Summary:

- Apple looks attractive from a Return on Net Tangible Assets perspective.

- The information technology industry is facing margin contractions which are causing a decrease in earnings growth.

- The increased risk in holding Apple instead of VGT is only worth it if you hold it for the long term.

nayuki

Overview

Whenever you are looking at purchasing an individual stock it is important to compare it to the industry it is part of on multiple dimensions. This allows you to see where the company is outperforming and underperforming its peers. In this article we will use Returns on Net Tangible Assets, Net Margins, and Forecasted Risk for the comparison.

It is also important to compare the company to a true investment alternative. In this case we are comparing the performance of Apple (NASDAQ:AAPL) to the Information Technology industry as defined by the Vanguard Information Technology exchange traded fund (VGT). By using an exchange traded fund (ETF) to define an industry we have the advantage of having a true alternative investment.

External and Internal Risks

ETFs offer a way to decrease risk. An investment in a single stock holds more risk than a basket of stocks. This is the fundamental reason a diversified portfolio is important. It reduces risk. The simplest way to achieve this is through ETFs because they hold the advantage of diversification while charging very low fees.

All companies that comprise an industry face similar external risks. These are risks from things like market conditions, supply chain shortages, geopolitical events, and economic stability. Individual companies face additional internal risk related to their ability to execute. These are risks from competition, mismanagement, poor product performance, and similar risks. Internal risk is additive to the external risk the industry is facing.

When we accept these simple facts we must assess an industry before buying an individual company’s stock. We must determine if there is sufficient potential reward necessary to justify the additional risk. We will need to look at Apple in comparison to its industry.

Return on Net Tangibles

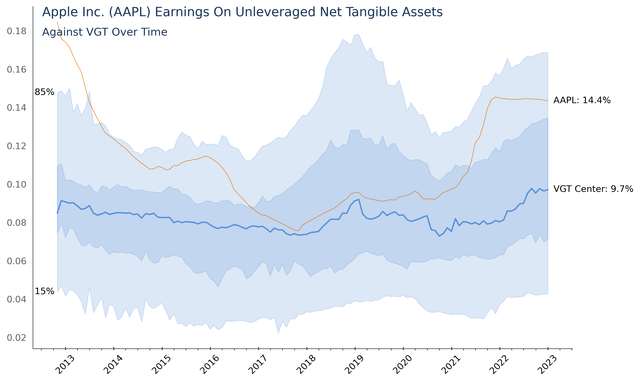

Warren Buffett uses unleveraged net tangible assets to decide what he calls the long-term economic prospects of a business. Great companies have extremely high Returns on Net Tangible Assets and show up above the blue region in the chart below. This group is great because they can grow fast.

The following chart shows Apple with the rest of the companies in VGT. The blue shaded area shows the distribution of the top 75 companies in VGT by weight. Apple is in the top third of information technology companies. This indicates it can outgrow roughly 75% of its competitors. Considering Apple’s involvement in hardware product lines this is exceptionally impressive because hardware typically requires massive capital expenditures to produce. The company clearly focused on long-term competitive advantages when structuring its value chain.

Authors Image from Financial Modeling Prep Data

Net Margins

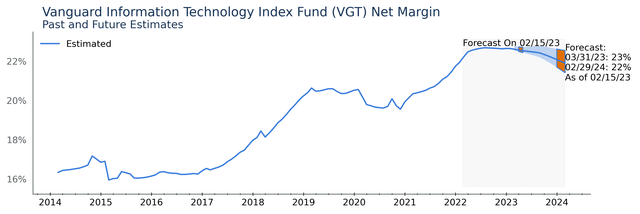

Net margins are important in financial analysis because they provide a measure of the profitability of a company. By calculating the net margin, analysts can determine how much of each dollar of sales a company is able to keep as profit. This can be useful in comparing the profitability of different companies in the same industry, or to assess the performance of a company over time. Net margin can also assess the efficiency of a company’s operations and to identify areas for potential improvement.

The orange projection bands seen in the chart below are generated by Wall Street analyst forecasts on individual stocks which are then aggregated by my software to present a forward-looking view of the industry. Analysts are projecting a 1-2% margin contraction over the next two years for the Information Technology Industry. The industry is fighting hard for its margins by decreasing labor costs, however those decreases are accounted for in the analyst estimates and may lead to decreased rates of innovation at the companies who are taking that tactic.

Authors Image from Financial Modeling Prep Data

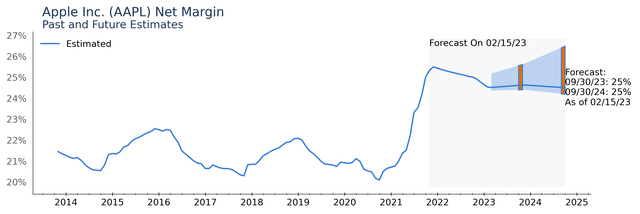

In the chart below you can see Apple is forecast to have higher margins than its industry peers for the next two years. Apple is also forecast to have relatively stable margins while the rest of the industry experiences a minor decline. The high spread above the median forecast line shows a few Wall Street analysts believe Apple’s margins may even grow.

Authors Image from Financial Modeling Prep Data

Strong margins may appear to give Apple stock ownership an advantage over VGT, however we need to perform a risk analysis to get a full picture.

Forecasted Risk

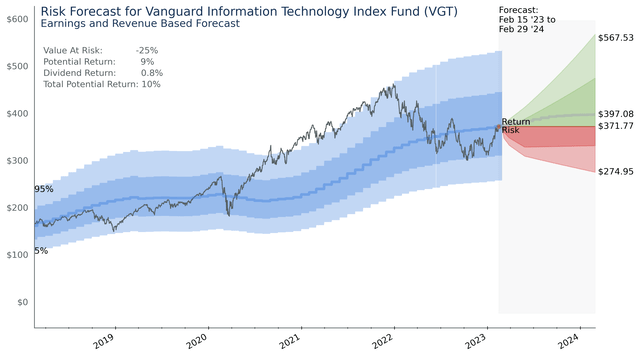

Here we explore value at risk and potential returns for AAPL over the next two years and compare it to VGT. The below chart is a prediction of value at risk and potential return of holding the VGT ETF and Apple stock. As shown by the blue intrinsic value region in the chart below both investments are in the center of their intrinsic value regions. To learn more about the methodology, its capabilities, and limitations check out my article on Home Depot (HD).

As shown below VGT is trading very near its current intrinsic value and 9% below its projected value in little over a year.

Authors Image from Financial Modeling Prep Data

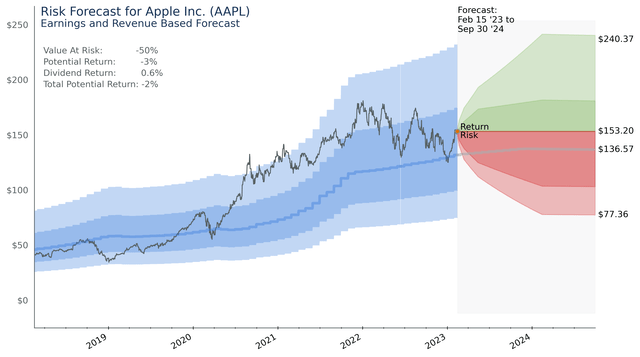

On the other hand, the chart below shows Apple has a current price of $153.20 and is 12% overvalued. It also trades around its intrinsic value inside a bigger range. This causes additional share price risk, and potential short-term reward.

Authors Image from Financial Modeling Prep Data

The 50% value at risk of Apple is twice that of VGT. Decreases in intrinsic value growth are seen for both Apple and the Information Technology industry over the next two years. This is due to the decrease in earnings caused by lower net margins for both Apple and the industry.

Final Word

Apple looks attractive from a Return on Net Tangible Assets perspective, so I think it will continue to perform very well for years to come. However, over the next two years margin contractions are seen causing a decrease in earnings growth. While this is affecting the whole industry there are exceptions that look more promising. I also think Microsoft (MSFT) is a strong buy and will likely outperform the industry over the next two years. I would hold off on AAPL for now. If I was sitting on a large amount of capital gains, I would hold to avoid the tax hit. If Apple is part of your core portfolio and you intend to hold it for decades, you will likely do very well.

I would like to hear your thoughts in the comments below. Please tell me what you think.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Content is not a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. Content was generated using multiple open-source data science and artificial intelligence libraries including, but not limited to, Python, Pandas, Matplotlib, Airflow, Open AI, scikit-learn, and TensorFlow. All content in this article and website is information of a general nature and does not address the circumstances of any individual or entity. You alone assume the sole responsibility of evaluating the merits and risks before making any decisions.