Summary:

- Intel is out of flavor, a 60% decline hit the stock, as investor ran for the hills.

- However, the semiconductor industry is not done with growing and Intel should be back for the next upward cycle.

- INTC stock is trading close to an all-time low in price-to-sales ratio, while owning 26% of their market cap in cash and short-term investments.

- Mobileye, of which Intel is still a majority shareholder by 94%, is worth almost 1/3 of the parent company after a massive run.

- Yet, Investors should watch out for Intel’s sly accounting and visual presentation tricks.

Justin Sullivan

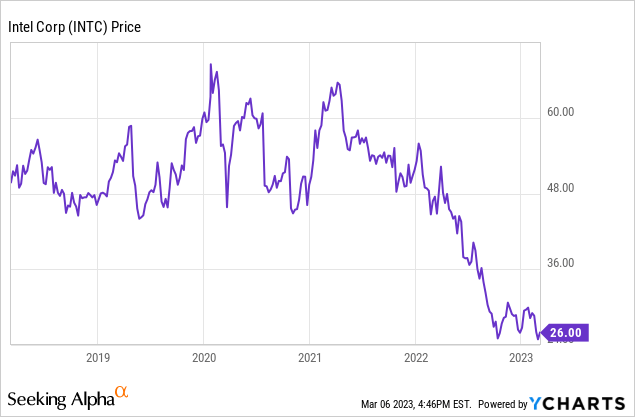

Intel’s (NASDAQ:INTC) sentiment has been everything but good. The stock is down more than 60% from all-time highs and has almost reached a decade low. The semiconductor industry’s profitability sank in the latest quarters, as demand for electronic goods saw a slump. Only few, like Super Micro Computer (SMCI), that are specialists in high demand sectors are able to hold their pricing power.

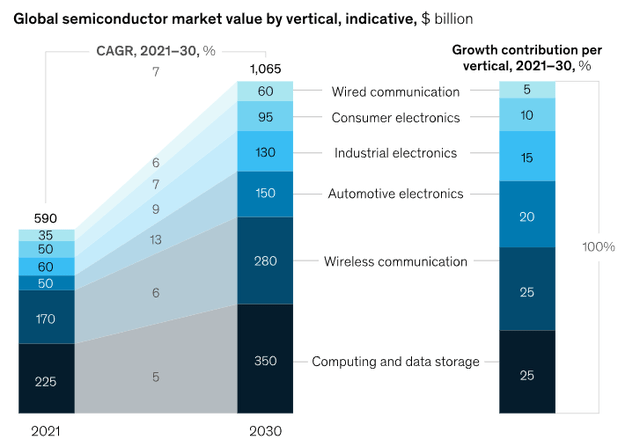

Crashing earnings definitely look scary and most investors have already ran for the hills. Therefore, great opportunities rise for value investments in the semiconductor industry. Intel is currently one of the most “hated” companies, which makes it much more interesting to go bottom fishing. The average investor is a short term thinker and it is easy to take advantage of that. Although the semiconductor market is hurting right now, it is still expected to grow enormously over the next decade.

McKinsey & Company

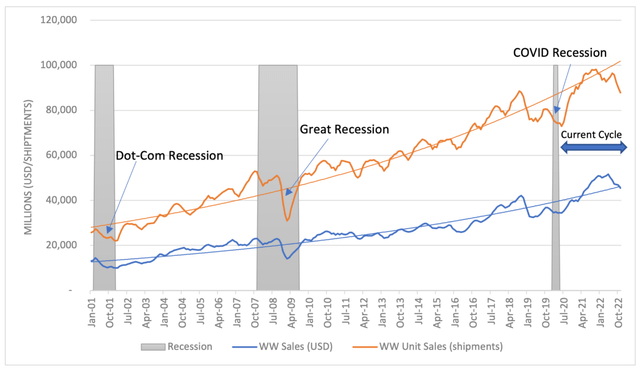

In addition, downward cycles are nothing new in the industry and are often followed by massive spending. Historically, a return to higher sales is quite rapidly. Big investments in manufacturing are being made to ensure there is enough supply for the next upward cycle, Intel is not an exception.

Sales and Unit Shipments 3 month moving average (Semiconductor Industry Association)

PE misleading

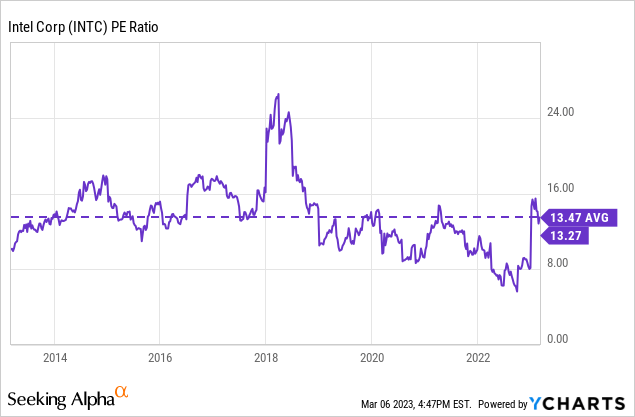

Intel might look fairly priced at the moment, but do keep in mind we are in a downward cycle and profitability of most semiconductor companies is decreasing. So the price-to-earnings ratio might not be the best metric to look at.

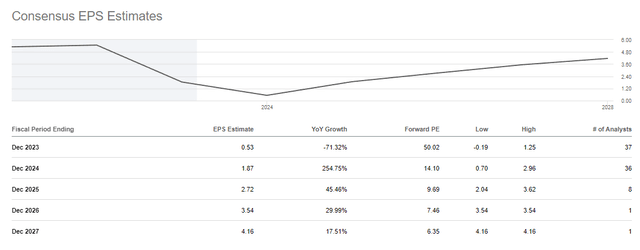

Analysts do expect earnings to recover as soon as 2024. If we take today’s price of $26 and look for the future price-to-earnings ratios of 2025 and 2026, we get respectively a PE of 9.55x and 7.34x.

Seeking Alpha

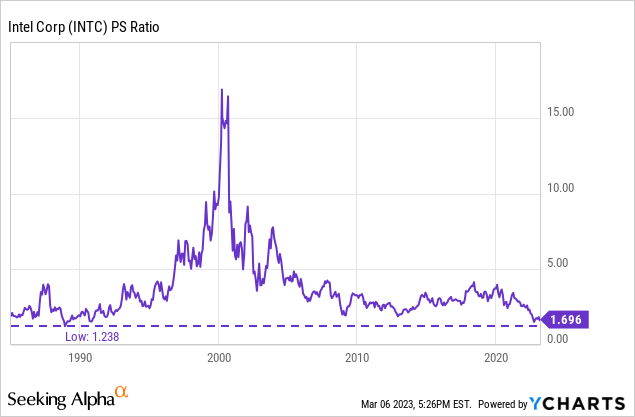

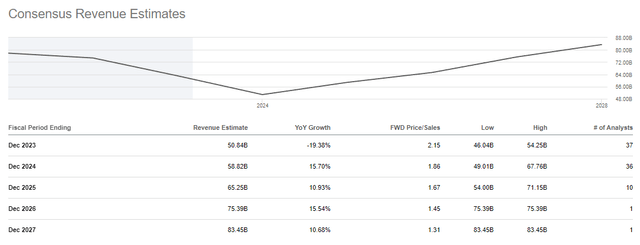

Intel’s price-to-sales is almost standing at an all-time low of 1.696x. Important to notice, that this is already with a decline of 20% in sales. Therefore, a rebound of sales would be mean an even lower price-to-sales.

Interestingly, after a decline in 2022 and probably 2023, revenue is expected to grow again by at least 15% over the following years. If we calculate the future price-to-sales ratio for 2025 and 2026 on today’s price (market cap $107 billion), we get respectively a PS of 1.63x and 1.41x. These would be a substantial discount compared to the average over the last years. Of course, the estimates are just a prediction, but they give a good overview how cheap Intel would be if demand recovered in the following years.

Seeking Alpha

Strong Balance Sheet

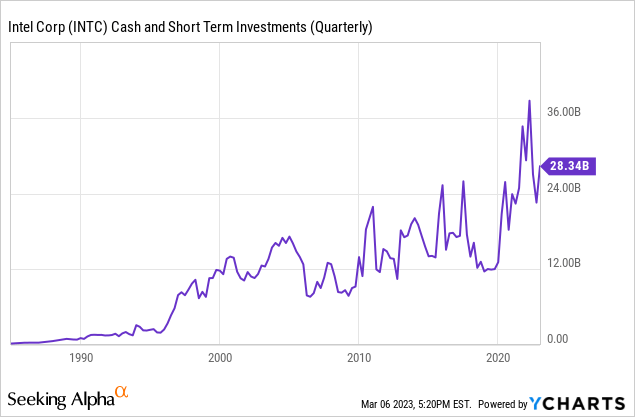

Intel still has a remarkable balance sheet with $28.34 billion in cash and short term investments or 26.4% of the market cap. This should suffice to fund further development and expansion to keep a strong market share in a growing industry.

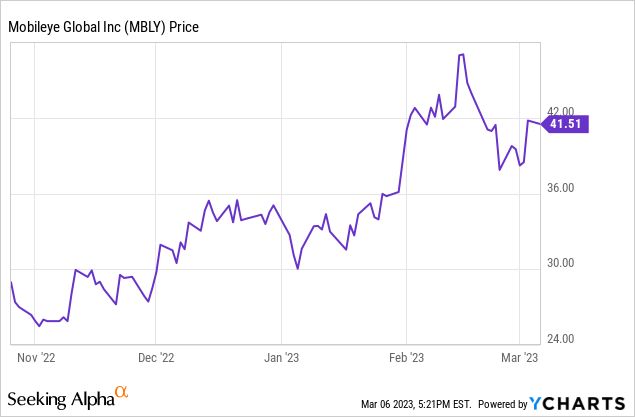

Mobileye (MBLY) IPO wasn’t cheered upon and many authors on Seeking Alpha were bearish, yet the stock has so far done an incredible run. After the IPO, Intel is still the majority owner of Mobileye by 94%. Mobileye is now worth a whopping $33 billion with $31 billion in the hands of intel, which is almost one third of Intel!

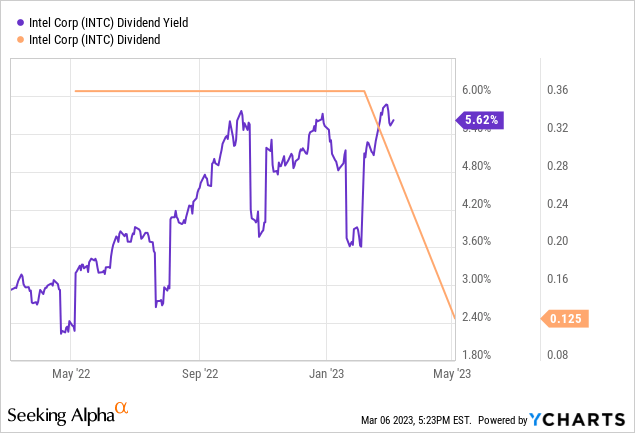

Dividend Cut

Everyone saw it coming, the dividend has finally been cut. However, it was for the better. Intel’s profit margins have been experiencing declines, as a result it pressured the dividend. On the other hand, the company has to invest in R&D and capital expenditures to keep up with competitors to gain benefits in the next upward cycle. The dividend yield for 2023 is around 2%, which is overall not too bad.

Be Careful With Sly Tricks

Unfortunately, you have to be really careful as an Intel investor. The management is pulling all tricks out of their sleeves to keep precious investors. In the latest quarter, Intel started with some accounting tricks to decrease expenses by increasing useful life of machinery. This looks great on paper, but it is of no value to the company.

*Effective January 2023, Intel increased the estimated useful life of certain production machinery and equipment from five years to eight years. When compared to the estimated useful life in place as of the end of 2022, Intel expects total depreciation expense in 2023 to reduce by roughly $4.2 billion, including an approximate $2.6 billion increase to gross profit, a $400 million decrease in R&D expenses and a $1.2 billion decrease in 2023 ending inventory values.

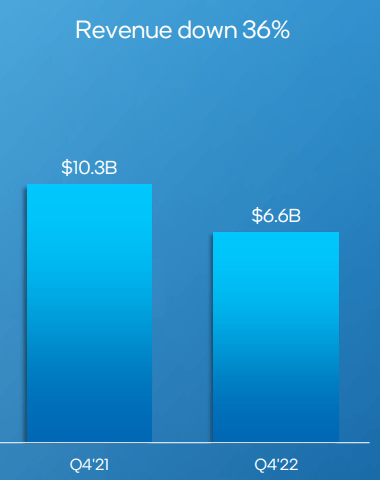

Additionally, charts in the latest earnings presentation did not have the right scaling compared to the values, which is again misleading to investors. It is really silly that these things happen and it does not give great confidence in the management team.

Intel Investor Relations – 22Q4

Takeaway

I agree with others that Intel is and has been underperforming and is no longer the dominant and almost monopolistic chip player. Guidance for Q1 was terrible and 2023 will be a tough year for Intel. Nonetheless, most of it looks to be priced in at the current price. Pat Gelsinger’s days may not have been the best so far, yet I give him a chance to prove everyone wrong.

We knew Intel’s recovery would take time, the future is hard to predict. Further, short term delays and misses were and are not to be unexpected. The semiconductor industry is far from done with growing and the world needs Intel as a supplier.

Selling your shares at $26, after a 60+% decline, might not be intelligent. You better wait for the next upward cycle, that might be here sooner than later as digitalization is still developing rapidly. Collect the dividend and let Intel allocate their massive balance sheet. In my opinion, a share price of $51 by 2026 does not seem unrealistic at all and would mean a move back to an average price-to-sales ratio (25% CAGR excluding dividend).

I initiate a Strong Buy rating.

Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial advisor. Investing is your own responsibility. I am not accountable for any of your losses.