Summary:

- Since my previous article, Boston Beer’s stock surged, but Q3 2023 sales stayed flat due to Truly’s struggle; Twisted Tea grew strong.

- Focused on Truly, the company faces market challenges, impacting long-term performance.

- Despite a solid balance sheet, Boston Beer’s overvaluation and lagging performance versus peers pose risks.

XtockImages/iStock via Getty Images

My previous hold rating for The Boston Beer Company (NYSE:SAM) was due to struggles in its Truly brand and a softened profit outlook amid alcohol market challenges, seemingly affecting Boston Beer more than its industry peers. Since my prior analysis, the stock surged by 8.85%, while short interest dropped from 6.12% to 3.81%. Despite this, in Q3 2023, sales were flat, primarily driven by the underperformance of Truly. On a positive note, Twisted Tea shows strong double-digit growth, excelling in flavoured malt beverages (FMB). However, the persistent financial focus on Truly raises concerns, especially amid enduring market challenges. Furthermore, the stock remains expensive compared to alternatives in the industry. Consequently, my recommendation of a hold rating remains unchanged.

Stock price versus peers (SeekingAlpha.com)

Company updates

Since 2010, global alcohol consumption has plateaued or declined, but the retail value is rising due to premiumisation. 2023 marks the first year that alcohol consumption is predicted to increase again.

Volume of the alcoholic drinks market worldwide from 2014 to 2027 (Statista.com)

Alcohol companies are adapting strategies to meet evolving consumer habits, yielding mixed results. Boston Beer reflects both smart decisions and setbacks impacting overall performance.

Annual revenue and gross profit (SeekingAlpha.com)

Q3 2023 saw a 2.5% YoY decline in sales volume to 2.3 million barrels, urging a need for improved sales and cost-cutting measures, reflected in the appointment of a new CFO. Notably, Boston Beer faces repercussions from its investment in Truly Hard Seltzer, experiencing continued sales decline. Efforts to revive sales in 2024 involve innovation through new packs, flavour enhancements, and seasonal marketing. Conversely, its largest brand, Twisted Tea, excelled with a 34% growth in Q3 2023, fuelled by effective branding, expanded distribution channels, and successful product launches.

The company is banking on the Beyond beer category for faster growth than traditional beer markets. Furthermore, to streamline costs, Boston Beer is scrutinising various business areas, from raw materials and packaging to brewery expansion and waste reduction, aiming to bolster margins. Anticipated capital expenditure of $60 to $90 million focuses on company improvements and capability-building. While these efforts are being made, we have yet to see a major impact on financials, which is concerning; the company is also waiting for FY 2024 until February amidst uncertainty in the market.

Financial updates

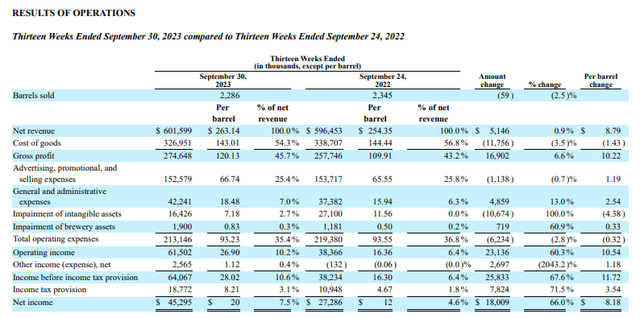

In Q3 2023, the company’s top line increased slightly by 0.9% YoY to $601.6 million, hit by an underperforming Hard Seltzers category. Furthermore we can see that TTM revenue is less than FY 2022 revenue at $2.06 billion. Despite this, notable progress was made in enhancing gross profit margins from 43.2% to 45.7% over the last two quarters by optimising operational efficiencies and aligning cost structures with volume expectations.

Financial highlights Q3 2023 versus Q3 2022 (Sec.gov)

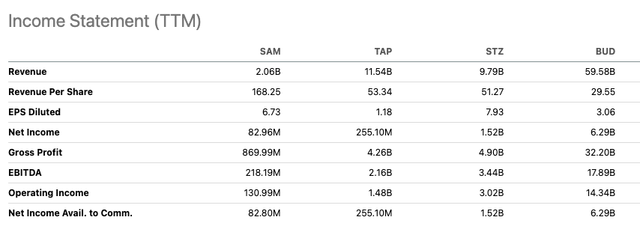

However, while Q3 2023 net income reached $45.3 million, the trailing twelve-month (TTM) net income of $82.96 million falls notably below industry peers for the same period, indicating a performance gap.

Net income versus peers (SeekingAlpha.com)

Although a high cash generator with a robust balance sheet showcasing $250 million in operating cash from the last two quarters, the company’s strategic focus on reinvestment and rewarding investors with a $69 million stock repurchase year-to-date underscores its commitment. Ending Q3 2023 with a cash balance of $311 million and an unused credit line of $150 million positions the company favourably for strategic initiatives. However, the discrepancy in net income compared to peers is a concern in a highly competitive industry.

Valuation

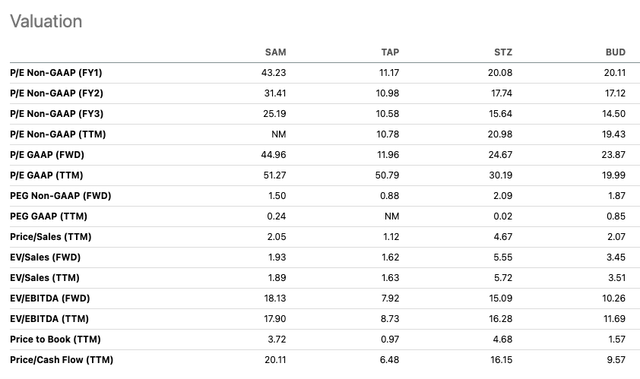

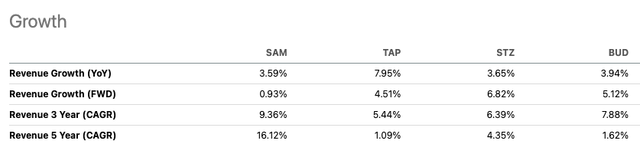

When comparing Boston Beer to industry giants like Molson Coors (TAP), Constellation Brands (STZ), and Anheuser-Busch (BUD), evident overvaluation surfaces, notably seen in its forward price-to-earnings ratio of 44.96 and price-to-book ratio of 3.75. Additionally, the company’s growth rate lags behind its peers at a year-on-year rate of 3.59%. Although showing improvement at 42.18%, its gross profit margin still trails all peers except Molson Coors, which stands lower at 36.91%. This indicates potential disparities requiring attention to align with industry standards and competitive positioning.

Relative peer valuation (SeekingAlpha.com) Growth versus peers (SeekingAlpha.com) Profitability versus peers (SeekingAlpha.com)

Risks

Boston Beer faced significant setbacks from costly investments in Truly, which haven’t yielded profitable returns. To counter this, it is initiating changes by phasing out certain products and introducing new ones. However, persisting with a brand that doesn’t align with consumer demands poses a long-term risk, potentially impacting business performance. Additionally, while many alcohol companies are experiencing volume declines, more successful peers excel in boosting top-line revenue. This divergence in performance raises concerns in a dynamic and competitive industry landscape.

Final thoughts

Given recent performance challenges and the ongoing struggle with Truly, Boston Beer faces critical hurdles to overcome in aligning its brands with market demands. While Twisted Tea’s growth signifies some strength, the company’s reliance on underperforming segments continues to hamper overall sales. Furthermore, amidst industry shifts and intensified competition, its valuation appears inflated compared to industry giants. Despite these concerns, Boston Beer’s strategic focus on cost-cutting measures and reinvestment reflects a proactive approach to improving margins and driving growth in a challenging market. Therefore, I maintain a wait-and-see-hold approach.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.