging.

In this direction, Meta’s strategic acquisition approach is pivotal in its growth. The company completed acquisitions totaling $467 million in cash during Q1-Q3 2023. In detail, $88 million was allocated to intangible assets, while a major portion, $366 million, went towards goodwill. The acquisitions are concentrated to capture potential monetization opportunities.

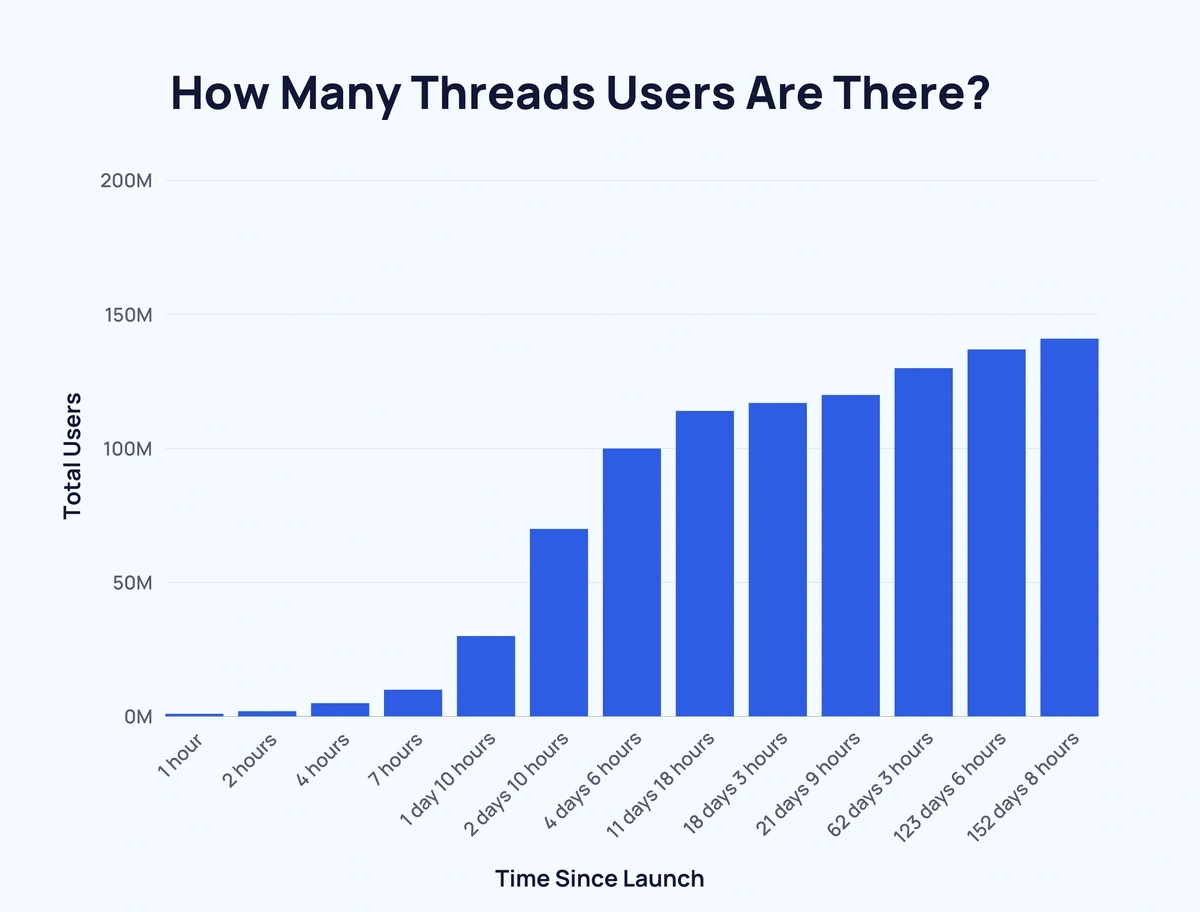

Threads Hits 141M Users: Rapid Rise, Slowing Momentum

Moving to Threads, the Q3 2023 earnings report for Threads revealed a substantial user base of nearly 100 million monthly active users. This figure signifies a solid initial adoption rate and indicates positive reception among users.

However, recent data indicates that the platform has experienced a notable slowdown in growth. While the most recent data (as of December 4, 2023) showcases a user base of 141 million Threads users, the pace of growth has decelerated significantly in recent months.

Notably, it took Threads 4 days to hit the milestone of 100 million users. However, since then, the platform has managed to add only an additional 41 million users, indicating a considerable decrease in the rate of user acquisition.

explodingtopics.com

On the downside, current statistics reveal that users spend an average of merely 3 minutes daily on the app. This pales in comparison to the engagement metrics of other social media platforms. For instance, X (ex-Twitter) boasts 200 million daily active users (DAUs), each spending an average of 31 minutes per day on the platform, suggesting a stark contrast in user engagement between the two platforms.

Specifically, the decline in user growth momentum and the comparatively low average daily user engagement time on Threads, as opposed to platforms like X, suggest potential challenges for Threads in retaining and engaging its user base. However, positive growth in Threads user base’s average time spent metric may serve as progressive support for Meta’s topline expansion.

Reels Revolution: Driving Instagram’s Engagement and Meta’s Monetization

On the other hand, Reels has a vital impact on Instagram’s user engagement. Since its launch, Reels has derived a notable increase of more than 40% in time spent on Instagram. This surge in user engagement indicates the progress of Meta’s strategy of introducing practical content formats with solid user adoption, compelling them to spend more time on the feature. Thus, Reels’ popularity among users enhances monetization opportunities for Meta.

Moreover, Reels has reached a point where it is now net neutral to overall company ad revenue. This signifies that the revenue generated through Reels’ ads has balanced with the investment and resources allocated to the feature’s development and maintenance.

Meta’s focus on advancing AI technology is evident from its significant investment in AI-driven solutions and platforms to harness the monetization potential. The company leverages AI in various facets, including generative AI models like Llama 2 and recommendation AI systems powering feeds, Reels, ads, and integrity systems.

AI Mastery: Boosting Engagement & Monetization

Llama 2, with over 30 million downloads, represents Meta’s leadership in developing and deploying advanced AI solutions at scale. The impact of AI-driven feed recommendations led to a 7% increase in time spent on Facebook and a 6% increase on Instagram. This indicates the effectiveness of AI algorithms in curating personalized content for users, thereby increasing their engagement on Meta’s platforms.

Furthermore, the integration of AI tools for advertisers, such as Advantage+ Shopping Campaigns and Advantage+ Creative tools, has resulted in tangible outcomes, including a $10 billion run rate for Shopping Campaigns and more than half of advertisers utilizing Advantage+ Creative tools to optimize their ads’ images and text.

Meta’s strategic focus on enhancing its products, especially reels and onsite experiences like click-to-message ads, reflects its focus on innovation and user engagement. Reels’ evolution from an early initiative to a core part of Instagram and Facebook signifies its integration into the platform’s fundamental experiences.

Finally, Meta’s efforts to improve Reels’ ads performance through ranking enhancements and increased interactivity target a balance between engagement and revenue growth.

Unstoppable Growth: Soaring User Engagement and Ad Impressions

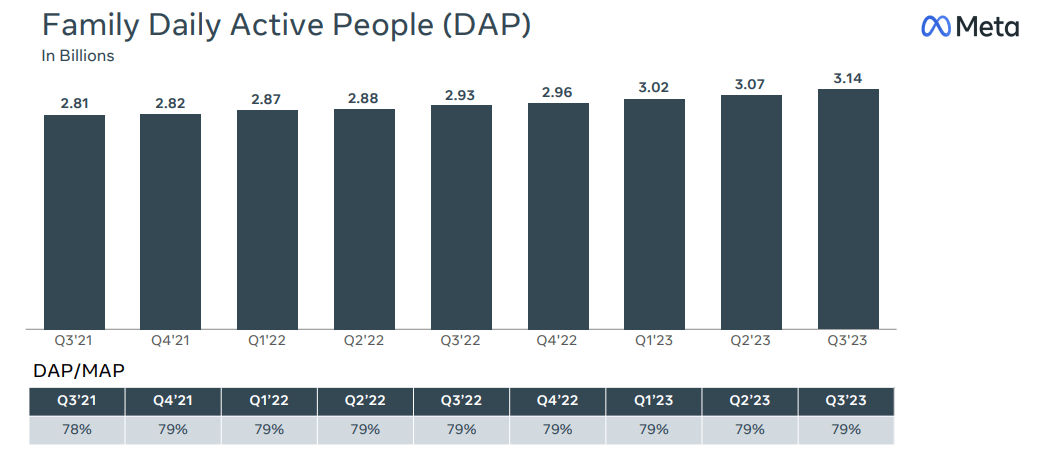

At its key performance metrics, Meta has delivered a solid trajectory in its Family Daily Active People (DAP) figures. Across multiple quarters, the average DAU consistently grew. In Q3 2023, DAP stood at 3.14 billion, with a 7% year-over-year increase. This surge aligns with the year-over-year growth trend observed earlier, maintaining a growth rate of 7% in Q2 2023, 5% in Q1 2023, and 5% in Q4 2022. Even in Q3 2022, the rate was at 4%.

Therefore, this consistent increase in DAP signifies Meta’s ability to retain its existing user base and attract new users steadily. This suggests that Meta’s offerings continue to engage a vast audience globally, solidifying its position as a primary platform for social interaction and content consumption.

Earnings Presentation

Similarly, Meta has attained substantial growth in its Family Monthly Active People (MAP) metrics, signifying increases quarter over quarter. As of Q3 2023, the MAP had reached a massive 3.96 billion users, showcasing a 7% year-over-year uptick. The growth pattern in MAP reflects that of DAP, maintaining a 6% and 5% year-over-year increase in Q2 and Q1 2023 and 4%-4% in Q4 and Q3 2022.

Fundamentally, the expanding MAP suggests Meta’s ability to engage many users, including those active monthly. This metric is vital as it points out the platform’s potential to retain and keep users engaged over extended periods.

On the other hand, Meta’s advertising ecosystem has grown substantially in ad impressions across its Family of Apps over consecutive quarters. In Q3 2023, ad impressions surged by 31% year-over-year, building upon previous growth rates of 34%, 26%, 23%, and 17% in the last four quarters.

Critically, the growth in ad impressions suggests that users spend more time on the platform, creating more opportunities for advertisers. Also, it signals the effectiveness of Meta’s advertising strategies in capturing users’ attention and maintaining high user activity levels.

In contrast to the growth in ad impressions, Meta experienced a consistent decrease in the average price per ad over the quarter. In Q3 2023, the average price per ad decreased by 6% year-over-year, following a reduction of 16%, 17%, 22%, and 18% year-over-year in the previous four quarters. Even though the declining price per ad might seem concerning at first glance, this reduction is logically strategic to attract advertisers through cost-effective advertising solutions.

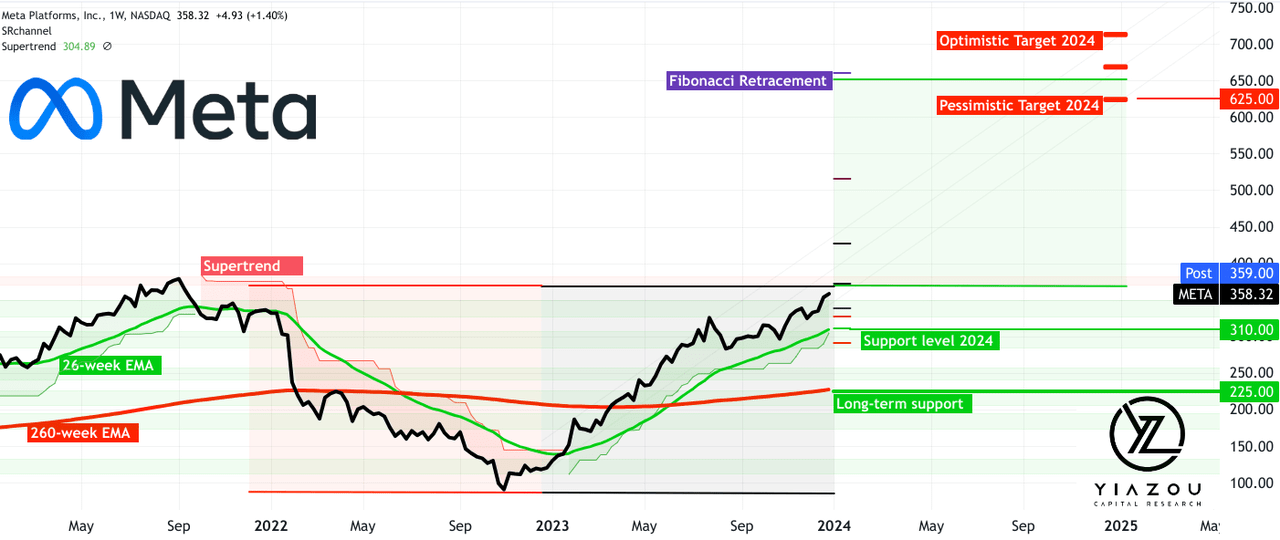

Poised for Bullish Breakthroughs

Meta’s stock price has recovered almost entirely from its fall (from 2021’s peak). The price is still experiencing solid bullish momentum, as the supertrend indicator suggests. The exponential moving average of 26 weeks (green EMA) may be a crucial navigator for the stock’s upward trajectory.

If the price follows a 26-week EMA with progressive quarterly results, the price may hit a pessimistic target of $625 (an optimistic target is $715). The target is based on the current strength of the price trend and the Fibonacci retracement. The price must close over $375 in early 2024 to confirm the current bullish projection.

After breaching the mega range (red and black channel), if any of the four quarterly earnings in 2024 disappoint (as a surprise), the price may retest the $375 level as the pivot (of the forward projection) on the downside.

Finally, for any worst-case scenario (less likely, a recession may be), $310 and $225 serve as key support levels. Also, on the uptrend, $520 and $430 may serve as minor resistance that may lead to minor corrections.

Takeaway

The key takeaway for Meta in 2024 is its strong positioning in the digital advertising market, bolstered by innovative AI-driven strategies and a diverse range of platforms. With the upcoming US election cycle, Meta is poised to benefit from a significant surge in political ad spending, aligning with the broader trend of increasing digital advertising.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.