Chevron’s Investor Day: Perfectly Positioned For The Next 10 Years

Summary:

- Chevron held its Investor Day this morning (Tuesday, February 28th) and shared why it believes the company is a compelling investment opportunity.

- In a nutshell, CVX believes it can continue delivering excellent shareholder returns by leveraging its advantaged portfolio, strong balance sheet, and capital and cost efficiency.

- For instance – if Brent crude averaged $75/bbl 5 years, Chevron says it could still increase the dividend at “higher rates” and buy back 25% of its total outstanding shares.

- In a press release prior to the presentation this morning, Chevron said it’s raising its targeted annual share buyback rate to $17.5 billion starting in Q2.

- At pixel time, Chevron has a forward P/E of only 10.5x, pays a $6.04/share annual dividend, and yields 3.72%, all of which are superior to the broad S&P500 average.

Chevron Posted Back-to-Back Record Profits &Free-Cash-Flow In 2021-2022.

Mario Tama

As my followers know, I have long considered Chevron (NYSE:CVX) to be the best international integrated oil company on the planet. The company certainly proved that in 2021 and 2022 – delivering record profits and free cash flow in back-to-back years. Today, Chevron held its 2023 Investor Day Presentation and gave shareholders a clear line-of-sight into what they can expect from the company moving forward. From a high-level perspective, I would characterize the presentation by observing that Chevron’s capital and cost efficiency means the company can deliver downside resilience while maintaining excellent upside leverage. That all starts with an advantaged portfolio, so that’s where I will start.

Advantaged Portfolio

As an excerpt from one of the presentation slides shows below (you can view the entire 2022 Investor Day Presentation here), Chevron has a well-diversified portfolio (both by resource and geography) that positions it perfectly for the next decade:

Chevron

I say that because the foundation of the portfolio is long-cycle assets in its base production: Australian/Angola LNG, TCO (more on TCO below), and deep-water Gulf-of-Mexico, for instance. Most of you are already familiar with Chevron’s excellent LNG assets (Gorgon and Wheatstone in Australia) and GoM deepwater, so I will start by discussing TCO.

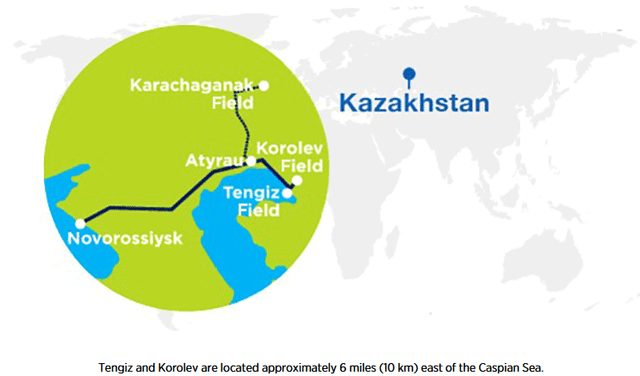

TCO stand for “Tengizchevroil,” which is a joint venture: Chevron (50% share in the consortium), Exxon Mobil (25% share), KazMunayGas (20% share) and LukArco (5% share). During this morning’s presentation, CVX management discussed TCO’s “FGP/WPMP” project. FGP/WPMP stands for the integrated Future Growth Project – Wellhead Pressure Management Project and is designed to increase total daily production from the Tengiz reservoir by an estimated 260,000 bpd while maximizing ultimate recovery. The project will keep the existing Tengiz plants running at capacity by lowering the flowing pressure at the wellhead and then boosting the inlet pressure of the six existing processing trains.

The discussion included the following update on FGP/WPMP:

- Construction is 82% complete, project is 89% complete.

- Current focus is on getting utilities up and running and completing construction on the process systems.

- TCO has already started up three of four production metering stations, delivering high-pressure oil from the new wells to the existing plants.

The bottom line here is that spending on this project – which has been on-going for years and which has suffered everything from cost-overruns and the impact of the global pandemic – is quickly winding down while production will soon ramp-up. That means a big change in TCO’s free cash flow profile. Indeed, Chevron said TCO’s FCF is expected to be in the range of an estimated $6-7 billion by 2024. That will result in significantly higher dividends from the JV and the ability of TCO to pay back Chevron’s $4.5 billion loan.

For those of you not familiar with Tengiz, it’s an elephant field in western Kazakhstan (see above) in which the super-giant reservoir has an oil column an amazing one mile across. Tengiz ranks as the world’s deepest producing field and is the largest single-trap producing reservoir known to man. TCO also operates the nearby Korolev Field.

Estimated oil in place in the Tengiz Field 25.5 billion barrels, with the Korolev Field adding another 1.6 billion barrels. Between the two fields, estimated total recoverable crude oil is 7.1-10.9 billion barrels. In the first half of 2021, TCO’s crude oil production was 108 million barrels (54 million bbls net to Chevron). After the FGP / WPMP growth projects reach capacity, TCO is expected to produce more than 1 million boe/d.

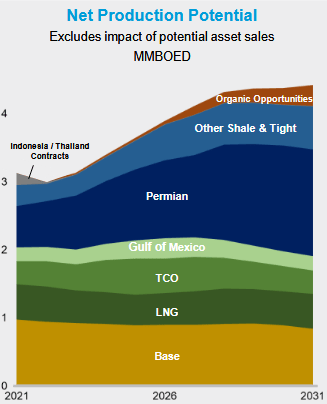

With these long-cycle sources forming the base of Chevron’s upstream production over the next decade, we can now turn our attention to the short-cycle growth prospects – primarily, the Permian Basin:

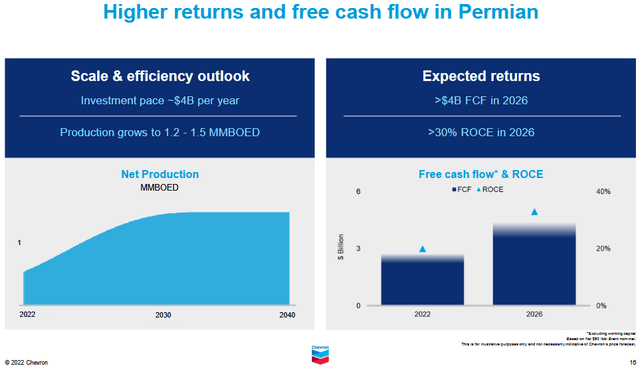

As I have reported previously on Seeking Alpha, Chevron is in full-on manufacturing mode in the Permian and is on schedule to raise production to reach 1 million boe/d by 2025. With investments of an estimated $4 billion annually, Chevron plans to continue ramping up production to an estimated 1.2-1.5 million boe/d plateau by 2030, and then keep it there for an entire decade to year 2040. At $60/bbl WTI, Chevron expects the Permian to deliver >$4 billion in FCF by 2026. Part of the reason for Chevron’s excellent returns in the Permian is due to the fact that a very large percentage of its position is legacy acreage with little or no royalty payments.

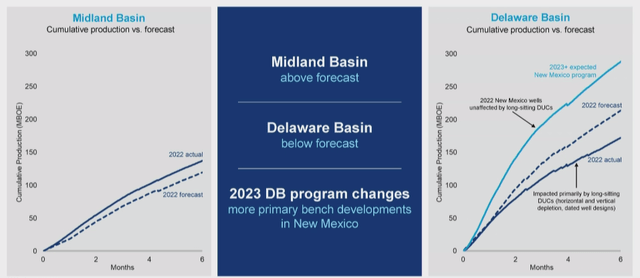

That said, during the presentation, and while the company exceeded expectations in the Midland Basin (see below), Chevron discussed some challenges it had in the Delaware Basin – these included long-sitting DUCs, Hz drilling interference, and out-dated well designs. The combination of these factors led Chevron to under-perform its internal forecast:

Meantime, Chevron also has excellent shale resources to exploit in the DJ Basin, the Haynesville Basin (natural gas), and the Vaca Muerta play in Argentina, where the target for development cost is less than $7/boe.

One of the best potential organic growth opportunities in Chevron’s portfolio are its low-carbon natural gas opportunities in the Eastern Mediterranean as the EU weans itself off natural gas supplies from Russia. In addition to a recent “major discovery” offshore Egypt that adds to Chevron’s Leviathon and Tamar fields located off the Israeli coast, the company plans to fast-track the development of the Aphrodite gas field to supply European markets. The Aphrodite natural gas field lies southeast of Cyprus and was discovered in 2011. It’s part of the assets Chevron acquired via its well-timed Noble acquisition. Aphrodite is estimated to contain about 4.5 trillion cubic meters of natural gas.

Lastly, CPChem – Chevron’s 50/50 joint-venture with Phillips 66 (PSX) – is arguably one of the best chemical companies on the planet due to its excellent and advantaged access to cheap domestic natural gas and NGLs feedstock. In addition to CPChem, Chevron’s downstream assets also include a global refining footprint where it can pick-up margin in times of weaker crude prices.

Low-Carbon Initiatives

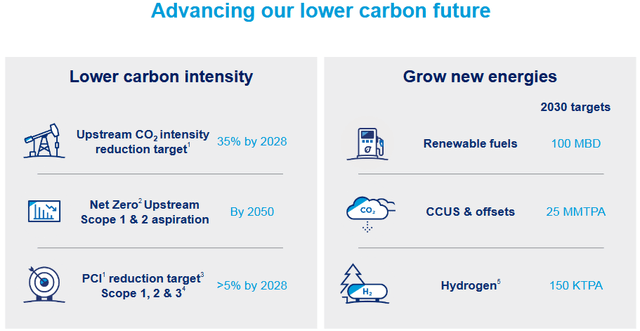

As the slide below shows, Chevron’s Low-Carbon initiatives primarily revolve around two strategies:

- Reducing emissions from operations.

- Growing “new energy” projects.

The “new energy projects” are centered on renewable fuels, carbon-capture and offsets, and hydrogen. However, note that the renewable fuels target of only 100,000 bpd by 2030, and the 150,000 tpa of hydrogen, are not overly impressive for a company of Chevron’s size and scale.

The larger point here: It’s notable that there are still no signs that Chevron has any plans to embrace standard renewable energy projects like solar, wind, and battery backup.

Downside Resilience, Upside Leverage

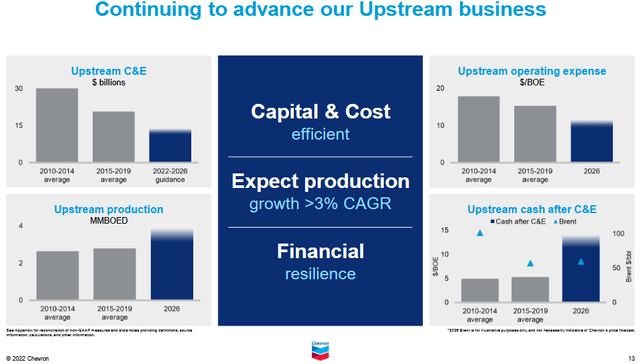

The bottom line: That Chevron has spent a lot of money over the past decade to develop long-cycle assets – like Australian LNG, deepwater GoM, and TCO. Today, the company’s annual cap-ex is much lower, production is growing with higher-margin bbls, and – as a result – upstream operations are much more capital and cost efficient:

Indeed, Chevron says it is “20% more capital efficient than it was pre-COVID.” As a result, the company is going to deliver significantly more FCF for shareholders as its continues to add higher-margin production to the existing mix.

During the presentation, Chevron said that with $50/bbl flat Brent for five years, it can still grow the dividend and maintain buybacks while its net debt ratio would likely move back to its mid-cycle guidance range 20%-25% (CVX ended 2022 with an industry leading debt ratio of 12.8% and net-debt of only 3.3%). However, if Brent nominal prices average $75/bbl over 5 years, Chevron says it could increase the dividend at “higher rates” (while giving no definition of that …) and buyback more than 25% of its outstanding shares. As of today, note that 25% of Chevron’s market-cap ($309.7 billion) equates to $77 billion, which is – of course – $12 billion more than the company’s previously announced $65 billion share buyback authorization.

Indeed, in a press release this morning prior to the Investor Day Presentation, Chevron announced it was increasing its share buyback guidance to a range of $10-$20 billion per year and “will raise its targeted annual share buyback rate to $17.5 billion starting in the second quarter.“

This morning’s press release also summarized the company’s top-level spending, production, and returns outlook:

- Maintaining its guidance for annual organic cap-ex of $13-$15 billion through 2027.

- Affirming its O&G production guidance of more than 3% annual growth by 2027.

- Extending its 12% ROCE target to 2027 at $60/bbl Brent.

The bottom line here: as good as the last two years have been for Chevron shareholders, the next few years could be even better.

Risks

While Chevron appears to be perfectly positioned for the coming decade with respect to O&G assets, in my opinion the major risks for Chevron shareholders over the longer-term are two fold:

- Chevron is significantly over-emphasizing share buybacks as compared to dividends directly to shareholders (see Chevron: What A Big Dividend Disappointment). This effectively forces shareholders to double down on their oil investment rather than letting them have the option of re-investing greater dividends into, perhaps, clean-energy alternatives.

- There’s still no indication that Chevron will directly embrace clean-energy through investments in large-scale solar, wind, and battery-backup assets in order to diversify the portfolio away from O&G.

That being the case, Chevron appears to be ignoring the 10,000 lb gorilla in the room: EVs are expected to make up 50%-plus of new vehicle sales in the U.S. by 2030 (60% on a global). Anecdotally, BYD (OTCPK:BYDDF) and Tesla (TSLA) alone put over 3 million new EVs on the road last year. If we assume these EVs replaced ICE-based vehicles that get 20 mpg and are driven only 10,000 miles per year, that equates to an annual reduction in gasoline demand of 1.5 billion gallons. I will leave the 2030 math for you to do (it’s not hard).

Nearer term, there was a discussion during the Q&A session of the presentation related to the risks of TCO production being transported through the Caspian Sea given Russia’s unpredictable behavior. CEO Mike Wirth responded that there are risks everywhere these days and didn’t seem particularly concerned about Caspian Sea transport. I hope he’s right, it would be awful if – after all the years of capex investment to grow TCO production – if that production was suddenly bottled up due to Russian aggression. That would significantly – and very negatively – impact Chevron’s free cash flow profile.

Meantime, shareholders should not be surprised if Chevron re-issues many (most all?) of the repurchased shares onto the market in order to make a large-scale O&G acquisitions. During the Q&A session of today’s presentation, Wirth responded to a question on M&A by saying the company had a ~2% share of the global oil market and had no holes in its current resource base. At the same time, Chevron has a long record of making excellent acquisitions (as Noble has obviously turned out to be) and obviously has the financial strength, today, to make a sizable acquisition. In other words, there must be a reason that Chevron only raised the dividend 6.3% last year while sitting on a pristine balance sheet and $18 billion in cash.

So, while Chevron appears perfectly positioned for the next 10 years, with the company’s unwillingness to invest in solar, wind, and battery backup, and doubling-down on its O&G investments, I’m not so confident about the following 10 years.

Summary and Conclusion

Chevron’s strong portfolio of both long- and short-cycle assets, combined with its best-in-class balance sheet and excellent capital and cost efficiency, gives shareholders a clear line-of-sight into excellent returns over the next decade. Chevron currently trades with a forward P/E of only 10.5x, pays a $6.04/share annual dividend, and yields 3.72%, all of which are superior to the average S&P 500 company. Chevron is a buy.

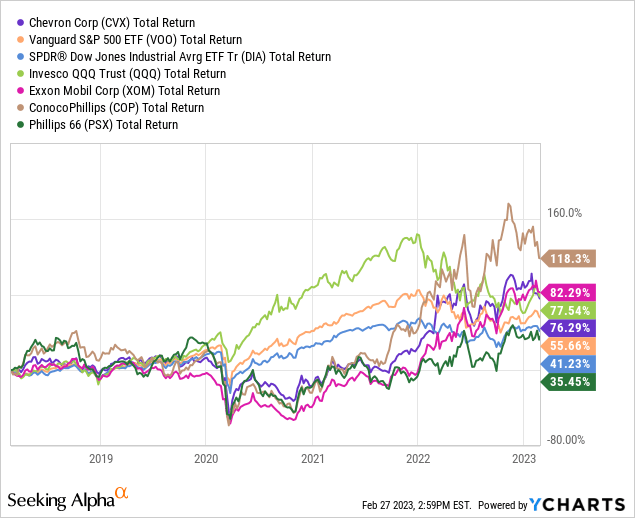

I’ll end with a five-year total returns comparison of Chevron vs. the broad market averages as represented by the Vanguard S&P 500 ETF (VOO), the SPDR DJIA ETF (DIA), and the Invesco Nasdaq-100 Trust (QQQ), along with energy peers Exxon (XOM), ConocoPhillips (COP), and Phillips 66 (PSX):

Note that Chevron has outperformed the S&P 500 by 20%-plus over the past five years, but has trailed its primary peer Exxon by ~5%. For years Chevron ran rings around Exxon, but with the addition of three Engine #1 board, XOM has rediscovered capital-discipline and cost efficiency and may challenge Chevron as my pick for No. 1 international integrated major going forward (read How Tiny Engine #1 Totally Turned Exxon Around). Time will tell. Meanwhile, it’s interesting to me that – despite the big pullback in COP stock YTD (-6.6%), ConocoPhillips has significantly beaten all of the chosen group (see COP: Ironically, Biden Could Be Great For The Stock).

Lastly, note that Chevron is having a retail investor “Exchange Day” on March 23 at 11am. It’s my understanding that ordinary shareholders will be given the opportunity to direct questions to the management team. I plan to question the company on how it is short-changing shareholders on the dividend. I encouraged other shareholders to submit their questions as well.

Disclosure: I/we have a beneficial long position in the shares of CVX, COP, PSX, XOM, VOO, DIA, QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.