Summary:

- Tesla’s stock has skyrocketed since the irrational panic capitulation, like selling, brought shares down to approximately a $100 low.

- However, I anticipated a significant drop in Tesla and had trade triggers ready around the $100-$110 level.

- Tesla’s rally has been epic, but we’re likely around a short-term high now.

- Tesla could have a significant correction in the coming months, and I’m getting ready to get back in at a specific price point.

jetcityimage

Tesla’s (NASDAQ:TSLA) rebound has been epic! Over the last few months, the company’s stock skyrocketed by more than 100%. In my “Approaching the Buy-in Level” article, I outlined that Tesla would probably drop into the $100-$110 price range but should quickly rebound and move much higher. I put out several buy alerts around and after Tesla’s recent lows, outlining why Tesla was likely around a long-term bottom, even calling its stock “a gift” if it came down to about the $100 level.

Tesla – We May Have Reached The High, For Now

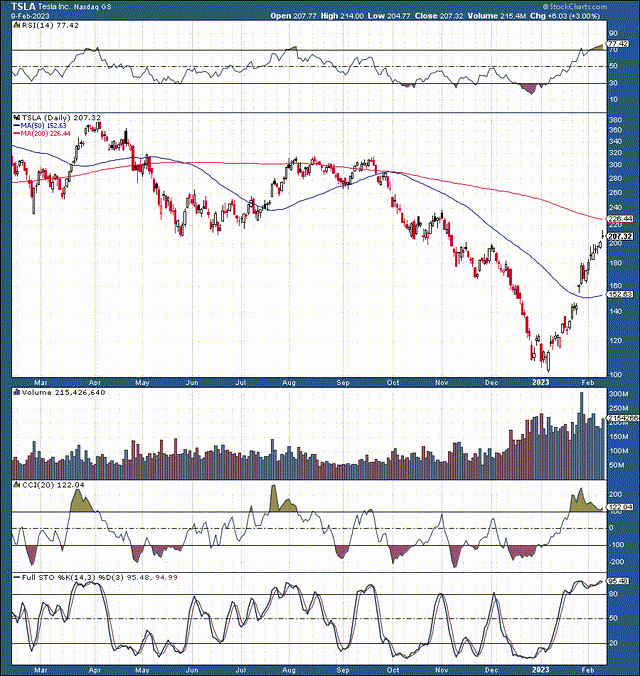

I was very bullish on Tesla’s stock in the $100-$120 range, and Tesla has been one of the all-weather portfolio’s “AWP’s” most significant holdings this year. However, I recently sold shares after a 70% increase as Tesla’s stock may be around a near-term high again. The RSI has gone from well below 30 to nearly 80, illustrating a shift from highly bearish to remarkably bullish sentiment in a concise time frame. Moreover, the short covering has exacerbated Tesla’s up move. Tesla’s stock is ripe for a correction, and if the general stock market takes a leg lower, we may get another excellent buying opportunity in Tesla for $150 or less.

However, despite Tesla’s transitory technically overbought conditions, its stock can go much higher long term. Therefore, I will consider adding Tesla exposure on future pullbacks, especially if upcoming corrections take the company’s share price below the $140-$150 range.

Recent Earnings – Almost A Home Run

Tesla’s recent earnings and outlook were excellent. The company beat Non-GAAP EPS estimates by 8 cents, providing $1.19 in EPS and a staggering $24.32 billion in revenues. Revenues were up by about 37% YoY, and Tesla’s automotive gross margin came in at approximately 26%. Tesla’s operating margin was at a very healthy 16% last quarter, and the company expects to produce at least 1.8 million vehicles this year. The company also discussed its upcoming cyber truck and other exciting developments.

Elon Musk’s outlook remains optimistic, enough to keep shareholders happy and short sellers scared. The CEO noted that the company’s 2023 1.8 million vehicle production estimate was very conservative and that Tesla would likely produce closer to two million cars this year. In addition, Elon Musk noted that there should be enough demand to meet Tesla’s increasing supply of its vehicles.

Additionally, I want to underline Tesla’s recent success in using price cuts to spark demand. The company cut prices globally by about 20%, gaining an edge and taking market share from rivals. Tesla’s massive advantage is the company’s high level of profitability due to excellent efficiency and the effective implementation of its economies of scale capabilities. Therefore, Tesla should continue implementing strategies that strengthen and help cement its position as the dominant EV maker globally.

Two Million – A Lot Of Vehicles

Tesla produced around 1.3 million vehicles last year. Thus, we’re looking at a staggering production increase of approximately 40-50% YoY. Sales-wise, we saw about 4.25% of deliveries coming from the Model S/X segment last quarter; therefore, if Tesla produces around 1.9 million vehicles this year, about 81,000 maybe Model S/X cars. Once adjusted for lease accounting (8% leases), we could see about 75,000 Models S/X sales this year. Any price decreases, especially in Tesla’s higher-end segment, may be temporary, and a $125,000 ASP for the Model S/X cars seems reasonable. Thus, Tesla’s Model S/X sales segment should bring in around $9.4 billion in sales this year.

However, the lion’s share of Tesla’s sales will come from its mainstream Model 3/Y lineup. If the company produces around 1.9 million cars next year, roughly 1.82 million vehicles could be Model 3/Y deliveries. Once adjusted for lease accounting (5%), 1.73 million Model 3/Y sales and an ASP of approximately $52,000 equate to roughly $90 billion in sales.

My 2023 Sales Estimates

- Model 3/Y segment: $90 billion

- Model S/X segment: $9.4 billion

- Services and Other: $9.5 billion

- Energy Generation and Storage: $5.5 billion

- Automotive leasing: $3.5 billion

- Regulatory credits: $1.8 billion

- (estimates based on company information and recent 10-K)

Total: $119.7 billion

Consensus Estimates – Too Depressed

Revenue estimates (SeekingAlpha.com )

With Tesla’s drop to $100, analysts scrambled to revise their estimates lower. The consensus revenue estimate for this year is about $103 billion, well below my target of about $120 billion. Nevertheless, many analysts may underestimate Tesla’s growth ability and earnings potential. Long-term, Tesla’s stock should go much higher.

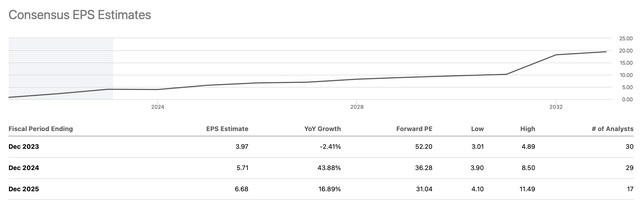

Earnings-Wise A Similar Image Emerges

EPS estimates (SeekingAlpha.com )

Many analysts anticipate that Tesla will go through an earnings decline, a stagnation period, and worse. However, EPS estimates may be overly pessimistic due to the recent panic-related adjustments. Therefore, Tesla can do much better than many analysts expect.

Here’s what Tesla’s financials could look like in future years:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $119 | $160 | $215 | $300 | $400 | $510 | $640 | $780 |

| Revenue growth | 47% | 34% | 34% | 40% | 33% | 27% | 25% | 22% |

| EPS | $6.50 | $9.23 | $13 | $18 | $23 | $30 | $35 | $40 |

| EPS growth | 60% | 42% | 40% | 38% | 32% | 28% | 19% | 18% |

| Forward P/E | 22 | 23 | 25 | 27 | 25 | 24 | 23 | 22 |

| Stock price | $200 | $299 | $450 | $621 | $750 | $840 | $920 | $1,000 |

Source: The Financial Prophet

Tesla is a dominant, market-leading company with unprecedented potential. Therefore, Tesla’s stock deserves a premium valuation and could have its forward P/E ratio above 30 as we advance. In conclusion, Tesla should continue becoming more efficient and profitable while expanding revenues and earnings aggressively through 2030. Therefore, Tesla’s stock has remarkable potential to move substantially higher in the coming years, and I am going along for the ride! Are you with me?

Wait, There Are Some Risks To Consider

A slowdown in demand, increased competition, supply issues, decreased growth, issues with regulators and foreign governments, and other variables are all risks we should consider before betting on Tesla to move higher. Serious concerns could cause Tesla’s valuation to lose altitude, and the company’s share price could even head in reverse if any serious issues should arise. Therefore, one should consider these and other risks before committing any capital to a Tesla investment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long a diversified portfolio with hedges.

Are You Getting The Returns You Want?

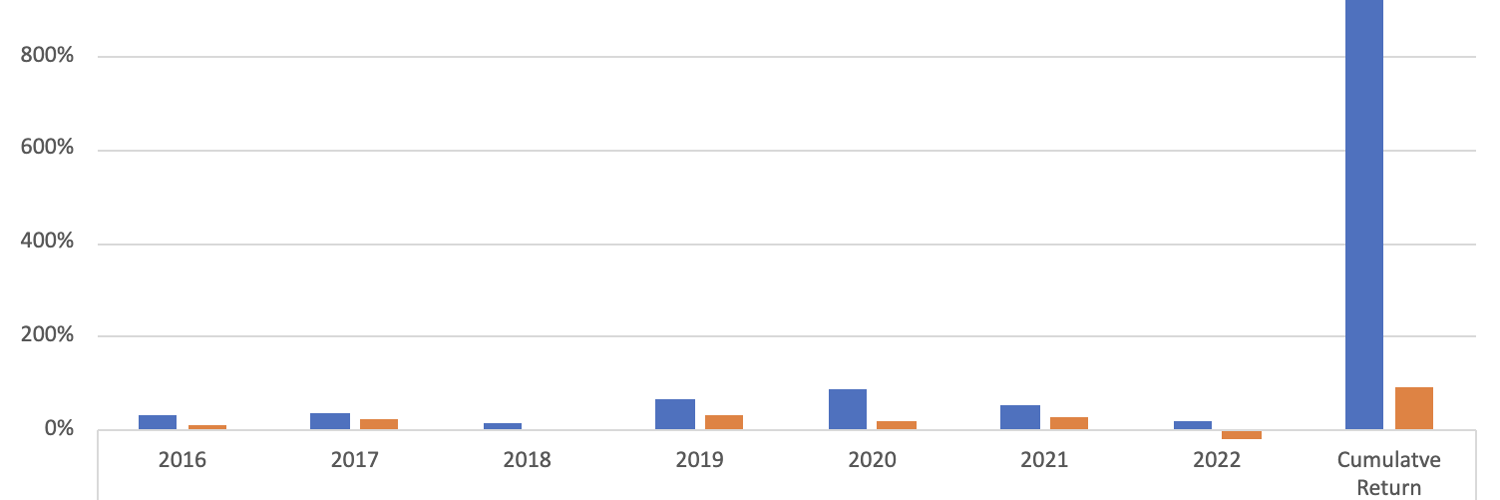

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!