Summary:

- Google reported mixed Q4 2022 earnings results, sending the stock down slightly in after-hours trading.

- The company continued hiring in Q4’22, with major job cuts not taking place until early 2023.

- The financial picture is much improved when viewing non-GAAP earnings with non-cash charges and equity losses excluded from the numbers.

- Google stock is cheap, trading with an EV of only 15x ’23 EPS targets with a massive upside bonus from achieving targeted efficiency goals.

Justin Sullivan

While Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) has rallied off the late 2022 lows, GOOG stock still sits $50 off the all-time highs. Shareholders want to see more progress from the company on efficiency goals similarly to what sent Meta Platforms (META) rocketing higher following META’s Q4’22 results. My investment thesis remains ultra-Bullish on Google due to its misunderstood cheap valuation and the big opportunity in AI search, combined with 20% efficiency gains at the search giant.

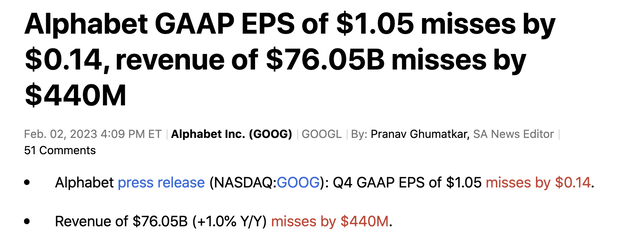

Ugly All Around

Google was late to the game in cutting employees, and the Q4’22 results saw the margin pressures resulting from management being slow to react to achieve the 20% efficiency targets of the CEO. The company reported both revenues and GAAP EPS that missed analyst targets, though revenues did actually grow for the year.

A prime example of the issues still presented in the Q4’22 results was an ending-year employee count of 190,234, up an incredible 3,455 employees sequentially. Google started 2022 with 156,500 employees and ended 2022 with a gain of 34,734 employees.

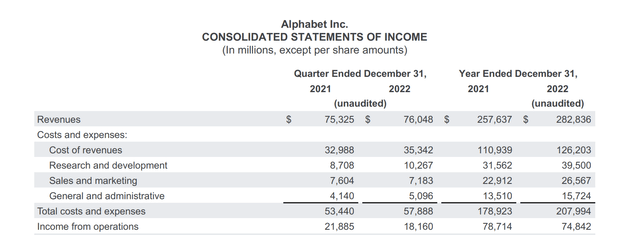

The company reported Q4’22 revenues of $76.0 billion, up just 1%. Revenues were hit hard by constant currency, whereas revenues would’ve grown 7% otherwise.

The market would view GOOG stock is a far different light with a reported growth rate of 7% while recently announcing a 12,000 workforce reduction. Instead, Google reported 1% growth with a massive increase in employees and costs.

All of the business categories struggled, with Google Search and YouTube Ad revenues down and only Google Other and Google Cloud revenues up. In fact, the business saw some rather weak results, if not for the $1.8 billion increase in Google Cloud revenues.

By all accounts, the issues facing Google are really on the cost structure. The tech giant reported cost of revenues grew $2.4 billion and other costs jumped from Q4’21, for a combined boost to total costs by a massive $4.4 billion.

Source: Alphabet Q4’22 earnings release

Google didn’t announce the 12,000 job cuts until January 20, with the impact mostly felt in the Q1’23 results. With flat revenues, the search giant would need to cut total quarterly costs by $11.6 billion in order to achieve 20% efficiency goals. The job cuts only amount to a 6% reduction of the workforce, leaving a big gap where the company must grow revenues while keeping costs flat in order to improve efficiency.

GAAP Pains

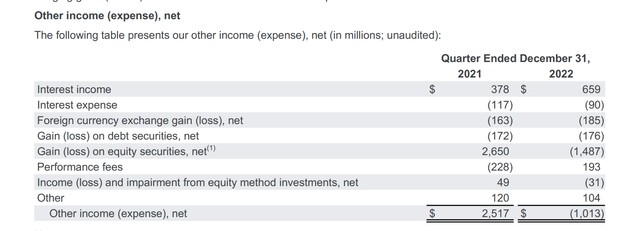

The tech giant continues to report GAAP earnings with questionable use, considering the inclusion of extra non-cash charges and volatile changes in other income. Technically, Google missed analyst EPS estimates by $0.14, but this number isn’t very useful and definitely isn’t fully comparable to the reported $1.53 EPS back in Q4’21.

In reality, Google reported a $1.0 billion loss in other income that impacted the EPS numbers for the quarter. The losses on debt and equity securities added an additional $1.6 billion loss in comparison to a $2.5 billion gain in Q4’21.

Source: Alphabet Q4’22 earnings release

With 12.9 billion shares outstanding, the after-tax impact of these volatile security investments unrelated to the business were an impact of up to $0.11. The actual EPS miss was closer to $0.03 and entirely related to the revenue miss impacted greatly by currency impacts.

The other major impact to the GAAP profit picture is the accelerating stock-based compensation (“SBC”) expenses. Google spent an incredible $5.1 billion in the quarter on such expenses, but the job cuts and cost reductions in the tech space over the last few months should start reducing the impacts of these costs.

On top of these costs, Google lost $1.6 billion in the quarter alone on Other Bets. The company needs to continue investing in areas such as Waymo, but Google has already cut back on Verily to reduce costs and focus on viable business opportunities versus a wide net of targets.

While Other Bets is an area where the tech giant can boost profits via either cutting costs or launching new businesses, SBC is an area that shouldn’t be included in costs. As highlighted many times, the Q4’22 SBC costs of $5.1 billion alone cut EPS by ~$4.3 billion after tax cutting EPS by $0.33, or what amounts to over $1.32 annually now.

The company talked extensively on the Q4’22 earnings call about improving efficiencies and cutting costs while using AI to enhance search and other Google products and services. The stock is initially down 5% in after-hours trading on the technical EPS miss, but the company generally reported in-line with analyst estimates.

Analysts forecast the company earning $5.24 in 2023, with the SBC boost pushing the non-GAAP EPS target closer to $6.56. The stock trades at $103 with an EV of only $96 after adding back the $99 billion net cash.

Google trades at an EV of only 15x our EPS targets. Remember, this P/E ratio is before any real efficiency benefits are included in the analyst targets. The company hitting a 20% efficiency target would have to cut costs by over $40 billion at the 2022 expense levels of $207 billion, or grow revenues while generating substantial positive leverage.

Either way, Google would generate up to $3 per share in additional profits, with a big efficiency boost bringing the total non-GAAP EPS target to nearly $10. The stock only has an EV of $96 here, highlighting the incredibly cheap valuation on this potential earnings stream, though the Google management team still appears too set on investing in the future and hiring employees to suggest this $3+ efficiency boost EPS will fully occur.

Takeaway

The key investor takeaway is that Google is far too cheap at just above $100 in after-hours trading. GOOG stock trades at an EV of just 15x EPS targets, with tons of upside potential from improving efficiency in the business.

Investors should use any weakness in Google stock to load up.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.