Summary:

- Intel Corporation cut its dividend by two-thirds.

- The writing was on the wall due to Intel’s cash flow problems.

- Intel could be a turnaround play, but it is not certain that things will work out well.

Delmaine Donson

Article Thesis

Intel Corporation (NASDAQ:INTC) has cut its dividend dramatically in a move that seeks to preserve cash, as the company will be burning through billions of dollars this year, weakening its balance sheet further. The dividend yield has now dropped to a rather low level, and INTC surely isn’t attractive for income investors. INTC can be seen as a potential turnaround play, but we prefer other chip companies with better execution.

We Told You So

In our most recent article, we argued that Intel’s dividend could be in danger. And today, we have confirmation from the company: Intel cut its dividend by 66%, to $0.125 per share per quarter, or $0.50 per year. With INTC trading at $26 at the time of writing, that makes for a dividend yield of 1.9%. While that is still marginally ahead of the broad market’s dividend yield, a sub-2% dividend yield isn’t attractive for income investors, especially when there is little reason to believe that the dividend will grow meaningfully in the foreseeable future.

Why Intel Had To Cut The Dividend

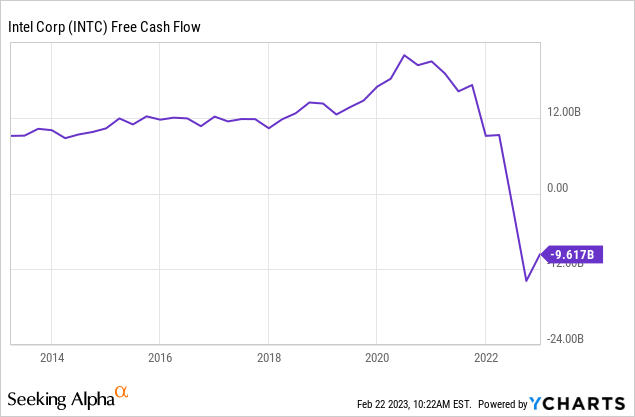

Intel used to be a highly profitable company that made many billions of dollars in cash per year:

For many years, Intel generated $10 billion to $20 billion in free cash flow per year, with capital expenditures, for maintenance and growth, already being accounted for. The company could thus spend billions of dollars on dividends and share repurchases, while it also made some acquisitions from time to time. Over the last year or so, that changed dramatically, however. Due to strong competition from Advanced Micro Devices, Inc. (AMD) and NVIDIA Corporation (NVDA), especially in the data center market, Intel has seen its profits come under pressure.

Execution problems, such as process delays, played a role here as well. At the same time, Intel has been spending more on more on capital expenditures, as the company seeks to become a major foundry player. While some see this strategy in a positive light, it is far from guaranteed that this venture will be successful, and it is pretty clear that this strategy requires hefty capital investments in the near term. This, combined with the profit (and thus operating cash flow) decline, has made INTC’s free cash flows drop dramatically.

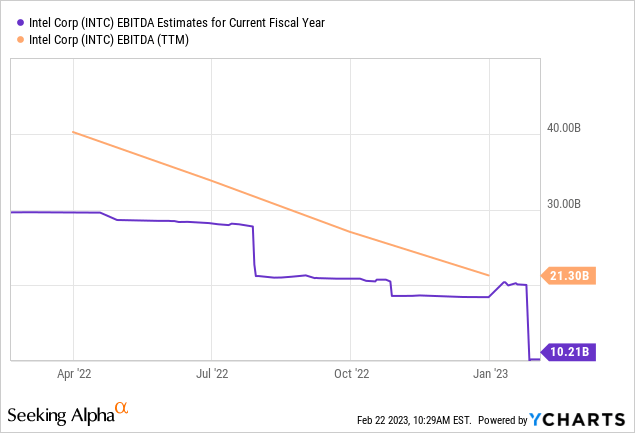

Over the last year alone, Intel has burned through $9.6 billion of cash, and its dividends and share repurchases are not even included in that number yet. And it looks like things will get worse in 2023, relative to Intel’s results in 2022. After all, Intel itself is forecasting that Q1 of 2023 will be its worst quarter in a long period of time, as Intel is expecting net losses, which had not been the case during any quarter of 2022. This is also reflected in analyst estimates:

Intel generated $21 billion of EBITDA last year — not a great result, but still much better relative to what is expected for the current year. Analysts are expecting that EBITDA will fall by more than 50% this year, to just $10 billion. It is thus likely that operating cash flows will take a big hit as well. They might decline by a number in the ballpark of $10 billion, based on EBITDA estimates for this year being $11 billion lower than for 2022.

Intel has spent an increasing amount of money on capital expenditures in recent years. If that trend continues, Intel’s free cash flow (“FCF”) number will come under even more pressure, as declining operating cash flows in 2023 would go hand in hand with rising capital spending. I believe it is likely that Intel will try to cut back on capital expenditures, but even if capital expenditures were to decline slightly this year, it seems pretty likely that Intel’s free cash flow will be worse than the -$10 billion number from 2022. If Intel had maintained its dividend at the old level, which cost the company around $6 billion a year, Intel could thus have burned through $20 billion to $25 billion in cash this year [$10 billion free cash burn in 2022 + $6 billion for the dividend + expected weaker FCF this year due to declining operating cash flows]. Burning through $20 billion of cash a year is not sustainable, not even for a large company such as Intel. One could thus argue that Intel’s hand was forced when it comes to the dividend cut decision — the weakening balance sheet required that Intel reduces its cash outflows, and reducing the dividend was an obvious choice for management, despite the fact that this has destroyed Intel’s dividend track record.

Based on the fact that Intel could still burn through $15 billion or more of cash this year, even following the dividend reduction [$11.5 billion at the 2022 FCF burn rate once we account for the lower dividend, plus the expected impact of weaker operating cash flows], the dividend reduction does not make Intel’s problems vanish. Instead, the cash burn will still be quite meaningful this year even though the dividend has been cut. This means two things:

– First, Intel might decide to cut the dividend again in the foreseeable future, to preserve more cash. I believe that it might have been a better idea to cut the dividend to zero — INTC has destroyed its dividend legacy no matter what, and it would have been done by now.

– Second, it is pretty clear that the balance sheet will continue to weaken this year. This, in turn, will increase risks and could discourage investors from holding onto their INTC position as they see the balance sheet get weaker and weaker.

Intel As A Turnaround Play, And Alternatives To An INTC Investment

Intel had been a strong performer for years, both when it comes to its operations and when it comes to total returns. Between 2013 and 2021, Intel delivered total returns of several hundred percent, which is quite attractive. But as execution problems mounted while the cash flow situation worsened, Intel has become an increasingly bad investment. Now, Intel is not attractive for income investors, and it seems questionable how attractive Intel is for value investors — after all, shares are trading for a hefty 48x this year’s forecasted net profit.

Instead, Intel seems like a pretty clear turnaround play here: if the company manages to turn things around, improve efficiency and margins, and gets its profits and cash flows up to historic levels, then Intel could be an attractive investment from the current level. But that is far from guaranteed, and even if it were to happen, we don’t know how long it will take for this to play out. I personally am not interested in owning Intel as a potential turnaround investment, at least until I see clear signs of improving operations and execution. For now, that is not the case — Q1 will likely be even worse than the previous quarter, which suggests that the nadir has not been passed so far.

Instead, I prefer to own AMD, one of Intel’s core peers. AMD is gaining market share in the extremely important data center market, has a clean balance sheet, generates strong free cash flows, and AMD trades at roughly half the earnings multiple Intel trades at today. A better company with fewer problems at a much better valuation seems like a good choice to me, relative to an investment in Intel.

Takeaway

Intel’s hefty dividend cut came as a huge surprise to some investors. But it shouldn’t have — the writing was on the wall. Intel’s many problems have not vanished, and the company will surely burn billions of dollars this year, even following the dividend cut. In fact, it is possible that the dividend will be reduced further, although that is, of course, not guaranteed. No matter what, Intel is not looking like an attractive income investment — other chip companies such as Texas Instruments (TXN) look far more attractive from that perspective.

Investing in Intel Corporation could work out well if INTC manages to turn around its operations, but I personally do not want to bet on that. That is why I opted for Intel’s better-performing peer, AMD, which has far fewer problems and which trades at a more favorable valuation.

Disclosure: I/we have a beneficial long position in the shares of TXN, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!