Summary:

- Innovative Industrial Properties remains one of the most undervalued REITs.

- Innovative Industrial Properties has outperformed cannabis operators due to its landlord status and strong cash flow generation.

- The possibility of cannabis rescheduling on the Federal level could improve tenant credit quality and lead to a higher stock valuation.

- The Innovative Industrial Properties 7.2% dividend yield is too high given the minimal leverage compared to peers – reiterate buy.

LeoPatrizi/E+ via Getty Images

Innovative Industrial Properties, Inc. (NYSE:IIPR) remains one of the most undervalued names in the real estate investment trust, or REIT, sector. The cannabis REIT has faced some tenant difficulties amidst a cannabis bear market, but the current stock price continues to more than price in these risks. The company maintains an incredibly low leverage ratio as compared to traditional net lease peers, and management is taking proactive steps to address the tenant issues.

The company should benefit from the potential legalization of adult-use sales in Florida, and the possibility for a rescheduling of cannabis on the federal level represents another important near-term catalyst that may address the tenant credit quality issues and spark a re-rating higher. I reiterate my buy rating for IIPR stock, as it offers a nice blend between solid growth and dirt-cheap valuation.

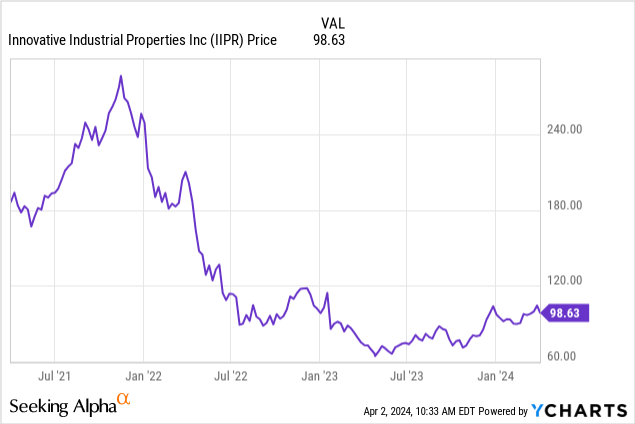

IIPR Stock Price

Innovative Industrial Properties, Inc. has been one of the worst-performing names in the REIT sector, but its stock price plunge has been arguably modest when compared to the stocks of its publicly traded cannabis tenants. The relative outperformance is likely due to the company’s landlord status as well as its stronger free cash flow generation. I would not be surprised to see IIPR continue to outperform cannabis operators from here.

I last covered IIPR in December, when I rated the stock a Buy on account of the 7.4% dividend yield. While it is difficult to predict when exactly a re-rating may occur, I am happy to collect the generous dividend checks while I wait.

IIPR Stock Key Metrics

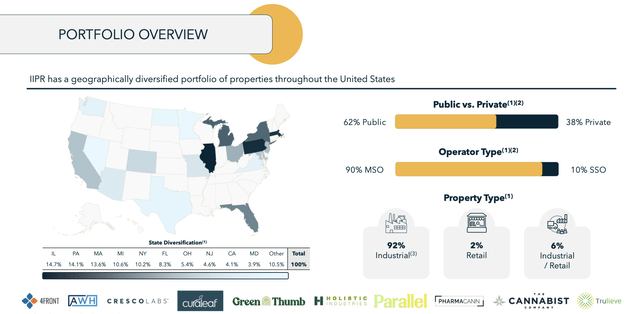

IIPR is the largest cannabis net lease REIT, meaning that it leases cultivation and retail assets to cannabis operators in the United States.

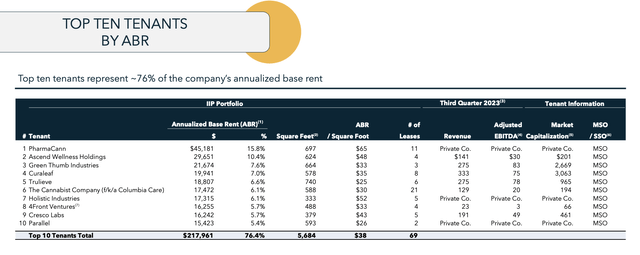

We can see a breakdown of the company’s top 10 tenant list below.

With the Florida Supreme Court allowing adult-use legalization to go on the ballot come November, it is notable that many of IIPR’s tenants operate in the state and stand to benefit. These include Trulieve Cannabis Corporation (OTCQX:TCNNF), Curaleaf Holdings, Inc. (OTCPK:CURLF), Cresco Labs Inc. (OTCQX:CRLBF), and Green Thumb Industries Inc. (OTCQX:GTBIF). Because these net leases carry corporate guarantees, IIPR’s tenant credit profile improves even if the company does not specifically own these Florida properties, as these tenants may benefit from a boom in business that further improves their ability to pay their lease obligations.

In its most recent quarter, IIPR saw revenues grow 12% YoY with adjusted funds from operations (“AFFO”) growing 8%. I note that AFFO is an acceptable proxy for free cash flow due to IIPR having minimal maintenance capital expenditure requirements. The company employs triple net leases which means that its tenants are responsible for real estate taxes, insurance, and maintenance costs. The $2.28 in AFFO per share comfortably covered the $1.82 quarterly dividend payout.

Rent collection came in at 100%, but it should be noted that this is for the “operating portfolio” and excludes nonperforming properties.

IIPR ended the quarter with $140.2 million of cash versus $301 million of debt. That $161 million net debt position represents just around a 1x debt-to-EBITDA ratio, an exceedingly conservative leverage position considering that most NNN REIT peers have leverage around the 5x to 6x debt-to-EBITDA range.

On the conference call, management reiterated their target payout ratio range of 75% to 85% (the dividend payout ratio stood at 80% in this past quarter). Management was upbeat with regard to the progress made on some of their troubled properties. Management noted that after taking back possession of their Summit property in Michigan in March of 2023 (while it was under development), they signed a letter of intent (“LOI”) for the asset in Q3 and executed a lease in this past quarter. Management expects to complete the redevelopment of the projects by the fourth quarter of this year.

While not explicitly stated, it looks like the tenant will start paying rent only once they have moved into the building. Management also noted that they have signed LOIs for their Mclane and 19th Avenue properties in California. These three properties represent “over $120 million of invested capital.” Management noted that they have also seen “significant interest” in their Harvest Park property (previously occupied by Green Peak) and have already executed a letter of intent in early February. Despite management’s clearly upbeat tone, analysts tried to ask if investors should expect these LOIs to lead to an impact on the financials by 2025, to which management declined to respond.

I found it interesting that IIPR extended $14 million more into their New York property occupied by Goodness Growth Holdings, Inc. (OTCQX:GDNSF), even as they note that GDNSF is exploring a sale of its New York operations, as well the state seeing “more than three quarters of total sales” driven by illicit competition. It is looking increasingly likely that New York may become California 2.0 from a cannabis perspective. The presence of a large illicit market may keep prices low to the benefit of consumers, but make profitability very difficult for legal operators.

Management noted that they have reduced the base rent obligation for their 4Front Illinois property through September of this year due to delays in development. Management noted that the building finally got permanent power in January.

I found it notable that the company raised $9.6 million in proceeds through its ATM program, as the company already has a strong balance sheet and investment opportunities have been rare in the current environment.

Management expects 2024 to “look kind of similar to 2023,” which I interpret to mean that investors should expect around single-digit AFFO growth. If Florida voters manage to pass adult-use legalization in November, then 2025 may see the capital markets open up as Florida operators seek to take market share ahead of the legal market.

Is IIPR Stock A Buy, Sell, or Hold?

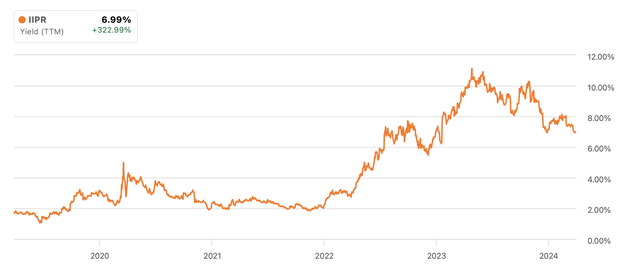

Even after a sizable rally from the lows, IIPR still trades at a generous 7.2% dividend yield. I note that while the stock previously traded at a sub 4% dividend yield, investors should not view that as being the norm given that the stock had benefited from positive investor sentiment towards the cannabis sector, which has since soured.

The real crux of the undervaluation comes when realizing that IIPR has minimal leverage yet trades at 12.3x FFO, yet a stock like Realty Income Corporation (O) has substantially more leverage and trades at around 12.8x FFO. On an EV/EBITDA basis, which factors in leverage, IIPR trades at 12.7x versus 19x for Realty Income. While Realty Income has a higher quality tenant base, I am not convinced that the difference warrants such a valuation disconnect, especially given that IIPR earns higher annual lease escalators (around 3% versus 1%).

I have already discussed how the legalization of adult-use sales in Florida may benefit the tenant’s health. Prospects for the DEA to reschedule cannabis continue to be another important near-term catalyst. If tenant credit quality is the main factor holding back the stock, then rescheduling cannabis to Schedule III would be an immediate antidote. These operators are unable to deduct operating expenses including debt interest cost from the calculation of taxable income, leading to egregious corporate tax rates, sometimes even if they have negative taxable income. Removing this “280e tax” would immediately boost the free cash flow generation of IIPR’s tenants, and at this point, I would be aggressively buying the stock of IIPR and other similar REITs (though I suspect more attention would be placed on the stocks of the multi-state operators).

Over time, I see IIPR trading to a premium or at least in line with the dividend yield of Realty Income, which currently stands at around 6%.

What are the key risks? IIPR has underperformed peer NewLake Capital Partners, Inc. (OTCQX:NLCP) from a fundamental perspective due to its arguably aggressive underwriting practices in the past in which it made considerable investments in unlimited license states like California. It is possible that IIPR will continue to have tenant difficulties and this may act as a persistent overhang on the stock. It is possible that cannabis is not rescheduled by the DEA this year, or in the near term whatsoever.

While IIPR employs long-term leases and its tenants are obligated to pay rent, it is possible that we see a meaningful wave of bankruptcies sweep the sector and the leases may need to be renegotiated to lower rates. The main risk for IIPR is if federal reform takes too long, offering little financial relief for its tenants. The stock is not as cheap as it was just one year ago, but is still pricing in a lot of pessimism.

I reiterate my buy rating for Innovative Industrial Properties, Inc. stock as the near-term catalysts and strong balance sheet make the elevated dividend yield a gift for long-term investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IIPR, NLCP, TCNNF, GTBIF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!