Summary:

- Google/Alphabet’s relatively weak performance in Q4 is not that big of a deal.

- Unlike its peers, the company was able to grow its sales Y/Y in a challenging environment which gives reasons to be optimistic about its long-term performance.

- Google’s stock continues to be undervalued and offers a great entry point at the current levels.

Justin Sullivan

Google’s (NASDAQ:GOOG)(NASDAQ:GOOGL) relatively weak performance in Q4 was not that big of a surprise given the challenging environment which led to the cutting of advertising spending across the globe. The fact that the company managed to grow its revenues at all while its competitors experienced Y/Y declines indicates the strength of Google’s digital advertising portfolio and gives reasons for optimism for the company’s future. Considering that the weakness in the advertising market is likely to be temporary I’m inclined to believe that Google continues to be a decent investment at the current price in the current environment and think it’s ridiculous that the market punished the company’s shares after the release of the earnings report.

Q4 Wasn’t That Bad

The recent depreciation of Google’s stock is ridiculous given the fact that the company’s business showed a Y/Y growth in Q4 and FY22. The business’s revenue of $76.05 billion in Q4 was up 1% Y/Y while its peers like Meta Platforms (META) and Snap (SNAP) saw their businesses decline during the same period. At the same time, all of Google’s divisions also experienced Q/Q growth during the last three months of 2022 which shows that the company’s portfolio of products and services continues to be in high demand primarily amongst advertisers and subscribers.

Going forward several growth catalysts could help Google deliver on its promises in 2023 which could lead to the improvement of the sentiment and a subsequent appreciation of its stock.

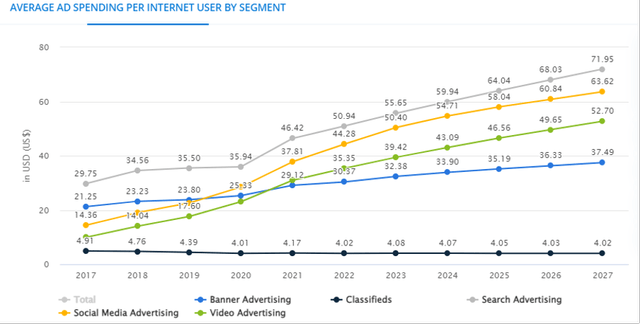

First of all, as the undisputed leader in the search market, the company is likely to continue to outperform its peers simply due to the fact that the ARPU in the search business is greater in comparison to all the other segments and is expected to increase even more in the following years. As a result, even if the advertising spending is cut, the search business would be the last to feel it which gives Google an edge against its peers that are dominant in other non-search segments.

Average Ad Spending Per Internet User By Segment (Statista)

At the same time, during the conference call, Google’s management noted that if we exclude the negative currency impact on the company’s business then the search business showed moderate growth during the recent quarter while the overall revenues increased not by 1% Y/Y which includes the foreign exchange impact but by 7% Y/Y in constant currency. While it makes no sense to forecast the growth of the business by looking at its performance only in a perfect environment, such a foreign exchange impact gives an understanding of how Google could perform when the macroeconomic situation improves and the dollar begins to weaken to its pre-tightening levels.

Considering the recent more dovish remarks of Fed Chairman Jerome Powell there’s a case to be made that the worst is behind us and as the central bank has finally acknowledged the start of the disinflationary process. As such, it’s likely that currency risks would no longer negatively affect Google at the same level as in Q4 which gives reasons to be more optimistic about the company’s performance in the following quarters.

Add to all of this the fact that Google’s YouTube subscription business continues to rise and now has over 80 million subscribers across Music and Premium while the cloud business experienced a 32% Y/Y revenue growth in Q4, and it becomes obvious that Google is unlikely to lose its advantages in the digital advertising, media, and cloud fields anytime soon.

Therefore, it made no sense for Google’s stock to experience a rapid depreciation after the results were announced as the company has everything going for it to continue to create additional shareholder value for years to come. The only question is how much upside its stock offers at the current levels and my updated DCF model below would be able to give an understanding of what to expect in the future.

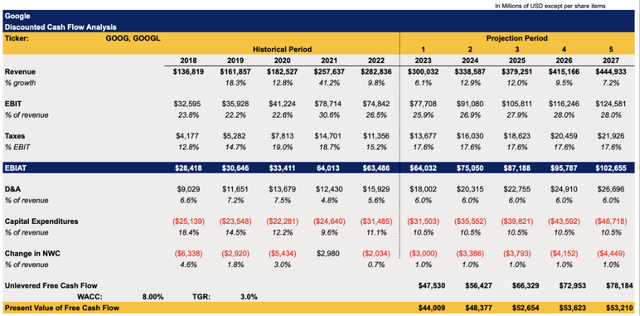

The previous model that was made a few months ago showed Google’s fair value to be $120.81 per share. The new model is updated with the latest financial data and has several changes to reflect the changing environment.

The top-line growth rate forecast for the next couple of years in the model is mostly in-line with the street expectations after which it stabilizes closer to the terminal year. A similar thing is true for EBIT as a percentage of revenue which is also close to the street assumptions in the model. The tax rate as a percentage of EBIT and D&A as a percentage of revenue for the following years are averages of their respective last three years. The capital expenditures are aligned with the management forecast which aims to achieve a similar CapEx in FY23 as it was in FY22. The change in net working capital is at 1% in the model this time as it better reflects the reality in comparison to the 2.4% from the previous model. The terminal growth rate of 3% is the same while the WACC has been increased from 7.5% to 8% to reflect the recent rise of interest rates.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

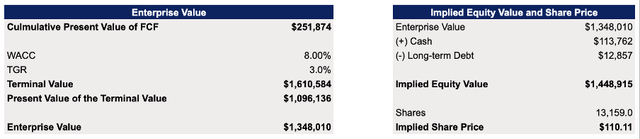

This updated model shows that Google’s enterprise value is $1.35 trillion while its fair value is $110.11 per share which represents an upside of around 7% from the current levels. The decline in fair value from the previous model is mostly due to the increase in WACC. With the previous WACC of 7.5%, the current model would’ve shown a fair value of around $120 per share.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

Some might think that even an 8% WACC is low given the recent interest rate increases, but let’s not forget that we’re talking about Google, a company that has relatively high margins, can aggressively generate free cash flow, and has greater cash reserves than annual GDPs of entire countries. As such, the company is more than likely to have easy access to capital at an appropriate rate similar to the model. Add to this the fact that a potential likely outperformance of the top-line expectations in the following years could outweigh a further increase in WACC which would lead to the same conclusion that the stock represents an upside at the current levels. Therefore, Google is a buy for me at this stage.

Risks To Consider

I see two major risks to Google’s dominance in the digital advertising market which could undermine the company’s business model and lead to the destruction of value. First of all, the rapid growth of ChatGPT in recent months forced the management to declare a “code red” as there’s a possibility that the chatbot’s ability to quickly and efficiently give relevant answers to user queries could make Google Search obsolete in the future and undermine the whole bullish thesis.

At the same time, further regulatory pressure this time from the DOJ could also force Google to split its business especially if the Europeans demand the same thing from the company. This is something that I’ve extensively covered in one of my other articles on Google where the regulatory risks were extensively highlighted.

The good news though is that both of those risks are not imminent. It’s still too soon to talk about ChatGPT eating Google’s lunch since the data shows that the latter continues to grow its business while there’s also the possibility that the potential monetization of the former could lead to users sticking with Google’s free search. At the same time, as I’ve explained in the past, the regulatory pressure won’t materialize anytime soon as various trials coupled with appeals would take years to complete before Google’s financials would have an even remote chance of shrinking. As such, I wouldn’t worry too much about regulators at this stage.

The Bottom Line

While Google is likely to face greater regulatory scrutiny in the following years, we’re unlikely to see a major monetary impact on its financials anytime soon. As such, the company is likely to improve its performance in the following quarters as it appears that the macroeconomic situation improves and there’s even a case to be made that we’ll be able to fully avoid a major global recession that could’ve forced advertisers to cut their marketing budgets even more. As such, I continue to be bullish about Google’s future and believe that it’s ridiculous that the stock has depreciated after the release of Q4 results since its competitive advantages coupled with a unique position in the digital advertising industry can help it to extend its lead over others and create additional shareholder value along the way.

Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He’s/It’s/They’re solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!