Summary:

- My previous bullish thesis aged well as Energy Transfer LP has delivered a 17% total return since mid-December, outperforming the broader U.S. market.

- The company demonstrates consistently improving operating leverage and the management’s guidance for 2024 suggests that the profitability expansion trend will persist.

- My valuation analysis suggests that the stock is around 30% undervalued.

CHUNYIP WONG/E+ via Getty Images

Investment thesis

My previous bullish thesis about Energy Transfer LP (NYSE:ET) aged well as the stock delivered almost 17% total return since mid-December, outperforming the broader U.S. market. The company’s fundamentals are improving steadily, which is a bullish sign to me. I think that the above 8% distribution yield is safe as the company continues to improve its operating leverage. I also like the management’s capital allocation and growth priorities for 2024. My valuation analysis suggests that the stock is more than 30% undervalued, which means there is a solid upside potential. All in all, I reiterate my “Strong Buy” rating for Energy Transfer LP.

Recent developments

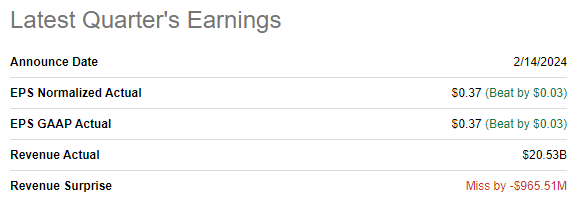

The latest quarterly earnings were released on February 14, when ET missed revenue consensus estimates but delivered a beat in terms of EPS. Revenue was about flat YoY and the adjusted EPS expanded from $0.34 to $0.37.

Seeking Alpha

The bullish sign is that the EPS expansion was achieved due to the improved operating leverage. The operating margin expanded from 8.81% to 10.54% on a YoY basis and ET recorded fourth straight quarter of double-digits in this metric.

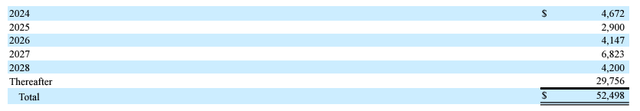

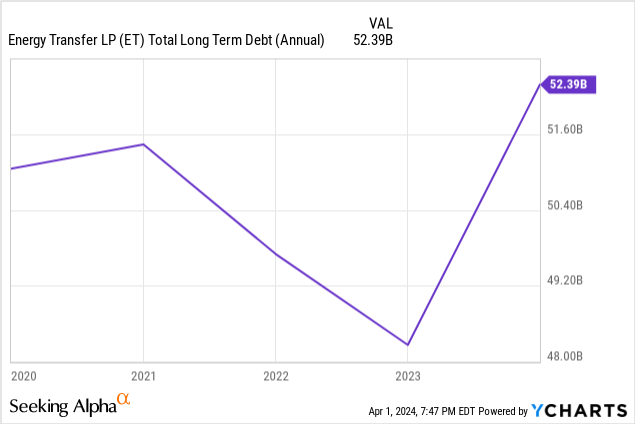

Total debt has increased notably in 2023 and it also announced a pricing of $3 billion senior notes in January 2024, and the proceeds are expected to be utilized as part of debt restructuring. Meanwhile, in February, Fitch upgraded ET’s credit rating to “BBB” with a stable outlook. I do not think that these developments are adverse for investors because the major portion of debt matures in 2027 and thereafter, which is a long-term horizon. Moreover, principal amounts maturing each year are notably below the levels of the company’s operating cash flows in recent years.

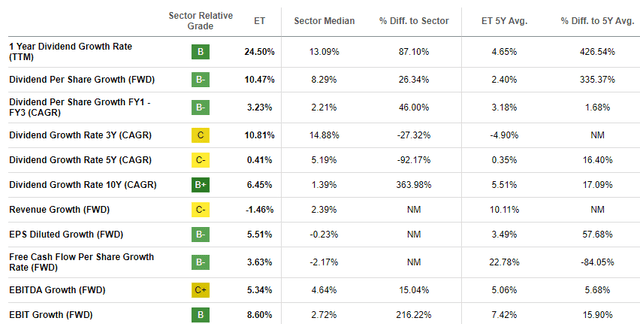

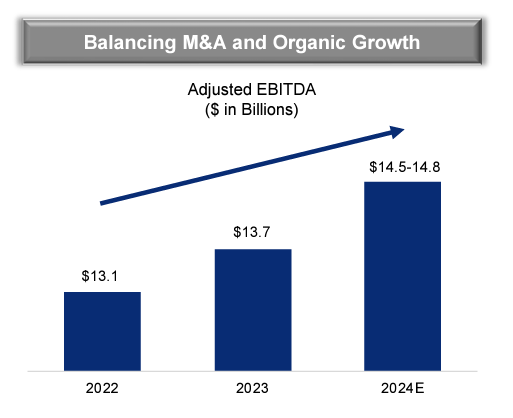

The management’s confident forecasts for 2024 also add optimism to me. According to the latest earnings call, the management expects 2024 adjusted EBITDA to be around 7% higher than 2023 and around 12% higher than 2022. I like this steady growth trajectory despite the fact that the business is capital intensive and we are currently in the environment of high interest rates.

ET’s latest earnings presentation

The company generated $9.5 billion in operating cash flow during 2023, and the expected to expand adjusted EBITDA suggests that the operating cash flow is poised to grow in 2024 as well. For dividend investors it is good news because it increases the probability that the stellar above 8% distribution yield is safe and will highly likely continue to grow.

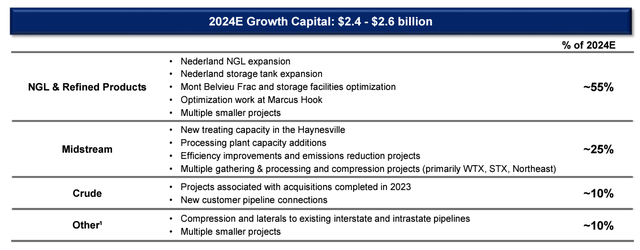

I like the management’s capital allocation priorities for 2024 as well. During the Q4 earnings call the management reiterated its long-term goal to improve the balance sheet and increase equity returns to unit holders via distributions growth. It is also crucial that the management has an outlined plan to finance growth in 2024, the major portion of investments is expected to be allocated to the NGL and refined products business. Investing heavily in expanding the capacity of its NGL export facilities looks strategically sound in light of a growing global LNG demand. The war in Ukraine is unlikely to end this year and the recent reelection of Vladimir Putin as the Russian president until 2030 is another reason why this war might last for longer. Therefore, Europe is very unlikely to switch back to the cheap Russian natural gas anytime soon, which is a solid tailwind for the U.S. LNG exports. This ultimately benefits American midstream companies with a notable U.S. LNG exports exposure.

ET’s latest earnings presentation

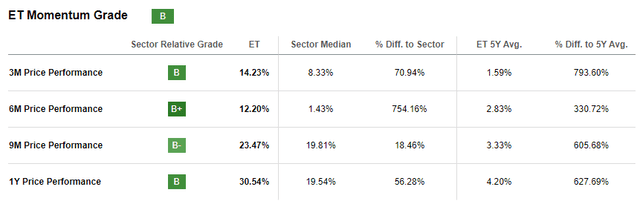

Apart from the fundamental strengths I have highlighted above, another good factor for investors is that the stock is gaining momentum. If we look at the stock price chart over the last five years, we can see that the current share price is almost exactly the same as it was five years ago. However, ET demonstrates solid momentum across different timeframes within the last 12 months, significantly outperforming the sector median.

To summarize, I remain bullish on ET. I see a nice combination of consistently improving fundamentals, the management’s solid strategic vision and sound capital allocation priorities as well as the stock gaining notable momentum.

Valuation update

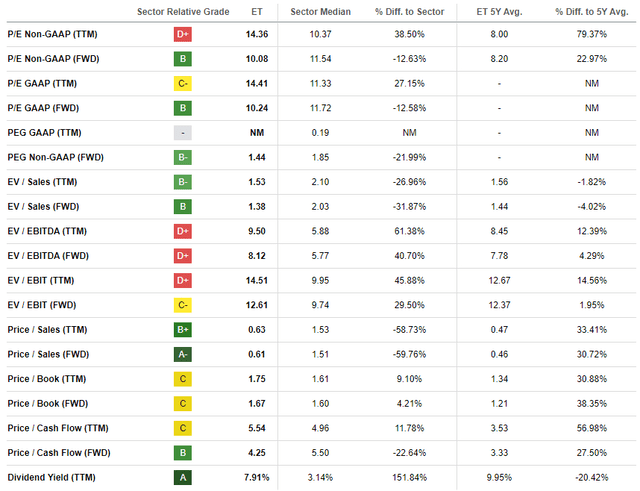

ET rallied by 14% year-to-date, and delivered a 30% share price increase over the last twelve months. Valuation ratios look mixed compared to the sector median and historical averages. Therefore, it is difficult to assess the attractiveness of ET’s valuation from the multiples point of view.

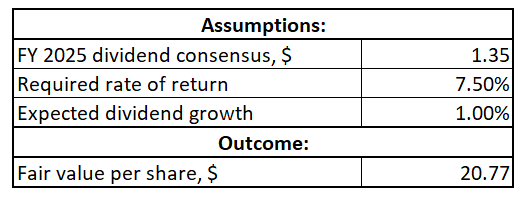

Therefore, I should update my dividend discount model [DDM] simulation. I use a 50 basis points less tight required rate of return this time due to the expected Federal funds rate cuts in 2024. My 7.5% required rate of return also aligns with the cost of equity range suggested by valueinvesting.io. Since I am figuring out the target price for the next 12 months, I also use FY 2025 dividend consensus estimate this time, which is $1.35. I am still conservative about the long-term dividend growth rate, so I reiterate a 1% CAGR.

Author’s calculations

According to my DDM simulation, the fair value of the stock is around $21. This represents a 32% upside potential, which looks very attractive in my opinion. Please also keep in mind an above 8% distribution yield.

Risks update

As the whole developed world is investing vast amounts in clean energy, we can say that the oil and gas industry is in a secular decline. While it is impossible to imagine our world as 100% carbon-free, it is also difficult to expect rapid leaps in volumes for energy midstream. Therefore, rapid growth in ET share price is quite unlikely. Since we see that technological giants are currently driving the new AI revolution and some companies’ revenues and profits are soaring, it is highly likely that shares from legacy industries will lag behind in terms of share price growth.

As an energy midstream company, Energy Transfer’s operations effect on the environment is under thorough scrutiny. The company might face environmental fines and charges, which is likely to result in unplanned expenses. Apart from the potential adverse effect on the company’s P&L, violating environmental regulation will also highly likely undermine the company’s reputation. Reputation loss might lead to the stock sell-off, which will pressure the share price down.

Potential investors should also keep in mind that the energy midstream industry is highly cyclical. Yes, earnings of midstream companies are far less dependent on energy commodities prices compared to upstream, but still volumes and margins tend to deteriorate when energy markets cool down.

Bottom line

To conclude, ET is still a “Strong Buy”. The company’s fundamentals are improving and the stock is still very attractively valued, even after a strong start in 2024. The above 8% forward distribution yield looks safe to me and is very attractive given the substantial upside potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.