Summary:

- Disney investors initially cheered the return of CEO Bob Iger as ex-CEO Bob Chapek received his marching orders. However, that optimism has since been digested by market operators.

- Iger needs to prove that he knows how to move Disney’s DTC segment toward profitability. But, the intense competition could prove to be a stumbling block.

- Therefore, it’s important for investors not to chase upward momentum spikes but be patient to wait for constructive pullbacks. Don’t fall for the market’s traps.

- Until Iger can convince the market, DIS is likely to move sideways.

Charley Gallay

The Return Of Bob Iger Does Not Guarantee DTC Sucess

The Walt Disney Company (NYSE:DIS) has had a tumultuous year in 2022. DIS posted a total return of -40% YTD, as the market digested the recent optimism on the return of the current CEO, Bob Iger.

We have been waiting patiently to alert investors to another entry opportunity to strike, as we refused to be drawn into the recent optimism. With the pullback sending DIS back closer to its November lows, investors who bought into the recent spike fell for the bull trap laid by market operators.

Bob Iger had proved his execution prowess with his track record in Disney over the years before he handed the reins to ex-CEO Bob Chapek. However, we believe the competitive landscape has changed dramatically.

Therefore, we believe investors still intend to parse what Iger is planning with his restructuring strategies for Disney. They are likely looking for more than what Iger has highlighted initially upon his return, as he articulated:

Over the coming weeks, we will begin implementing organizational and operating changes within the company. It is my intention to restructure things in a way that honors and respects creativity as the heart and soul of who we are. – Bloomberg

Insider shortlisted several senior executives with significant influence on the creative content side of the house of Mickey Mouse. It also includes Disney’s long-serving CFO, Christine McCarthy, who was reported to have fallen out with Chapek and played an instrumental role that led to his dismissal.

However, Iger’s return has come at an opportune time for him and Disney’s investors. With DIS battered to valuations close to its COVID lows, we believe significant pessimism has been baked in even before Chapek’s contract was terminated.

Therefore, we believe Iger has a better chance of “overdelivering” if he can steer Disney’s media and content division in the right direction.

But, it could prove to be immensely challenging to lift its direct-to-consumer (DTC) segment toward profitability, even as it launched its ad-supported tier recently.

Investors Are Still Waiting For Iger’s Plans

We discussed in our previous article that Chapek needs to find a way to chart a profitable path for its DTC segment. The market has made it clear to management that they will no longer prioritize growth in place of profitability.

Also, it’s useful for investors to note that Chapek was put in place to execute what was, after all, Iger’s strategy when he initiated Disney’s strategic pivot toward its DTC investments.

What Chapek has done was to make sure Disney+ could scale, even if it meant taking significant losses along the way. With Disney+ reaching nearly 152M in paid subscribers over three years, Chapek has done an incredible job.

He likely had Netflix (NFLX) worried about intense competition, as Disney could leverage their profitable Parks division to scale its DTC segment. However, critics pointed out their frustration that followed Chapek’s decisions to raise prices and move into yield management.

However, he also explained in a late October WSJ Tech Conference before he was fired on those decisions:

We want to guarantee a great guest experience no matter when people come. So [no] matter what day you come, you are guaranteed to get that magical experience that creates magical memories that last a lifetime. In a world where we don’t control demand, you’re left with one of two situations: you either let way too many people into the park, where they don’t have a great experience, or you manage it by just turning people away at the gate. We developed a reservation system so people would know ahead of time whether they were going to get in or not. And then we practiced yield management, which, again, every other company in the world can do, so that we have pricing be a reflection of how many people we can actually let in and still guarantee that great experience. So for some of our fans, that’s heresy, but I think it’s not only good business practice in terms of maximizing shareholder value, but more importantly, it protects the guest experience so that when you get into the park, you can have confidence it’s not going to be over-crowded. – WSJ Tech Live

Before anyone thinks that Chapek isn’t qualified to run Parks, remember that he led Parks. He may have ruffled feathers with investors, senior executives, customers, and Hollywood stars, which likely led to his eventual downfall. But he certainly knew how to run Parks effectively, As Iger also praised him in a letter of recommendation for Chapek, as WSJ highlighted:

“Bob is celebrated for his business acumen and his proven ability to repeatedly deliver historic performance,” Mr. Iger wrote, praising Mr. Chapek’s work in developing Shanghai Disneyland, one of Mr. Iger’s signature projects. “But, what I have always admired most about him—and what truly defines him as a leader and drives his success—is his humanity,” Mr. Iger wrote, “the fundamental decency at the core of his character.” – WSJ

Therefore, it was remarkable how Iger undermined Chapek’s leadership as Disney underwent significant challenges in scaling its DTC segment profitability.

However, with Iger now back in charge, it remains to be seen whether he could chart a dramatic turnaround to lift Disney+’s profitability sustainably. With macroeconomic headwinds intensifying and the advertising market likely getting weaker in 2023, it’s easier said than done.

Therefore, we assess that it’s critical for investors to demand a considerable margin of safety and not chase any short-term upward spikes in DIS’s price action.

Takeaway

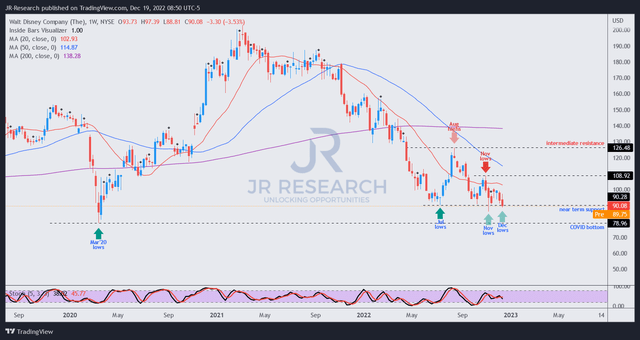

DIS price chart (weekly) (TradingView)

As seen above, DIS is getting supported at the $90 level, which has been buyers returning to stanch further downside since July. Coupled with a less aggressive valuation and easier comps through 2024, Iger potentially has an “easier” route to help Disney regain operating leverage.

The Street expects Disney to report growth of 7.7% in adjusted operating income in FY23, lowered after its FQ3 earnings card. However, they penciled in a return to double-digit growth in FY24, with an uptick of 23.8%.

Therefore Iger has an opportunity to address investors’ concerns about whether the consensus estimates are still credible and not fumble as Chapek did in his last earnings call with analysts.

For now, the market seems to be giving Iger the benefit of the doubt as DIS consolidates. However, with the macro headwinds intensifying, investors are urged to be ready for potential downside volatility and layer in accordingly.

Maintain Buy with a price target of $120.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!