Summary:

- Over the last decade, Intel’s revenue grew at a CAGR below 2% which is by far behind growth pace of the semiconductor industry indicating the company is losing market share.

- Intel announced a reduction in its quarterly dividend by about two thirds due to weak PC demand, competition from AMD, and ongoing execution issues leading to market share loss.

- Valuation analysis suggests the stock is significantly undervalued, but I prefer to stay on the sidelines.

Justin Sullivan/Getty Images News

Investment thesis

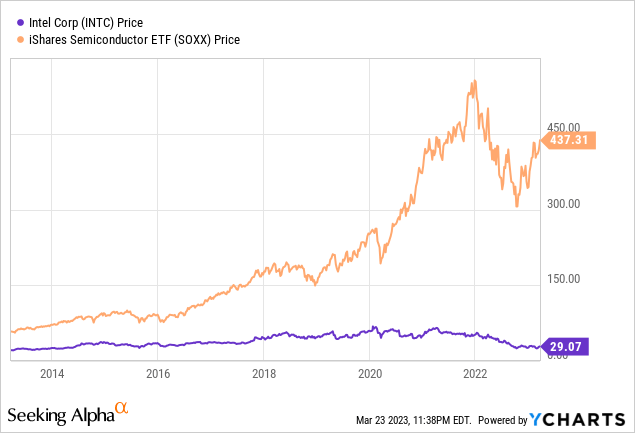

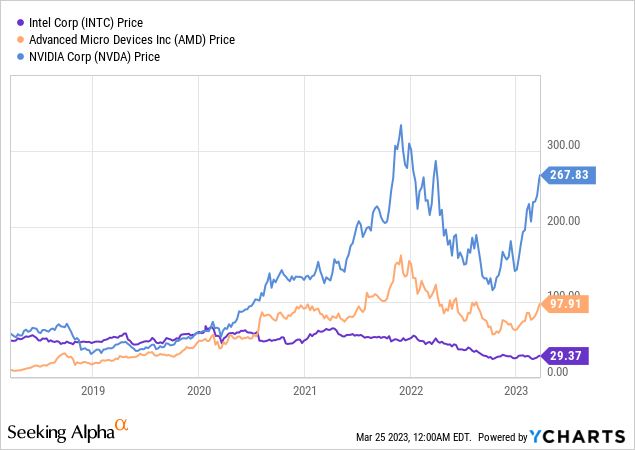

According to statista.com, global semiconductor market size grew from $305 billion in 2013 to $580 billion in 2022 which indicates a 6.6% CAGR. During the same period, Intel (NASDAQ:INTC) delivered 1.8% top line CAGR falling significantly behind the industry pace. The company has been rapidly losing market share to Advanced Micro Devices (AMD) in recent years. Despite my valuation calculations suggest that the stock is undervalued, I believe that risks significantly outweigh potential benefits here. For me it is not surprising that the stock price gained almost nothing over the past decade compared to broader semiconductor ETF.

Company information

Intel Corporation is a multinational technology company that designs and manufactures microprocessors and other computer components. Intel has a strong presence in both the consumer and enterprise markets. In the consumer market, its products are found in a variety of devices, including laptops, desktops and tablets. In the enterprise market, Intel’s processors and other components are used in servers, data centers and other high-performance computing applications.

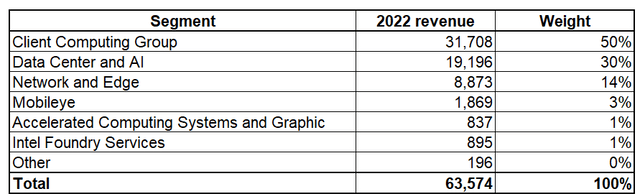

The company manages its business through six operating segments presented in the table below.

Author’s calculations

Financials

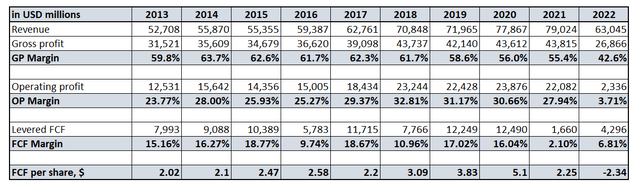

I have started financials analysis by zooming out and looking at major trends in the company’s financial performance over the last decade. What captured my attention is a very modest 20% cumulative increase in revenue over 10 years, which means a CAGR of below 2%. Margins also deteriorated significantly over the last decade.

Author’s calculations

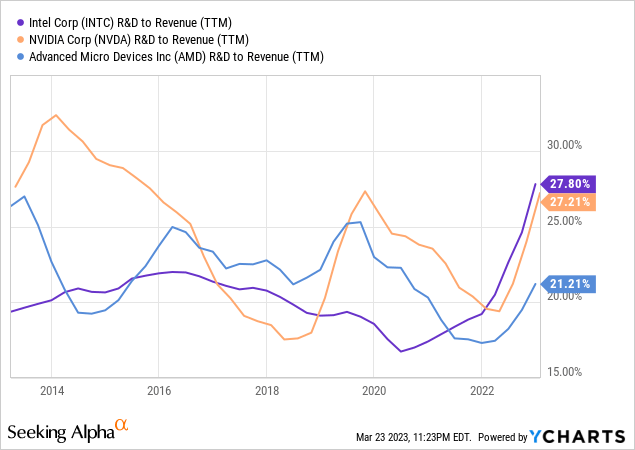

We cannot say that the company does not strive to innovate, investments in research and development [R&D] were massive over the last decade, totaling $133 billion. On average, one fifth of its revenues the company reinvested into R&D.

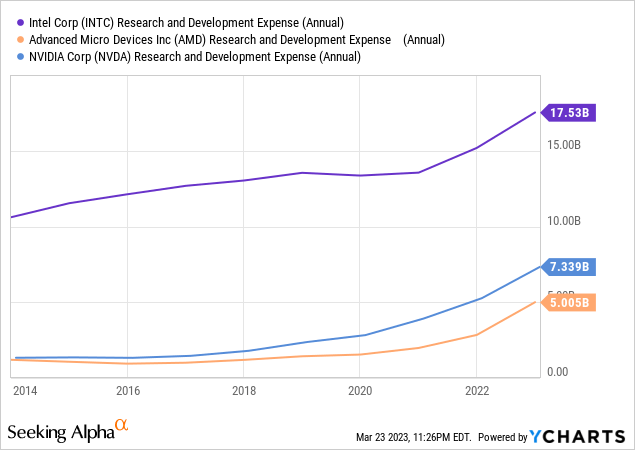

That R&D to revenue ratio is in line with competitors’ ratios, but it is just a ratio and here we should not forget that in absolute numbers Intel’s sales are still much higher than major rivals and were many times higher at the beginning of the decade. So, if we look at absolute R&D figures, we can see that Intel’s total R&D expenses were by far higher than AMD and Nvidia (NVDA) had.

Based on the above figures I can conclude that Intel was not as efficient in innovating as AMD and Nvidia were. And it does not mean that Intel’s management was poor, but that competitors’ management was far better and their fabless model approach seems to be more efficient in developing new products.

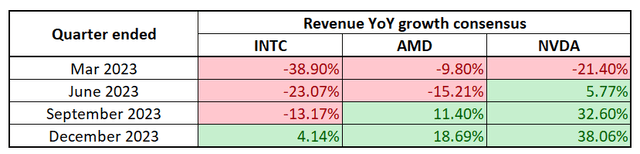

It is not surprising that the company last quarter’s financials missed consensus estimates both in terms of revenue and EPS, and, according to quarterly consensus estimates, there is still pain ahead in next 3 quarters. AMD and Nvidia also expect that Q1 FY2023 will be weaker YoY, but they are expected less and start rebounding earlier and much faster than INTC.

Compiled by the author

Declining financials has led management to reduce its quarterly dividend by approximately two-thirds, from $0.365 per share to $0.125 per share, as announced by the company’s board of directors on February 22. I see an apparent inconsistency between the statement made by Intel’s CFO, Dave Zinsner, during the company’s latest earnings call on January 26, in which he expressed a commitment to maintaining a competitive dividend, and the subsequent 66% dividend cut. Compared to the fact that AMD pays no dividend and Nvidia’s dividend yield is insignificant, Intel’s dividend still looks “competitive”. However, we should not forget that both AMD and NVDA are growth companies and did not aim to provide returns to shareholders in the form of dividends, but instead to increase shareholders’ wealth by increasing the share price, which Intel obviously failed to do in recent years.

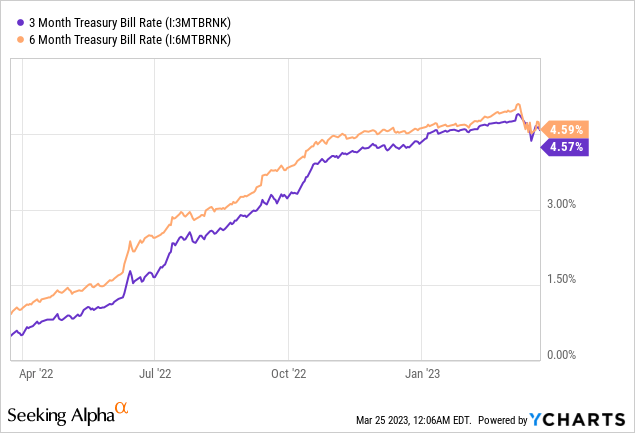

So I do not think that either AMD or Nvidia had the goal of competing with Intel in terms of dividends. Therefore, when assessing whether Intel’s forward dividend yield of 1.72% is competitive or not, I would rather make a comparison with short-term treasury bills, which currently offer investors much higher yields risk-free.

Dividend cut decision logic is obvious – the company needs vast amounts of capital to execute its turnaround IDM 2.0 strategy. The strategy includes three components to achieve sustained technology and product leadership: internal fabs network for at-scale manufacturing, increased use of third-party foundry capacity, and building a world-class foundry business – Intel Foundry Services. The company plans to invest approximately $20 billion in two new manufacturing facilities in Arizona to support its current products and customers and provide committed capacity for foundry customers, creating over 3,000 permanent high-tech, high-wage jobs. Intel also announced a research collaboration with IBM to accelerate semiconductor manufacturing innovation across the ecosystem and improve the competitiveness of the U.S. semiconductor industry.

In my opinion, it is commendable that Intel’s management is trying to strengthen its manufacturing capabilities in order to remain competitive. However, although the company is investing significant sums and management resources in new foundries, competitors without fabs continue to focus exclusively on developing more sophisticated chips. As a result, Intel runs the risk of lagging behind its competitors in terms of technological progress. In addition, Intel has had significant difficulties in recent years in bringing new products to market within the intended timeframe, which suggests that Intel may not succeed in getting new fabs up and running in a timely manner, which will also contribute to widening the gap with AMD and NVDA .

In summary, Intel’s profitability was excellent in the first part of the last decade. Moreover, the company’s revenues are still several times higher than those of Nvidia and AMD. However, we as investors should look ahead and look at the recent dynamics, which do not look rosy. The big turnaround plan will also be a big burden for the company, which I will discuss in more detail in the “Risks to Consider” part of this article.

Valuation

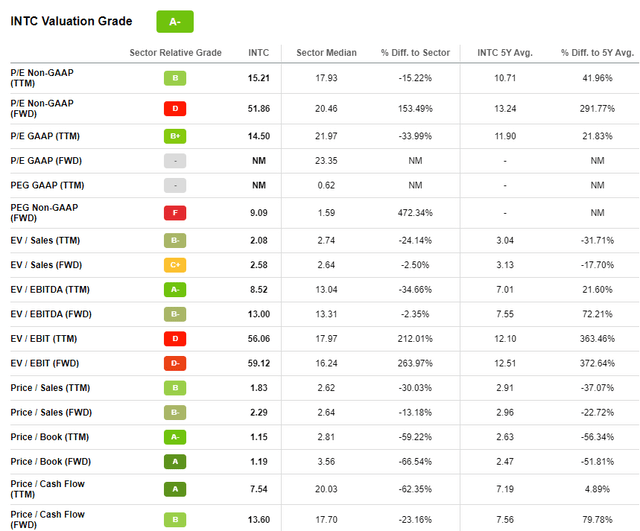

In recent years the market has been severely punishing Intel stock because of decelerating top-line growth rates, especially if compared with other players in semiconductor industry. Therefore, it is not surprising for me that Intel has a very high Seeking Alpha Quant valuation grade of “A-,” indicating attractive valuation.

Seeking Alpha

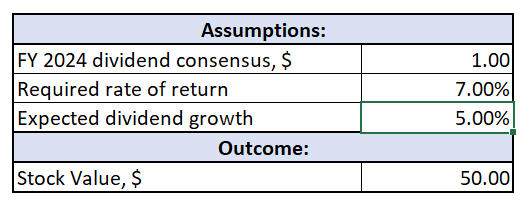

To cross-check multiples I conduct valuation analysis with the help of both dividend discount model [DDM] and discounted cash flow [DCF] model. For both approaches I need discount rate and I use WACC from Gurufocus for these purposes and round it up to 7%.

First, for DDM I use current dividend based on FY2024 dividend consensus estimate which is $1 per share. For dividend growth rate I prefer to be conservative and use 5% growth rate because the company has cut dividend recently and next couple of years will be investing massively in the IDM 2.0 strategy. After incorporating all the assumptions to the DDM I ended up with an outcome indicating a 72% upside potential.

Author’s calculations

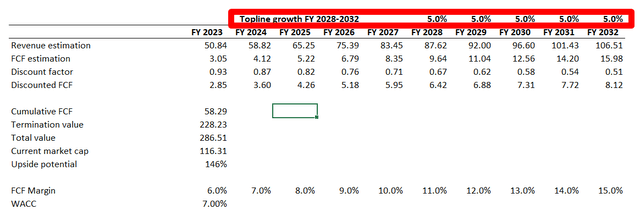

Second, for DCF modeling purposes I need free cash flow [FCF] estimates. I calculate them by multiplying FCF margin by consensus revenue estimates, which are available up to FY 2027 and then implement a top-line CAGR of 5% for years beyond FY 2027. FCF margin is assumed at 6% for the first year and expanding on average by 100 basis points each year. Based on this assumptions, DCF indicates an upside potential of 146%, which is huge in my opinion.

Author’s calculations

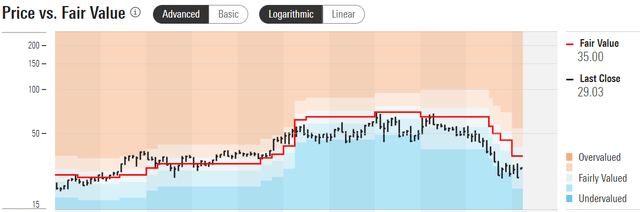

Morningstar Premium weights INTC fair price per share at $35 indicating a double-digit upside potential, but here I would like to emphasize your attention on the below chart where you can see that in last 5 years INTC stock has been consistently trading below Morningstar’s FV assessment.

Morningstar Premium

The valuation analysis suggests a massive undervaluation, but I strongly recommend you to read the following part about the risks to consider thoroughly before expressing any bullish expectations about the prospects of INTC stock.

Risks to consider

I see numerous risks in investing in Intel stocks. There are major risks to consider which I would like to emphasize.

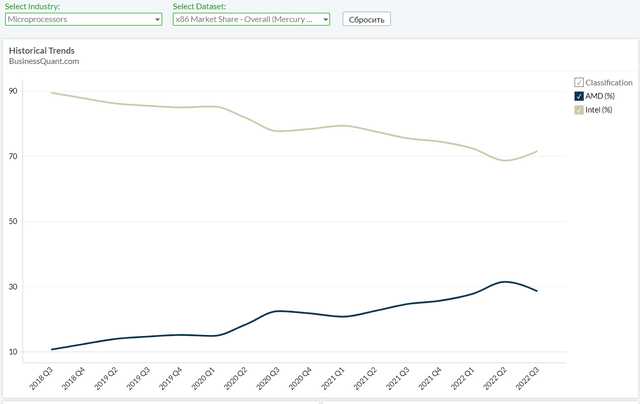

First of all, Intel is facing intense competition from other chip manufacturers, especially AMD and Nvidia, who have been challenging Intel’s dominance over the past decade. According to Business Quant, within just last 4 years, Intel’s market share in x86 CPUs deteriorated from 89.4% to 71.5% which I think is a massive loss.

Business Quant

This market share deterioration urged Intel’s management to take steps for a turnaround, to regain market share and close the technological gap with competitors. That is why the company is company implementing the IDM 2.0 strategy worth of at least $20 billion and will be executed in next couple of years. However, embarking on such a massive project comes with significant risks. One of the major risks is the possibility of cost overruns, which could result in the company having to spend even more money than anticipated. This could have negative consequences on Intel’s financials and could lead to a decline in investor confidence. Another risk is the potential negative consequences of cutting headcount and implementing temporary compensation reductions as a means of cutting costs. This could result in the loss of some of the brightest chip designers in the industry, as well as lower employee morale and a negative impact on the company culture. Additionally, there is always the risk that the company’s competitors will continue to innovate at a faster pace, leaving Intel struggling to keep up. This could result in the company falling further behind its rivals and losing even more market share.

Second risk is general for all chipmakers, but its probability is increasing almost every day and it is called “recession”. This will lead to reduction in demand for PCs, which already significantly deteriorated in 2022. Softening semiconductor demand will hit company’s financials by adversely affecting the top line together with inventory backlog.

Third major risk for Intel which I see is the company’s track-record of delays in launching new products which undermines market share and the company’s dominance. It is obvious that the company still dominates the market in terms of absolute size, but it is also obvious that market share is deteriorating. The company should return public’s faith in its ability to streamline launch of new products, otherwise market share will continue to suffer which is highly likely from my point of view.

Bottom line

In summary, while Intel stock may appear undervalued based on valuation analysis, investors should be cautious before investing in the stock. The risks and uncertainties facing the company are significant, and there are indications that the company will continue to lose market share to its competitors. This is mainly due to Intel’s technological lag in recent years, which has made it difficult for the company to keep up with the rapid pace of innovation in the market CPU.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.