Summary:

- NBCUni’s CEO Jeff Shell discusses Peacock/movie outlook.

- Currently, Peacock has 15 million paid subscribers and aims to grow with targeted content investments and opportunistic movie strategies.

- The “Halloween Ends” film is a continuation of last year’s move to place a high-profile horror picture on streaming day/date; there can be more experimentation with this strategy.

- The sequel unfortunately didn’t do as well, probably because of competition in the marketplace; it still should promote streaming, though.

- Comcast’s dividend yield is very attractive; it is a long-term buy.

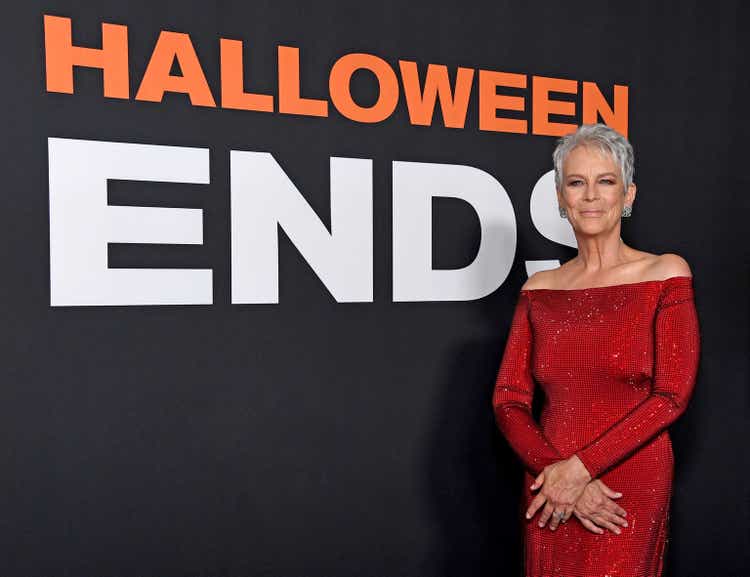

Jon Kopaloff/Getty Images Entertainment

Consider this article about the current Halloween sequel a sequel of its own.

Last year at this time, Comcast (NASDAQ:CMCSA) applied the same hybrid release pattern for the previous Halloween outing – that is, release at theaters and on Peacock the same day.

With NBCUni CEO Jeff Shell recently discussing his thoughts about streaming and theatrical, I wanted to take another look at the Halloween strategy and update my thoughts on it. Some perspective will be the same, of course; the newer elements, including the current level of paid subscribers, will hopefully provide further useful context.

“Halloween Ends”…On Streaming

The CEO of Comcast’s NBCUniversal, Jeff Shell, recently spoke out in the financial press about Peacock and his company’s commitment to using movies as a way of growing subscribers. That has been a potent theme as of late, with some believing that a vibrant theatrical experience is key to success in ancillary channels such as streaming, various pay windows, and physical release.

Actually, it’s more than a belief. There’s no question that movies in multiplexes can serve as great advertisements for all other release windows, leading to a more sizable ultimate, all-in profit on any particular project. Trade press such as Deadline make this point often: films that first start on the big screen help to increase the money earned on all other screens. It just intuitively makes sense.

But then there is the day/date issue: can that work too? In a holdover strategy from the height of SARS panic, the last film in the current incarnation of the Halloween franchise was released in theaters and on Peacock the same day. Producer Jason Blum seems to support using this release mechanism, and in fact made a deal for another major franchise, The Exorcist, to use Peacock as a component of a release strategy (although not necessarily day/date in this case; the point here is that Blum sees the value of streaming, especially from an opportunistic angle – i.e., I speculate he probably gets a backend boost in the deal, a point that relates to something else which I will get to shortly).

Halloween Ends follows Halloween Kills as a Peacock day/date release, and it seems to mostly work for this franchise (I’ll clarify the “mostly” part in a bit as well).

But the big point is increasing subscribers for Peacock, and that has been challenging at times. Back in January of this year, the company saw an increase in monthly-active-users to 24 million versus 20 million. Back in July, there was mention of flat growth in paid subscribers (paid subscribers seem to be the focus now, as opposed to total which includes those who receive the service as part of a linear bundle subscription), coming in at 13 million at the time. Shell just stated at the beginning of October that there are now 15 million paid members.

It’s right to focus on paid members, and Shell also touted the fact that Comcast has many opportunities in exploiting engagement because of the advertising model that NBCUni has relied on for years – it’s an industry the company knows, as opposed to Netflix (NFLX), which is now in learning mode.

He also said that streamers are supported and driven by movies. The question is, what is the best strategy going forward? There probably isn’t one correct answer.

The reason why Peacock can experiment with a hybrid-release paradigm is because it is small relative to the other streamers at 15 million paid subscribers (plus the context of 27 million monthly-active-users reported in July, of course, which does increase scale, but the goal here is to get the paid side up). That isn’t enough scale to guarantee full value has been exploited for the Halloween film if it was only released to streaming – i.e., not enough people would be able to see it. And while the film would certainly do more box office if it was a theatrical exclusive, the company can afford to experiment at gaining more subscribers by sacrificing some of that box-office gross to the digital side; cannibalization will occur, but the type of film that sees horror tends to be a younger demographic that still heads to theaters for the full experience.

Last time out, Kills made $90 million at domestic locations and $130 million worldwide. The domestic opening weekend was just under $50 million. Compare that to almost $160 million domestic and over $250 million worldwide for Halloween in 2018, with an opening domestic frame of $76 million. Last year, the pandemic was absolutely more of a concern, so that exerted a negative effect with the comparisons, but streaming probably amplified that aspect.

This year, there was some depreciation in value: Ends grossed, according to estimates as of this writing, a little over $41 million for the domestic three-day weekend. That wasn’t too bad in the sense that the film did debut at number one.

Getting back to experimentation, there was an interesting observation made over at Deadline that the film essentially did not have an exclusive run in the theater for the Thursday preview sessions as it was available at 8 PM. For me, that presents an opportunity.

Why not keep it exclusive for the previews, at the very least? Okay…that might not make much of a difference.

But it inspires us to look at more angles in the streaming-vs.-silver-screen conundrum. Ends could have opened on Tuesday of this week for three full screening days before heading to streaming on Friday. I’ve often wondered if opening earlier in the week with some exclusivity, and then ending on the weekend with the hybrid paradigm, might maximize domestic openings with a film like this one (albeit it wouldn’t be an equivalent comparison to a three-day weekend).

There are also other ways to slice it, such as an exclusive week at theaters followed by Peacock…a near day/date. But, Shell seems more concerned that it was on Peacock at the very least in addition to theaters. Let me focus on something that might offer an answer.

Deadline mentioned in its box-office analysis the weekend of the opening that the film did seem to be hurt this time out by Peacock (originally, the trade site seemed more bullish on the strategy before the new numbers rolled in); the cannibalization was simply worse. That’s okay, I still support experimentation with theatrical/streaming hybrids to hone the data. But there was something very interesting to me buried within the narrative.

Essentially, NBCUni isn’t making a whole lot of money on Ends anyway from theatrical; instead, it’s receiving a smaller distribution percentage only. This means the studio may not have been incentivized to a multiplex-exclusive release. The producer participants on the project are Blumhouse Productions, Trancas International Films, and Miramax. Their respective backend participations had to be balanced out by Universal, so that represented an increased investment allocation on the studio’s part, and that leads to the conclusion that this represented a bet…a bet that streaming would indeed cannibalize some theatrical, and that would be okay, since Peacock wants to expand its user base. Universal transferred the risk on to the production side, the latter chancing that the movie’s prospects were greater than the cannibalization potential. I don’t know how much backend compensation we’re talking about, but I have to wonder what Jason Blum et al. are thinking with the current Ends opening.

Shell, however, is looking at all of this in another way. He is thinking streaming-first, and that all of the content produced/distributed by NBCUni will eventually be geared toward that final destination. He discussed the well-covered by now issue of taking content away from Disney’s (DIS) Hulu and using it on Peacock. He also talked about how the Comcast ecosystem makes for an efficient process of producing content for the streamer – i.e., it can be produced not just for Peacock but for other platforms and become amortized before it is ported over. The Halloween film’s budget/backend-payments can be offset by theatrical and then placed on Peacock to capture a higher margin of distribution (followed by licensing to competitor platforms and physical release, as well as digital-transactional release). This is what Shell means when he mentions scale…scale doesn’t have to just come from acquisition (he said he wouldn’t mind having the Hulu asset if Disney were interested in offloading it, which it is emphatically not), it can come from depth of platform ecosystem.

Shell also recognizes the value of a movie slate and how it promotes direct-to-consumer subscriptions. I’ve written about that concept many times; it is undeniable that a thriving streaming platform benefits from more bets made at the multiplex. Of course, theaters are still favoring only tentpole franchises, especially as pandemic fears continue, but franchises can come at all budgetary levels, as horror films prove. Shell should increase movie output to have more options when it comes to hybrid releases, straight-to-streaming, or theatrical-only.

Also, we have to consider the $41 million opening a little further. As Deadline put it – where is the missing $10 million compared to last year’s $50 million debut? I think the site is not crediting the competition enough. Paramount Global’s (PARA) (PARAA) Smile seasonal entry has become a surprise hit; its success is based in part on a clever advertising campaign involving smiling people. The film has grossed nearly $140 million worldwide so far, with half that amount coming in for domestic.

Good on Paramount for a great release execution; bad for Comcast, because when you think about it, Smile probably took some box-office oxygen away from Ends by presenting a tantalizing option for some potential ticket-buyers: go see Smile and enjoy a night out, then opt to stay in for Ends. It’s entirely conceivable to me that if Smile had been absent from the marketplace Ends could have made it to $50 million based on people wanting to see a horror film in an actual theater in October; if you already got your fill of that ritual, why not stay home for the second big release of the month and see it more economically? That might account for the deficit.

Again, I don’t know what talent thinks of all this, but for Comcast, this was a solid opportunity for a second time to get more user traction for its Peacock service. The code just needs to be cracked in terms of how exactly the whole process could be optimized…let the weekend be exclusive, then stream the middle of the following week? Also: shareholders should hope advertising loads were appropriate given the premium feature being presented. That’s not consumer-popular, but since this is a hybrid release, a little extra advertising would seem to be a fair trade.

Conclusion

NBCUni should take movies seriously and increase its investment in bigger slates. Shell is correct that ecosystem scale works for Comcast. He should be careful of budgets and above-the-line compensation whenever possible, but the big takeaway is: make a lot of movies, stream some exclusively, multiplex some exclusively, go hybrid at times, and chop up the window at several different days-in-release to acquire data to inform decision-making.

The new Halloween film may not have lived up to expectations precisely, but it was close, and that’s acceptable given the surprise Smile film and the fact that sequels sometimes gross less money over time. It’s just box-office physics. We will see the results of this release strategy when Comcast eventually reports an update on paid subscribers.

As for the stock: it’s looking pretty good on a long-term basis. The 52-week range is $28 versus $54; at the time of this writing, shares were at $30. The dividend yield is 3.6%. That’s an attractive yield, and given the company’s assets, those with a long investment horizon who are willing to dollar-cost-average to take advantage of volatility stand a solid chance of doing well.

Disclosure: I/we have a beneficial long position in the shares of CMCSA, DIS, NFLX, PARA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.