Summary:

- With the growing inflationary pressure, elevated energy costs, and rising unemployment rates, INTC’s expansion plans in Germany may be at risk, depending on the subsidy expansion.

- Things do not look rosy in Germany as well, with the ongoing energy crisis, massive €264B subsidy program, and high debt levels of €2.48T in 2021.

- With China yet to approve the deal, it is uncertain whether the Tower Semi acquisition will be successful, significantly destabilized by the ongoing Chips War.

- The PC destruction is also not expected to alleviate in the short term, prompting the management’s swift portfolio divestiture and aggressive operating optimization.

- Things remain exceedingly volatile indeed, indicating the minimal margin of safety for those who choose to add here, despite the massive discount from peak levels in 2021.

LumerB

We have previously covered Intel Corporation (NASDAQ:INTC) here as a post-FQ3’22-earnings article in November 2022. Its market opportunities in the x86 segment were discussed extensively, with the company retaining its lion’s share at 71.5% for the quarter. However, the lowered FQ4’22 guidance has also caused market analysts to drastically downgrade its top and bottom line growth through FY2024, suggesting further headwinds in its forward execution through the worsening macroeconomics.

For this article, we will focus on INTC’s challenges in its expansion plans in Germany, with a brief outlook on the country’s energy crisis. We will also discuss the management’s prompt decision to divest non-core businesses, which may help streamline its business and operating efficiencies during the PC demand destruction. However, with growing debt levels and capital expenditure, the stock may continue trading sideways over the next two years, with minimal catalysts for sustainable recovery.

Investment Thesis – INTC’s Plan In Germany May Be Jeopardized

According to the German newspaper Volksstimme, INTC may delay the construction of its semiconductor manufacturing plant at Magdeburg in Germany, which is supposed to kick off by the first half of 2023 and commence chip production by 2027. The rising inflationary pressure has tremendously driven up labor, raw material, and energy costs by 17.6% to over €20B, against the original projection of €17B. Consequently, the company has requested additional government subsidies for the project, above the €6.8B currently committed. Considering the ongoing energy crisis in the country, it will be interesting to see whether the German government adheres to its previous offer of up to €14B in subsidies. Intel spokesperson, Benjamin Barteder, said:

Geopolitical challenges have become greater, semiconductor demand has declined, and inflation and recession are disrupting the global economy. This means we cannot yet give a definitive date for the start of construction. (The Register)

The German government has recently announced a massive €264B subsidy program to aid its citizens with the rising energy costs, since the start of the energy crisis in September 2021, further exacerbated by the Russian invasion. The support measures are expected to last through April 2024 to subsidize fossil gas, district heat, and electricity. For now, the financing is expected to come from the windfall tax imposed on energy companies from the surplus profits made between 2022 and 2023, amongst other things. However, given the country’s elevated debt of €2.48T in 2021, we are naturally concerned about this aggressive spending.

Market analysts also expect the ongoing energy crisis to potentially push Germany into a recession, with the rising prices putting a damper on industrial production and inflation tightening consumer discretionary spending. The German economy is also expected to shrink by -0.4% in 2023, with the inflation rate remaining elevated at 7% at the same time.

Furthermore, the new plant in Germany is expected to consume an immense volume of resources similar to the Magdeburg city, at approximately 1.5K GWh of electricity, 1.4K GWh of gas, and 500 GWh in district heating by 2027. This is naturally a sore point, as the country had previously over-depended on Russian oil/gas for electricity and heating, before switching to a mix of coal, gas, and renewable energies. In addition, the new fab may consume up to 20M gallons of water daily, double the current consumption in Madgeburg city. Prior to achieving the goal of using only renewable energies from 2030 onwards, the country and company may likewise be exposed to high costs at a time of rising inflation.

On the other hand, the State of Saxony-Anhalt (where Madgeburg city is) has planned to make crucial infrastructural investments worth €0.5B to prepare for the energy and water-intensive manufacturing endeavor. This includes new water lines and wind farms, with INTC potentially building solar panel capacities ahead. However, it remains to be seen how feasible this plan is, as Germany tries to phase out nuclear power by 2023 amid high energy prices. By November 2022, the states’ unemployment rate also climbed to 6.3%, against the country wide average of 5.6% and the 5% reported in 2019. More uncertainties may be triggered by these developments indeed.

With the European Chips Act, Intel was initially set to play a significant role in increasing the EU’s self-sufficiency in the semiconductor design and manufacturing sector. The company planned for an aggressive €33B investment in the EU then, with expanded operations in Ireland, an R&D/ design hub in France, and manufacturing/ foundry/ packing services in Italy, Poland, and Spain. The European Commission President, Ursula von der Leyen, has previously said:

Our goal is to have 20 percent of the world’s microchips production in Europe by 2030. That’s twice as much as today in a market that is set to double in the next decade. (Emerging Europe)

It is also unclear if the Tower Semi (TSEM) acquisition may be able to close by February 2023, since INTC has yet to receive regulatory approval from China with the ongoing Chips trade war remaining volatile. These continue to trigger further doubts about INTC’s IDM 2.0 strategy in the EU, due to Tower’s strategic geographical location in the US, Israel, Japan, and Italy. There have been rumors that Tower Semi’s CEO will be leading the Intel Foundry Services by Q1’23, however, the situation was further destabilized by the early departure of INTC’s head of foundry in November 2022. Considering the possibility of a soured deal, the stock may further retrace in the short term indeed.

INTC’s Recovery Is Also Hindered By PC Demand Destruction & Elevated Costs

The PC/ gaming destruction of demand is projected to negatively impact INTC’s top and bottom line growth by -14.4% and -32.1% in FY2022, respectively. Due to the worsening macroeconomics through 2023, it is unlikely that the consumer and corporate demand may return anytime soon, with most tightening discretionary spending in the short term. The Feds are also due to raise until a terminal rate of 5.1%, with a 2% target inflation rate, potentially triggering prolonged elevated interest pain through 2023, if not 2024.

This is why INTC had to drastically improve its operating efficiencies, with a projected $10B in cost savings by 2025. The company also plans to lay off many of its employees globally, with thousands of staff already offered months of unpaid leave in Israel and Ireland thus far. These are already reflected in the massive $664M restructuring charges in the recent FQ3’22 earnings call, with more likely to come over the next few quarters.

Furthermore, INTC has been aggressively divesting its non-core portfolios, with the most recent Mobileye IPO in October. The latter has netted the company $0.86B in capital, while maintaining control with 750M of Class B shares. This is on top of the previous $0.55B of impairment reported for the Optane memory business in July, and its Drone Light Shows for an unspecified amount, which was sold to Kimbal Musk, namely Elon Musk’s brother, at the same time.

While we may see INTC report improved margins in the intermediate term, its IDM 2.0 success remains uncertain indeed. The company would likely face teething problems in the fledging foundry business, due to the intense competition from Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) and Samsung (OTCPK:SSNLF). Apple (AAPL) and Nvidia (NVDA) are already expected to be TSM’s first few customers in the Arizona plant, with a speculative addition of Advanced Micro Devices (AMD). Furthermore, the management would need to establish a mastery of the global supply chain, while gaining foundry experience through specialized talent/ expertise to succeed. Only time will tell.

So, Is INTC Stock A Buy, Sell, Or Hold?

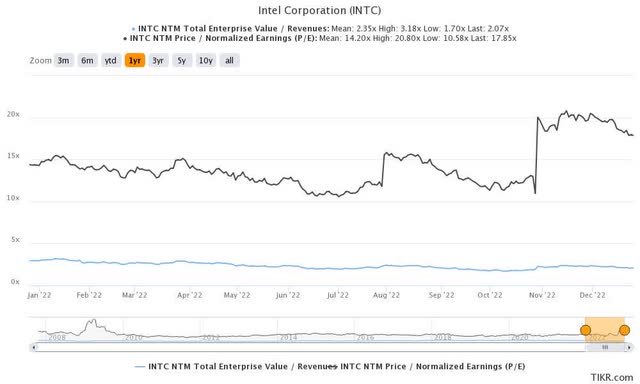

INTC 1Y EV/Revenue, P/E, and NTM Market Cap/ FCF Valuations

INTC is currently trading at an EV/NTM Revenue of 2.07x and NTM P/E of 17.85x, lower than its 1Y EV/Revenue mean of 2.35x though elevated from its 1Y P/E mean of 14.20x.

INTC YTD Stock Price

Despite the multitude of pessimism baked into INTC’s stock price, plunging by -52% YTD, its projected FY2023 EPS of $1.97 indicates an aggressive price target of $35.16. Naturally, market analysts are less bullish with a price target of $29.80, suggesting 16.6% upside potential from current levels.

These are no wonder, due to INTC’s projected annual capital expenditure of $22.37B over the next two years, compared to $20.32B in FY2021. Its net debts may also grow by 32.9%, from $15.77B in FQ3’22 to $20.97B in FY2023. The company’s negative Free Cash Flow generation of -$13.31B over the last twelve months has also prompted a fellow contributor to anticipate a dividend cut by early 2023. Assuming so, we would likely see the stock further decline, testing its previous $20s support level.

As a result, we prefer to continue rating the INTC stock as a Hold. The thesis needs to be more convincing, despite the massive discount compared to April 2021’s peak of $66.73.

Disclosure: I/we have a beneficial long position in the shares of INTC, AAPL, NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.