Summary:

- The article discusses the impact of stock-based compensation (SBC) on the free cash flow of Google and Apple.

- Christopher Hohn has asked Google to reduce its headcount and average salary and to establish and disclose an EBIT margin goal above 40%.

- The article also highlights the debate on SBC and its accounting practice, with investor Terry Smith arguing against excluding SBC from measures of income and earnings.

- Ultimately, I believe the stock is trading around fair value, and this leaves me confident enough of wanting to Hold here.

anyaberkut/iStock via Getty Images

Introduction

In the midst of the AI-stock hype, a big topic linked to big-tech seems to have been completely forgotten. That is, there is no more talking about the huge employee-cost-structure and how some big-tech companies eat a big chunk of their free cash flow though stock-based compensation (SBC).

In this article I would like to give a follow-up of an article I wrote back in November where I showed how Google (NASDAQ:GOOGL; NASDAQ:GOOG) and Apple (AAPL) were in very different situations regarding the aforementioned topics. In particular, we have to see how the two companies have been managing headcount and the SBC impact on their FCF.

Summary of previous coverage

The issue we dealt with was rather simple to understand, yet it has a major impact for shareholders.

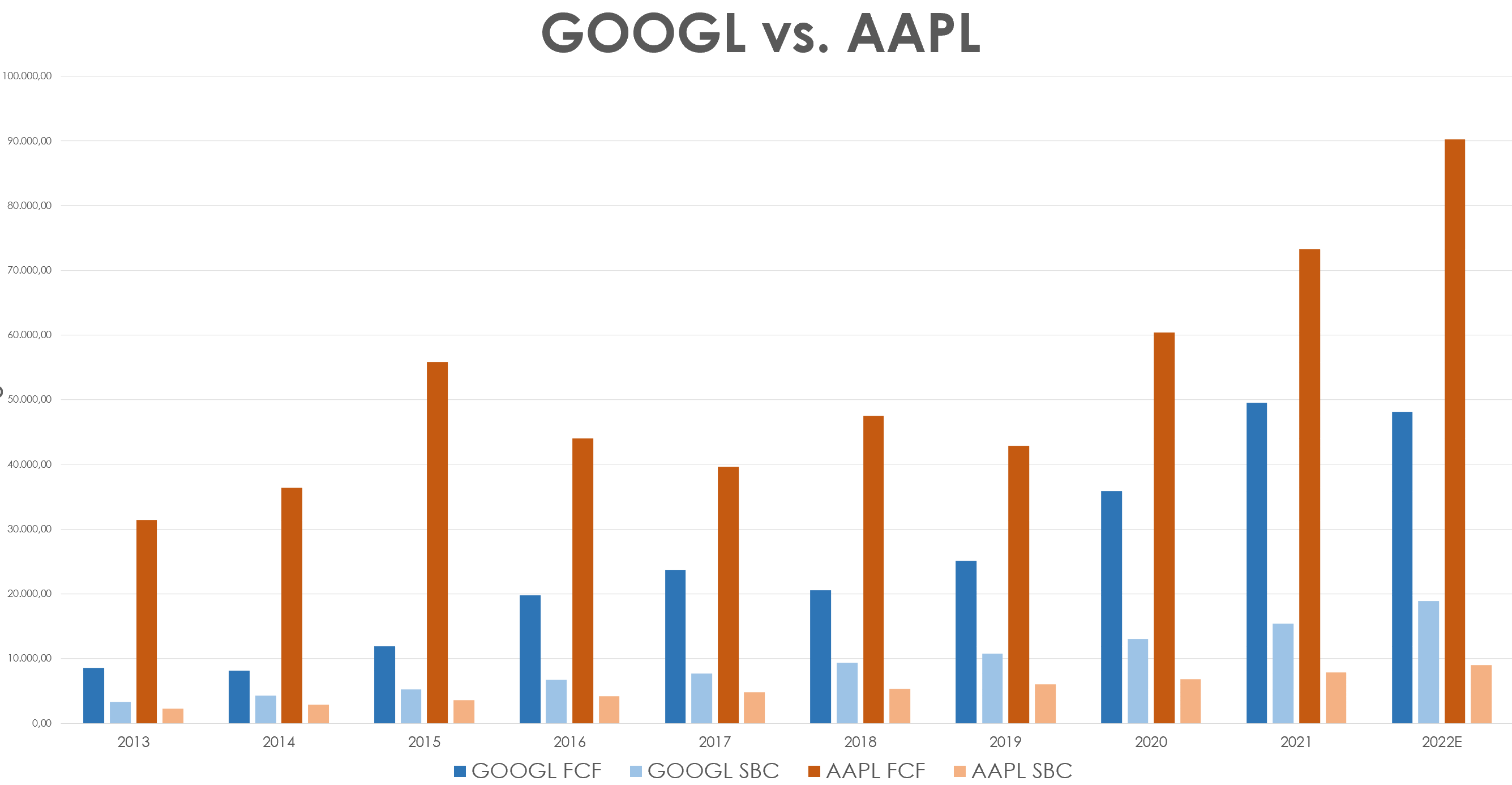

I used this graph to highlight it.

Author, with data from SA

Here, we see in blue and light blue what was Google’s parent company Alphabet’s situation. More or less, both FCF and SBC have grown at a CAGR of 19%. So, while Google’s FCF reached almost $50 billion, its SBC got close to $20 billion, eating away around 40% of Google’s FCF.

Apple presented a different situation, where SBC is always between 7%-14% of FCF.

The consequence is clear. Apple’s FCF is much freer than Google’s and investors can benefit from it more. Not by chance, Apple is deploying a huge amount of its free cash flow in buybacks to achieve the long-sought-for goal of cash neutrality.

But why is there such a big difference between the two giants? We saw how Google actually overhired, catching up with Apple’s headcount and even surpassing it. In particular, Google increased its total employees by 40% in the past two and half years, since December 31st, 2020. Apple, on the other hand, has been much more conservative, steadily increasing its headcount by about 5% per year, finishing its FY 2022 with 164,000 employees.

Google’s increasing workforce has led to higher SBC expenses per employee compared to Apple. And this is why back in November it was quite clear Google would have been led to layoffs, just like other companies among big-tech were doing.

The word from two investors

Christopher Hohn asks for higher efficiency

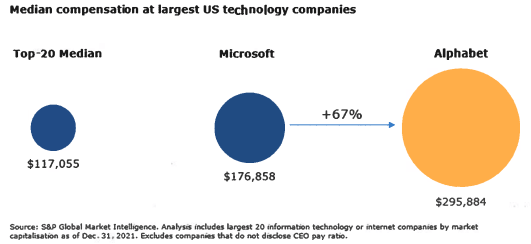

A few days before I wrote my previous article, Christopher Hohn wrote a letter to Sundar Pichai addressing the headcount issue, writing that he agreed with Altimeter Capital’s Brad Gerstener when he says that “it is a poorly kept secret in Silicon Valley that companies ranging from Google to Meta to Twitter to Uber could achieve similar levels of revenue with far fewer people”. In addition to headcount, Mr. Hohn argued that Alphabet was paying a median compensation of $295,884 per employee, 67% higher than Microsoft did and even 153% higher than the 20 largest listed tech companies in the U.S.

TCI Fund

Finally, Mr. Hohn asked Google to establish and disclose an EBIT margin goal above 40%, to reduce losses in other bets, and to increase share buybacks while the share price was depressed.

Now TCI Fund owns just a 0.3% stake in Google. However, it was one of the most active funds in asking Google to change.

On the other side, we saw no such claims addressed to Apple by shareholders such as Berkshire, for example.

Let’s see what happened since November. Just a couple of months went by, and Mr. Hohn wrote another letter to Alphabet’s CEO Mr. Pichai. While appreciating the decision to cut 12,000 jobs, he kept on arguing how Alphabet’s management needed to go further, reducing its headcount back to 150,000 employees while also reducing the average salary. In addition, Mr. Hohn warned Sundar Pichai how it would have been wise to reduce SBC, given the depressed stock price.

Terry Smith warns about SBC accounting methods

While Hohn aimed at improving Google’s efficiency, we have another topic intertwined with what we have seen: SBC and its accounting practice. At yearend and for a few months this year, it was deeply debated what Terry Smith highlighted in his last annual letter to shareholders.

In particular, in this letter he meant to dover the topic of “share-based compensation and especially its removal from non-GAAP profit figures”. He pointed out how all of the companies in the S&P Dow Jones Technology Select Sector Index “whose share-based compensation represents greater than 5% of revenue remove share-based compensation from non-GAAP measures”.

In his letter, Terry Smith, makes six main points:

- He thinks it is invalid to exclude SBC from measures of income and earnings because it is a non-cash expense.

- Some argue that SBC should be excluded from the income statement because of fluctuations in share prices. There are actually other items that rely on estimates and/or assumptions, like commodity prices.

- According to some, SBC must be excluded is that it would result in double-counting because the shares paid to the workers would appear both as an expense item in the income statement and in the outstanding share count used in the denominator of measures such as EPS

- SBC can lead to a distortion of cash flow metrics. Since it is actually classified as an operating activity it is added to increase the final free cash flow, while it should be reported as financing activity, thus decreased the available free cash flow.

- Finally, Terry Smith thinks “the most pernicious effect of adjusting profits to exclude the cost of share-based compensation occurs when the management start to believe their own shtick and mis-allocate capital based upon it. Too often management fail to mention expected returns on capital deployed when they make acquisitions and instead rely on statements about earnings dilution or accretion”.

Once I read Terry Smith’s take on SBC accounting, I though it even stranger that Fundsmith is not big into Apple, a company with great attention to capital allocation and return on capital employed. In any case, Mr. Smith did initiate a very tine position in the stock in the last quarters, however, for some reason I don’t fully understand, he has never made Apple a cornerstone of his portfolio.

What Google and Apple have been doing

Now, let’s take a look at the most recent reports to see if Google is catching up with Apple in terms of capital allocation, workforce cost management, and use of SBC.

In Alphabet’s latest 10-K, we read the following words:

Beginning in 2023, the timing of our annual employee stock-based compensation awards shifted from January to March. While the shift in timing itself will not affect the amount of stock-based compensation expense over the full fiscal year 2023, it results in relatively less expense recognized in the first quarter compared to the remaining quarters of the year.

In other words, investors should be aware that Q1 will look a bit better than usual due to the shift of SBC timing. Given that Google’s Q1 report had many investors waiting for a sign of better cost management, this was a move to get a quick win, without changing much.

And yet, Alphabet reported SBC expense of $5.3 billion for the three months ended in March, versus the $4.5 billion paid in the same quarter last year. This is a 17% increase YoY. However, in Q1 part of the SBC expense – $412 million – was associated with workforce reduction costs. In fact, Alphabet also declared that “we have a company-wide effort underway to re-engineer our cost base”. The 12,000 employee reduction let to severance and related charges of $2 billion. To this, we need to add another $564 million of charges related to office space reductions. In total, Alphabet reported $2.56 billion of charges.

In terms of headcount, at the end of Q1 the picture was somewhat mixed. Alphabet reported it had 190,711 employees at the end of March 2023. However, the company reported that this number includes almost all of the employees affected by the workforce reduction. In other words, almost 12,000 of these employees have been laid off after the close of the quarter.

If we dig a little bit deeper, we find that during Q1, Alphabet’s R&D department increased its expenses by $2.3 billion, mainly the result of a 14% increase in average headcount. Sale & Marketing see the same situation, with expenses up 9% YoY and the average headcount up by 7%. General and administrative expenses increased, too, by 5% while the average headcount was up by 6%.

This is why, even though layoffs started in the last quarter of 2022, we found out that at the end of Q1 2023, Alphabet’s headcount was still slightly higher QoQ with 190,711 employees vs. 190,234 of the prior quarter.

What should we expect for the quarter that is now coming to an end? For now, we know Google reduced its headcount by 6% and we could thus expect the number of total employees to be around 179,000. Ruth Porat, Alphabet’s CFO, was clear about this during the last earnings call:

The reported number of employees at the end of the first quarter includes almost all of the employees impacted by the workforce reduction we announced in January. We expect most of the impacted individuals will no longer be reflected in our head count by the end of the second quarter.

Considering Q2 will be largely impacted by layoffs, I actually expect SBC to increase again as part of the severance costs the company has faced. In addition, we also have to recall that Alphabet shifted further into the year the timing of stock-based compensation payment and this will impact Q2. However, starting from Q3 we should see the effect of the “slimming treatment” Alphabet has started, even though it may not be as large as Mr. Hohn required.

Just to get an idea of how SBC impacted the real shareholder return, let’s consider that Alphabet, during Q1 2023 repurchased and subsequently retired 157 million shares for $15.1 billion.

In the meantime, it had an expense of $5.3 billion in SBC, partially offsetting the buyback. The proportion is significant, around 33% of the amount spent on repurchasing and retiring shares has been deployed to expense SBC. Thus, the real shareholder return is around $10 billion.

In addition, Alphabet reported $23.5 of net cash provided by operating activities. However, $5.3 billion come from SBC. So, if actually adjust the operating cash flow to SBC, we have a net $12.9 billion of operating cash flow. Subtracting another $3 billion used in investing activities, the free cash flow for the quarter is $9.9 billion. Let’s use this quarterly result to make a projection for the year and we have about $40 billion of real FCF. This gives a real FCF yield of 2.6% versus the FCF yield of 5.2% we would have starting from the operating cash flow reported minus investing activities (the projection would be of $80 billion of FCF for a year). The difference is quite important.

Apple, on its side, keeps on cruising on the same path already laid out in the past and carefully pursued year after year.

It was actually able to reduce its SBC from Q1 (for Apple it is the last quarter of the year) to Q2 of its FY 2023. In fact, share-based compensation was $2.9 billion for the three months ended on December 31, 2022 while for the past quarter the reported SBC expense was $2.7 billion.

This gives us the following result when considering the real FCF of the first half of the year. We have $57.2 billion of operating cash flow (62.6 – 2.7*2). If we subtract $6.7 billion of capex we have $50.5 billion of free cash flow. Apple used $39 billion to repurchase its shares and paid out $7.4 billion for dividends for a total shareholder return of $46.4 billion, which is equal to 92% of the FCF generated during the first six months of its fiscal year. Bear in mind that this massive return is done without hurting Apple’s R&D and other investing activities.

What is Apple’s true FCF yield, then? Considering a whole FY, we can forecast Apple to reach around $100 billion of FCF. Dividing this number by the 15.7 billion common shares outstanding, we have a FCF/share of $6.37 which is a 3.4% yield.

However, if we adjust this number for SBC – which should be around $10 billion for the year – we have a FCF of $80 billion, which gives a FCF yield of 2.7%, slightly above Google. But what matters most, is that Apple doesn’t eat away as much of its FCF through SBC as Google does. Therefore, Apple was the big-tech company that didn’t have to use layoffs because of its prudent cost structure.

Takeaway

Even though these issues seem to have been a little forgotten in the past few months, it is important to keep on monitoring them to get a real grasp of what we are buying when we purchase a stock. So far, it seems like Apple keeps on being rather immune from the inefficiencies Google had. At the same time, even though Google has offered some signs to the market about its will to re-engineer its cost base, it is clear how investors will still need to wait for a couple of quarters before seeing an improvement.

In the meantime, what should investors do? Although the main goal of this article is to give an update a relevant issue to understand the true value of some valuation metrics, I want to share how I am behaving with the two stocks. I own both, although Apple is a much larger position of my portfolio than Google. At the end of 2022, I significantly increased my position in the stock, identifying a clear opportunity for a stock that had traded down to $127. Since then Apple has had a massive run giving a total return of 50%. Google, too has returned more than 34% YtD to its shareholders. In terms of free cash flow yield, we have seen both companies trade around the same value which is not cheap, but it is not expensive either for companies such as these. Other valuation metrics do reflect how investors bid up the price of both stocks. Apple now trades at a fwd PE of 32, while Google is trading at a 23. Google is still trading at a lower valuation compared to Apple and I think this is deserved because, as this article tries to show, there are inefficiencies and management choices that decrease the overall value of the business. In any case, what am I doing? I am not buying at these prices, but I am not either selling. I believe both stocks are trading around fair value and this leaves me confident enough of wanting to hold them both in my portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.