Summary:

- Intel delivered a shocking FQ1’23 guidance that left investors reeling and also caught Wall Street analysts off guard.

- Will Intel be able to mount a comeback against both AMD and TSMC? So far, the company has yet to prove its ability to execute that strategy.

- With macro headwinds intensifying, investors must consider the significant execution risks in its valuation.

- The crucial question persists: Can investors have confidence in CEO Pat Gelsinger’s ability to execute and improve INTC’s current valuation?

Alex Wong/Getty Images News

We have seen several disaster stories reported across the media outlets, from Bloomberg to the WSJ, to Barron’s, to Wall Street analysts slamming Intel Corporation’s (NASDAQ:INTC) “disastrous” FQ4’22 earnings release.

To be sure, Intel’s FQ1’23 outlook underperformed the Street’s projections massively. So, what now?

Management highlighted that downstream inventory digestion is expected to continue through H1’23. However, it expected H2’23’s performance to improve markedly, coupled with the recovery of its China market exposure and enterprise spending.

As such, the revised consensus estimates suggest a delay in its revenue recovery from a bottom in the quarter that ended in December 2022 to June 2023’s quarter. Moreover, Intel’s stunning adjusted gross margin projection of 39% for FQ1 is also expected to be its low, with a recovery from FQ2.

Let’s be clear about this. Saying Intel’s guidance was poor is an understatement. One Wall Street analyst on the earnings call even accentuated:

We never thought we’d see a 3 handle on your gross margin. And so we really want to know what it’s going to take to get back to a 5 handle, and if that’s significantly changed from the last framework that you provided us. (Intel FQ4’22 earnings call)

So, let’s take nothing away from Intel’s shocking guidance that stunned even the most pessimistic projections from Wall Street analysts as they revised Intel’s average adjusted gross margin projection down from 46% previously.

However, investors following the malaise in downstream consumer electronics should not have been surprised.

In a recent December article, we updated investors highlighting that we don’t expect a recovery in H1’23. Hence, investors shouldn’t be flabbergasted about the substantial revision of its guidance.

Why? Intel is still the consumer and data center segment market leader! As such, if the broad market is not expected to perform well through H1’23, why should we expect Intel to outperform? Does it even make sense?

Commentary from leading notebook ODM (including for Apple (AAPL)) and white-box server manufacturer Quanta Computer was in line with Intel CEO Pat Gelsinger & team’s outlook on the PC and server market. Quanta Computer Vice Chairman CC Leung stressed:

In theory, the market should recover in the second half of 2023, but not likely to the level of 2021. While sales in the second half of 2023 should be better than those in the second half of 2022, recovery will be limited. The year 2023 will not be a good year for the IT industry. Based on the information so far, interest will need to be stabilized for a while to ease global inflation, and for US Federal Reserve to cut back the interest rate. The server industry should grow faster than others, depending on when the economy improves. Cloud service providers need to be profitable before making heavy investments for expansions. Regardless, as demand for data increases, the industry will continue to see accelerated growth. – DIGITIMES

So, Intel investors need to tide through a very tough H1’23 before anticipating a recovery in H2. We explained why Intel’s Sapphire Rapids launch could help the company to at least mitigate its recent market share losses against arch-rival AMD (AMD).

It’s not a secret that Intel is expected to continue losing market share against AMD. Therefore, investors and analysts have likely reflected market share loss headwinds against Intel.

The critical question is whether Gelsinger’s optimism about mitigating that decline could start with Sapphire Rapids? Gelsinger highlighted:

I think the most important thing is what we just did with Sapphire Rapids, right? Our customers were anxious for a great product from Intel. And the other thing, as we’ve indicated, is we re-won our customers’ confidence that they could bet on our road map. And then we’ll ramp it [up] looking very healthy for later this year. Granite Rapids and CR4 [are] looking very healthy for next year. And all of those, I believe, are rebuilding our customers’ confidence. And I believe with that, given the massive incumbency that Intel has, and I would just emphasize that even though we have seen the share shift in recent sell-in, the installed base is Intel, right? (Intel earnings call)

That’s right. Intel is still the market share leader. Yes, it has lost its edge against AMD and TSMC (TSM). Regaining leadership on the design and process manufacturing front concurrently is an immense challenge. But that’s what Intel has to execute to return leadership back to Intel investors, and not one that Gelsinger is shying away from.

We are not disputing that Intel’s roadmap remains highly challenging, and its execution is fraught with tremendous uncertainty. But, investors need to ask whether these headwinds have been contemplated since the market is forward-looking.

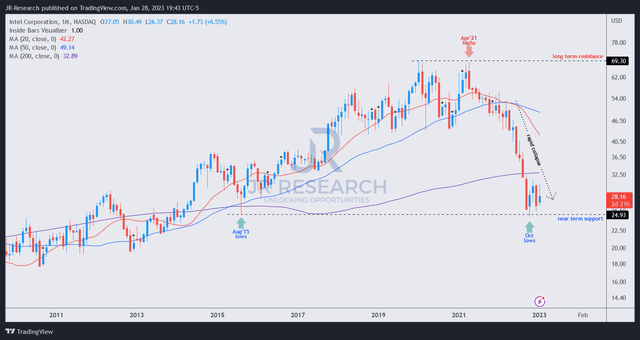

INTC price chart (monthly) (TradingView)

INTC’s long-term price chart remains constructive, given the massive collapse to form its October lows. Hence, the market has already anticipated Intel’s malaise, with October lows taking out August 2015 lows, forming an astute bear trap.

While we are not expecting a quick recovery back toward its 2020 highs, there’s no need to. Why? The question is always about reward/risk.

INTC fell nearly 65% from its 2020 high to its October bottom. But, for INTC to gain 65% from its October lows, it needs to recover only the $41 price levels last seen in June/July 2022.

I believe for bottom-fishers who picked their October lows, even a 50% gain is more than adequate to cut exposure/take profits by pricking the market’s extreme pessimism.

From what we gleaned, if INTC’s massive disappointment from its FQ1 guide couldn’t force the selling to untether its October lows, we believe the bottom is already in. Therefore, the recent pullback that savvy investors were waiting to pick is here for the taking.

Rating: Buy (Revise from Hold).

Disclosure: I/we have a beneficial long position in the shares of AMD, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!