Summary:

- Cisco Systems’ stock had a tough 2023 and sits today roughly 20% off its September peak.

- The company reported lackluster earnings for the 2nd quarter of FY2024 and analysts’ revenue estimates have decreased.

- CSCO’s acquisition of Splunk for $28 billion represents a major shift in the company’s strategy towards cybersecurity and one that we think presents a long-term opportunity for investors.

Sundry Photography

We last covered communications giant Cisco Systems, Inc. (NASDAQ:CSCO) in January 2023 (you can read it here). At the time, we were bullish on Cisco’s prospects: the stock had been punished like many others for supply chain pressures, but management had begun to assert that those pressures would abate in the near future. The stock was also very cheap – trading at just ~9x forward EV/EBITDA estimates.

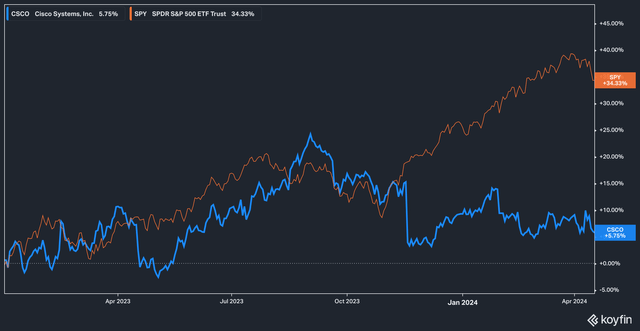

CSCO vs SPY (Total Return) (Koyfin)

2023 saw Cisco’s stock turn in a good performance, keeping pace with the broader S&P 500 (SPY). In September, however, things began to break down, with the stock falling roughly 20% off its peak.

So, where do we think things with Cisco stand now? Let’s dive in.

A Disappointing Year

Ultimately, 2023 and early 2024 have not given investors many reasons to celebrate. Cisco reported lackluster earnings for the 2nd quarter of FY2024, posting $12.79 billion in sales against $13.5 billion for the same quarter the prior year.

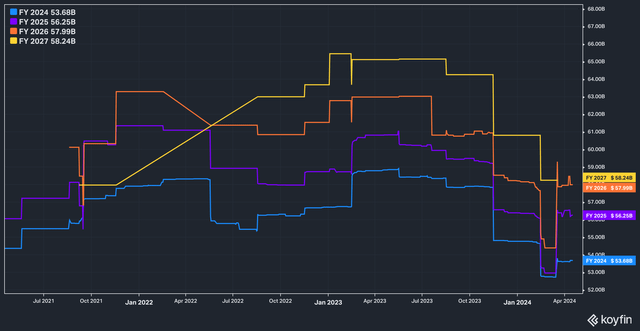

Estimates from analysts on the company’s prospects also ground downward throughout the same time frame.

Cisco Analyst Revenue Estimates (Koyfin)

At its peak in 2023, analysts expected ~$58.8 billion in total revenue for Cisco for FY2024. Today, that estimate stands at $53.6 billion. The outlook for future years has brightened a bit, but likely not enough to make investors excited.

Despite these headwinds to the top line, Cisco’s management has been able to pinch costs and maintain gross margins quite well – the latest quarter saw the company post a 64.2% gross profit margin, a bit above the 3-year average of 63.15%.

Of course, no discussion of Cisco’s 2023 would be complete without touching on the September announcement of the acquisition of Splunk, which was closed in March 2024. Cisco paid $157 per share (roughly $28 billion) for the cybersecurity firm – a price that many considered steep for a company which posted ~$1 billion in revenue in its last quarter of independent operation and net income of $96 million.

Management, naturally, was more upbeat about the acquisition than investors, and the deal represented a major shift in the company’s strategy, entering the cybersecurity space in a big way and lessening its reliance on enterprise back-end and hardware products.

Speaking on the latest earnings call, CEO Charles Robbins had this to say:

Our pending acquisition of Splunk also further supports our transformation strategy by fueling stronger growth, expanding our portfolio of software-based solutions and generating higher levels of ARR with roughly $4 billion in additional ARR expected upon closing and will make us one of the largest software companies in the world.

Aside from that figure, however, management had little to offer in terms of guidance on any further expected synergies between the two companies, with CFO Richard Herren responding to an analyst question with this, combining the issue of the Splunk acquisition with the company’s well-known inventory woes:

I think looking at year-on-year growth rates, I don’t think you’re going to see those growth rates begin to normalize until we work through the inventory that’s in the field right now, which is one of the biggest headwinds we’ve got, right? And then we can get back to regular ordering and then you need to lap that, right? You need to go 4 quarters out to be able to compare it to a more normalized point. So I think that’s the way you need to think about that longer term. But there’s no change at this point. We’ll update the longer-term model after we finish the acquisition of Splunk and can give you better insight into what we look like as a combined company.

Despite this lack of commentary on what the Splunk acquisition means for Cisco, we can reasonably assume a few things:

- The acquisition will bolt-on close to $4 billion per year in top-line revenue.

- Gross and operating (and, hopefully, net) margin are likely to expand as Splunk’s business is not hardware and inventory dependent, as so much of Cisco’s legacy business is.

- The debt load incurred by Cisco in the acquisition was minimal, which means that the servicing load should be correspondingly light.

Valuation

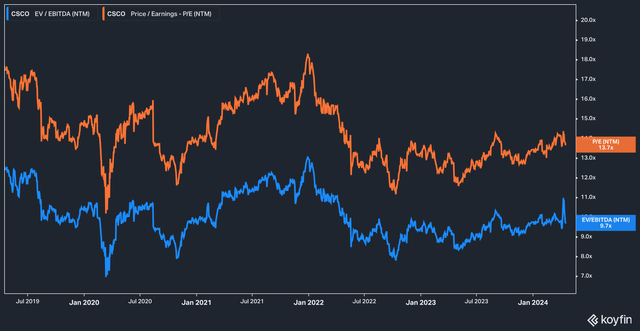

In light of all the pessimism surrounding Cisco’s inventory headaches and investor displeasure with the company splurging on its $28 billion purchase, Cisco remains cheap, although it is no longer plumbing the lows of its historic valuation range.

CSCO EV/EBITDA and PE (5 Yr) (Koyfin)

On a five-year basis, Cisco’s current forward P/E of 13.7x is just a tick under its 14.2x five-year average. EV/EBITDA is similarly close, with an average of 10.1x against today’s 9.7x.

Now, it’s more or less normal for Cisco to have a P/E below 20, as the above range suggests – the market has determined that hardware businesses like Cisco deserve this level of valuation. But what to make of today’s valuation now that the company has a significantly large new, higher-profile margin business in an industry where the market typically assigns premiums?

Splunk competitor CrowdStrike (CRWD), for example, trades at a P/E of 76x. Fortinet (FTNT) trades at 37x forward earnings, and Zscaler (ZS) trades at a multiple of 61x.

Splunk’s products were and are certainly a capable competitor in this field. So the question for investors is, as we see it: will Cisco’s valuation expand as its foray into cybersecurity grows? We think that while achieving the multiple of, say, CrowdStrike may be a bridge too far, we don’t think it would be that remarkable for the market to reward Cisco as quarters pass and performance in the cybersecurity segment begins to make its mark.

The Bottom Line

Cisco has had a tough eight months or so. The stock has been driven lower by investor concerns over an expensive acquisition, as well as the company’s well-known inventory woes. We believe these near-term issues are just that: near term. Inventory issues will eventually be resolved, and we think it likely that Splunk’s business will be a major driver for Cisco in the coming years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice and individuals should conduct their own due diligence before investing. The author is not suggesting any investment recommendations – buy, sell, or otherwise. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgment at the time of writing and is subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.