Summary:

- Ford Motor Company is focusing on traditional segments and scaling back on electric vehicle production due to challenges in the EV space.

- Concerns regarding the debt load and struggles in establishing a foothold in the EV market are valid but overstated.

- I am concerned that Ford’s stock could represent a value trap. Declining inventory turnover, gross margins, and stagnant market sentiment complicate the investment decision.

- Therefore, I assign a “Hold” rating to this iconic carmaker.

teddyleung/iStock Editorial via Getty Images

Introduction & Investment Thesis

I recently published an article about Tesla (TSLA) and argued that beyond all the confusion about what it can achieve in the future thanks to its technology, it is essentially a car company. The major difference is that it solely focuses on electric vehicles, while its more traditional competitors mainly sell internal combustion engine [ICE] or hybrid vehicles, seeing EVs as a venture.

As I discussed the problems awaiting Tesla in the EV space, I wanted to have a look at the traditional carmakers as well. And today, I am analyzing one of the oldest and most iconic carmakers in the world, with a history going back to the early 1900s. That company is the American symbol Ford Motor Company (NYSE:F).

I am excited about this article, because I believe there are a couple of misconceptions about Ford. Investors who are not familiar with car manufacturers look at Ford and think it has a pile of debt it cannot pay, and the company will have to cut its dividend. As we’ll talk about in this article, that could not be more wrong. Additionally, I have had people ask me about “Ford’s failure in electric vehicles”. We’ll touch on that as well.

Although there are promising signs, such as Ford’s strategic decision to temporarily scale back on electric vehicle production to focus on traditional segments, challenges like declining inventory turnover and gross margins, along with the market’s reluctance to value the stock more highly, lead me to assign a “Hold” rating to Ford.

I know Ford is a well-known company that may not require a description, but as some readers might be new to this space, I want to briefly go over how the business works.

Company Description

As highlighted earlier, Ford is one of the oldest car manufacturers in the world. According to Elon Musk, it is one of the two carmakers in the US not to have gone bankrupt, the other one being Tesla.

Ford operates under the Ford and Lincoln brands, producing a range of vehicles that include internal combustion engine (‘ICE’), hybrid, and electric models. Additionally, the company offers service parts, accessories, and digital services, primarily through dealership sales channels.

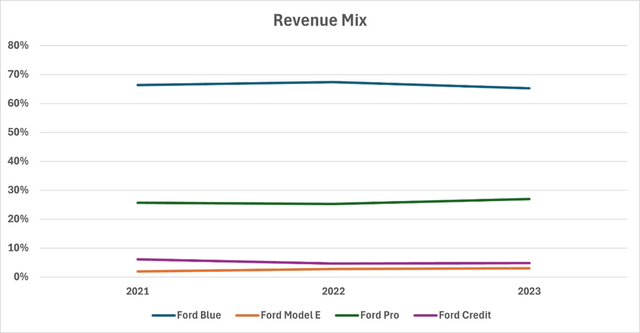

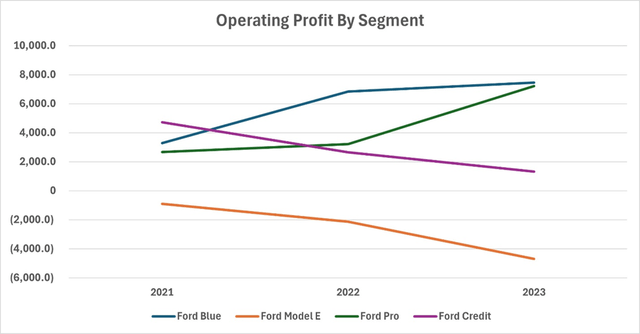

Ford’s business is structured into four main segments: Ford Blue, which handles the sales of ICE and hybrid vehicles and their parts; Ford Model E, focused on electric vehicles and their components; and Ford Pro, which caters to commercial, government, and rental markets.

The fourth segment, Ford Credit, functions as a financing arm for car buyers. Although it doesn’t seem like a big segment when one looks at the revenue mix, it plays a vital role in sustaining high sales across other segments, particularly significant as total vehicle sales have yet to rebound to peak levels.

You can find the revenue mix and operating profit by segment charts below.

It is important to note that while Ford Blue, the largest segment by far, has seen increasing operating profits over the past three years, the efforts to build a profitable electric vehicle business have been unsuccessful so far. As sales of electric vehicles increased, it cost the company more money.

Cutting Back On The Electric Vehicle Bet

The EV space has been thriving since 2019. Tesla is a very good example of this. Between early 2019 and late 2021, the stock surged 1500%. Despite struggling financially in 2018, Tesla achieved $13.6 billion in operating income by 2022.

However, it’s not easy to build an electric vehicle business. Tesla had the first-mover advantage, and its high-quality cars set the barrier to entry high. Its cars were expensive but deemed worthwhile by many consumers, explaining why other automakers were hesitant to invest heavily in this sector initially, given the difficulty of challenging Tesla’s market dominance.

However, the tides are turning. As I discussed in my Tesla article, competition in the EV space is intensifying, particularly with Chinese cars entering the market. These models are not only more affordable but also rival Tesla’s in terms of features and overall quality.

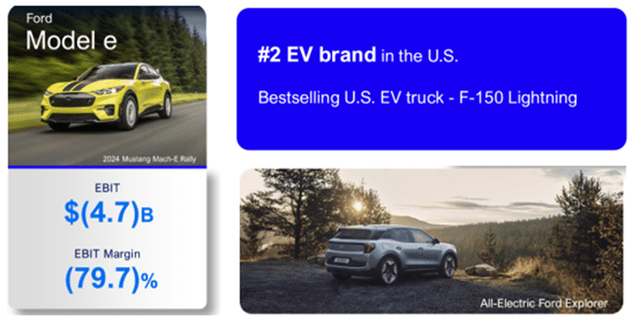

Ford has been working on electric cars since the company was founded, however, it never became the main focus of their business. The more recent round of investments in EVs started in 2009 when the company introduced Focus Electric in 2009. But it was expensive and the lack of sufficient infrastructure was a big headwind. With Tesla’s determined investments in infrastructure, For renewed its focus on EVs and established a new operating segment: Ford Model E. Although it is the #2 EV brand in the US, as can be seen above, it never turned profitable.

Competition is tough, but that is not the only problem. Overall consumer demand for EVs seems to have paused, influenced by rising interest rates and the initial excitement waning. Consumers are gravitating back towards a more diverse mix of vehicles, including ICEs and hybrids.

A good indicator of this trend is the fact that Tesla’s stock declined more than 50% since January 2022.

Recognizing these market signals, Ford and other major automakers like General Motors, Mercedes-Benz, and Volkswagen have adjusted their strategies accordingly. For instance, Ford recently announced that it will scale back production of its electric pickups. General Motors and others have also announced similar plans.

The market responded positively to these strategic shifts, with Ford’s stock climbing 20% in just two and a half months following the announcement. The company is focusing on where it wins, which is hybrid and ICE. Investing in electric vehicles and trying to sell more seems like a very good way of burning cash in the short-term. EV continues to be a tough place for new and existing companies alike.

The Debt & Dividend Question

Another big question is about debt and dividends. Recently, I have had people ask me recently about the huge debt maturities coming up for Ford and about the safety of dividends. It’s crucial to delve into the specifics of this debt to understand its implications accurately.

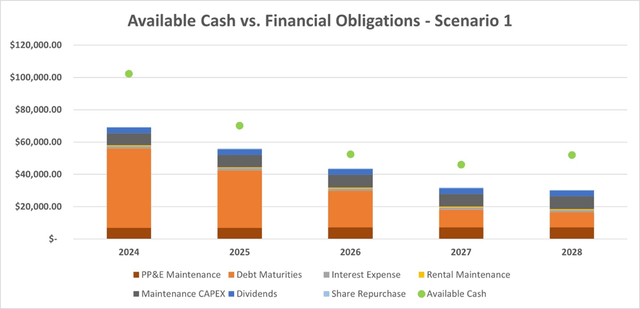

Indeed, Ford carries a significant amount of debt; as of December 2023, the company reported $49 billion in current debt and nearly $100 billion in long-term debt. However, it’s essential to distinguish between Ford’s operational business, which involves manufacturing and selling cars, and Ford Credit, the company’s financing division.

Of the total debt, $49 billion of the current and $80 billion of the long-term debt are attributed to Ford Credit, not to the manufacturing operations. Why does this matter?

Ford Credit cannot be evaluated as an industrial business. In fact, it is more accurate to evaluate it as a bank. Its primary function is to raise funds through debt to finance consumer purchases of Ford vehicles. Therefore, while the debt figures might seem scary, Ford Credit also holds substantial assets in the form of loans and leases due from consumers. For example, as of December 2023, the financing arm had $56 billion in short-term loans to collect from consumers and $49 billion to pay for current debt. This large amount of receivables significantly mitigates the impact of the debt.

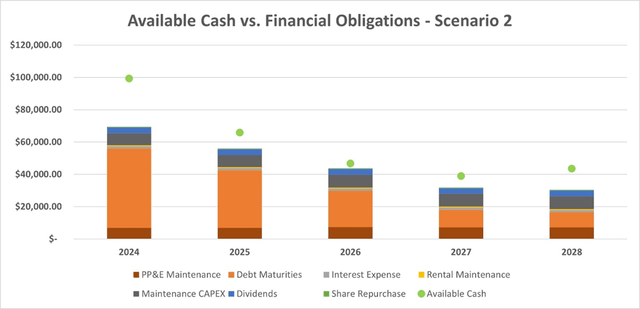

Below, you can find a model outlining Ford’s cash position and financial obligations for the upcoming years. The starting cash balance is calculated as the sum of current cash, annual cash flow before obligations, and short-term loans to be collected from customers. Although upcoming debt maturities are huge, Ford should be able to pay them with ease.

This analysis suggests that fears of Ford facing bankruptcy or needing to cut dividends are likely overstated. A better way to think about the company’s debt is to recognize the consumer credit risk the business takes on. Each loan made to a new car buyer carries the potential risk that the principal amount may not be repaid. Typically, this is not a significant issue, as companies like Ford have substantial experience in setting allowances for such contingencies. However, we are not in normal times. Interest rates are high, consumers are getting weak, and what was considered low risk before may now carry higher risks. That is why I constructed an alternative model. This model conservatively estimates that only 95% of the principal will be repaid in 2024, and this figure is projected to decrease to 90% in subsequent years.

Even in this case, the company has enough cash to not only pay for its financial obligations, but also invest in growth and return cash to shareholders. Therefore, I don’t think Ford is going to cut its dividend in the near future.

Not Expensive, But Might Be A Value Trap

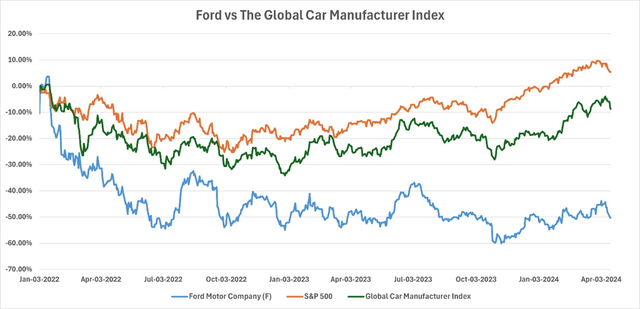

Ford investors have been in the red since January 2022. While the S&P500 recovered, Ford stock fell by nearly 50% and underperformed the global car manufacturer index, which is an index I have created to track the performance of various big car manufacturers around the globe. This index uses the equal-weighted average of daily performances of global car manufacturers, namely Ford, BMW (OTCPK:BMWYY), Mercedes-Benz Group (OTCPK:MBGAF), Volkswagen (OTCPK:VWAGY), General Motors (GM), Tesla (TSLA), and Toyota (TM).

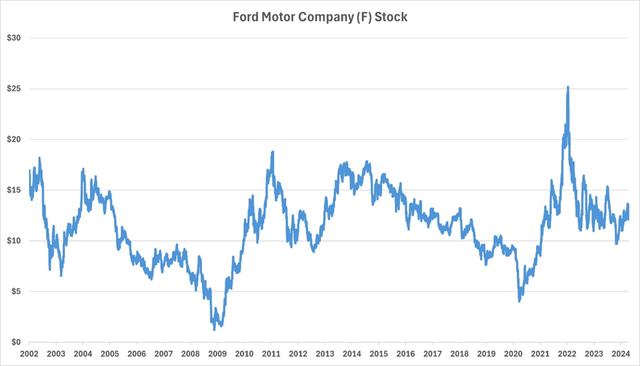

The stock doesn’t look promising in the long term either. The chart below shows Ford Motor Company stock since 2002. It typically falls significantly during crises, recovers fast, and trades around $10 to $15.

At the time of this article’s writing, the stock has a dividend yield of 5% and the company has been a big dividend payer since 2012. These returns are not accounted for in the stock chart above.

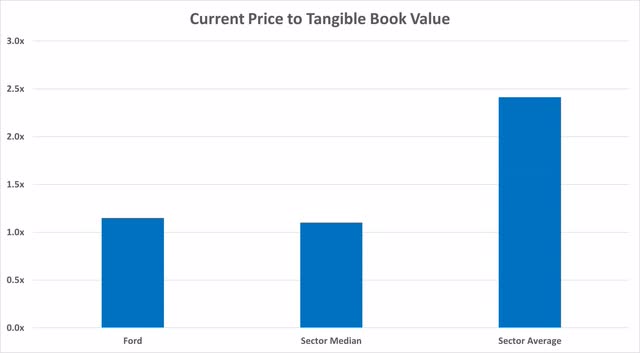

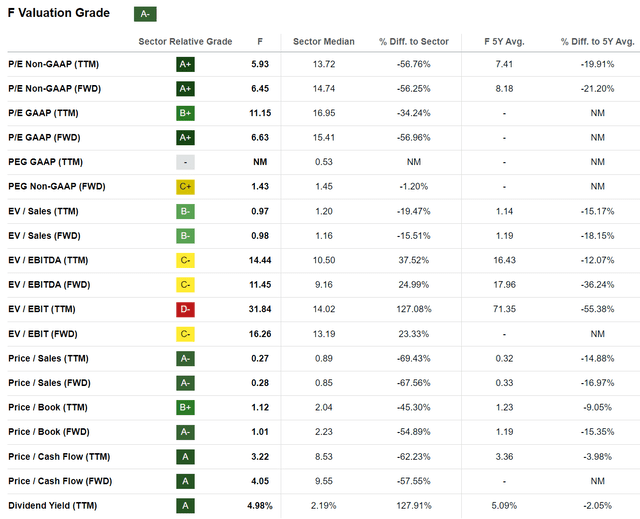

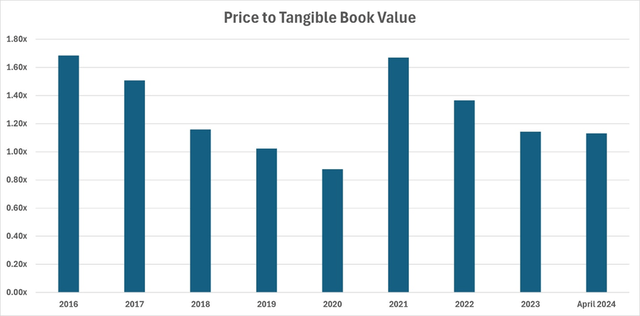

Let’s see what the company’s valuation relative to its competitors looks like. Based on the chart below, Ford seems to be priced at a similar price to tangible book multiple with the global carmaker sector median and a lower multiple compared to the sector average.

Additionally, according to Seeking Alpha valuation grading, the stock appears cheap based on various multiples such as price to earnings and price to book.

Despite this inexpensiveness, I believe this could be a value trap for several reasons, and with the stock price remaining flat, 5% dividend is not enough.

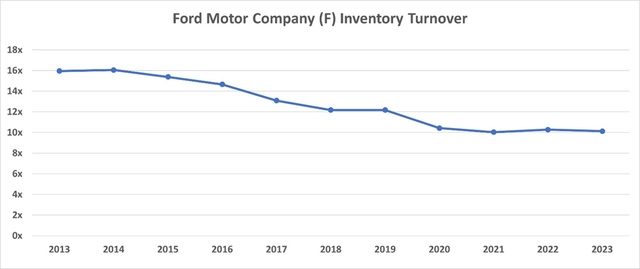

Firstly, the company’s ability to efficiently sell its inventory raises concerns. Ford’s inventory turnover has been declining since 2013. And before making optimistic projections, I think we need to see inventory turnover increase.

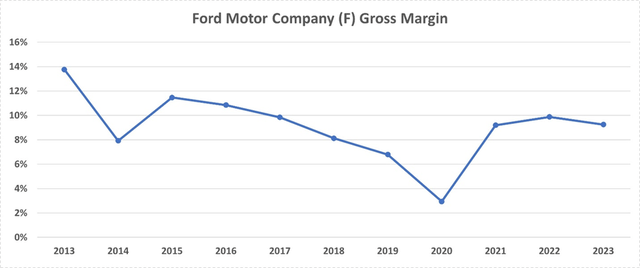

Another concerning factor is the declining trend in Ford’s gross margins over the same period. Although there was a dip in 2020 due to the pandemic, followed by a recovery to levels higher than those seen pre-pandemic, the margins began to decrease again in 2023. This trend serves as an indicator of Ford’s pricing power and overall competitiveness in the market. Before making any assumptions about margin improvements, it’s crucial to observe proactive measures taken by management to address this issue.

Finally, the market sentiment about Ford’s growth has been largely stagnant since 2016. The price to tangible book value ratio declined until 2021, when it jumped to 1.6x with post-pandemic recovery. It has been declining since and is around 1.2x currently. I would like to see evidence that market sentiment can shift positively, reflecting in higher growth valuations and increasing multiples. I do not see that right now.

If the dividend per share was higher, or the stock price was lower, this could have been a buying opportunity. I believe that the current enthusiasm for a return to internal combustion engines from electric vehicles is likely transitional, and I don’t want to base my investment decision on this trend alone.

Upcoming Earnings

Ford is gearing up for its Q1 2024 earnings call on April 24th, with Wall Street analysts anticipating a slight drop in revenues from $43 billion to $41.5 billion, alongside an increase in net income. This upcoming call will be crucial for monitoring trends in inventory turnover and gross margins, key indicators of Ford’s competitiveness and its capacity to price and sell effectively. While current market sentiments are favorable towards Ford’s emphasis on ICE and hybrid vehicles, for a positive shift in valuation and multiples, improvements in these metrics are essential.

Additionally, this is the first earnings call after the company announced they are reducing production in the Ford Model E segment (electric cars). It will be important to hear what management has to say about the future of electric cars, and Ford’s short-term actions. If management indicates that investments in electric vehicles may continue soon, it could be a reason to walk away. However, a long-term expectation of Ford’s positioning in the EV market would be helpful. Management may also comment on Ford Credit and its role in this high-rate environment.

Given the pressures on the electric vehicle segment, I anticipate slightly lower revenues, gross margins, and inventory turnover for Q1. It’s important to note that the closure of the production line in April will not impact the Q1 results.

Final Thoughts

Ford is a solid business. I understand where the concerns about its debt load and struggles to penetrate the electric vehicle market are coming from, but as I explained in the article, I think its debt is manageable, and steering clear of heavy investments in EVs might be the right move for now.

I think Ford Blue and Ford Pro will continue to be cash machines. However, this is not enough for me to recommend investing in this business. Inventory turnover and gross margin, metrics I like to track in carmakers, have been declining. There is no indication of these trending higher in the near future.

Additionally, the market seems unwilling to pay more for the stock. The current dividend yield of 5% does not offer enough incentive for a stock I expect to perform with the market at best. That is why Ford is a “Hold” for me.

The upcoming earnings call will be critical for reasons already outlined, and I’ll be paying close attention to any developments that might influence Ford’s market position. I plan to continue tracking the company and will provide an update on Seeking Alpha if my assessment changes to a “Buy.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.