Summary:

- Coca-Cola is a dividend-paying stalwart and has made a lot of people rich over the long run.

- KO’s reputation and brand power are unmatched, but there are reasons to try and objectively look at the next 2 decades compared to the past few.

- I don’t see the case for investment in KO stock at today’s valuation.

J. Michael Jones/iStock Editorial via Getty Images

Coca-Cola (NYSE:KO) is a company with a brand known by almost every person in the world. The length of its operating history and strength of its marketing have put it in a position to drive significant returns for its shareholders over time. Adding on to that, Buffett’s legendary investment in KO back in the 1980’s is discussed consistently in value circles, and it’s elevated KO to an almost untouchable status among many investors.

However, it’s highly likely the next 2 decades won’t look like the last 2 did for the company. KO is operated well enough that it will likely continue to churn out profits and may even manage continued sales and volume growth over the medium term. Debt has climbed consistently over the past 10 years, the company has relied heavily on acquisitions to change its volume mix in the face of rapidly shifting consumer tastes, and investors today have to hang their hat on further international penetration.

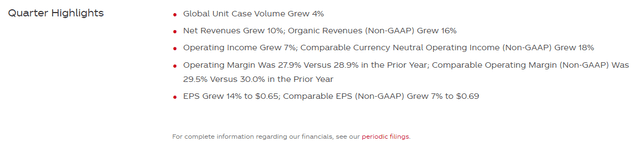

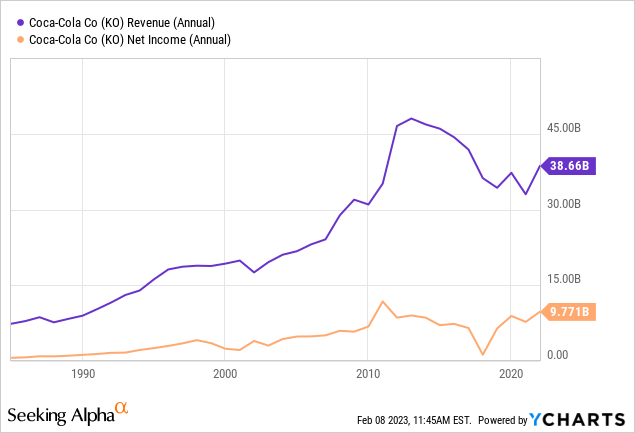

Looking at the most recent quarter, the company drove solid results. With revenues up 10%, or 16% adjusted, and EPS up 14% or 7% adjusted, that’s solid for an old stalwart like KO. Management is projecting 14-16% revenue growth on the full year, with 15-16% EPS growth and $10.5B in free cash flow.

Zooming out a little bit, some of these numbers can be put into perspective. The company is bouncing back well, but revenue growth overall has not been increasing at the blistering pace one could glean from the quarterly earnings report.

With the difficult macroeconomic environment, KO is well-positioned to shield itself from much of the pain due to its strong distributor and bottling partnerships and rock-solid pricing power. However, international distribution will be more difficult to manage compared to the disparate and smaller distributors in America.

In the face of significant headwinds in the home market, KO has shifted its brand mix over time and continues to try and move away from the image of sugary, unhealthy beverages. Most recently, the company’s acquisitions of Body Armor and Costa coffee look to leverage the company’s global reach to maintain volumes. The company is among an elite group that has managed to find broad success globally, with Sprite recently becoming a $1B brand in India, and emerging markets will continue to be the major growth driver for KO as we look ahead.

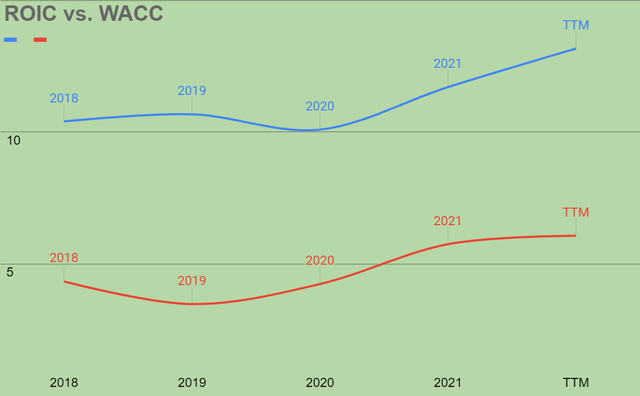

Through the shifts in the business, KO has maintained a positive economic spread for its shareholders. With a company continuously pushing through acquisitions to maintain relevance, management has obviously made the right moves with returns on invested capital trending mostly up over the past 5 years.

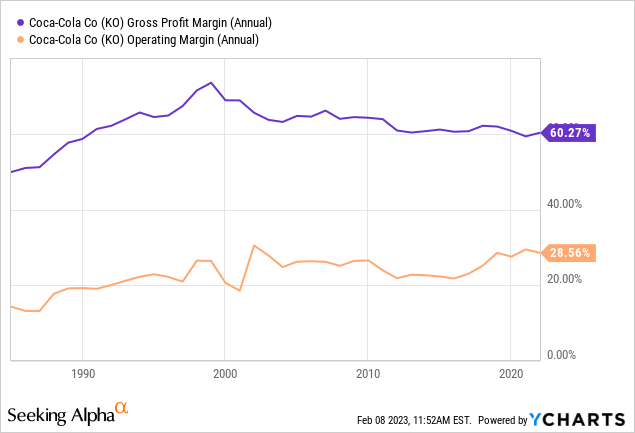

On an incredibly zoomed out scale, you can see the consistency KO has given shareholders over time. Operating margins trended up over the long-run, but gross margins remained mostly flat. I wouldn’t be looking for KO to expand its operating margin significantly from here. The company will more than likely maintain its long-run advertising expenses around 10.5% of sales, and I don’t see any firm path to other cost-cutting that would significantly improve the company’s operating margin picture.

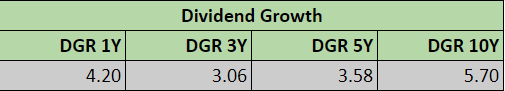

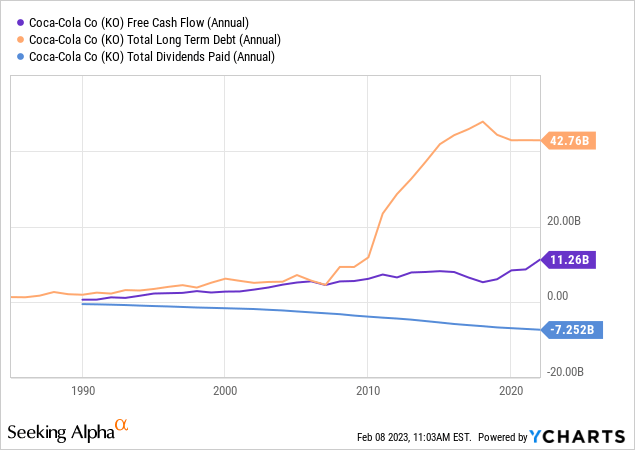

There are few companies with as straight of a line in dividends over a 30 year period as KO. The company’s payout ratio now stands at 75%, long-term debt is at $35.4B with a debt to equity of 1.56X, and dividends represent about 69% of free cash flow. Dividend growth has not been fantastic, but it’s also not some of the other old-line companies 1-2% increases just to maintain the track record. With 60 years of consecutive dividend increases, KO actually has the room to at the very least continue to raise it in-line with earnings growth. However, with the debt load the company now carries, it is more likely to see these types of ~4% increases to give the company more wiggle room. The thing I want to point out here is that KO has shifted its company over time well to accommodate headwinds in consumer tastes. But with the company’s debt load and 75% of earnings going out the door as dividends, it will be more difficult for the company to continue to snatch up brands over time. I’m not calling for a liquidity crisis or doom and gloom here, but growth won’t be as easy going forward as it was when the company quadrupled its debt load from 2010-2020.

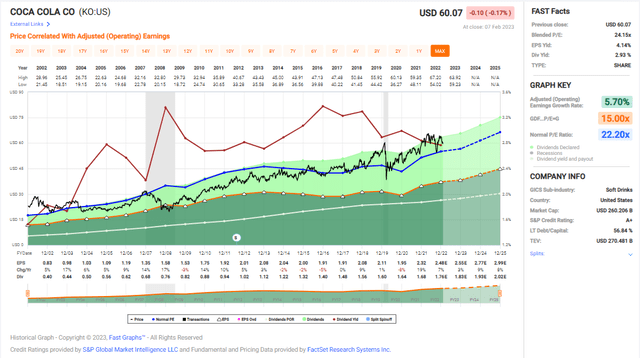

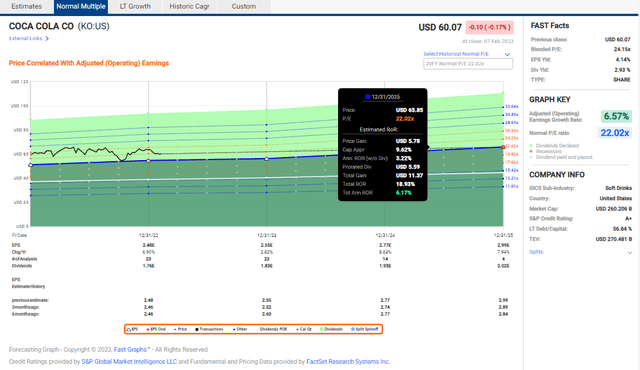

So, I think I’ve made the point that KO is a fantastic operator and a model of consistency, but I have some concerns moving forward for the company. However, looking above, the valuation doesn’t reflect that at all. At 24X earnings, KO is above its long-term average, from when things were likely rosier than they are today. At a dividend yield of around 3%, it’s a tough comp to today’s 30-year treasury note of 3.7% with no risk. If you’re looking at KO as an income play, the shine is off somewhat with rates up.

I don’t forecast or expect investors to lose money buying KO. What I do expect is that a purchase at today’s valuation doesn’t account for the actual likely path for KO from here. The company is likely to continue driving revenue and earnings growth, albeit somewhere in the single-digits. An investment at today’s valuation based on analyst estimates for earnings growth and a return to the long-run average (assuming the company should remain at that multiple) could yield around 6% annualized total returns. Half of that comes from the dividend.

Companies like KO can be a touchy subject for long-time holders. I’m in awe of KO’s brand and pricing power, and the fact the company continues to reinvent itself to stay relevant. However, I just don’t see the case for an investment today. There are much better opportunities out there for income, dividend growth, or just growth in general. There are also much cheaper ones. KO stock is a hold, I won’t be buying any.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.