Summary:

- For those down in Intel, the wash sale rule might be your friend.

- The story regarding national security and semiconductors is still intact, becoming more important by the day.

- Intel still stands to be the primary beneficiary of US Chips Act.

David Silverman

The Wash Rule

For those of us that have been taking the long-term view on Intel (NASDAQ:INTC), it started as a dirt-cheap stock with a lot of potential in front of it. The stock circa 2020-21 fits all kinds of valuation metrics for a cheap stock. Discounted cash flow enthusiasts loved it, it had a low PEG ratio, traded near book value, and has gone in and out of being a Graham number stock. For some time, it even screened in the top 50 stocks in the entire stock market for high returns on invested capital plus a high earnings yield, following Joel Greenblatt’s Magic Formula system. Then CEO Pat Gelsinger took over and the numbers started to change.

The modus operandi Gelsinger was tasked with was to build out the domestic chip manufacturing infrastructure that would ultimately protect the US from a semiconductor shortage. This even came pre-packaged with a few 60 minutes pieces and a planned chips act to subsidize and induce the acceleration of fab production. However, excess capital expenditures and lower cash from operations created a negative free cash flow situation the likes of which Intel investors had never seen. This includes famed Value investor Seth Klarman who not too long ago held Intel as one of his biggest positions.

I am still an Intel long, but I hold about 80% of it less than I did. I still like the story and the capital expenditures are an anomaly, not the new norm. Once the fabs are complete, I would expect free cash flow to slowly get back to normal. In the meantime, cutting my position after the dividend cut lets me lock in my tax-deductible losses, wait 30 days, and re-assess. When you have a value stock that you don’t think is going anywhere anytime soon, the wash sale rule can be your friend. I don’t anticipate Intel will be going anywhere, anytime soon. If anything, I expect it to dip even further, making my buyback in even better. Intel stock is a hold, if you have losses, it might be a good time to take those and wait 30 days.

Abnormal Capex

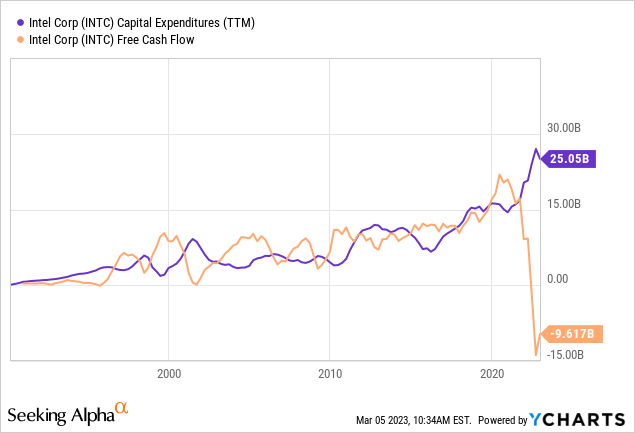

Before 2020, Intel’s Capex hovered under $15 Billion. Only post the new fab buildout phase do we see an abnormal jump in capital expenditures, which nearly doubled in a 3-year timespan. At the same time, you witness free cash flow also take an abnormal dip into very negative territory. Just after 2000 is the only time we see Intel get even close to touching the negative free cash flow line. In short, this is a historically abnormal blip for Intel.

With free cash flow being the resource of a company being able to pay its dividend, this massive cash sink created an insurmountable issue that resulted in Intel needing to shore up its cash position. This was inevitable. If capex continues to rise without offsetting increases in cash from operations, the dividend may need to be cut completely.

Debt, Capex and Cash From Operations

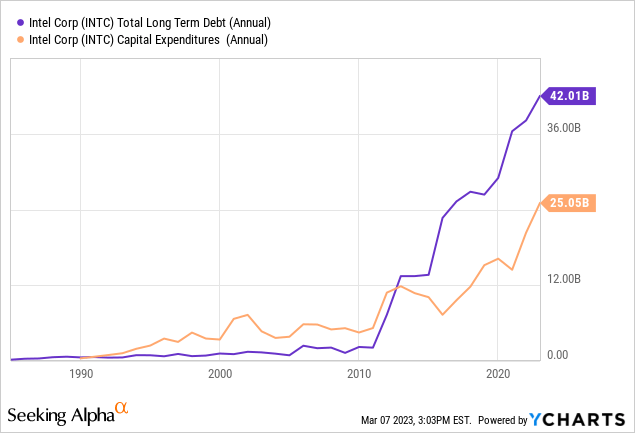

Firstly, the debt. Similar to the abnormal trend lines we observed in just capital expenditures alone, let’s extrapolate this to pit capital expenditures against total long-term debt. The two trend lines are certainly skyrocketing post-2020, with long-term debt now above $40 Billion when it consistently remained below $30 Billion for the past decade.

Standard and Poor’s cuts Intel’s credit rating for the first time since 1993. Uh oh, that’s the last thing you want when you increase the debt on your balance sheet. Corporate bonds on my brokerage screener that fit these criteria have a yield-to-worst of around 5.3%. Intel’s earnings yield is 7.5%. The last stated effective tax rate that Seeking Alpha shows for Intel is 8.5%. Using the interest rate X 1- tax rate, gets us a debt-based cost of capital of 4.84 %, certainly a better deal than selling shares which costs about 7.5% at the current yield. This may have been true in the trailing couple of years, hence the huge debt increases, but the balance sheet tells a bit of a different story.

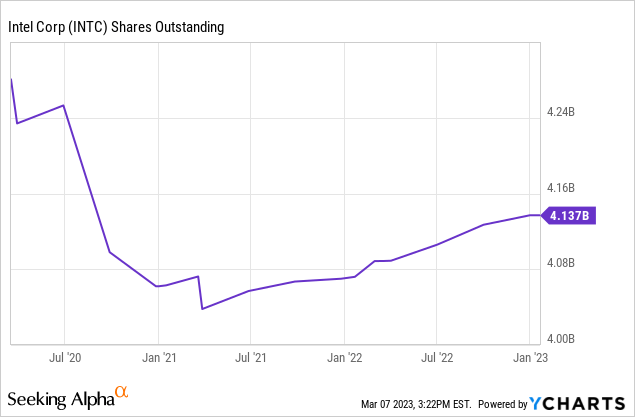

Intel is historically a crafty financial engineer. Buying back shares and maintaining a steady and predictable EPS guidance. Beginning in 2021, we can see that Intel began to supplement its cash from debt with cash from dilution. This tells me that internally, Intel knew in mid-2021 that the earnings yield on equity would most likely be cheaper than debt at some point in the near future, even at what we all assumed were low prices. This is because they knew the “e” in their e/p ratio (inverse of the p/e), was going to trend downwards.

The forward numbers on the Non-GAAP look atrocious. The sector median for GAAP forward earnings across the industry is in the realm of 25 X or an earnings yield of 4%. If this is the case, share issuance will soon be a cheaper option than debt issuance for every semi-producer, even as their shares appear cheap from a technical standpoint. With Jerome Powell set to raise rates even more than many had anticipated, I would expect some dilution in every semiconductor name.

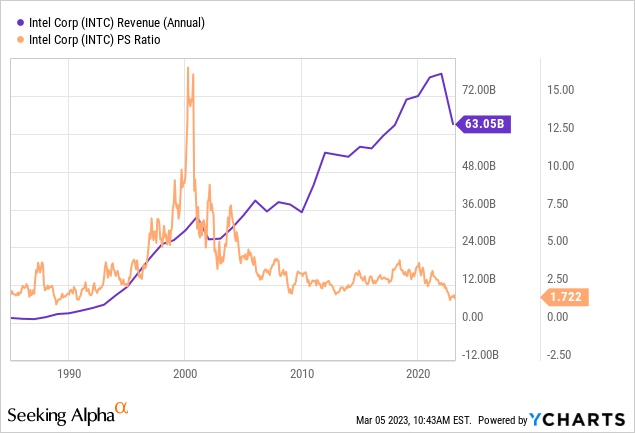

James O’Shaughnessy price-to-sales

Revenue is the lifeblood of earnings and free cash flow. We can see a tailing off in revenue rolling into 2023. The famed writer of What Works on Wall Street, James O’Shaughnessy states that the single-best value factor was a company’s price-to-sales ratio (P/S). Stocks in the 1.5 X and under category were the most desirable. With the crash in Intel shares but a still fairly stable revenue trend, we may hit that 1.5 number shortly. With TTM revenue at $63.05 Billion and 4.137 Billion shares outstanding, we get $15.24 in revenue per share. At 1.5 X, $22.86 would be a fair price on a price-to-sales ratio metric.

With the absolute destruction of Intel’s historically consistent free cash flow production combined with terrible forward guidance in earnings, price to sales is the last line of support for the value investor looking at Intel for the time being.

Catalysts

We’re still two years away from the Fabs being done, at least, with the first of the two Fabs slated to be completed in 2025. Anyone in construction financing also knows that almost nothing gets finished on time and on budget. To me, watching the construction progress is my number one focus. They are 9 months in at the Columbus plant, and Intel needs a comprehensive childcare plan for construction workers in place if they want to tap into government funding. A plan for child care seems like a strange catalyst, but a well-put-together one that is quickly accepted by the Federal government is the only near-term catalyst I see on the horizon.

Risks

The Chips act isn’t as good as we thought it would be:

Although no chip industry sources said companies would scrap expansion plans to build in the U.S., they grumbled about the U.S. Department of Commerce’s broad range of rules to receive funding, from requirements to share excess profits with the government to providing affordable child care for construction workers who build the plants.

Yes, that’s right, folks, the government could want a piece of the action should you get excess profits on these fabs. As many, including Intel, were looking to the Chips Act for assistance, this could make some of the financing covenants or convertibility aspects of existing capital in new fab construction less attractive. If Intel were to take government assistance, companies like Brookfield Infrastructure Partners (BIP), may need to re-consider all the terms of the deal and whether or not they still want to finance the original amount of up to $15 Billion. In the end, no matter how deep your pockets are, it’s hard to win a case against the Washington bureaucrats.

Conclusion

With the semiconductor industry as a whole not performing well during this cyclical downturn, this could be a good time to pick up your favorite names while they are out of favor. Intel is trying to pull something off that other chipmakers are not, being a fab leader. If they survive this fab buildout and start pumping out chips for other fabless companies, like NVIDIA (NVDA), what an amazing turnaround story it will be. If they don’t successfully finish these Fabs, supposing the cost of capital and a lack of free cash flow forces a construction shutdown, Intel will be obliterated even further. I am betting that they pull everything off with some government assistance. Still, I am waiting until at least April to buy back in and I am taking advantage of the wash sale rule. I’m licking my wounds and coming back to fight another day.

Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.