Summary:

- Abbott Laboratories reported strong Q4 2023 earnings, with year-over-year growth in EPS and revenue.

- The company’s 2024 guidance projects further growth and improved EPS, with organic sales expected to rise by 8%-10%.

- Analysts expect ABT to report modest growth in Q1 2024, with a slight decrease in EPS, but the company has a history of exceeding estimates.

MCCAIG

In my previous Abbott Laboratories (NYSE:ABT) article, I discussed the company’s Q3 2023 earnings, revealing a significant resurgence in their primary business segments. The decline in COVID-19 testing-related revenue did not stop Abbott from pulling in $10.1B for the quarter thanks to 13.8% organic growth from their base business. At that time, I believed ABT was offering a great opportunity for investors thanks to its healthy dividend and that the company was poised for sustained growth after the resurrection of their core markets and the addition of new acquisitions. This view was supported by Abbott’s Q4 earnings, where they reported year-over-year growth for both EPS and revenue. As a result, ABT reacquired some bullish momentum over the past several months and is up roughly 15% from my previous article. Now, we are looking ahead to Abbott’s Q1 2024 earnings on April 17th, where the Street expects the company to report normalized EPS to come in at $0.95, GAAP EPS of $0.66, and revenues at $9.88B. Indeed, these estimates are not very inspiring; however, I am looking forward to the finer details to get a better understanding of how the company is running under the hood.

I intend to provide a brief background on Abbott Labs and their recent earnings performance. Then, I will discuss the company’s 2024 guidance and will match it to the Street’s projections for Abbott. In addition, I will point out a few hurdles that could disrupt Abbott’s growth trajectory. Finally, I reveal my plans for managing my position around the Q1 earnings.

Background Abbott Laboratories

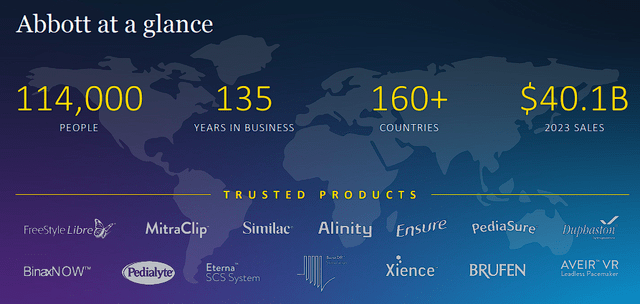

Abbott Laboratories is a healthcare company, offering a broad array of products in over 160 countries around the globe. Abbott is divided into four segments:

- Established Pharmaceutical Products

- Diagnostic Products

- Nutritional Products

- Medical Devices

Abbott’s Established Pharmaceutical Products segment offers a plethora of generic pharmaceuticals for a myriad of conditions and diseases.

The company’s Diagnostic Products category is in charge of advanced laboratory systems that are used in immunoassays, clinical chemistry, hematology, and transfusions. Furthermore, this segment offers cutting-edge informatics and automation solutions refined for laboratory uses.

Abbott Laboratories Overview (Abbott Laboratories)

Abbott’s Nutritional Products segment develops and distributes some of the biggest brand names in the pediatric and adult nutritional markets.

The company’s Medical Devices segment is a leader in developing advanced solutions for metabolic and cardiac indications.

Recapping Q4 2023

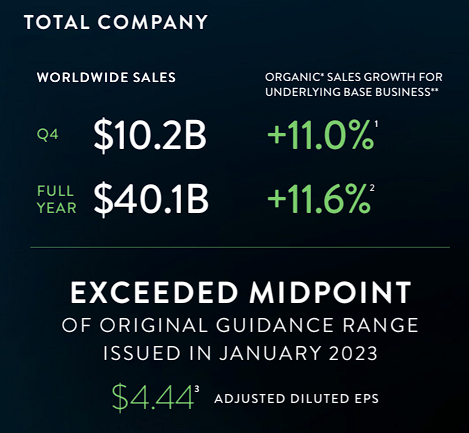

Abbott’s Q4 earnings showed a 1.5% growth in revenue, with a 2.1% rise in organic sales if you exclude COVID-19 testing-related revenue. Most importantly, Abbott’s underlying base business experienced an 11% increase in organic sales. As for EPS, Abbott’s GAAP diluted EPS was $0.91, and their adjusted diluted EPS came in at $1.19.

Abbott Laboratories Q4 2023 Earnings (Abbott Laboratories)

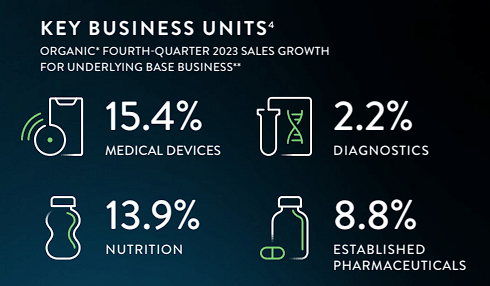

Taking a look at the segments, nutrition experienced significant growth with Pediatric Nutrition continuing to reclaim their U.S. market share.

Abbott Laboratories Business Units Q4 Performance (Abbott Laboratories Business)

In the Diagnostics segment, Abbott’s COVID-19 testing sales weakened as expected, but organic sales revealed positive momentum. Both Established Pharmaceuticals and Medical Devices also recorded organic sales growth.

Mapping Out 2024

In 2023, Abbott regained market share in the U.S. infant formula market and attained FDA approval for key products. However, full-year 2023 reported sales declined by 8.1% due to an expected decrease in COVID-19 testing-related sales, but organic sales for their base business grew by 11.6%. Full-year 2023 GAAP diluted EPS was printed at $3.26, while adjusted diluted EPS was listed at $4.44.

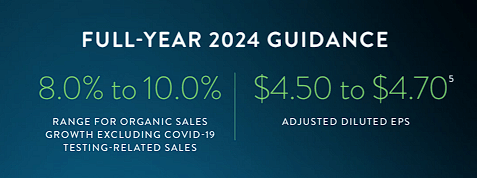

For 2024, the company anticipates further growth with organic sales rising by 8%-10%, excluding COVID-19 testing-related sales. Abbott’s guidance for full-year 2024 projects diluted GAAP EPS in the range of $3.20-$3.40 and $4.50 -$4.70 on an adjusted basis. So, another year of growth and improved EPS.

Abbott Laboratories 2024 Guidance (Abbott Laboratories)

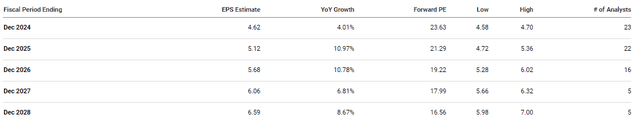

It looks as if the Street is expecting a similar performance from Abbott, with a $4.62 EPS for the full-year 2024, which would be about 4% growth over 2023.

Abbott Laboratories Annual EPS Estimates (Seeking Alpha)

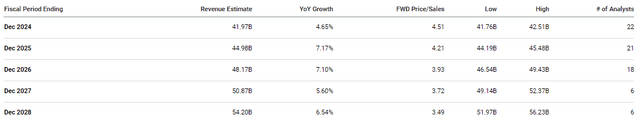

Furthermore, the Street expects Abbott to report roughly $42B in revenue for the full year 2024, which would be about 4%-5% growth over 2023.

Abbott Laboratories Annual Revenue Estimates (Seeking Alpha)

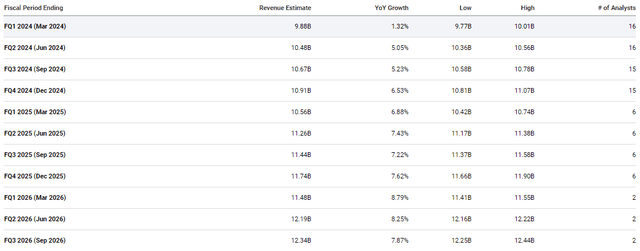

For Abbott to achieve these full-year 2024 marks, Abbott will have to start on the right foot. Analysts are expecting the company to report roughly $9.88B in revenue for Q1 of 2024, which would only be 1.32% growth year-over-year.

Abbott Laboratories Quarterly Revenue Estimates (Seeking Alpha)

In addition, analysts are projecting Abbott will also report sequential revenue growth through 2024.

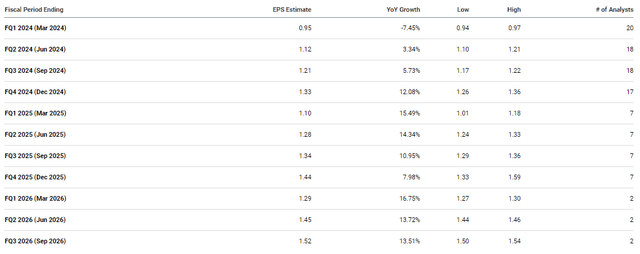

On the other hand, the Street is expecting the company to record a 0.95 EPS, which would be around 7.45% decrease year-over-year. However, I will point out that the company’s quarterly EPS is anticipated to reacquire a growth trajectory for the next couple of years.

Abbott Laboratories Quarterly EPS Estimates (Seeking Alpha)

So, it looks as if we should expect murky Q1 earnings for Abbott with a year-over-year growth in the revenue, but a slight decrease in EPS. Thankfully, Abbott has a history of often beating the Street’s estimates, so perhaps the market will reward ABT with a shot of bullish activity. However, I believe investors need to look beyond the headline numbers and focus on whether the company is still reporting organic growth from their legacy brands and markets.

Another item to look out for is to see if Abbott’s recently launched products are gaining some traction on the market. Abbott’s GLP Systems Track got FDA approval in December, so its progress might not be highlighted in the earnings. However, its approval will be a key advancement in laboratory automation to help streamline diagnostic testing and could drive substantial revenue growth for Abbott. Any indication of early adoption would be a positive omen for a segment that has been hurting as COVID-19 testing revenues decline.

Another product to keep an eye on is Abbott’s PROTALITY high-protein nutritional shake to help people maintain muscle while dieting for weight loss. One of the primary concerns around the GLP-1 boom is that people are losing weight, but they are losing muscle as the body attempts to shed lean body mass to reduce caloric demands. Abbott could benefit from patients and providers looking for a reliable nutritional brand to use while patients are navigating their weight-loss journey.

So, it looks as if we should expect a nuanced start to 2024, however, Abbott’s trajectory for the remainder of 2024 is promising. With projected organic sales growth of 8%-10% and anticipated EPS in the $4.50-$4.70 range, Abbott might be moving closer to their goal to enhance the lives of one in every three people on the planet by 2030.

Some Q1 Risks

Despite my bullish outlook for Abbott, I must concede that investors need to be cognizant of some lingering risks that could hinder ABT’s trajectory.

First, the company’s dependency on COVID-19 testing revenue during the pandemic has hurt their growth metrics. Again, the company’s organic growth has been strong coming out of the pandemic, however, the expected decrease in COVID-19 testing-related sales could partially offset these bullish notes and impact earnings.

Another concern is the commercial performance and adoption of the company’s new products. The success of Abbott’s GLP Systems Track and PROTALITY line is crucial for projecting a future laden with fresh growth opportunities. Any delays or issues in adoption could damage the company’s future all-stars.

One more concerning item is the divergence between the Street’s projections and Abbott’s guidance for 2024 EPS and revenue. If Abbott fails to hit or surpass these forecasts, it could lead to analyst downgrades and elevated selling pressure.

Considering these risks, I am going to maintain my ABT conviction level at 4 out of 5.

My Plans

My plans for my ABT position are centered on the company’s ability to hit the Street’s revenue and EPS estimates, while also achieving their internal forecasts of 8%-10% organic sales growth. A reminder, the Street is expecting Abbott to report $9.88B in revenue for Q1 with a 0.95 EPS. If the company can achieve or surpass those marks, I will consider adding to my position under my Buy Threshold of $107.50.

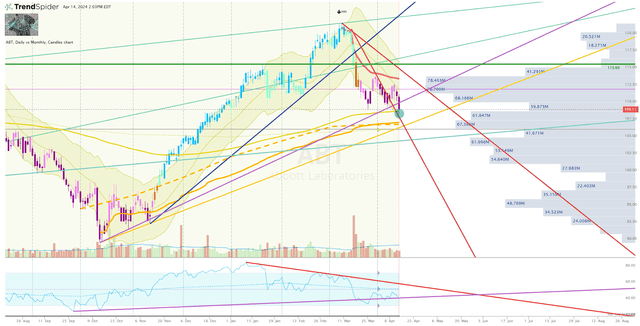

Looking at the ABT Daily Chart, we can see that the ticker is currently trading above my Buy Threshold, but is approaching the anchored-VWAP from the October low with a bearish rating on the “Go-No-Go” indicator. So, a negative reaction to the Q1 earnings could push the ticker down low enough for me to grab a small number of shares to add to my dormant position.

If the earnings beat the Street’s expectations, I will consider adjusting my Buy Threshold and Sell Targets for the company’s upgraded performance.

For now, I anticipate following this strategy through 2024 in anticipation, Abbott will continue to report organic growth that will ultimately outpace the decrease in COVID-19 revenues.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Want to capitalize on the next big medical breakthrough?

Tired of missing out on some of the healthcare sector’s multi-baggers?

Join Compounding Healthcare where we employ data analytics in combination with technical analysis and clinical data breakdown in order to manage a position in numerous potential multi-bagger investments that can grow into a comprehensive healthcare portfolio.