Summary:

- Gold prices are rising due to the Russia-Ukraine conflict and Hycroft Mining seems to have attracted significant retail investor interest.

- The company has over 22 million ounces of gold equivalent resources and its valuation has quintupled this week.

- However, Hycroft Mining has a high debt load and is in pre-commercial scale operations, which means that it’s in trouble financially and won’t benefit much from high gold prices.

- In my view, retail investors should eventually realize their mistake, or the company could take advantage of the situation and carry out a capital increase to strengthen its balance sheet.

ErikMandre/iStock via Getty Images

Investment thesis

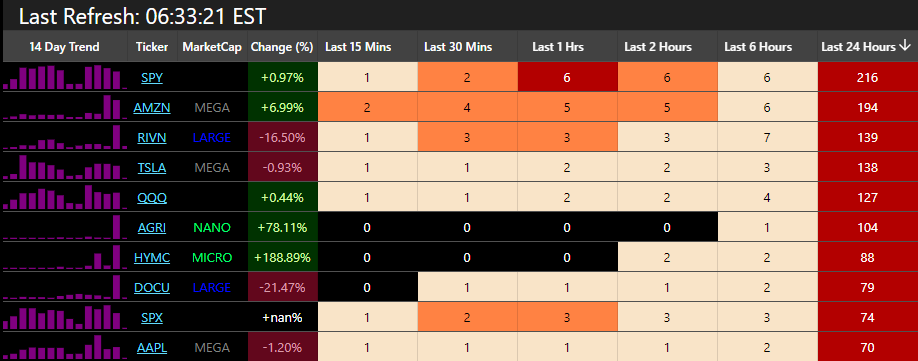

On Thursday, I was going through the list of the top trending stocks on Fintwit and I was surprised to see there a micro cap that I’ve covered on SA – Hycroft Mining Holding Corporation (NASDAQ: NASDAQ:HYMC).

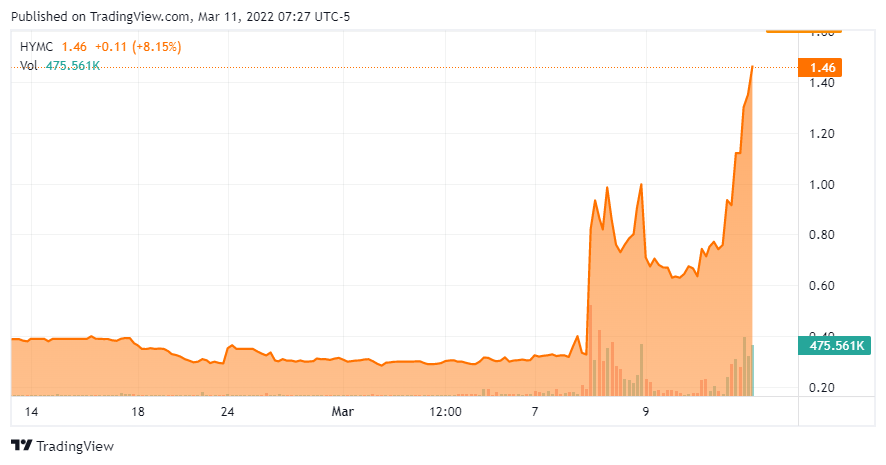

finapse.live

I wrote a bearish article on the company in July 2021 when the share price was $2.80. Since then, the share price slowly drifted lower to below $0.30. Yet, the company’s market valuation has quintupled this week to close at $169.2 million on March 10. In my view, the reason behind this could be high retail investor interest, which I think creates a good short selling opportunity. Over the past year, I’ve written bearish SA articles on more than 50 companies that seem to have attracted significant retail investor interest. The share prices of the vast majority of them have declined as of the time of writing as retail investor interest is often fleeting and the fundamentals just aren’t there in most cases. Let’s review.

Overview of the business and financials

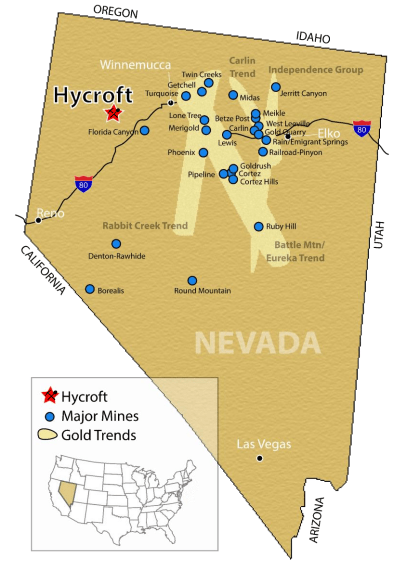

Hycroft Mining owns a gold and silver project under the same name that started out in 1983 as a small heap leach operation known as the Lewis Mine. It’s located near the Florida Canyon gold mine of Argonaut Gold (OTCPK:ARNGF).

Hycroft Mining

In 2021, Hycroft Mine produced 55,668 ounces of gold and 355,967 ounces of silver. At the moment, the company has a pre-commercial scale direct leaching run-of-mine (ROM) operation there. Mining stopped in November 2021 due to cost pressures for reagents and consumables.

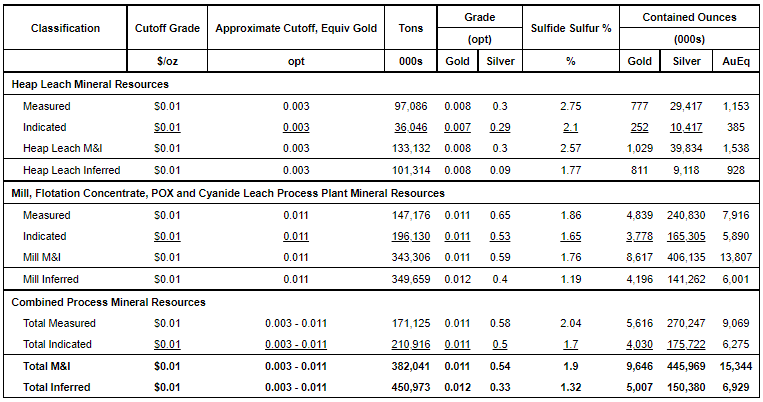

On February 22, Hycroft Mining released the results of an initial assessment of the project that showed the mine contains an estimated 15.3 million ounces of gold equivalent resources in the measured and indicated categories as well as another 6.9 million ounces of gold equivalent in the inferred category.

Hycroft Mining

This makes the Hycroft Mine one of the largest gold and silver projects in the entire world and what’s even more impressive is that the current mineral resource can be found on only 2% of the land package. However, there are several issues with this mine. First, resources can be very different from reserves and we don’t know how many of those ounces are recoverable at the current gold price. Second, the grades are low which usually leads to high production costs. Third, almost all of the material is sulfide, which means that recovery rates could be an issue. Simply put, it’s a large but technically challenging gold and silver deposit. Processing of ore on leach pads is expected to proceed through the second quarter of 2022 and Hycroft Mining plans to bet its future on a mill and pressure oxidation (POX) process. The idea is that this should generate better gold and silver recoveries than the sulfide heap oxidation and leach process and thus improve the economics of the project. However, the completion of this project is probably years away.

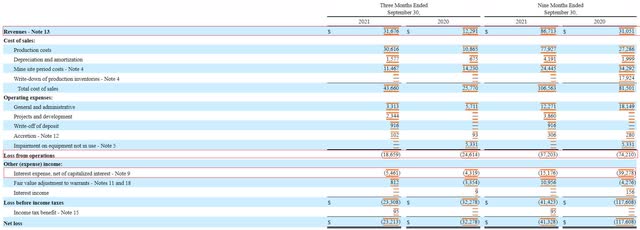

Looking at the financials, the situation looks bad due to the pre-commercial nature of operations. In Q3 2021, Hycroft Mining booked revenues of $31.7 million and a net loss of $23.2 million. The company’s debt load stood at $146.2 million as of September and interest expenses surpassed $5 million during the quarter.

In February, Hycroft Mining revealed that cash on hand had decreased from $19.5 million in September to $12.3 million by December.

In my view, the debt load is unsustainable and it’s likely that we will see a debt for equity swap in the near future. I also view it as also possible that the company decides to take advantage of its soaring share price and launches a capital increase to strengthen its balance sheet.

Seeking Alpha

As you can see from the chart above, the trading volume has been high too, with over 220 million shares changing hands on March 10 alone. My theory is that the share price and trading volume are soaring as a result of high retail investor interest. As I mentioned, Hycroft Mining is among the top trending stocks on Fintwit as of the time of writing. There are also a large number of posts about the company on websites like Twitter, and StockTwits. Here’s a post from a trader on Twitter claiming that he bought 5 million shares and his price target is $4.

Twitter

On YouTube, Hycroft Mining is being covered by several channels, including ClayTrader, Flight Financial, SomeCityTrading, IT NEWS BIKUL, Evan Evans, Cyber Trading University, and Pack-A-Punch Traders. Note that the company isn’t doing the promotion of its business or shares itself, but this is being done by a significant number of private investors and traders.

So, why are retail investors and traders buying Hycroft Mining? Well, many of them claim that they like the company’s vast resource base and that its market valuation is being boosted by rising gold prices as a result of the Russia-Ukraine conflict. Others are claiming that there is a short squeeze going on. I doubt the latter is true considering that data from Finviz shows that short interest is around only 170,000 shares. Also, data from Fintel shows that there are no shares available for borrowing as of the time of writing and that the latest short borrow fee rate was 94.74%.

Investor takeaway

The Hycroft Mine project has significant gold and silver resources but I continue to doubt that it will be able to reach commercial production without encountering significant technical or operational issues. Even if everything goes smoothly, I doubt the current shareholders of Hycroft Mining will reap the gains considering the company has a lot of debt and is almost out of cash.

I’m surprised that Hycroft Mining has attracted significant retail investor interest considering that operations are in a pre-commercial stage and the company thus won’t be able to take advantage of elevated gold prices due to the Russia-Ukraine conflict.

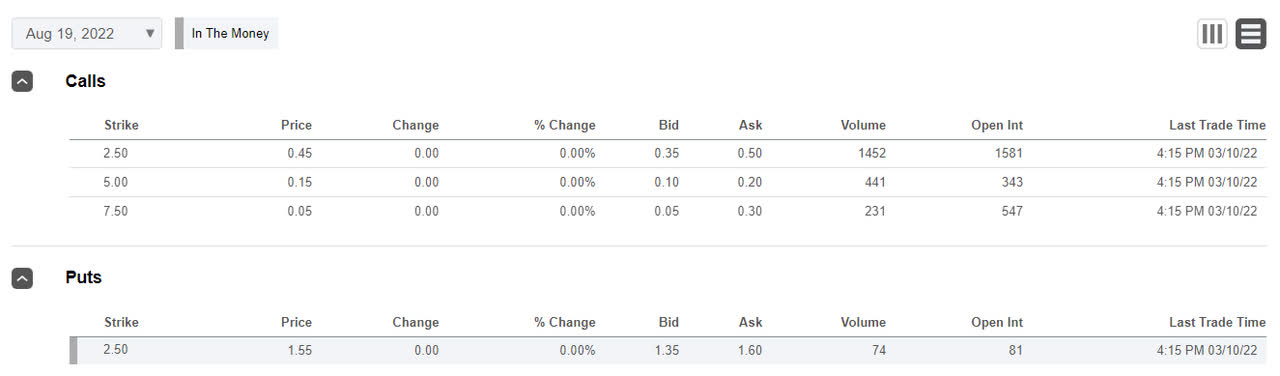

I think that retail investor interest is likely to fade away in the near future and the share price will return to below $0.30. There are no shares available for borrowing but there are put options for Hycroft Mining. However, they aren’t cheap.

Seeking Alpha

For risk-averse investors, I think it could be best to avoid Hycroft Mining as I perceive this as a high-risk, high-reward type of opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial adviser. All articles are my opinion – they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.