NextEra: Bigger Dividend, Healthy Momentum, Bode Well (A.I. Too)

Summary:

- The Utilities sector performed poorly in Q1 but has seen a rebound in the past month, helped by gains in NextEra Energy (NEE).

- NextEra, the biggest component of the Utilities sector ETF, has a modest valuation and I reiterate a buy rating.

- NextEra Energy has strong earnings and dividend yield forecasts, though shares are not far from key resistance levels.

shulz

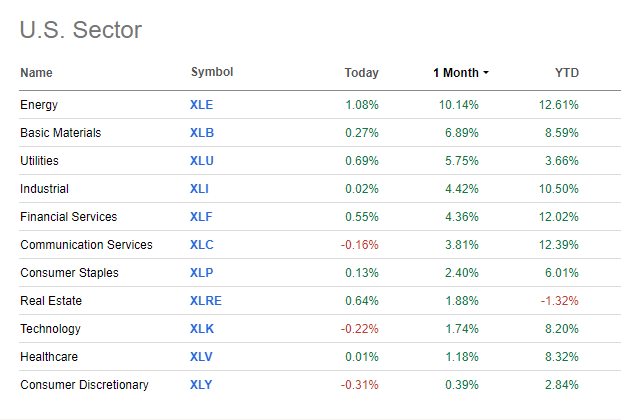

The rate-sensitive Utilities sector was among the bottom S&P 500 sector performers in Q1, but there was a snapback over the back half of the period. The group was up just 3.7% over the first three months of 2024, but on a 1-month basis, XLU is actually the third-best performing sector.

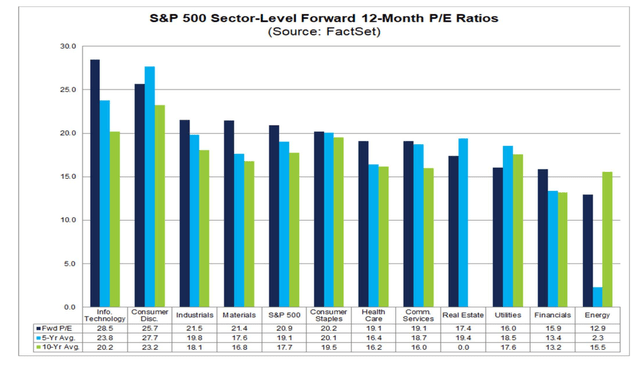

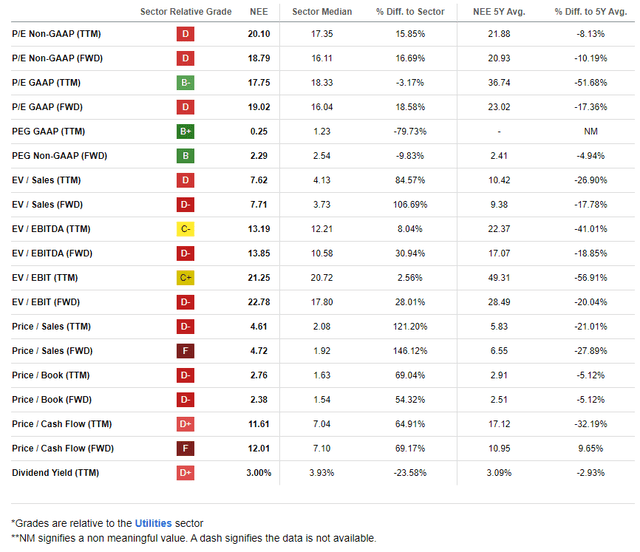

A drop in Treasury yields has certainly helped, while other high-growth sectors now have lofty valuations. With Utilities trading just 16 times forward earnings estimates, the group is by no means pricey. XLU’s biggest component, NextEra (NYSE:NEE), features a valuation premium, deservedly in my view.

I reiterate a buy rating on the Florida-based Electric Utilities industry stalwart. With a yield more than twice that of the SPX and with a modest valuation compared to history, I am upbeat about its prospects.

Utilities Gaining Ground Since Early March

Seeking Alpha

Utilities Just 16x Earnings

FactSet

NextEra Energy consists of two main business operating segments: the Florida-regulated utilities (primarily Florida Power & Light) and NextEra Energy Resources, a deregulated generator of predominantly wind, natural gas, nuclear, and solar-powered assets in North America. Moreover, it also holds an ownership position in the YieldCo NextEra Energy Partners (NEP). Other businesses include gas pipelines, electric transmission, and other novel energy businesses.

Back in January, NextEra reported a solid earnings beat. Q4 2023 non-GAAP EPS came in at $0.52 versus the consensus estimate of $0.49. Revenue of $6.9 billion, up 12% from the same period a year earlier, was a significant $550 million beat. The management team reaffirmed its long-term outlook, expecting $3.33 to $3.43 of operating EPS this year and 6% to 8% bottom-line growth in the out year. For yield-focused investors, NEE hiked its dividend by 10% in its new policy. Moreover, for growth investors, analysts at Morgan Stanley see this renewables-heavy utility as a potential beneficiary of AI technology.

Shares traded higher post-earnings by 1.7%. The company has now topped EPS estimates in each of the past 12 quarters with back-to-back price climbs post-reporting. Looking ahead, data from Option Research & Technology Services (ORATS) show an implied move of 3.5% following the April Q1 report.

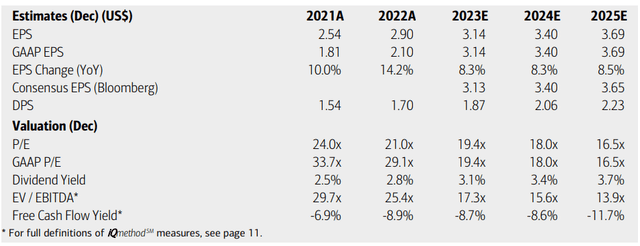

On valuation, analysts at BofA see earnings rising at a steady 8% to 9% annualized rate this year and next. The sanguine outlook is about on par with consensus figures from Seeking Alpha which reveal $3.40 of current-year operating EPS and $3.68 in the out year while revenue growth may dip in the red for 2024 but then revert higher over the later quarters. Dividends, meanwhile, are forecast to rise at a healthy clip, though free cash flow, as with many Utilities sector stocks, is negative due to high operational and maintenance capex.

NextEra: Earnings, Valuation, Dividend Yield Forecasts

BofA Global Research

If we assume a 20x forward multiple, which is actually about a turn lower than its 5-year average historical earnings-based valuation, and go with $3.50 of non-GAAP EPS over the coming 12 months, then shares should trade near $70, making the stock still a buy today after a decent last several months. I lifted my multiple by a handle given some stabilization in the sector and in the renewables industry.

NEE: Still Below Its Long-Term Valuation Multiple and PEG Ratio

Seeking Alpha

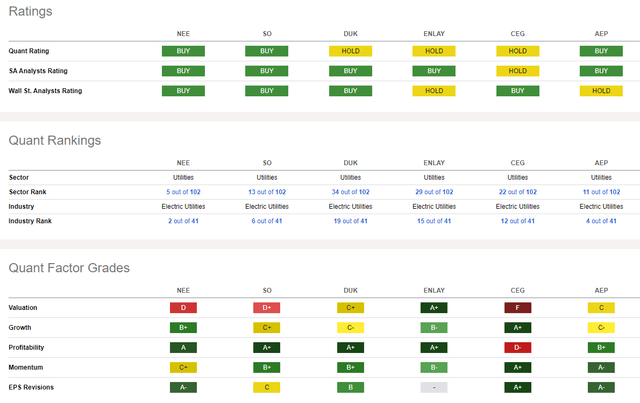

Compared to its peers, NextEra has an elevated valuation, but its access to high-growth markets, including renewables, should help fuel long-term profit growth, despite the near-term risks. As such, the Growth rate is very healthy while its profitability trends have held up well during the violent cycle of rising interest rates in the last two years.

Share-price momentum was in free fall during periods in Q3 and Q4 last year, but it has since stabilized – and I will note a rebound in price action later in the article. Finally, EPS revisions are solidly to the good side since the last earnings report, indicating that the turmoil and outright fear around NEE last year may have been overblown. The stock is now ranked #5 out of 102 in its sector – an impressive comeback.

Competitor Analysis

Seeking Alpha

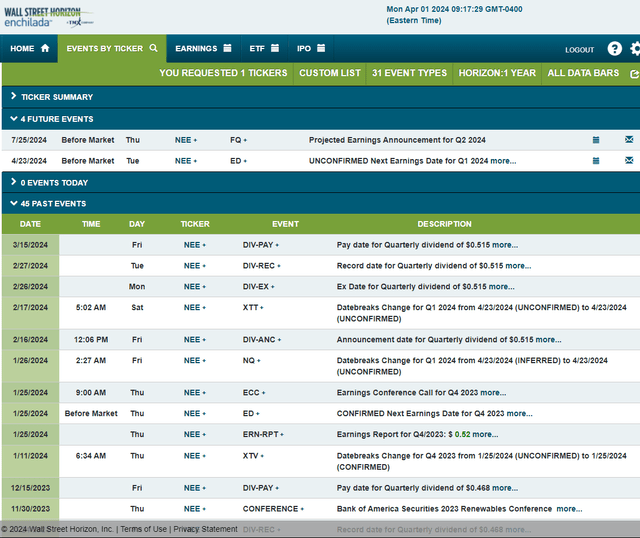

Looking ahead, corporate event data provided by Wall Street Horizon, show an unconfirmed Q1 2024 earnings date of Tuesday, April 23. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

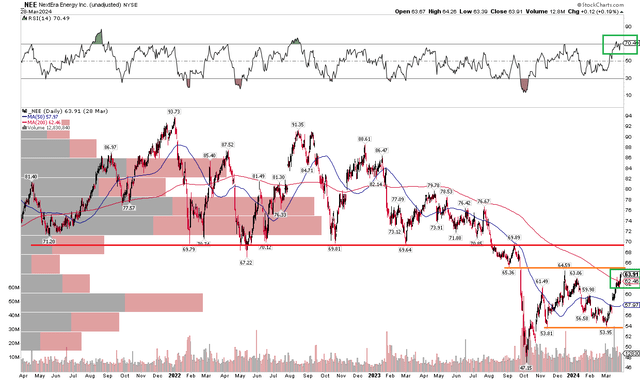

The Technical Take

Last year, I noted key resistance in the $67 to $68 range for NEE. The stock is higher since that analysis, but there’s still room to run in my view. Notice in the chart below that shares, currently under $64, have near-term resistance at the December 2023 peak just above $64. When looking closer at the price action over the past few years, there is really a broad potential selling zone between $67 and $70. So, the stock is not a screaming buy on the chart here, but with the strongest RSI momentum reading since August 2022 now taking place, the bulls may have taken control of the trends.

And that is underscored by the stock climbing above its falling 200-day moving average following an almost 20% advance off its March low. But there remains a price gap down at $55 which could be filled.

Overall, NEE is approaching key resistance levels, but I see more upside ahead given impressive momentum.

NEE: Approaching Long-Term Resistance, Big Momentum, Above the 200dma

Stockcharts.com

The Bottom Line

I reiterate my buy rating on NEE. I see the stock as about 10% undervalued today while a higher dividend yield asserts that the company’s management team is confident about hitting EPS targets over the coming periods.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.