Summary:

- Intel is facing significant challenges in the near-term as its financials are quickly deteriorating and the company is struggling with macroeconomic headwinds.

- Intel has had a terrible decade in which it faced many technical challenges, resulting in it falling behind the competition.

- While the recently released financials were once again horrible (as was the outlook), Intel does look like its on schedule regarding its product releases and technological progress.

- While the thesis is overly negative, government incentives and new node releases are positives for Intel. The company also still holds a significant position in the PC x86 CPU market.

- In my eyes, the future remains highly uncertain. There seems to be a lot depending on the success of the ambitious turnaround resulting in significant operational risks, making it a risky investment.

4kodiak

Introduction

Over the last several months I have initiated coverage of multiple semiconductor companies on Seeking Alpha and the story with most of these companies was one of stellar outperformance over the last decade. Take Nvidia (NVDA), Broadcom (AVGO), and AMD (AMD) for example which have returned 6500%, 1600%, and 2900% over the last decade, respectively. The semiconductor industry has seen stellar performance driven by the digitalization trend and secular drivers such as cloud computing, AI, VR/AR, and industry-wide digital acceptance. The good news for investors is that this trend is far from over and the semiconductor industry will most likely have to double again in product output over the next decade to satisfy demand.

Despite the incredible growth of the semiconductor industry, there have also been significant underperformers and the most pronounced one is dotcom bubble survivor Intel Corporation (NASDAQ:INTC). Intel has returned only 31.6% to shareholders (excluding dividends) over the last decade and therefore underperformed the SP500 index (SPY) which grew 168% over the same time period. Still, Intel is not just any semiconductor company, but has been the world’s top for many decades and was founded in 1968 by Robert Noyce and Gordon Moore (known for Moore’s law). For those unfamiliar with Intel, although unlikely, a lot will become clear about the company over the course of this article, but here is a quick overview:

It is the world’s largest semiconductor chip manufacturer by revenue and is one of the developers of the x86 series of instruction sets, the instruction sets found in most personal computers (PCS). Incorporated in Delaware, Intel ranked No. 45 in the 2020 Fortune 500 list of the largest United States corporations by total revenue for nearly a decade, from 2007 to 2016 fiscal years.

Intel supplies microprocessors for computer system manufacturers such as Acer, Lenovo (OTCPK:LNVGY), HP (HPQ), and Dell (DELL). Intel also manufactures motherboard chipsets, network interface controllers and integrated circuits, flash memory, graphics chips, embedded processors and other devices related to communications and computing.”

The products manufactured by Intel are most known for their use in personal computers, but also expose Intel to several high-growth industries like cloud computing, which is an important revenue driver for Intel.

Intel product portfolio (Intel)

So, why did Intel underperform all its semi peers? The company faced several challenges over the last decade that led to its decline in performance. Some of the reasons include:

- Competition from Advanced Micro Devices (AMD): Intel faced stiff competition from AMD, which was able to deliver more advanced and powerful chips at a lower cost.

- Manufacturing Issues: Intel faced several manufacturing issues that resulted in production delays and reduced chip performance. This impacted its ability to deliver competitive products to the market and resulted in it falling behind the competition which benefitted from the incredible technical dominance of TSMC (TSM). In many aspects, Intel still significantly lacks manufacturing technology performance compared to TSMC and Samsung (OTCPK:SSNLF), leaving its products trailing the competition or being delayed for months or even years.

- Struggles in the Data Center Market: Intel also faced challenges in the data center market, where it faced increased competition from both established players and new entrants and significantly lost market share to, again, AMD.

These challenges have impacted Intel’s market share, financial performance, and reputation, leading to disappointment for its investors and customers. However, the company has been working to address these challenges and has made some progress in areas such as manufacturing and data center chips. Its relatively new CEO – Pat Gelsinger – introduced his very own reinvention plan which has to put the company back on track and back to expanding its portfolio and financials.

Yet, the reinvention plan from Intel has not really shown good results so far, and the latest quarterly results reported by the company disappointed investors as the company is seeing an accelerating decrease in financial performance, far worse than expected by analysts and partially driven by a continued loss in market share and macroeconomic circumstances. Intel reported EPS of $0.10, 50% below the consensus. Meanwhile, revenue also missed by $490 million as Intel saw revenue decelerate further by 28.2% YoY.

Intel seems to have ended up in a never-ending stream of negativity driven by a horrible operational and financial performance, multiple failed promises by management, and significant market share loss to primarily AMD. The negativity among analysts and investors seems justified as Intel is far from its once untouchable position. Even more, the ambitious reinvention plans by management focused on regaining its dominance in semiconductor manufacturing and attempting to take market share from Samsung and TSMC, is resulting in extremely high Capex to build new facilities on both the European and North American continent. With Intel barely reporting any free cash flow over the last year or so, this is looking increasingly bad for both the balance sheet and the very important dividend safety. A possible dividend cut is a worry on many investors’ minds and a drag on the share price in addition to being a serious possibility.

Still, to also bring on some positivity in this introduction, Intel is seeing significant financial tailwinds from government incentives and tax breaks by both the EU and the US, possibly bringing down Capex expectations. In addition to this, its recently released products at least seem to be somewhat more competitive compared to rival AMD.

Now, within this article, I will take a look at the current position of Intel by looking at its fundamentals, future growth plans and expectations, outlook, and putting its recent financial performance into perspective. Is it really that bad or could the current low share price offer a good turnaround buying opportunity in this large-cap semiconductor company?

Let’s dive in and see for ourselves.

IDM 2.0

I already mentioned the turnaround plan introduced by Pat Gelsinger which is called IDM 2.0. This plan is supposed to bring on better times for Intel by focusing efforts on a couple of areas combined with cost-saving initiatives. One of these focus areas for Intel is Intel Foundry Services which is supposed to open Intel up to the very lucrative foundry industry where TSMC and Samsung are currently the leading companies. This means that Intel plans to start producing semis in its foundry facilities for other companies and not just its own semi(conductor) products. Intel wants to start competing with the above-mentioned industry giants and wants to distinguish itself with manufacturing primarily in the US and Europe whereas most semiconductor manufacturing currently happens in Asia. This, of course, positions Intel favorably towards the tax incentives from both the EU and the US. It is therefore called the most important play for US semi manufacturing with neither TSMC nor Samsung planning to move a lot of manufacturing to the US due to higher costs.

In order to start competing in the foundry business, Intel plans on building new fabs in both Arizona and Germany. This will require tens of billions of dollars in investments from Intel but is supported by the government. Each location should at least see 2 new factories build over the next several years, but the total could be expanded to 8. The partnership with ASML to supply the most advanced EUV equipment will play a crucial role in this transition for Intel. Intel already has a deal to receive the new high-NA EUV machines from ASML (ASML) by 2026.

It is exactly this, the use of EUV, or actually the rejection of it, that has turned out to be a drag on Intel’s technological deterioration over the last decade. Whereas TSMC partnered up with ASML to develop EUV technology, Intel decided that they did not think the technology was mature enough and started searching for their own solutions. By now we know that this has not worked out for them. As a result of this decision, it took Intel 6 years instead of two, to transition from 14nm to the 10nm node and made it fall way behind TSMC and Samsung from a technological perspective.

To catch up with the competition, Pat Gelsinger redesigned the product roadmap from Intel and planned to release 5 new nodes between 2021 and 2025. A rather ambitious plan, but also a necessary one.

So, in summary, Intel plans to massively increase its semiconductor production capacity to become “the semi manufacturer of the west” and compete with TSMC and Samsung. In addition to this, the company wants to catch up with the competition in CPU and GPU technology by increasing the number of product releases until 2025. The plans are ambitious, challenging, and will cost serious amounts of capital investments. Add to this a decreasing macro environment with weak consumer spending as a result and we can see why Intel is struggling with its performance.

Now, with this conclusion, let’s jump to the latest earnings results.

Quarterly and FY22 financials

As said before, Intel dramatically missed analyst estimates when it released its 4Q22 results. EPS missed by 50% and came in at just $0.10. Revenue was $14 billion and was down 28% YoY (using non-GAAP numbers). Results eventually came in at the low end of guidance as macroeconomic impacts came in worse than anticipated before. And to start with the bad news, management does not necessarily see any near-term improvement. Intel expects the current weakness to remain volatile for at least the first half of the year, with possible improvements by the second half. This is what management commented on the quarterly results and FY22 results:

Despite the economic and market headwinds, we continued to make good progress on our strategic transformation in Q4, including advancing our product roadmap and improving our operational structure and processes to drive efficiencies while delivering at the low-end of our guided range. In 2023, we will continue to navigate the short-term challenges while striving to meet our long-term commitments, including delivering leadership products anchored on open and secure platforms, powered by at-scale manufacturing and supercharged by our incredible team.

Specifically, the bad quarterly results were driven by significant weakness in both its cloud and PC segments. Intel reports revenue across six different business segments being:

- Client computing group (CCG)

- Data center and AI (DCAI)

- Network and Edge (NEX)

- Mobileye (MBLY) (with Intel owning a majority interest in the company after the spin-off, the revenue is still reported in its financial results)

- Accelerated Computing Systems and Graphics (AXG)

- Intel Foundry Services (IFS)

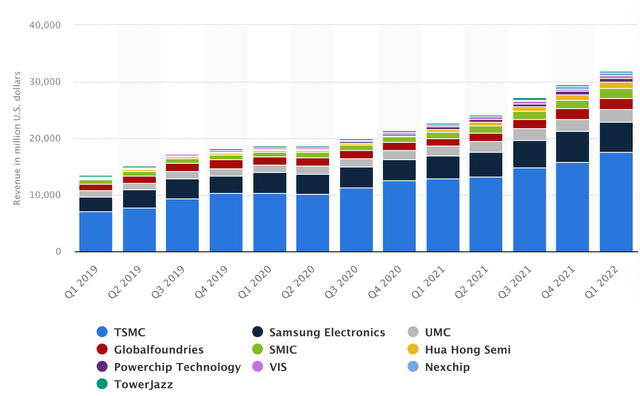

The image below shows just how each individual segment performed over 4Q22 and FY22.

4Q22 financial results (Intel)

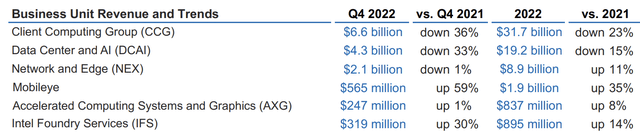

The weak performance in the CCG segment was due to lower consumer spending resulting in a drop in PC sales which eventually came in lower than previously projected by management. And still, despite the already serious drop in 2022, management said during the earnings call that customer inventories remain elevated, and this will need to be corrected over the first half of 2023, so we should not expect a serious improvement in performance from CCG anytime soon. As shown by the image below, revenue for the segment is at a multi-year low.

Intel quarterly CCG revenue (Statista)

Still, it was especially the cloud weakness that surprised me. Yes, a slowdown was imminent, but the results from Intel were really bad compared to the performances from peers AMD and Nvidia. Intel is witnessing a significant slowdown in data center CPU demand.

Some of the smaller segments from Intel did perform well and saw revenue grow during both the recent quarter and FY22. Still, this was not able to offset the significant decline in the two largest segments of Intel.

The gross margin for the 4Q22 did come in higher than anticipated by Intel and was 44%. Still, this was down 12.1 percentage points compared to the same quarter last year. EPS missed significantly due to lower-than-expected revenue and increased inventory reserves. Operating cash flow for the quarter was $7.7 billion and minus Capex of $4.6 billion, this resulted in a free cash flow of $3.1 billion.

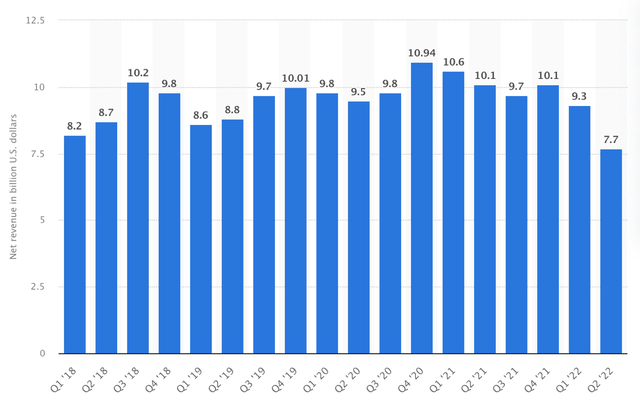

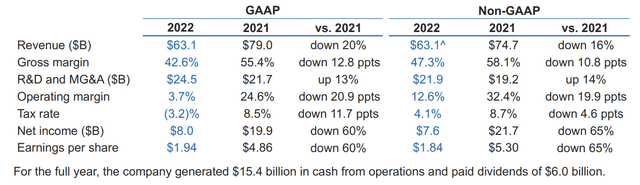

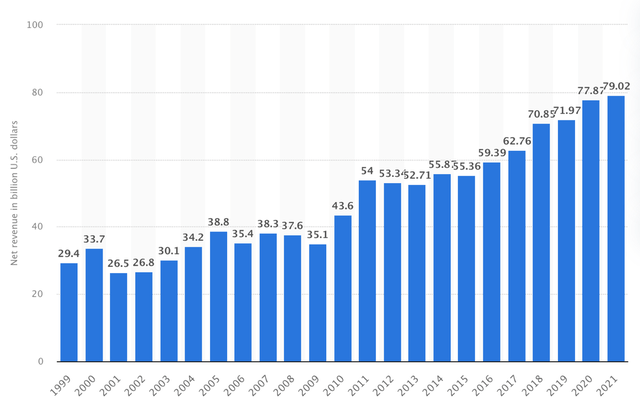

With the $14 billion in revenue reported in the fourth quarter, Intel reported FY22 revenue of $63.1 billion. As shown by the graph below, revenue for FY22 was significantly below its recent years and the lowest since 2017.

Intel financial results FY22 (Intel) Intel revenue growth (Statista)

The gross margin for the full year was 47.3% and EPS came in at $1.84. Whereas Intel already guided for negative free cash flow (of $1 to $2 billion) at the start of the year as a result of the high Capex needs for its turnaround plan, Intel eventually reported a negative free cash flow of $4 billion. This was despite it already shifting $3 billion in investments to 2023.

All in all, 4Q22 was bad as the impact of the economic weakness came in worse than anticipated and FY22 in general was not much better with the company reporting significantly worse numbers than anticipated and significant slowdowns compared to previous years. As Wall Street analysts have put it – the deterioration of the financial performance is stunning and much worse than expected.

Quarterly developments

With Pat Gelsinger trying to turn the business around, very solid numbers were not expected and current shareholders are most likely not invested in Intel with the expectation of great financials anytime soon. Therefore, maybe even more interesting with the release of the quarterly results is the earnings call that follows it, which can supply us with crucial information about underlying developments, expectations, and performance of the business.

Pat, indeed, illustrated that the quarter’s results came in much lower than anticipated, and for 2023, they do expect the same for the first half of the year. Therefore, Intel increases its focus on achieving $3 billion in cost savings in 2023 to partially offset the business weakness and make the business more resource effective. This is part of a larger cost-saving program as part of the IDM 2.0 strategy.

As for the product roadmap, importantly, Pat made the following comment during the earnings call:

Our progress against our TV road map continue to improve throughout calendar year 2022 and every quarter, our confidence grows. We are at/or ahead of our goal of 5 nodes in four years.

Intel 7, Intel’s 10nm node, is now finally in high-volume manufacturing for both client and server products. Products on this node offer 10-15% better power capacity and should increase power efficiency, making Intel more competitive compared to its main rival in both PC and datacenter, AMD. Still, AMD is already building its newest chips on the latest technology from TSMC which involves 7nm, 5nm, and even 3nm.

Now, to give you some background information, the size of the node is crucial when it comes to the performance and energy efficiency of the semi(conductor) product. A smaller node size allows for faster transistor switching speeds, lower power consumption, and improved thermal performance. This results in faster, more powerful, and more energy-efficient chips. This is the primary reason that companies such as AMD and Nvidia, which design high-performance CPUs and GPUs, outsource their manufacturing to TSMC as this company currently produces the smallest nodes by leveraging its decade-long extensive partnership with ASML.

With this in mind, it is easy to conclude that technological progress for Intel will determine the future success of the business. It is then good to hear that Intel confirmed during the earnings call that also Intel 4 (Intel’s 7nm node process) is ready for manufacturing, and we should see its Meteor Lake CPU being ramped up in the second half of the year after being postponed multiple times before. This one will be followed by Lunar Lake which will be optimized for ultra-low power performance to enable smaller and more powerful PCs, coming out in 2024.

In addition to these two nodes being finally well underway, Intel 3 development is also on track. As a result, Intel believes it is well underway to regain its transistor power and performance leadership. An important move to accomplish this is the launch of Emerald Rapids by the second half of 2023, Intel’s new generation chip for data centers and high-performance computing. The road map for Intel looks strong, although a lot is still very unclear and performance numbers remain a large question mark and the competition is also not sitting back. At least Intel looks like it’s on course to achieve the ambitious targets it had set for itself. This is how CEO Pat Gelsinger summarized the expected releases for the following years:

We will, one, deliver on five nodes in four years, achieving process performance parity in 2024 and unquestioned leadership by 2025 with Intel 18A. Two, execute on an aggressive Sapphire Rapids ramp, introduce Emerald Rapids in second half 2023 and Granite Rapids and Sierra Forest in 2024. Three, ramp Meteor Lake in second half 2023 and PRQ Lunar Lake in 2024, and four, expand our IFS customer base to include large design wins on Intel 16, Intel 3 and 18A this year.

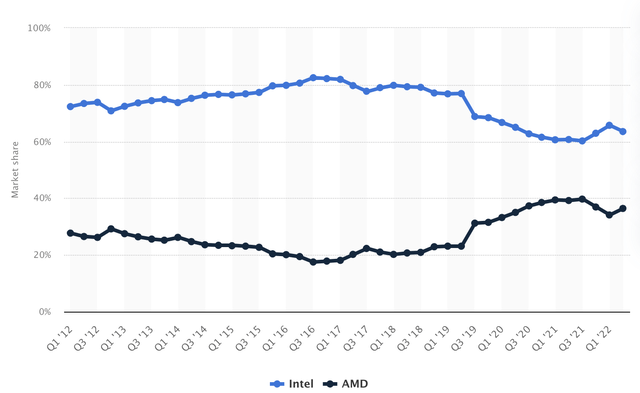

We should not forget that, while Intel has had a tough decade that resulted in losing market share to AMD, the company is still dominant in the PC segment with its data center segment also gaining share. As of the second quarter of 2022, Intel held a 63.5% market share in the x86 computer CPU market.

PC X86 chip market share between Intel and AMD (Statista)

Outlook & Valuation

Now let’s move on from the FY22 results and technological developments to the expectations for the first quarter of FY23 and see what we should expect. Let’s start with a quote from the earnings call:

We expect macro weakness to persist at least through the first half of the year with the possibility of second half improvements. However, given the uncertainty in the current environment, we are not going to provide revenue guidance beyond Q1.

This is not a good sign, but I am happy with this decision from management. Consistently underperforming your own consensus is not much better. For 1Q23, Intel guided for revenue of between $10.5 billion and $11.5 billion, showing continued weakness and another significant drop YoY. Intel expects its customers to burn through inventory at a much faster pace compared to prior quarters, impacting the sales of Intel itself. And even despite an expected $3 billion in cost savings, Intel expects that the decline in revenue will cause another quarter of negative operating margin. Intel expects to report a gross margin of 39% and a negative EPS of $0.15 showing even further deterioration of the bottom line. Total operating expenses for FY23 should come in under $20 billion, a 10% decline YoY. Honestly, Intel does not have much choice on this front as margins are incredibly weak, leaving no room for excessive investments.

In closing, we remain committed to the strategy and long-term financial model we laid out at Investor Day last year. The opportunity for strong revenue growth across our business unit portfolio and free cash flow at 20% of revenue remains. While we’re not satisfied with near-term results, this market downturn represents an opportunity to accelerate the transformation necessary to achieve our long-term goals. I look forward to providing updates on our transformation journey as the year progresses.

So, in short, Intel guides for a horrible Q1 which is also far below the consensus estimate prior to the earnings release. Wall Street analysts predicted revenue of $14 billion for 1Q23 with EPS of $0.25. Yes, this is some difference and explains why the stock dropped as much as it did in the hours after the market closed.

By now, analysts how downwards revised their expectations for 1Q23 and now expect revenue of $11.22 billion, on the higher end of management’s guidance, but still almost a 40% decrease YoY. EPS expectations are for a negative EPS of $0.14. For FY23 analysts now guide for revenue of $50.86 billion (a decrease of 19% YoY) and EPS of $0.54 (a decrease of over 70% YoY). Analysts expect a slight increase by the second half of the year to result in at least positive EPS for Intel.

That 2023 is going to be a bad year for Intel does not seem to be something to question as the macroeconomic outlook for Intel remains challenging and the company continues to significantly invest in its turnaround plan. Yet, when the economy will start recovering by 2024/25, we should see financials improve meaningfully for Intel as well and this is illustrated by current analyst expectations.

Intel EPS estimates (Seeking Alpha) Intel revenue estimates (Seeking Alpha)

As visualized above, analysts expect a significant increase in financial performance for Intel after the current year. Still, revenue is not expected to recover to 2021 levels until 2027.

What does this mean for its valuation? Well, as shown above, Intel is currently priced at a FY23 P/E of 51, but this is not a fair metric to use with profitability far below its average levels due to weak revenue growth and high Capex numbers. If we were to take a recovered 2025 EPS, we can see that by current expectations, this results in a P/E of 10. If Intel were to achieve its targets set by 2025 for both product releases and Foundry Services, Intel could easily earn a 15-20x P/E by then, making the company better value from this standpoint. Yet, this involves incredibly high risks and requires a successful turnaround plan which is not something that is easily achieved.

Intel does receive an A-grade for its valuation from Seeking Alpha. As for comparison, 41 Wall Street analysts currently maintain a price target of $28 per share, pretty much on par with its current share price and representing no upside. This is combined with a hold rating.

I believe it is fair to say that Intel is currently not cheap nor very expensive and trading around fair value. Still, this highly depends on the success of its turnaround plan and developments over the next several years.

Balance sheet & Dividend

Intel currently holds a total cash position of $28.34 billion which allows it to take a financial punch and plenty of cash to invest in the business. On the other side, it also holds a significant debt position of $42.47 billion. With Intel unable to generate a positive free cash flow, this is not looking overly comfortable, and increasingly so when considering the high interest rates and high payout of the dividend.

Intel needs to pay $1.5 billion in dividends each quarter to support its current payout. This means it spends $6 billion a year on dividends. Intel has a dividend yield of 5.25% which is great for dividend income investors. What is not so great is that the significant drop in revenue and cash-generating abilities of the company have resulted in a payout ratio of almost 80%, bringing on a lot of dividend safety problems. Multiple extensive articles were already written about this subject which you can find on Seeking Alpha, but overall, it is not looking great for Intel. Cutting the dividend would be another slap in the face of its investors. Cutting the dividend will probably be the last option for Intel to save money, but it might have to if the business fundamentals and economic outlook do not improve rapidly enough.

From a financial perspective, I would be urged to say that it would be a good move by Intel to cut the dividend in half and save an additional $3 billion a year. From the investor’s perspective, this is absolutely not the case. What do you think? Should Intel cut the dividend to focus its resources on reclaiming its technological leadership or is the dividend too important?

One thing is for sure – cutting the dividend will result in another significant drop in share price. Ironside Research recently wrote a thorough article about the risk of a dividend cut which I recommend reading for more of a deep dive in the dividend sustainability.

Some positives

So far, the narrative of this article is quite negative, and for good reasons. Financially, the company is in no great position and meanwhile, the business fundamentals seem to be deteriorating at a stunning pace driven by macroeconomic weakness and market share loss due to production flaws over the last 5 years.

Despite all the negativity, I also believe there are some positives that could cause some positive surprises or tailwinds. One of these is the incentives being offered by both the EU and US governments. In the US, the Chips Act is designed to bring semiconductor development and manufacturing to the US instead of Asia and Intel looks like the best candidate to bring home a lot of these incentives with its plans to build fabs on these two continents. According to sources from Reuters, the number of government incentives could come in higher than $20 billion for Intel. Intel itself has said that it expects to receive $3 billion in incentives from the US government for each fab the company builds in the US. These incentives offer a solid tailwind for Intel that is trying to bring manufacturing back to these continents. Eventually, the point of building these fabs on these western continents should benefit Intel when acquiring clients from both TSMC and Samsung. Several fabless semiconductor companies have already stated that they might prefer to have their designs manufactured in the US or Europe to see less geopolitical risk.

In addition to the challenge of catching up to current market leaders, it will also cost Intel gigantic amounts of dollars to get to where it wants to be. For example, Intel has confirmed that it plans to invest over $88 billion in Europe alone to expand its semiconductor manufacturing and research on this continent. The centerpiece will be found in Magdeburg, Germany, and will be a “megafab”. The first investment will be worth $19 billion to build the facilities, but a lot more will be invested in the decade after to expand the facilities and get them operational.

The effort from Intel on this front will open it up to the highly important semiconductor foundry industry which is projected to grow at a 6.5% CAGR until 2030 to reach a market size of $183 billion. TSMC currently controls over 50% of this market due to its technological advantage.

In addition to the foundry business, Intel also still holds a strong position in the PC market as shown in an earlier graph. And while the PC market will not be a massive growth driver with only a 1.81% CAGR until 2026, the strong market share Intel has does offer it a solid cash stream to fund its other projects such as foundry expansion and cloud computing & AI. We should expect PC hardware sales to bounce back when the economy recovers, and this will once again boost sales and cash flow for Intel again. In addition to this, with Intel on schedule regarding new product releases, Intel might be able to stop the loss of market share vs AMD. Yet, this is still to be seen as Intel will need to make sure they make their own targets and ensure that the new chips are competitive vs AMD.

Exposure to high growth markets such as cloud and AI can also become revenue drivers for Intel, but this will, again, depend on whether Intel can meet its product release targets and remain competitive vs other semi companies like AMD and Nvidia that are heavily investing in these markets as well.

Conclusion

So, what can we conclude from all the information discussed in this article? The first and most obvious takeaway is that Intel is currently in a really bad position. It is simple as that. The current bad position is due to a combination of factors of which the primary one being a deteriorating macroeconomic environment resulting in falling revenue for Intel. And while this will only be temporary, the combination with high investments in its turnaround plan caused Intel to report a weak or even negative bottom line which then causes bad EPS results, a weakening of the balance sheet, and a threat to the dividend safety.

The outlook given off by management for the first quarter of 2023 was no reason for much positivity either as it came in far below the consensus and guides for a staggering 40% decrease in revenue YoY.

It will be crucial for Intel to meet its own product release targets and deliver solid products that can compete with the likes of AMD and Nvidia. Whether Intel will succeed will remain a large question mark as it still holds a lot of uncertainties regarding product performance and its ability to take market share in foundry. While the setup for Intel is not horrible, the timing of its turnaround plan is rather bad with its once reliable revenue stream falling away due to a tough macro environment.

We should expect Intel to significantly improve its bottom line again once the economy recovers and start generating significant amounts of cash again as it has done for many years. This will give Intel more breathing room to increase its investment plans and easily pay its dividends to reward shareholders.

Yet, the question is in what state the company will be by that time and if it can manage without cutting the dividend.

All in all, I view Intel as a very risky investment as a lot of its ambitious plans are highly uncertain in their ending. I do appreciate the plan laid out by Intel and believe that if it works out, this could initiate new growth for many decades to come. This makes Intel an excellent investment for the investor that is willing to take the risk in this tech giant and believes in the plan of Pat Gelsinger.

For me right now, there are simply too many question marks and operational risks here to award the company a buy rating and I believe it’s better for investors to stay on the sidelines until the environment for Intel improves and the company gets back to reporting growth and a more solid bottom-line. Also, I am very curious about the product releases from Intel over the next several years and to see how competitive they can really be with both Intel 7 and Intel 4 finally here.

For now, I rate this semiconductor giant a hold as it looks fair value considering all circumstances. A sell rating does not seem necessary anymore considering the current share price and valuation. If you already own the shares, I see no direct reason to sell now. I do recommend investors to keep this one on the watchlist and look for a better moment to initiate a position – probably once most uncertainties are cleared.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.