Netflix: Price Increases Give Investors A Reason To Smile

Summary:

- Netflix has several catalysts for continued share price appreciation, including the end of Hollywood strikes and price increases.

- NFLX’s Q3 results showed strong subscriber growth, increased revenue, and record operating profits, indicating a positive outlook for 2024.

- Market share of all TV viewership is still sitting in the single digits, indicating more room for market share expansion – both against other streamers and linear TV.

Ake Ngiamsanguan/iStock via Getty Images

With markets careening back to YTD highs driven by the promises of lower inflation and lower interest rates, large-cap tech stocks are very much back in fashion. That doesn’t mean, however, that these tech giants with fantastic fundamentals can’t and won’t make great investments in 2024, especially when there are a number of catalysts underneath their belts to drive growth.

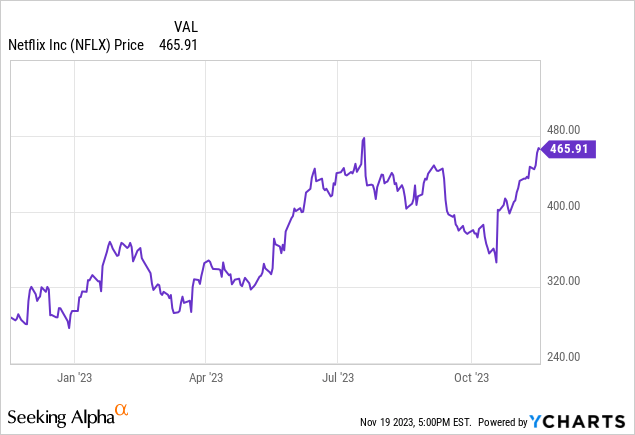

Netflix (NASDAQ:NFLX) is a top-notch example here. The leading streaming platform has seen its share price rise ~50% year to date, but in my view there’s still plenty of wind left in Netflix’s sails to keep rallying.

Netflix enjoys several catalysts to continue powering share price appreciation

A confluence of positive drivers for Netflix makes now the opportune time to buy. The first and foremost, of course, is the end of the Hollywood strikes that have put writers and actors on the sidelines, delayed hundreds of highly anticipated projects, and sapped billions out of the Los Angeles economy. Thankfully, the strike ended before the lack of fresh content was able to do any meaningful harm to Netflix’s business – the company was still able to release most of its flagship Netflix Originals this year, including new seasons of The Crown, Bridgerton, and The Witcher.

Here are a number of other core bullish drivers for Netflix:

- The company is enjoying the benefits of price increases at a time when many competitors are raising prices. Netflix’s financials (which we’ll discuss in the next section) have shown that subscribers have virtually shaken off any reaction to the recent price increases. After all, when most competing streaming services are raising prices, the alternatives aren’t as appealing. And with the company noting success in paid family sharing, the company has the opportunity to increase spend per household as well, versus its prior unlimited password-sharing model.

- An end to the content arms race? In its most recent earnings quarter, Disney (arguably Netflix’s most serious competitor, when considering the market share of Disney+ and Hulu combined, announced that it would reduce its content volume to focus on quantity. We’re likely moving toward a near-term future in which the major streaming giants will stop trying to outspend each other on content and focus instead on core franchises.

- Record operating profits. Due to a combination of strong membership growth, more efficient headcount levels, and more disciplined content spending as outlined above, Netflix is generating record operating profits.

- Alternative engagement strategies. The company is building off its pop-up Netflix Bites cafe experiences to create more physical/offline destinations for Netflix fans, which it is branding as “Netflix House”. Over time, the company could build up more of an experienced business as Disney has.

The bottom line here: it’s a great time to go long on Netflix. The recent rally has further steam in 2024, where Netflix has indicated it expects to benefit from a combination of both paid subscriber growth plus pricing tailwinds.

Q3 download

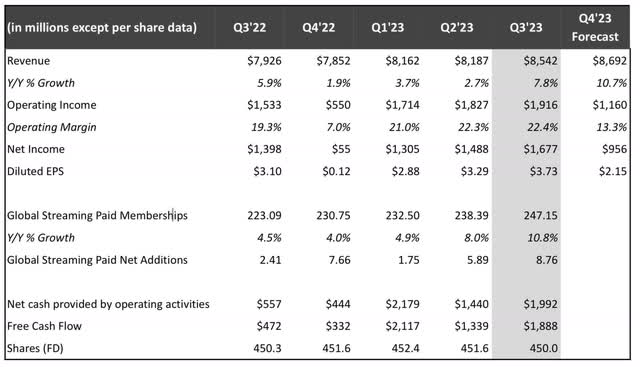

Netflix’s Q3 results showcased a strong beat in subscriber adds, which is the number-one metric that moves its stock. The Q3 earnings summary is shown below:

Netflix Q3 earnings highlights (Netflix Q3 earnings release)

Revenue grew 8% y/y to $8.54 billion, accelerating sharply over Q3’s 2% y/y growth rate. Note as well that Netflix’s guidance for Q4 calls for further continued acceleration in revenue growth to 11% y/y – which is a rarity in this economy where most companies, particularly in the tech sector, have commented on slowing revenue growth driven by macro factors. Evidently, consumers are reining in their spending on goods – but in spite of price increases, subscribers are still hanging on to their plans.

And new subscribers are signing up in large numbers as well. 8.76 million net-new subscribers joined Netflix in Q3, versus 5.89 million last quarter and 2.41 million in the year-ago Q3. These net adds were above the company’s expectations, and it expects a roughly similar number of net adds in Q4 “give or take a few million.” Usually, a large subscriber add in one quarter signals pull-forward from the next quarter – so we’ll see if Netflix’s strength can hold up in Q4.

By region, it’s worth noting that 1.75 million of these net adds came in the U.S. and Canada, where average revenue per member (ARM) is highest at $16.29. The next most-lucrative market, Europe (at $10.98 per member) contributed nearly half, or 3.95 million, of the quarter’s net adds. It’s worth noting that this is in spite of price increases in the U.S., UK, and France.

Note that membership in the ad-supported plans increased by 70% quarter-over-quarter (starting at $6.99/month in the U.S.). With many of the global price increases focused on the basic tiers, which are also being phased out in many markets, more customers have mixed into the ad-supported plans. While subscriptions remain the key revenue driver for Netflix, a higher ad-supported base will help to boost Netflix’s cachet and credibility with advertisers, which will be a key source of revenue in the future as Netflix strives to compete with lower-cost streamers.

On the content side, one notable hit for the past several quarters is Suits, the eight-season legal drama (the final season, unfortunately, is not available on Netflix to stream due to separate rights ownership) that demonstrated the value of library content. The renewed popularity of Suits has proven to Netflix and investors that splashy new content is not always the reason that people sign up and pay for streaming. 1 billion streaming hours in Q3 were spent on Suits. Licensing popular content and getting ahead of trends will be key for Netflix going forward.

In FY23, Netflix noted that virtually all of its revenue growth came from membership growth; in FY24, it expects contribution from both revenue growth and pricing growth, including the end of free sharing.

Speaking to this dynamic on the Q3 earnings call, CFO Spencer Neumann noted as follows:

So just looking at ’24 specifically, as Ted talked about, we expect to have a great slate to drive the business forward. And we expect to continue to do things like add extra members, grow our advertising revenue, as Greg discussed. And in addition, have some pricing adjustments. You saw that in our letter. All those things will drive ARM.

So ’23 was a pretty unusual year where essentially all of our growth came from member growth. And going forward, more broadly, not just ’24 and beyond, we’ll grow our business by continuing to kind of improve our service, increasing engagement, increasingly satisfying current and future members. And now that, as Greg discussed, we’ve got and account sharing solution, we have a more clear path to more deeply penetrate that big addressable market of 0.5 billion connected TV households and growing.

And with our continued plan evolution, pricing sophistication and all that hard work growing our ads business, we’ll keep getting better at monetizing that big and growing reach and engagement. So we believe we’ve got a long runway for growth in both kind of more membership and higher ARM over time in a more balanced way than what you saw this year, which was, again, a pretty early year.”

Finally, a word on profitability. Netflix’s operating income of $1.92 billion in Q3 grew 25% y/y and hit a 22.4% margin, 20bps above the company’s expectations and up 310bps y/y. The chart below, meanwhile, showcases that full-year operating margins are expected to hit 20%, the highest in any year except 2021.

Netflix operating profit (Netflix Q3 earnings release)

Now, we do note that with the end of the strikes, Netflix expects to spend more on content in FY24 (not fully hitting operating margins, of course, as content is amortized over several years). It’s expecting cash spend on content in FY24 to hit $17 billion, versus $13 billion in FY23. But with pricing tailwinds, strong subscriber trends, and increased contribution from advertising, we think there are several levers for Netflix to continue raising its margin profile and earnings next year. We note as well that the company also just started an FX hedging program which should reduce its FX exposure (60% of its revenue is non-U.S. denominated) in FY24 should rates be as volatile as they were in FY23.

Key takeaways

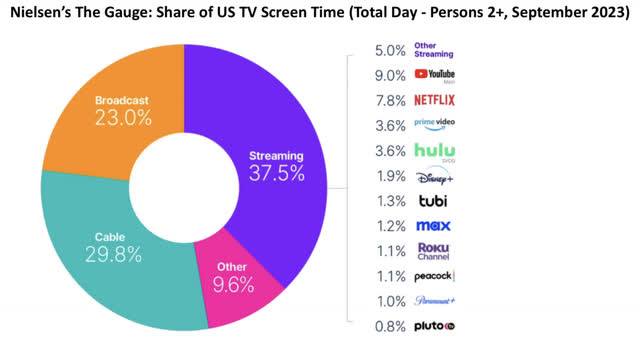

With successful price increases under its belt, strong subscriber engagement and a return to fresh content production, there’s a lot to like about Netflix heading into 2024. It’s also worth a reminder that the company is still a single-digit share of overall streaming viewership, indicating more room for market share growth.

Netflix viewership share (Netflix Q3 earnings release)

Stay long here and ride the recent upward momentum.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.