Summary:

- KO’s focus on profitability shows in its strategic ambition of being the “world’s smallest bottler” while also improving its marketing efficiency globally.

- The company is also attempting to onboard younger audiences by pushing for digital-first brand campaigns while releasing trendy limited edition Coca-Cola.

- KO combined a high volume-lower pricing mix in developing markets and a high pricing-lower volume mix in developed markets to improve its brand penetration as well.

- These may aid KO in achieving a robust balance of market share growth and sustainable profitability moving forward.

Baris-Ozer

We previously covered Coca-Cola Company (NYSE:KO) here in November 2022. Despite the rising inflationary pressures then, the company reported stellar gross margins of 58.5% and EBIT margins of 28.9% over the last twelve months. This is attributed to the prudent choice to mostly produce concentrates, which are then sold to licensed bottlers and distributors globally. The reduced Capex strategy has naturally triggered excellent FCF margins of 23.7%, which helps translate into continuous shareholder returns and deleveraging thus far.

For this article, we will be focusing on KO’s aggressive efforts in simplifying its marketing and bottling processes, while similarly achieving improved top and bottom-line growth. In addition, the company’s strategic pricing and volume approach towards different regions may also improve its chance of success moving forward, expanding its market share in the ready-to-drink [RTD] segment globally.

There Are Still Tremendous Opportunities In The RTD Market Indeed

In the recent Redburn 2022 conference in December, the KO management highlighted the consumer trend of over 75% market penetration for RTD products in developed markets, as opposed to 25% in developing markets. This is an interesting fact indeed, since Grand View Research reported that the company boasts nearly 48% share in the carbonated soft drinks market in the US.

This may explain why KO’s revenues remain largely concentrated in North America at 46.2% over the last twelve months [LTM], growing impressively from 41.9% in 2019. This is against Asia Pacific’s [APAC] sales contribution at 16.5%, Latin America [Latam] at 14.1%, and Europe, the Middle East & Africa [EMA] at 23.2% at the same time.

However, we must also highlight that KO’s operations in North America recorded the lowest operating margin at 24.7%, compared to the APAC at 42.2%, Latam at 58.9%, and EMA at 54.6%. This is likely attributed to 11 of 32 concentrate facilities being located in the Headquarters there, as recorded in its latest annual report with no quarterly updates offered thus far. Labor and operating costs may be higher in the region as well, despite only comprising 11.8% of its global workforce.

This is the reason why we see huge potential for KO’s advancement in developing markets, such as China, India, and Africa, due to the low penetration of RTD products and the expanded profitability, as discussed above.

Therefore, we concur with KO’s aggressive marketing expenses thus far, growing by 9.5% or $391M annually, to $4.48B over the LTM, which was otherwise stagnant at ~$4B pre-pandemic. Existing investors need not worry about the increased expenses, since we think the company should see excellent marketing investment returns, contributing to its brand penetration ahead.

This is due to KO’s strategic choice of simplifying to one global marketing partner, OpenX from WPP, a leading advertising firm based in the UK by November 2021. Notably, the company also boasts in-depth localized knowledge, which should continue to aid its marketing efforts across 200 countries and territories.

We are already seeing massive expansion in KO’s presence in India, where it reported an excellent 80% volume growth YoY by FQ2’22 and 2.5B transactions YTD by FQ3’22. The flagship Coca-Cola beverage also won the top spot in the RTD segment. Despite the Zero Covid Policy, the company also recorded robust demand in China through its first digital marketing strategy.

This new approach has been very successful indeed, due to the strength of KO’s sales over the first nine months, with 5% YoY growth in EMA, 8% in Latam, 2% in North America, and 8% in APAC. With Coca-Cola’s leading brand value of $97.9B by 2022 expanding from $81B in 2019, the company is well-positioned for long-term success in the beverage industry indeed.

While 2022’s results may only be released by mid-2023, KO has already achieved immense global household penetration at 43.6%, with 6.63B of Consumer Reach Points [CRP] for 2021. Notably, its e-commerce presence has grown tremendously, with the online CRP increasing by 38% YoY against its offline growth of 3% at the same time. Therefore, with a focused end-to-end approach, we reckon that the new marketing partnership may achieve an improved advertising outcome and brand penetration globally.

In addition, KO has been engaging the younger audience through its digital-first brand campaigns, while similarly expanding its offerings with trendy limited edition products. This includes Coca-Cola Dreamworld, Marshmello’s Coca-Cola, Coca-Cola Starlight, and Cola Zero Byte in combination with various metaverse, music, gaming, and fashion experiences.

The same ambition was also witnessed in KO’s continuous streamlining of the global bottling system to the current 3%, with it likely achieving its objective of being the “world’s smallest bottler” over time. The company has also been re-franchising its bottling partners to improve the operating margins, while remaining principally focused on revenue growth.

In the long term, the KO management has highlighted that the growth in the beverage industry has remained stable at 4% annually, with market analysts expecting the company to record accelerated top and bottom-line growth at a CAGR of 4.9% and 5.4% through FY2025, respectively.

Notably, there is no way of finding out the exact numbers, since KO does not provide detailed unit case volume and pricing mix in different regions, merely percentage changes in QoQ/ YoY sales. However, with the strategic combination of a high volume-lower pricing mix in developing markets and a high pricing-lower volume mix in developed markets, we reckon that the company may achieve a robust balance of market share growth, brand penetration, and sustainable profitability moving forward.

So, Is KO Stock A Buy, Sell, or Hold?

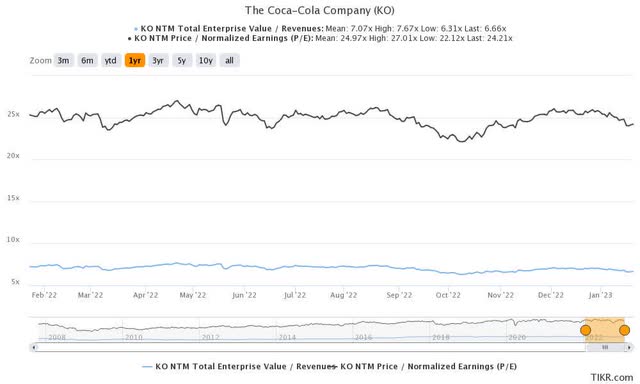

KO 1Y EV/Revenue and P/E Valuations

KO is currently trading at a NTM P/E of 24.21x, higher than its 3Y pre-pandemic mean of 22.80x, though slightly lower than its 1Y mean of 24.97x. Based on its projected FY2024 EPS of $2.76 and current P/E valuations, we are looking at a moderate price target of $66.81. This mirrors the consensus estimates of $67 as well, suggesting a notable 11.24% upside potential from current levels.

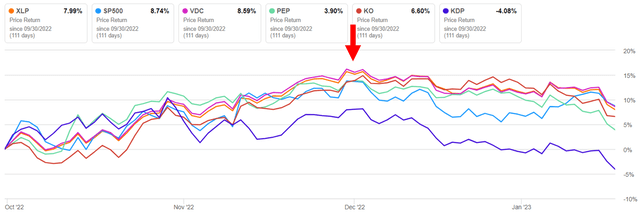

Consumer Staple Stocks

On the other hand, KO has pulled back from December 2022 heights by -6.63% at the time of writing, likely attributed to the normalization of market sentiments surrounding defensive sectors such as basic consumer staples. The same has been observed with PepsiCo, Inc. (NASDAQ:PEP) by -8.51% and Keurig Dr Pepper (NASDAQ:KDP) by -10.4%, at the same time.

Other stocks, such as Vanguard Consumer Staples ETF (NYSEARCA:VDC) and the Consumer Staples Select Sector ETF (NYSEARCA:XLP), have similarly retraced by -5.75% and -5.92%, respectively, against the S&P 500 Index’s moderate decline of -2.43% at the same time. Unfortunately, this may be further aggravated by the pessimism surrounding the declining consumer index.

The December CPI implies a deceleration in the juice and nonalcoholic drink index to 0.0% sequentially (12.2% YoY), against 0.5% in November and 0.5% in October 2022. While the index for carbonated drinks remains robust at 1.1% sequentially (13% YoY), this is negated by the nonfrozen noncarbonated juices and drinks at -0.7% (11.6% YoY). On the other hand, the December PPI suggests a normalization in the previously tight supply chain for soft drinks by -1.3% sequentially (12.1% YoY), compared to 0.3% in November and -0.6% in October 2022.

It remains to be seen how the situation may develop, seeing that market analysts are optimistically projecting a 25 basis points hike in early February 2023 instead. At best, the KO stock may continue trading sideways, though it is more likely that we may see another bottom retest, prior to its FQ4’22 earnings call on 14 February 2023.

The recent data suggests signs of a cooling US economy, raising Mr. Market’s increasing concerns about a growth slowdown or worse, a recession. The situation is further worsened by a potential margin compression if KO had to reduce its pricing mix.

However, we remain bullish about KO’s long-term prospects, especially due to its market-leading branding strategy and highly competent management team. This is also why smaller bottles and multipacks have been launched to limit consumer friction at a time of reduced discretionary spending. Additionally, the company encourages the return of PET bottles in developing markets to recycle packaging while similarly reducing its cost prices.

As a result, interested investors may consider nibbling on KO shares at the mid $50s for an improved margin of safety. Those levels may also provide an expanded dividend yield of 3.52% against its 4Y average of 3.06% and sector median of 2.45%, based on the consensus estimates projected FY2024 payout of $1.94.

In the meantime, long-term investors should simply hang on to the stock and enjoy a cold Coca-Cola.

Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.