Summary:

- Last year, the market was under enormous pressure due to inflation, rate hikes, supply-chain disruptions, and China’s zero-Covid policy, which has the ability to trigger a global recession.

- This environment brought even the most loved stocks to their knees. Stocks that were market favorites for the last several years and put out incredible returns for their shareholders.

- In this series, I want to look at some of these stocks and give a quick look at their recent developments and if they are “buys” yet.

- For a company of its size (>400B), Tesla has unmatched growth prospects, is already highly profitable, and has a clean balance sheet.

- The Q4 earnings report was decent with a beat on earnings and a rather good outlook.

JasonDoiy

Introduction

This is the fourth article from this series. If you want to know more about the stocks of this series, please see here.

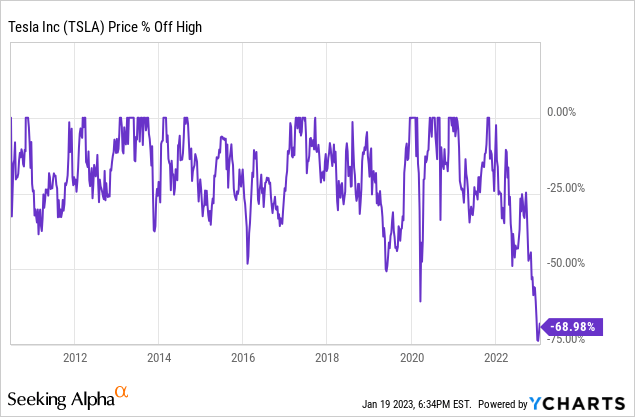

Tesla has been one of the most talked about stocks since 2020. At first, for stellar returns, the latest for losing most of the said returns. As of the time of writing, Tesla is down -64% since the start of 2022. At the peak low, it was close to -75%. This was due to a few reasons:

- Insider trading.

- Demand and margin worries.

- The fear that Elon Musk is focusing more on Twitter than Tesla.

All these problems are discussed in this article rather quickly. I will primarily focus on Tesla’s valuation because this is still the main factor that decides if Tesla (NASDAQ:TSLA) is a buy, hold or sell.

It is essential for you to know my view of the markets for this analysis. Since writing the first article of this series, I have been quite bearish, at least more bearish than the overall market. Because I don’t want to repeat my articles for the people following this series, I recommend reading my previous article for everyone wanting to know more about my view of the market. In short: I am still somewhat bearish and don’t think that the rally we have seen YTD is sustainable. We may not see the great sell-off I thought of last year, but we probably haven’t seen the bottom yet.

But now, let’s start with the fourth stock of this series:

Tesla

Tesla has been well-known for many years as the first-mover and leader in the EV space. The CEO, Elon Musk, is a very popular yet controversial character and is mainly responsible for Tesla’s fame as a brand and its stock performance in the last years. Most of Tesla’s performance came since early 2020 after mostly going sideways for a few years before. Since November 2021, Tesla has been in a major downtrend that accelerated since September 2022.

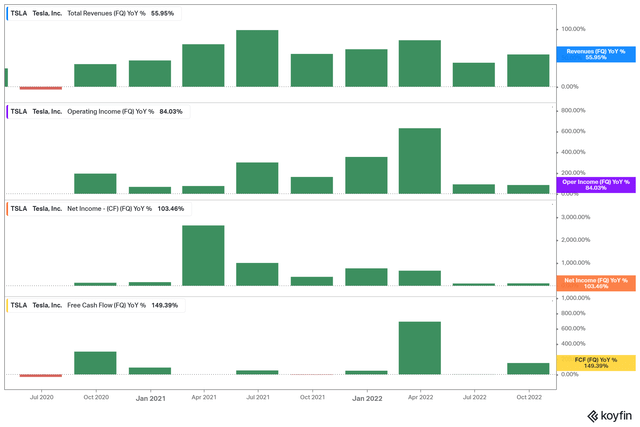

Five-year %-performance and drawdown (koyfin.com)

As you can see, Tesla has had a massive rally since the March 2020 low, which amounted to +1680% gains at the peak if you had invested in January 2018. Since the peak, Tesla has lost almost 78% of these gains at the lows on 01/04. As of now, you would still end up with +450% gains if you invested in January 2018, which is around 90% annualized. Still very impressive. But due to the enormous loss in share price, Tesla qualifies for this series of “Fallen Angels.”

A look at the percentage-off-high shows us that this sell-off is the worst since Tesla has gone public.

The problems that caused this are very prominent, ranging from the Twitter takeover and insider selling to demand and margin worries. I think most of these problems are more noise than anything else. The “Twitter problem” is probably just transitory – I don’t believe Elon will hold onto that CEO position for long. Insider selling is something other than what we want to see, but it also doesn’t affect the company’s business performance. The margin worries, something more company-related, are nothing I share. Until now, most car manufacturers weren’t much competition to Tesla, but that could change.

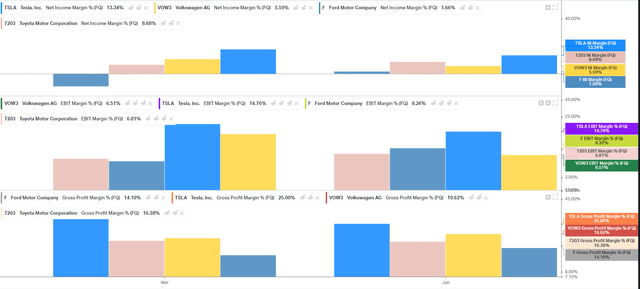

Car manufacturer’s margin comparison (koyfin.com)

But even if margins were to decrease, Tesla should be well above the competition. As you can see in the Chart, Tesla has by far the best margins in the business. Even if they were to decrease, I see good chances Tesla will still have the best margins. Furthermore, lower prices mean more sales.

How has Tesla’s business held up in this challenging year?

Other than the first three companies I wrote about in this series, Tesla has had an excellent year business-wise.

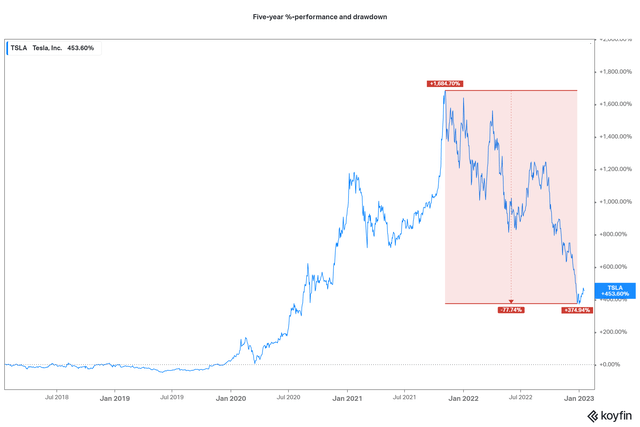

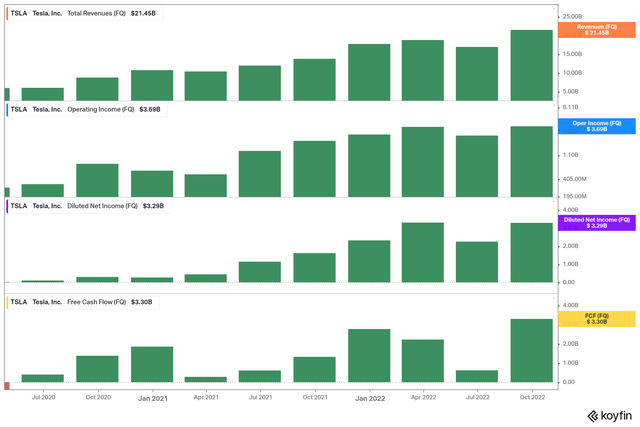

Business performance (koyfin.com)

As you can see here, Tesla has more sales than ever and is as profitable as ever. Revenue, Operating Income, and Free Cash Flow have never been higher in any quarter before. It is a slightly different picture when looking at the growth rates YoY:

YoY growth rates for revenue have come down quite a bit, while growth rates for the earnings metrics have come down a lot in the last two reported quarters compared to the quarters before. But while growth has slowed, it is essential to mention that growth rates are still very high. Revenue grew 56% YoY, operating income increased 84%, net income rose 103%, and free cash flow grew by an astonishing 150%. For a company of this size, these growth rates are unique. So, regardless of being a Tesla bear or bull, you must acknowledge that Tesla has done a great job. But since all that is the past, we should see what to expect in the future.

Future outlook

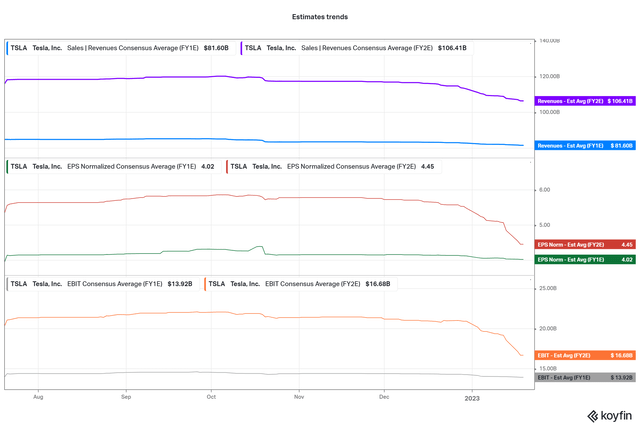

As you can see, analysts have revised their estimates to the downside, but growth rates are still very high.

Analyst consensus (koyfin.com) Analyst consensus (koyfin.com)

Looking at the analyst consensus, analysts predict a lot more growth in the following years. There is only one negative growth prediction (EPS 2026), which I assume is a mistake because all other metrics are positive this year. Analysts predict double-digit growth for most metrics in most of these years. I calculated the compound annual growth rate (CAGR) for the sales and earnings metrics to get one number for every metric:

- Sales five-year forward CAGR: 26.8%

- Gross profit five-year forward CAGR: 27.55%

- EBIT five-year forward CAGR: 34%

- Net Income five-year forward CAGR: 17.45%

- EPS GAAP five-year forward CAGR: 17%

These growth rates are unmatched for a company of that size, but I think analysts are too optimistic. I would cut all these growth rates by 30% to reflect the risk of slower demand (economically wise) and more competition. Furthermore, that gives us a margin of safety. So I expect the growth rates to look more like this:

- Sales five-year forward CAGR: 18.8%

- Gross profit five-year forward CAGR: 19.3%

- EBIT five-year forward CAGR: 23.8%

- Net Income five-year forward CAGR: 12.25%

- EPS GAAP five-year forward CAGR: 12%

I may repeat myself, but these are still excellent growth rates considering the size of Tesla and the timeframe of five years.

Regarding the future outlook, it is essential to mention that Tesla has more growth drivers to come. Just a few days ago, Tesla reported that they are planning a production plant in Nevada for its all-electric semi-truck. Even though production started in October 2022 and the first semi-truck was already delivered, I don’t expect Tesla to ramp up the production of the semi-truck fast. So far, Tesla has missed most major production/delivery dates, so I am cautious with the semi-truck. But that’s just a matter of time, as Tesla will someday have semi-truck production at full pace and can count on it as an additional growth driver. Considering Tesla is the first mover in the all-electric truck space, growth from this section could be massive. But once that is clearer, I will count it into my growth projections.

We can also see the estimated margins in the “actuals and consensus” charts. I calculated an average to get you one number for the next five years:

- Gross profit five-year average margin: 25.26%

- EBIT five-year average margin: 18.48%

- Net income five-year average margin: 14.35%

Again, I would cut 30% off those margins as I feel these are too optimistic. That gives us the following averages:

- Gross profit five-year average margin: 17.7%

- EBIT five-year average margin: 12.94%

- Net income five-year average margin: 10%

Still good margins, way above those of other auto manufacturers.

So, the underline here is that growth and margins are expected to be very good and unmatched, even when cut by 30%. Two reasons Tesla lost a lot of market share in the last year don’t appear to materialize.

Q4 quarterly earnings

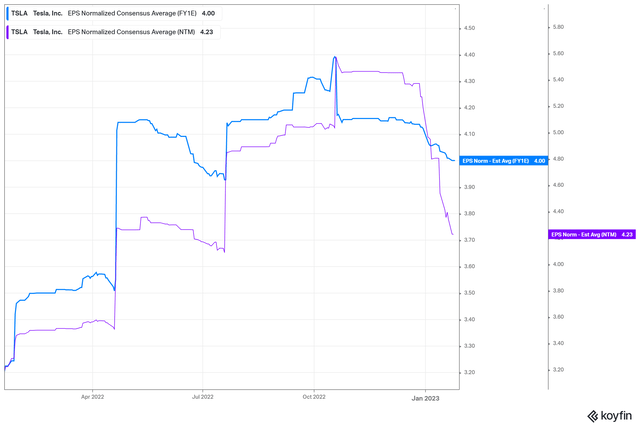

A few minutes ago, Tesla reported its Q4 numbers, which beat estimates. The beat alone is not that special because EPS estimates have been revised to the downside in the last few months.

FY1 and NTM EPS estimates (koyfin.com)

Nevertheless, Tesla has not disappointed as they published not even a record quarter but a record year.

Revenue and earnings

Quarterly total revenue grew by 37% YoY to $24.318M. Automotive revenue made up $21,307M and increased by 33% YoY. On an annual basis, Tesla records total revenue of $81,462M and automotive revenue of 71,462M. Both metrics grew by 51% YoY. Revenue was in-line with expectations.

Income from operations increased by 49% quarterly and 109% annually and came in with $3,901M and $13,656M, respectively. Quarterly EPS came in with $1.19 (non-GAAP) against estimates of $1.11, representing a beat of $0.08 or 7.2%. Annual EPS is $4.07 (non-GAAP) against estimates of $4. EPS grew by 40% YoY quarterly, while growth for the year is 80% YoY. The only downside in earnings is represented by net cash from operations and free cash flow, which decreased by 29% and 49% YoY in Q4. For the full year of 2022, both came in with positive growth of 28% and 51%, respectively.

Some margins took a hit in Q4, too. Automotive gross margin, total gross margin, and the EBITDA margin fell by a whopping 466, 360, and 86 bp. Contrary to this, the operating margin increased by 129 bp YoY to 16%. On an annual basis, the operating margin grew by 464 bp to 16.8%. Net income margin was flat quarterly but increased by 516 bp to 15.41% annually. Since the operating and net income margins are the most substantial margins to me, the overall look at margins is good.

Summarized, growth and margins are both pretty good. But we see a slowdown, and even a decrease in margins, in Q4, which could point to a deceleration of growth in the future.

Regarding costs, Tesla did pretty well in managing the challenges of 2022. Operating costs grew by just 2% annually and even decreased quarterly by as much as 16%. That is good news, considering the challenges of 2022 and that most companies showed significant cost increases.

Production and deliveries

Since these numbers were already reported earlier this month, I won’t say much about them. Just that both, production and delivery, are at record highs in Q4 and for the full year of 2022.

Production and deliveries in Q4 and 2022 (Tesla Q4 earnings)

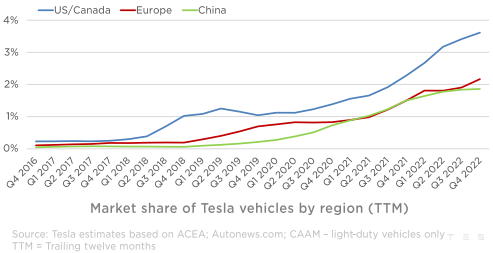

Something new is the market share of Tesla vehicles by region. The following charts shows that Tesla continued gaining market share in the US/Canada and Europe but was mostly flat in China.

Market share of Tesla vehicles by region (Tesla Q4 earnings report)

Outlook

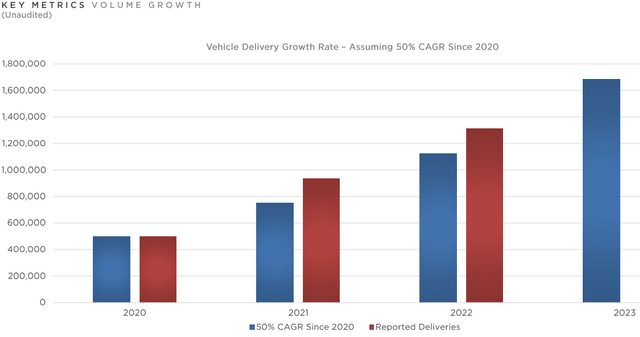

Tesla targets to grow the volume of deliveries by 50% CAGR as they did before, which would account for around 1.7M vehicles in 2023.

Vehicle delivery growth (Tesla Q4 earnings report)

Furthermore, Tesla stated that the Cybertruck remains on track to begin production later this year at Gigafactory Texas. More to this on the Investor Day on March 1st, 2023.

Considering profits, Tesla acknowledges the inflationary impact on its costs and announced an acceleration of its cost savings.

As we progress into 2023, we know that there are questions about near- term impact of an uncertain macroeconomic environment … In the near term we are accelerating our cost reduction roadmap…

Furthermore, profits are expected to get a boost by software-related profits in addition to further improvements of the cost of production:

While we continue to execute on innovations to reduce the cost of manufacturing and operations, over time, we expect … an acceleration of software-related profits.

Tesla also said that they

believe no other OEM is better equipped to navigate through 2023, and ultimately succeed in the long run, than we are

Considering the high margins I already talked about and the foresighted cost awareness, I do not doubt that this is everything but the truth.

Ultimately, this quarterly report is a decent one. Not as spectacular as others in the past, but not bad at all. Considering this, I don’t expect the market to react dramatically, positive or negative, as long as there isn’t any more good or bad news in the conference call. With this earnings report, Tesla supported my further assumptions that it is a high-growing company with more growth to come.

Valuation

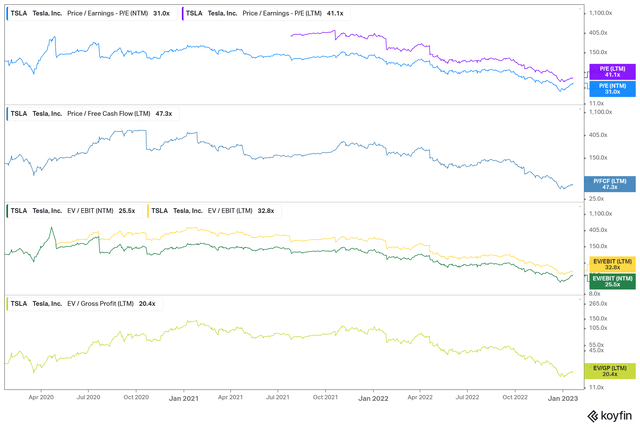

The valuation was the main argument of Tesla bears which is understandable considering how astronomically high the valuation metrics were:

Tesla valuation metrics (koyfin.com)

As of the time of writing, all these valuation metrics are at all-time lows after falling dramatically over the last year. And for the first time, Tesla is somewhat reasonably valued. But to clarify that and reflect other views, it is essential to make different attempts to value Tesla. Every time I read exchanges between Tesla bulls and bears about its valuation, I see two main arguments for Tesla’s valuation.

- “Tesla is still an auto manufacturer and therefore overvalued.”

- “Tesla is a high-growth company owning itself a premium valuation.”

I have made three attempts to value Tesla. First, I used FastGraphs to assess its valuation using fair values for growth and Tesla’s P/E averages. Second, I will compare Tesla’s valuation to the auto sector, and lastly, I will compare it with other high-growing stocks.

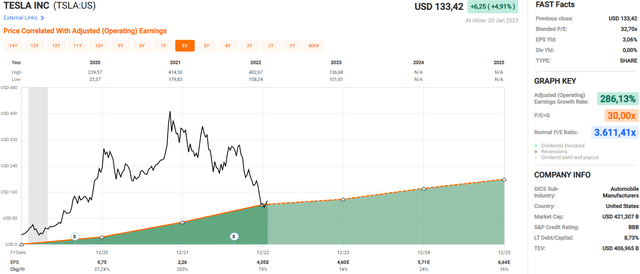

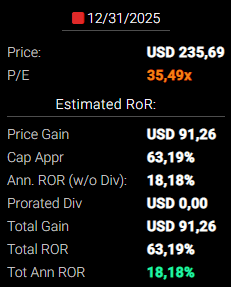

1. Valuation measured with FastGraphs fair values and Tesla’s P/E averages:

FastGraphs historical graph (fastgraphs.com)

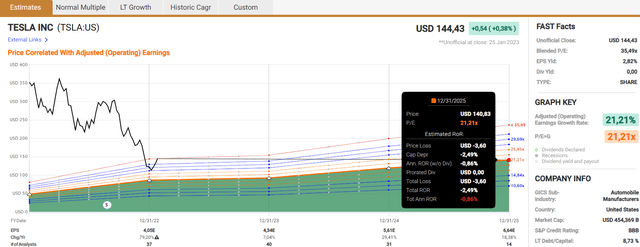

According to the P/E=G formula (P/E equals growth, capped at 30), Tesla is about fairly valued considering the average annual growth rate of 286% in the last three and following three years. Tesla’s average P/E ratio of >3600 is not shown in the chart because it would distort the chart and is meaningless. To predict the future, I will show you the forecasting chart calculating the annual earnings growth until the end of 2025 with 21%, according to analysts. If Tesla’s P/E ratio reverted to 21x (P/E=Growth), that would result in a -0,9% total annual return. If Tesla held its current (blended) P/E ratio of 35.5x, the annual total return would be as high as 18.2%.

FastGraphs forecasting chart 21x P/E (fastgraphs.com) FastGraphs forecasting chart 35.5x P/E (fastgraphs.com)

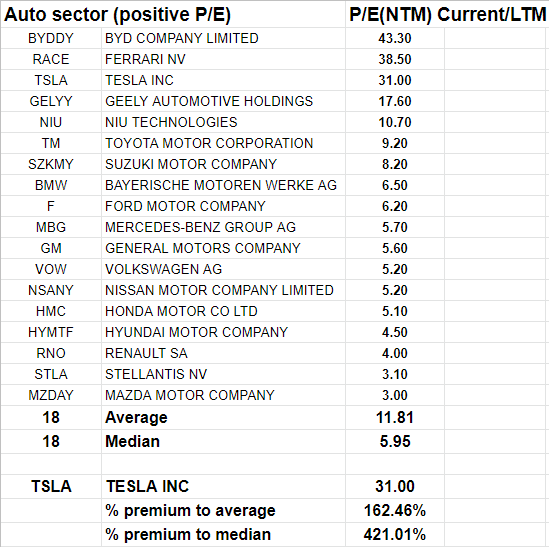

2. Comparing Tesla’s valuation against the auto sector:

To do that, I summed up all the auto manufacturers with positive P/E ratios and calculated the average:

Auto sector companies with positive P/E ratios (Author, data from koyfin.com)

The average P/E ratio for auto manufacturers is 11.81, while the median is 5.95. Compared to that, Tesla is overvalued with a premium of 162% and 421%, respectively. Combining the average multiple of 11.81 with the analyst’s and my estimates gives us the following price targets:

- Analysts estimates for 2028: $7.84 EPS (GAAP)= $92.6 (7.84*11.81)

- Current share price $144.43 -> $92.6 = -35.9% / -7.2% annually until 2028

- My estimates for 2028 (+12% annually as calculated earlier): $7.1 EPS (GAAP)= $83.85 (7.1*11.81)

- Current share price $144.43 -> $83.85 = -42% / -8.4% annually until 2028

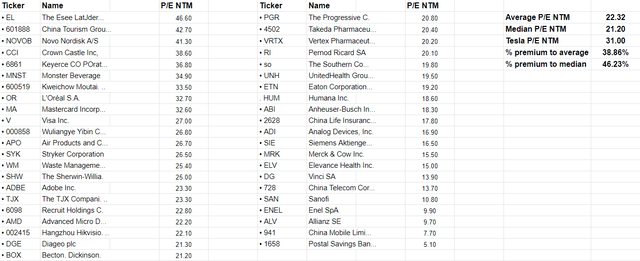

3. Comparing Tesla with other similar growing stocks

To do that, I screened the stock market with Koyfin’s screener and the following criteria:

- Trading regions: US/Canada, Africa/Middle East, Asia/Pacific, Europe, and Latin America/Caribbean

- Market cap: >$10B

- Primary security

- EPS GAAP growth consensus average: 12%-17% for the next 5 years

I got 43 stocks as a result, as you can see below:

Similar growing stocks comparison (Author, data from Koyfin)

The average P/E NTM is 22.32, and the median P/E NTM is 21.20. With Tesla’s 31x, we have a premium to the average of 39% and to the median of 46%. Combining the average multiple of 11.81 with the analyst’s and my estimates gives us the following price targets:

- Analyst’s estimates for 2028: $7.84 EPS (GAAP)= $175 (7.84*22.32)

- Current share price $144.43 -> $175 = +21.2% / +4.2% annually until 2028

- My estimates for 2028 (+12% annually as calculated earlier): $7.1 EPS (GAAP)= $83.85 (7.1*22.32)

- Current share price $144.43 -> $158.50 = +9.74% / +1.95% annually until 2028

Underline of these three valuation attempts:

The comparison to the auto sector is pointless, as none of these companies grows as fast as Tesla. Sure, most of them sell more cars and earn more money, but you can’t just let out the factor of growth Tesla provides and the margins that are way above the sector average. Therefore, I find it more meaningful to value Tesla as a growth stock. According to my calculations, that would give us little upside in the following years. But Tesla has a few significant benefits:

- One of the biggest companies

- Clean balance sheet

- From the US, so no disadvantages because of foreign governments or de-listing worries.

- sector leader

- best margins in the sector

So a premium against the selected company’s average P/E is reasonable. For me, the first attempt to value Tesla is the most reasonable one. I would be perfectly fine with paying 30x P/E for a company like Tesla growing at the projected rates. In my prediction (which is rather conservative) of $7.1 GAAP EPS in 2028, you would get an annual return of 12% if you invest at the current prices. Calculated with the analyst’s estimates of $7.84 GAAP EPS, you get a yearly return of 15.3%. These returns are good, but I recommend waiting for the first buy. The whole market rallied pretty good YTD, and Tesla gained even more. Naturally, there is a high probability that both correct some part of their rally. Looking at the chart, I see good chances that you could buy it for around $124, which would give you annual returns of 14.35% and 18%, respectively.

Conclusion

The sell-off we saw last year was massive, while the business performance was good. Therefore, the valuation has come down a lot. This was the biggest problem and the number one reason I never bought Tesla shares before. Tesla’s growth prospects are excellent for a company of this size, even when cut by 30% for a margin of safety. Currently, Tesla is the leader in the EV and autonomous driving space. I see that at risk but wouldn’t way that risk too much as long as Tesla can reach the growth estimates. Last but not least, Tesla got the Elon factor. He is one of, if not the most popularizing persons of our time, and I can see Tesla becoming a rallying “meme stock” again. This is obviously not a serious reason to invest, but I would gladly take short-term gains from this. Considering all these things, I rate Tesla as a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.