Summary:

- Oil prices should see a rally this year due to supply/demand issues being at the forefront once again.

- Exxon posted record profits in 2022 pulling in over $100 billion in EBITDA.

- Exxon did not increase the dividend after the record year, but did announce a $35 billion share buyback plan.

Scott Olson

Exxon Mobil (NYSE:XOM) recently reported 2022 results, and it was a strong record year. But, it left some shareholders standing around with their hands open asking for more. The company had record profits, yet did not increase the dividend or offer a special dividend. They did announce a buyback plan, but is it enough? With the bull market in oil looking as strong as ever thanks to supply issues, the party is far from over on Exxon Mobil, and buying this dip and any dip this year should yield investors a pretty nice return at the end of the year. Exxon will without a doubt make another run at an all-time high this year if we see the oil picture play out the way I think it will.

What’s Next For Oil Prices?

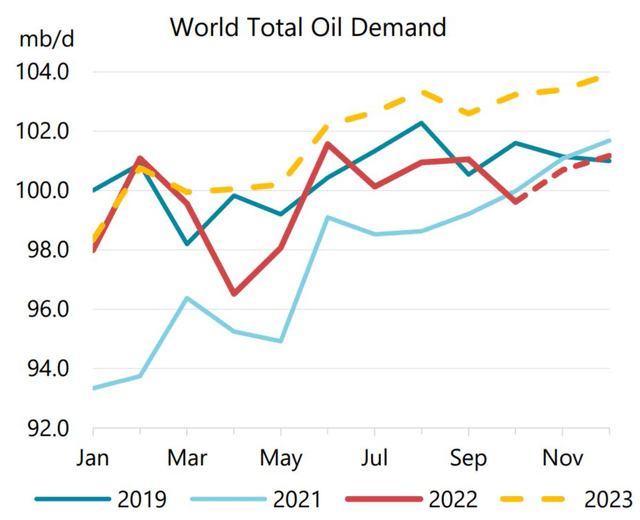

Before I dive into some of the numbers Exxon put up in 2022, let’s look at where oil prices could be headed. As I write this, WTI prices sit right around $75.00. Looking at the fundamentals, the bull case for oil looks incredibly strong. What’s the big driver behind this? China. If you look back to 2020-2022, the biggest shock to the oil market was China locking down. Suddenly there was a huge surplus in the market and we saw prices plummet. Fast forward to 2022 and we saw prices climb well over $100 and we have since seen them stabilize around $75-$80. So what does this mean as China opens back up? Well, we could see the opposite effect. We will without a doubt see oil demand climb to a record high in 2023. Mix this in with price cap sanctions on Russia damaging supply (500,000 cut coming in March). We all knew that the western sanctions wouldn’t really damage Russia’s output capacity due to their strong ties in Asia with respect to India and China, which in fact led to an increase in Russian output (10.7 million barrels per day) in 2022. But this latest cut is obviously a move to try and manipulate the price of the commodity and it will do just that.

Looking above you can see just how drastic the increase could be considering where we came from in 2019 (pre-covid). Where is the extra supply going to come from? It’s likely to be the US and Canada. I’m not sure if you’ve been following the oil reports thus far, but not many are predicting huge output growth or investing in major ways to increase production. With OPEC+ standing firm and cutting (thanks to Russia) someone has to pick up the slack. The big determining factor here will be the speed at which China re-opens and demand returns. Mix this news in with where we are in the seasonality picture (below) and you’ll think twice before trimming your current oil & gas positions. How high do oil prices climb in 2023? I’m not one to make bold predictions, but I would be shocked if we didn’t see $100 oil again this summer/fall.

Record Profits, What Do We Get?

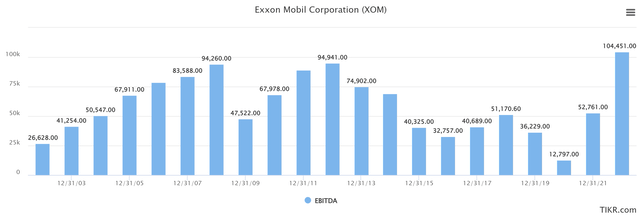

On January 31st, Exxon reported Q4/Year End earnings. The company posted an EPS of $3.40 and Revenue of $95.43 billion, 12% year-over-year growth, and a beat by $5.22 billion which was impressive. But, I want to focus on the year, and what shareholders are getting out of it, or lack thereof. Looking below we can see the company posted a record EBITDA of over $104 billion. Quite the jump from being under $13 billion in 2020.

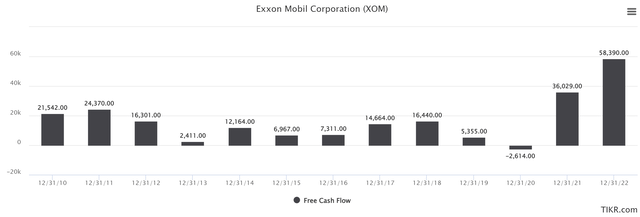

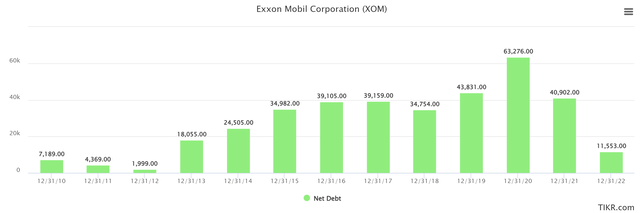

Furthermore to the story of records, we saw Exxon bring in record free cash flow as well at over $58 billion. We also saw Net Debt fall to about $11.5 billion. Quick math puts their leverage ratio at 0.11x which is extremely good. This must mean that shareholders have been paid out in spades right? Not so fast.

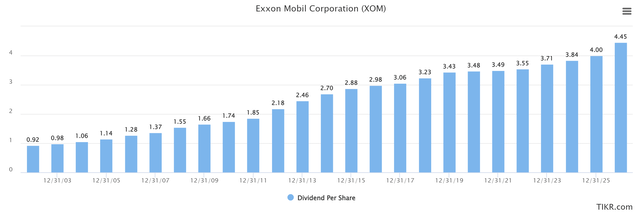

I was openly aggressive against Exxon’s borrowing in order to cover the dividend in 2020. Essentially stating that it would come back to bite shareholders one day and we may see that coming true now. Even though the debt profile is in a great spot now, they left the dividend untouched after a record year. In 2021, the company paid out $3.49 per share, and in 2022 they paid out $3.55. Exxon historically has been increasing once a year, and we have now seen two quarters at $0.91. Will we get another increase in 2023, absolutely. But I wouldn’t expect to see anything crazy. For whatever reason, Exxon seems to want to keep the increases modest. I fully believe this is why we saw the stock react negatively to the record earnings. Shareholders wanted more. Exxon proudly boasts that Exxon has a total shareholder return in 2022 of 87%, which is fine. But almost all of that is due to the stock appreciating, not due to anything Exxon did specifically to reward shareholders which is too bad. That said, the 87% does make them the best-performing super major in the industry which is worth something. At the end of the day, the dividend history here is impressive and the story will continue and keeping the pile of cash they currently have helped secure that future.

Now it wasn’t all bad news with respect to returning cash to shareholders. The company did announce a plan to buy back $35 billion worth of stock over the next two years. And to squash some of the rumors, no, this stock won’t be handed over to executives and board members, it will be retired. While this does generate shareholder value, with a float as large as Exxon’s is, it’s not going to have quite the same effect a dividend increase would. At the end of the day, I do think shareholders have a right to be disappointed. In the meantime, we wait and see what the increase in 2023 will look like.

What Does The Price Say?

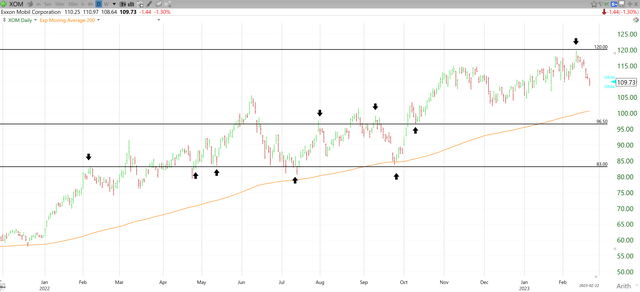

As the kids say, “It’s been a minute!” since I have written on Exxon. Back in May, I wrote how The Party Was Far From Over and that aged pretty well. The stock recently hit a new all-time high of $119.63 and has been down for 7 straight days since. Just so you know, the party still isn’t over. Let’s dive into the story the charts tell.

The target is easy at this point, and that’s $120 based on technical analysis. It appears to be a bit of a wall there given where we topped out. The good news is that where the stock is currently sitting, there’s lots of support and little resistance. As for the support, I look to $96.50 and $83.00. Assuming you are not late to the game and you’ve made some decent money on Exxon, you can place two stops.

Looking above, you can see the levels mentioned above and hopefully the picture as to why they are picked becomes more clear. As for how I would manage them, If you are just buying the stock I would have a hard stop at $96.50. This is about 12% from current levels and below that orange line which is the 200-day moving average (more on that later). There is clear support here and a break below likely sends the stock down to test $83.00. If you are up big and you’ve taken some profits, you can set a 50% stop at $96.50 and the rest at $83.00 if you so wish. A bounce at $83.00 would be very likely and a good buying opportunity if we saw a bounce and a positive test. This strategy allows for a rebound, but does expose you to a 25% hit to the current share price which can be a lot, which is why it’s important to cut at least 50% at $96.50. But I’m not too worried about either of these levels coming into play anytime soon.

Why? Look above. That orange line is the 200-day moving average and has been a rock-solid indicator of both tops and bottoms over the last couple of years. The good news? It’s on the right side of the price action right now. The current moving average rests almost bang on at $100.00. If we continue to see selling in Exxon and get closer to that moving average, the buying opportunity only grows. You can keep the stop at $95.60 and pick up a greater volume of shares while maintaining the same risk profile.

If we see the moving average break and stay broken, that’s when it’s time to get cautious. A touch or bounce off the 200-day moving average would be very bullish and a great buying opportunity. Having the stop just below it makes Exxon the perfect dip candidate.

Wrap-Up

As you can see, there is a lot to like about what’s going on here in the macro view. Do shareholders have a right to be disappointed with what’s happening with respect to the dividend? Yes, I think so. This is why I have been focusing more on the Canadian mid-caps which do carry a bit more risk, but they are returning anywhere from 50-100% of free cash flow to shareholders in the form of dividends and buybacks. But, there is something to be said for the stability and “guarantee” that Exxon is offering. I am buying the dips in the mid-caps, and if you need oil exposure, Exxon is as safe a bet as you can find. 2023 will be another great year for oil & gas stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.