Exxon Mobil: Energy Trade Is Over

Summary:

- Exxon Mobil failed to breakout leading to a Sell rating for the stock.

- Energy prices have failed to rally despite OPEC+ production cuts and the US failing to regain pre-Covid production levels.

- The stock is expensive at 12x ’24 EPS targets and over 20x normalized profits.

JHVEPhoto

Back in October, Exxon Mobil (NYSE:XOM) had the potential for a major breakout. The energy giant hit all-time highs around $115 in November, but oil prices haven’t cooperated at the end of 2022. My investment thesis has shifted back Bearish on the stock with the energy sector failing to breakout and the likelihood of more downside in energy prices.

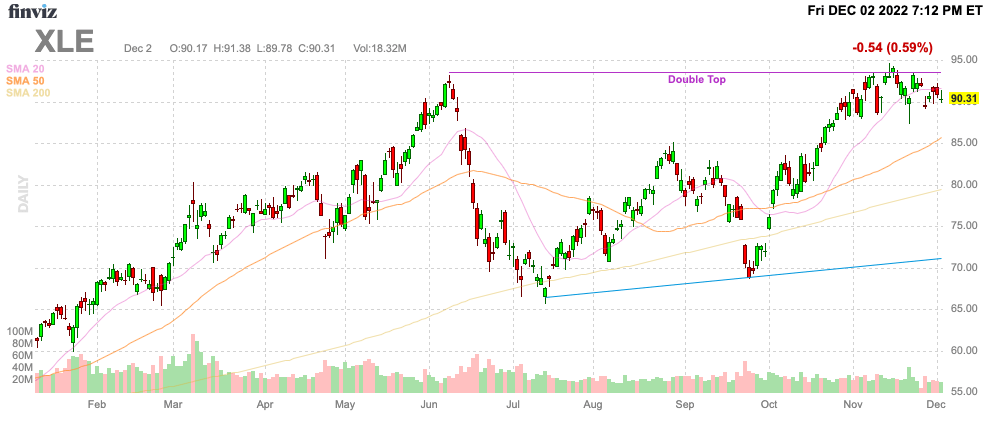

Double Top

The energy sector ETF just registered a double top over the last couple of weeks in a sign the sector is now falling out of favor after big gains following the covid lows in 2020. The Energy Select Sector ETF (XLE) hit a top below $95 back in June and the fund just repeated the peak price in November with a failed breakout.

Source: FinViz

Ineffective Russian Oil Cap

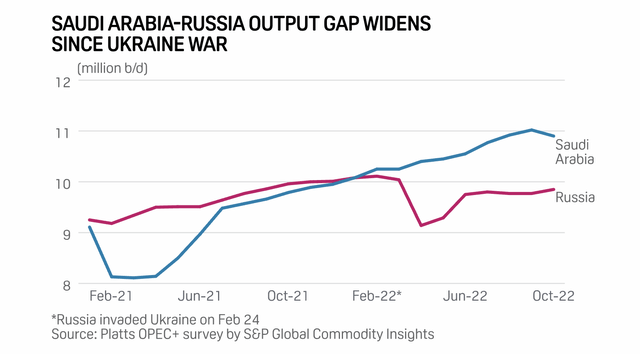

Oil fell into the $70s recently in part due to Russian oil staying on the market. The G7 nations agreed to a $60 price cap on Russian seaborne crude oil effectively allowing Russia to sell oil at similar discounts as in prior months.

The move ensures Russian oil stays on the market and eliminates the risk of a major price spike. Russia remains one of the largest oil producers in the world and the move balances the need to limit Russian revenue to block support for the war in Ukraine.

Russian oil production initially slipped following the start of the war. Russia has a current output of 9.85 million b/d versus the November quota of 10.5 million b/d. The country ultimately has the ability to ramp up production when the Ukraine aggression is finally squashed.

India has already said the country won’t comply with the price cap or any embargo. Russian oil will be shipped using non-Western services to transport the crude to India suggesting the price cap won’t have much of an impact other than for political theater.

China and India are already reportedly paying at $30+ discount to Brent crude prices for Russia Urals oil. With Brent closing the week at $86/bbl, the Asian countries were effectively paying somewhere around $56bbl for Russian oil anyway.

Exxon Peaked

The case for $120+ oil due to the Russian invasion of Ukraine is over. Russia is losing the war and the West clearly has a preference for keeping their oil on the market. In addition, WTI trades around $80/bbl after OPEC+ agreed to cut oil production by 2 million b/d back in early October. Another OPEC+ cut would just signal more oil demand weakness ahead.

Every reason existed for oil to stay excessively high, but the ultimate solution for high prices was high prices. OPEC+ and the US aren’t producing anywhere near record levels and oil has already fallen to near yearly lows.

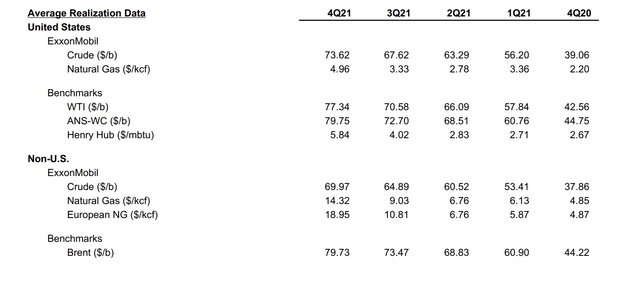

Exxon isn’t correctly priced for the scenario where energy prices just return to the 2021 levels. The energy giant earned $5.38 per share last year based on the following energy price realizations:

- Oil – ~$65

- Nat gas – ~$3 – US, $7 non-US

Source: Exxon Mobile Q4’21 supplemental data

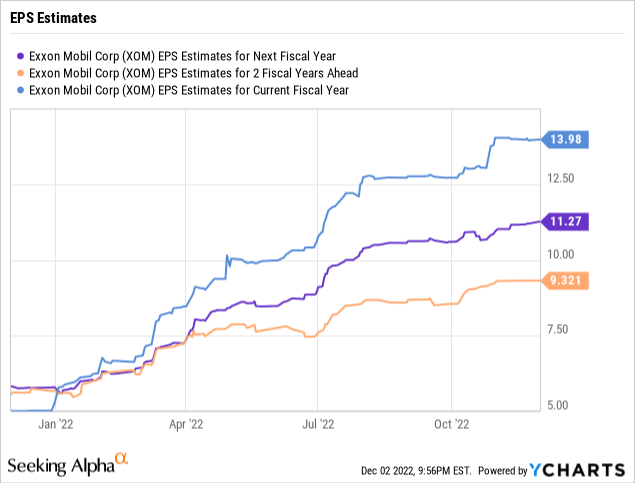

The lack of analyst EPS cuts for Exxon this year should be troubling to investors. As an example, the current consensus EPS estimate for 2024 sits at $9.32 and analysts haven’t revised the numbers lower despite persistently lower energy prices towards the end of 2022.

Under the best case scenario, Exxon Mobil now trades at ~12x 2024 EPS targets. Under a more normal scenario, the stock trades at over 20x the strong 2021 EPS where natural gas prices were already elevated.

Takeaway

The key investor takeaway is that Exxon Mobil had the potential for a breakout, but the opportunity failed to materialize. The whole energy sector has now stalled at prior levels issuing a Sell signal for the sector, which includes Exxon.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market during the 2022 sell off, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.