McDonald’s: Wait For A Better Time To Get In

Summary:

- McDonald’s is known for its delicious fries and burgers, but investors know it as a real estate company; it earns royalties from its franchisees.

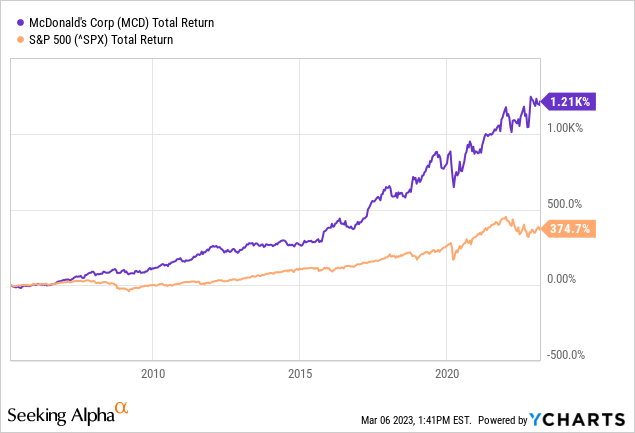

- With higher returns and lower volatility than the S&P 500, McDonald’s could look like a long-term buy.

- Fourth-quarter results showed strong growth in operating income, and analysts are positive about future earnings potential.

- Management is shareholder-friendly, as it pays a good dividend and also buys back shares.

- However, MCD stock’s valuation appears to be out of control, and with rising interest rates, this could be disastrous for the stock.

M. Suhail

Introduction

Though consumers associate McDonald’s (NYSE:MCD) with tasty fast food, investors recognize the company as a real estate firm that benefits from royalties paid by its franchisees. McDonald’s is a franchise where the business has expanded massively thanks to funding from small investors. And instead of selling fast food to customers, McDonald’s earns royalties from its franchisees. A strong business model and McDonald’s grew extremely fast.

The stock was a great buy in its early days. Recently, the stock price has risen significantly since March 2005 (I charted 2005 including the financial crisis but excluding the 2003 lows for MCD) with an average annual return of 15.4% compared to the S&P500’s return of 9.0%. The stock’s volatility is also lower than that of the S&P500. However, the stock’s valuation appears to be out of control and with rising interest rates, this could be disastrous for the stock.

Strong Fourth Quarter And Full-Year Results

McDonald’s performed strongly in the fourth quarter of 2022 with worldwide comparable sales up 12.6% thanks to menu price increases and positive guest counts. Comparable sales increased internationally, except in China due to continued COVID-19 restrictions. Consolidated sales decreased 1% (+5% at constant currency) but consolidated operating income increased 5% or 14% at constant currency, excluding the impact of the sale of McDonald’s Tech Labs. Non-GAAP earnings per share increased 16% or 23% at constant currency year over year (excluding the sale). Looking forward, more than 30 analysts expect revenue to grow at a CAGR of mid-single digit and non-GAAP earnings per share at a CAGR of high single-digits.

Dividends And Share Repurchases

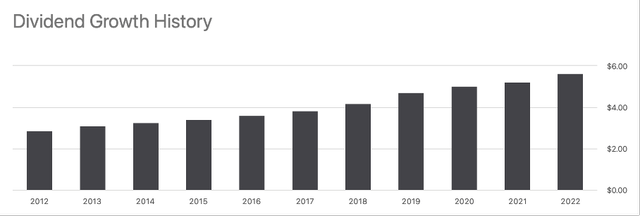

This strong real estate company has grown its dividend per share from $2.87 in 2012 to $5.66 in 2022 (annual growth rate of 7.0%). The forward dividend is listed at $6.08 and represents a dividend yield of 2.3%. However, the dividend yield is quite low compared to the 3-month government bond yield of 4.7% (even when a 7% annual growth rate is added to the equation).

Dividend growth history (Seeking Alpha’s MCD Ticker Page)

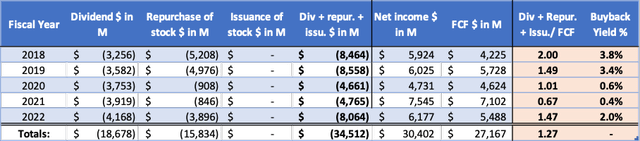

A deeper dive into the company’s cash flow statements shows that McDonald’s is buying back shares in addition to distributing dividends. Repurchasing shares increases dividends per share and earnings per share. In addition, it can provide a strong stock price return because there are fewer shares outstanding while demand for the shares increases.

In total, McDonald’s has returned $34.5 billion to shareholders over the past four years, while generating $27.2 billion in free cash flow. So, the share repurchases has reduced their cash on the balance sheet. With a net debt of $33.3B and an FCF of $5.5B in 2022 (net-debt to FCF of 6), I think the net debt is a bit on the high side. Interest coverage is currently 8.6, which is higher than 5 (which is fine according to Ben Graham). Problems may arise when McDonald’s refinances its debt at a higher interest rate.

McDonald’s Cash Flow Highlights (SEC and author’s own calculations)

McDonald’s Clearly Looks Overvalued

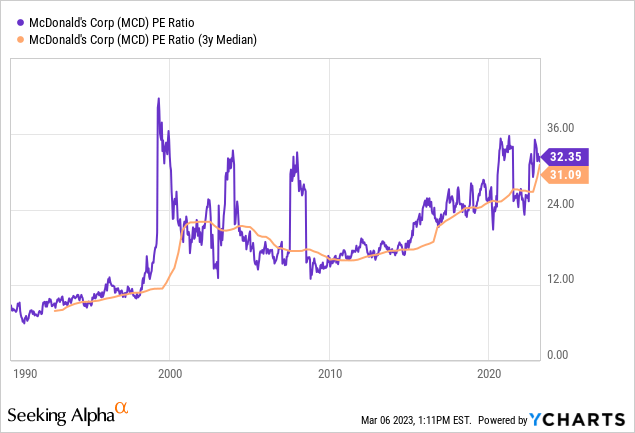

In terms of stock valuation, the PE ratio has increased significantly over the past 30 years. In 1990, McDonald’s PE ratio was only 10, but in the following years it increased significantly. At the height of the dotcom bubble in 2000, McDonald’s PE ratio was extremely high, over 40. Then the stock price collapsed. The stock price plummeted from a high of $48 to just $12.8 in 2003. Everyone sold in a panic, and the PE ratio was again favorable at 13.

Now the PE ratio notes 32, above the three-year average of 31. The three-year average has also risen significantly in recent years, as low interest rates caused significant asset price bubbles.

The inverse of the PE ratio, the earnings yield, is often compared to the yield on 10-year government bonds. McDonald’s earnings yield is currently 3.1%, while the yield on 10-year government bonds is 3.9%. The stock seems clearly overvalued at this price level based on the general market, but also compared to its historical figures.

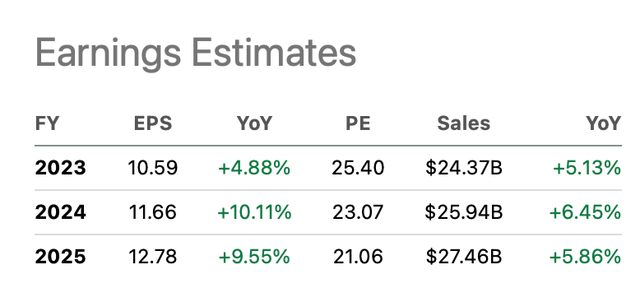

Looking ahead, analysts expect strong earnings growth with high single digits for the next few years. The forward PE ratio in 2025 is only 21 (earnings yield of 4.8%). I expect 10-year government bond yields to rise further now that the Fed has announced rate hikes. Investors should ask themselves whether they would rather invest in a government bond with a fixed yield, or in McDonald’s with a lower earnings yield but rising profits.

At this price level, the risk/reward seems out of control. I’d rather wait for a better time to get on the boat.

Earnings Estimates (MCD ticker page on Seeking Alpha)

Conclusion

Fast food franchise McDonald’s is well-known for its tasty French fries and hamburgers, but the company is also well-known among investors as a real estate firm that benefits from royalties paid by its franchisees. It is a strong business model that has benefited McDonald’s greatly. The company has grown strongly, and its stock price has risen rapidly. With higher returns and lower volatility than the S&P500, McDonald’s could look like a long-term buy. Fourth-quarter results showed strong growth in operating income, and analysts are positive about future earnings potential. Management is shareholder-friendly, as it pays a good dividend but also buys back shares. The mix between a tax-free shareholder return and dividend income makes the stock worthwhile for both income and growth investors. However, with a PE ratio that is sky-high at 32, I think the share price is rather expensive. The forward PE ratio for 2025 looks more favorable, with a ratio of 2 (the earnings yield is only 5%). However, the yield on 10-year Treasury bonds is rising sharply during this high interest rate environment. Therefore, I would wait for a better time to get in.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.