Summary:

- Intel Corporation delivered about the worst quarter we’ve ever seen from a company we cover.

- We reiterate our Accumulate rating.

- Because we don’t think it’s about the numbers, we think it’s about China.

Smiling Not Smiling Lintao Zhang

Numbers Don’t Matter Tonight – They Sure Didn’t Matter Yesterday

Our working hypothesis on Intel Corporation (NASDAQ:INTC) stock is that the fundamentals are almost irrelevant at this point. The U.S. and China are locked in a dance as regards the semiconductor industry. The players are the U.S. and Chinese governments; Intel; Taiwan Semiconductor (TSM) (“TSMC”); and a host of suppliers to the industry, from Tokyo Electron (OTCPK:TOELF) through ASML Holding N.V. (ASML) and beyond.

The U.S. is conducting an aggressive trade war vs China using a range of non-tariff barriers, culminating in national security restrictions on exports to China. You can form your own view on the politics thereof – that’s not our concern here. Our concern here is what does it mean for the semiconductor stocks we cover.

We think the main impact will be what appears to be irrational strength in the U.S. national champion names. The Boeing Company (BA) shows you how this can work. If you read our coverage of Boeing in the last year or so, you’ll know that we’ve said, fundamentals awful, doesn’t matter, stock likely to go up anyway. Which it has. At Boeing, the fundamentals are now improving, and that can now be the narrative behind any further rises in the stock price.

Intel just reported a spectacularly terrible Q4 2022 and declined to provide guidance beyond Q1 this year. Since we are already 1/3 of the way through Q1, Intel Corporation appears to be saying they have no clue what may happen in two months’ time. Unbelievable. This is not in the midst of a macro crisis or a recession, but in a period where GDP is up by a shade under 3%. So, either Intel is very badly managed, or they are losing share, or chip buyers continue to unwind inventory gathered during the supply chain shock, or something else. Anyway – a dreadful quarter.

In staff personal accounts, we have Intel as a long-term hold, and we added to positions today in the wake of this earnings report. Here’s the chart logic.

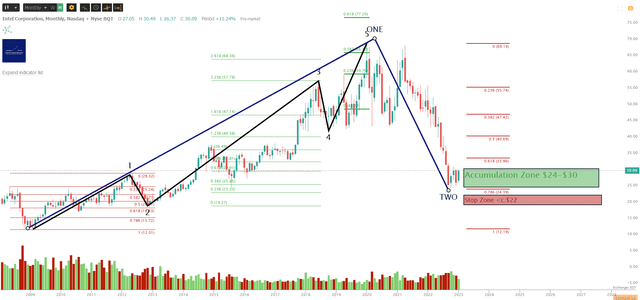

INTC Chart (TrendSpider, Cestrian Analysis)

Intel stock dropped so much from its March 2021 double-top that it didn’t find support until it hit the .786 retracement of the whole move up since the 2009 financial crisis low. (You can open a full-page chart, here).

Right now, the risk/reward of a long position in INTC looks attractive to us. You can place stops a little below that .786 level, as we show above, and try to ride the stock to the upside to see if the MAGA theme plays out. Risk management will be key. If the stock moves into a profitable position, consider using trailing stops to lock in gains in the face of further volatility.

For what it’s worth, here are the numbers.

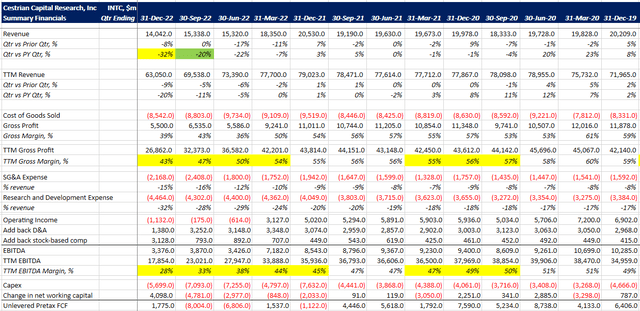

INTC Fundamentals (Company SEC filings, YCharts.com, Cestrian Analysis)

And the valuation metrics:

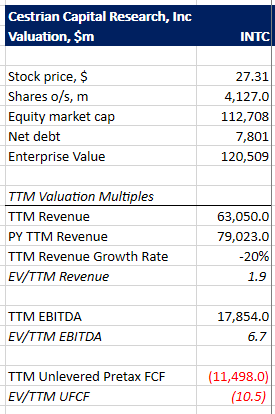

INTC Valuation (Company SEC filings, YCharts.com, Cestrian Analysis)

Accumulate rating, for the reasons above.

Cestrian Capital Research, Inc – 27 January 2023.

Disclosure: I/we have a beneficial long position in the shares of INTC, BA, TSM either through stock ownership, options, or other derivatives. Business relationship disclosure: See disclaimer text at the top of this article.

Additional disclosure: Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, INTC, BA, TSM

DISCLAIMER: This note is intended for U.S. recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

NEW – LOW COST NEWSLETTER FROM CESTRIAN CAPITAL RESEARCH

Our premium Growth Investor Pro service remains the #1 trending service on all of Seeking Alpha. You can learn all about it here – pricing is from $125/month.

But if you’re one of the many people who love our free notes and want to take the a first step with us – at a rock-bottom price – we suggest you join our new Newsletter service here on SA – from just $49/yr. Learn more here.