Summary:

- Airbnb’s results indicate strong demand for traveling, as the company increased its revenues 40% to $8.4bn and net income to $1.9bn in 2022.

- Management’s expectations have also been upbeat for Q1, contrary to some other retail stocks. Should the travel demand continue as expected, ABNB is poised to generate strong free cash flow.

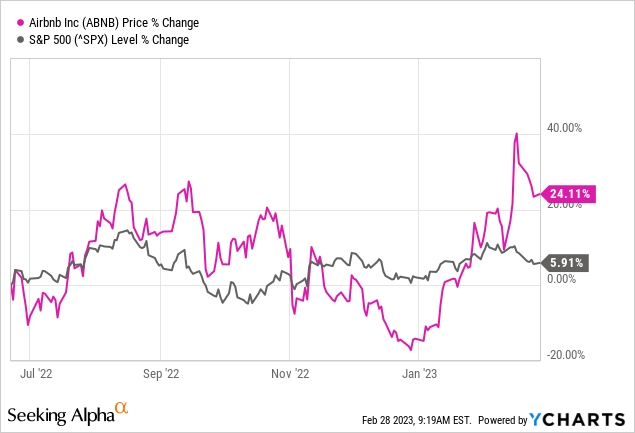

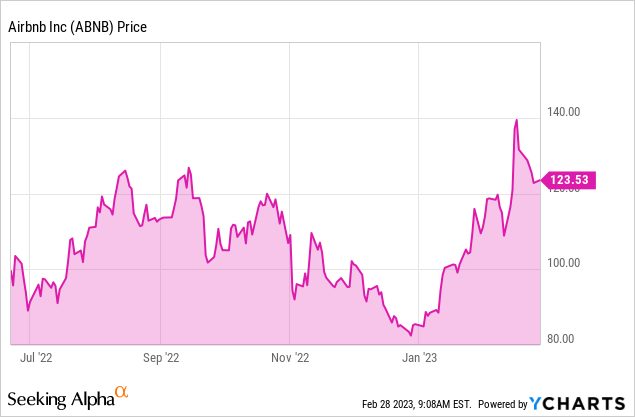

- ABNB delivered 24% returns since our last article compared to 6% for S&P 500. We remain bullish on the stock and slightly raise our target price to $135.

Thomas Barwick

ABNB as a Discretionary Stock

Airbnb, Inc. (NASDAQ:ABNB) was definitely one of the companies to benefit from the end of the COVID-19 pandemic and the resumption of travel. However, the past couple of years were also haunted by the fear of recession, which is negative for discretionary stocks like ABNB. The stocks in this sector provide non-essential goods and services, such as retail, leisure, and entertainment. These companies offer products and services that consumers may choose to purchase with their discretionary income, as opposed to essential goods and services such as food and healthcare. Therefore, the consumers are prone to reduce their spending on services of the companies such as Airbnb in recession times. That’s why we didn’t include any companies from the sector in our 9 Dividend Stocks article in the first year of pandemic and had a sell rating, followed by a hold for ABNB.

However, we did change our mind and recommended buying ABNB in June 2022, convinced by the company’s performance out of the pandemic. In our June article we set our target price at $133/share. Since then the investors following our recommendation would have made 24%, compared to almost 6% by holding the S&P 500.

As the stock has reached its target price (and fell off since then), today we revisit Airbnb’s business case and update our valuation.

Airbnb’s Financial Performance in 2022

The company announced its 2022 results on February 14, showcasing stellar performance and beating both on EPS and revenue expectations. Airbnb delivered $8.4bn in revenues for 2022, up 40% y-o-y and $1.9bn in net income. 2022 became the company’s first full GAAP profitable year with an impressive net profit margin of 23%.

According to the management, the results where positive across the board – the travel to cities resumed and grew faster, all regions performed well, with the U.S. being traditionally the company’s stronghold.

Similar to what we’ve heard during Booking Holdings (BKNG) earnings call, one of the key messages from Airbnb’s management was that they did not observe any reduction in the number of days or reduction in ADR in Q4 2022 and at the beginning of 2023. These are the typical signs of the consumers cutting their spending as the fear of recession dominates.

In fact the company’s management pointed out the following in its FY22 shareholder letter:

We are excited to see the continued strong demand in Q1 2023

Airbnb stock went up before the earnings and after the announcement. However, it gave away most of its gain shortly after, as Walmart (WMT) issued cautious outlook during its earnings call on Feb 21. As a result, the discretionary consumer stocks took a dive, including ABNB’s share price, falling over 2% that day.

The cautious message from retailers was reiterated by Target (TGT) during its earnings call on Feb 28, creating further pressure on discretionary stocks.

Airbnb’s Balance Sheet is Rock Solid

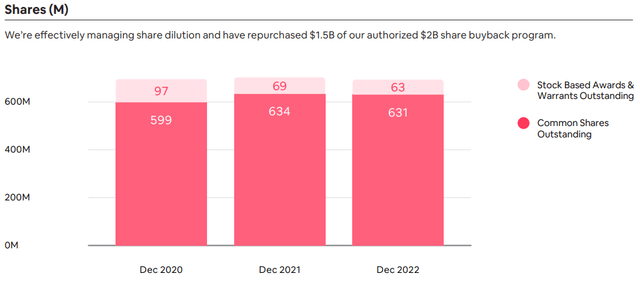

Airbnb has almost $9bn in cash and cash equivalents and only $2bn in long-term debt. The company spends up to a $1bn per year in stock-based compensation, which is a non-cash expense, has some working capital investments and virtually no CAPEX. As the company generates positive free cash flow, shareholders can expect to receive some of this cash back, either in a form of share buybacks or dividends.

In fact, Airbnb has initiated a $2bn share buyback program back in August 2022, with $1.5bn of funds used by mid-Feb 2023.

This way Airbnb’s management counteracts the shareholder dilution caused by the stock-based compensation, while supporting ABNB share price.

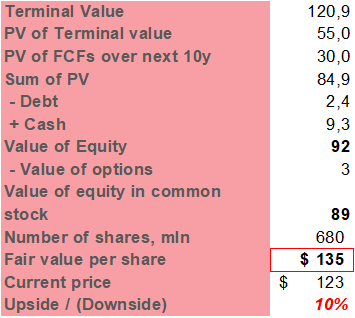

Airbnb’s DCF Model Update

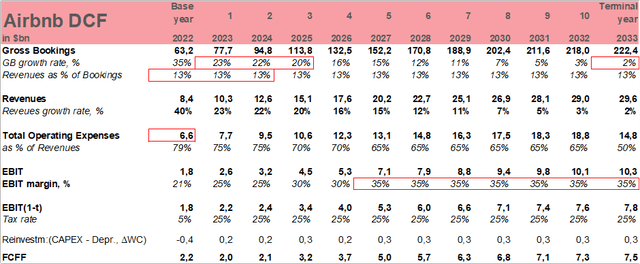

Revenue growth: We remain confident in the projected double-digit growth in the next several years, gradually slowing down to 2% terminal growth rate. We have slightly increased out forecast on the back of strong numbers for 2022.

EBIT margin: Airbnb has delivered over 21% EBIT margin in 2022. We expect the company to increase its profitability to the level of its competition i.e. 35% long-term.

Discount rate: This is the major change in our DCF model (and investor expectations) in the past two years. Now investors can achieve 3.95% return by merely buying 10-year US Treasury bonds, therefore, investing in stock market has to bring at least 4.89% on top (depending on the riskiness or beta of the company).

Author

In our previous DCF model for ABNB we used a discount rate of 7.8%. Now we adjust it to 8.2%, which leads to an estimated fair value of $135, almost unchanged from our previous target price ($133/share). In our opinion ABNB shares still have about 10% upside potential, while the downward risk is somewhat mitigated by the share repurchase program.

Potential Risks ABNB is Facing

While Airbnb has shown resilience during the pandemic, its business is still heavily reliant on the recovery of the travel industry. Any further disruption to travel or the global economy or a macroeconomic downturn, inflation and other factors could negatively affect the company’s financial performance and stock price. It’s always refreshing to read the risk factors summary for a company, just to keep one’s confirmation bias in check.

Moreover, Airbnb operates in a highly regulated industry, and any changes to local, state, or federal regulations could have a significant impact on its business model. For example, some cities have imposed restrictions on short-term rentals, which could affect Airbnb’s revenue.

In addition to that the company operates in a competitive environment, with traditional hotel chains and travel companies on one side and new entrants on the other. However, so far Airbnb has been successful in securing its niche and significantly improving its financial performance.

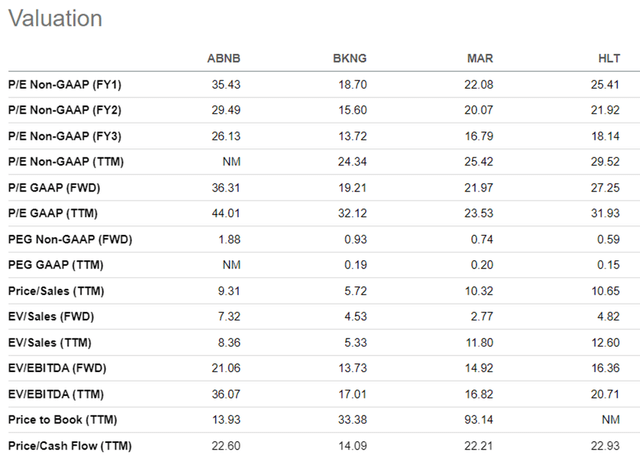

Relative Valuation

On P/E multiple ABNB is more expensive than its peers, however, P/Cash Flow ratio is in line with peers. Since the market expects higher growth rate from Airbnb than say from Booking Holding, higher P/E ratio is justified in our opinion.

Conclusion

Airbnb proved that it has a highly profitable business model, beating market and our expectations in 2022. We updated our DCF model, slightly increasing our projections, while also increasing the WACC to 8.2%. We remain bullish on the ABNB stock with an estimated fair share value of $135 and about 10% upside potential to the current share price.

Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Maximize your income with the world’s highest-quality dividend investments.