Summary:

- Intel slashed its dividends by nearly 66%. Are you surprised? You shouldn’t be.

- Before the cut, Intel was expected to post a negative free cash flow of nearly $8B in FY23.

- As such, the original $6B in annualized dividend payout has been reduced closer to the $2B mark.

- Therefore, it has given Intel much better flexibility in investing further to bolster its ability to catch up with TSMC.

Chip Somodevilla

Intel Corporation (NASDAQ:INTC) investors waiting for a steeper pullback into the $20s got one yesterday.

Thanks to its massive dividend cut that slashed its quarterly dividend from $0.365 per share to $0.125 per share (a cut of nearly 66%), income investors likely fled. With the 2Y Treasury yield flashing 4.69%, INTC’s revised dividend yield of 1.96% (based on February 22’s closing price) seems highly unattractive.

However, investors who are still hanging on to their holdings need to consider the perspective of the company’s balance sheet and cash flow priorities.

With INTC yielding 5.2% before the recent cut, we believe market operators had already anticipated that Intel might not sustain its previous dividend policy. Does it make sense?

Note that INTC’s previous 5.2% NTM dividend yield was well above its 10Y average of 3.04%, well above the two standard deviation zone over its 10Y mean. Therefore, it’s pretty clear that investors weren’t totally taken aback by the board’s decision to slash its dividend.

However, it is surprising that management didn’t update its new policy at its recent Q4 earnings call at the end of January. Moreover, CFO David Zinsner highlighted management’s confidence back then:

Well, obviously, we announced a $0.365 dividend for the first quarter. That was consistent with the last quarter’s dividend. I’d just say the Board, management, we take a very disciplined approach to the capital allocation strategy, and we’re going to remain committed to being very prudent around how we allocate capital for the owners. And we are committed to maintaining a competitive dividend. (Intel FQ4’22 earnings call)

Have things changed dramatically over the past month that forced management to overhaul its dividend strategy?

Management held a call with analysts yesterday to discuss the significant change in its capital allocation strategy.

Analysts peppered management with questions about the strategic intent behind the change and whether the company remains on track for its Intel Foundry Services (IFS) transformation.

Gelsinger attempted to assure investors that Intel’s “five nodes in four years” IFS transformation is still on track. However, the company downshifted some CapEx spending in line with the macro weakness.

Despite that, Intel highlighted that it’s seeing “green shoots” across its businesses. We also discussed the potential for bottoming the PC business in our recent AMD (AMD) update, bolstering Gelsinger’s credibility, given Intel’s market leadership.

Accordingly, Intel had already stepped up its cost-optimization strategies, which included cutting remuneration, CapEx, and OpEx. Reaching into its capital allocation plans was likely unavoidable, as the company was still expected to post nearly $8B in negative free cash flow (FCF) in FY23 after last year’s $9.4B outflow.

As such, the savings from an original $6B in dividend payout based on the previous allocation plan to a much lower $2.04B will be significant toward its ability to invest further in its IFS strategy.

Intel remains behind Taiwan Semiconductor Manufacturing Company Limited or TSMC (TSM) in its process leadership. Coupled with rising costs in setting up shop in Arizona, Intel will likely need to balance its needs of returning capital to shareholders relative to its investment to supplant TSMC subsequently.

Gelsinger highlighted the long-term strategic CapEx spending is unchanged, and investments in “shells” will continue as planned. However, the increased spending on process technology/equipment will depend on the momentum of customer uptake.

Therefore, it’s likely still too early for investors to assess whether Intel’s execution can justify the cut in its dividend to mitigate its FCF and leverage ratios.

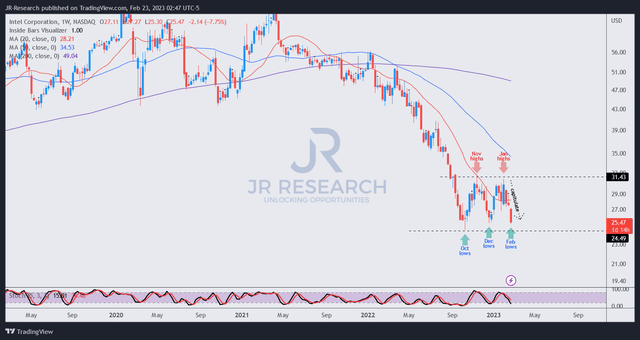

INTC price chart (weekly) (TradingView)

With that in mind, you are likely too late if you have not bailed out.

As seen above, INTC stock has already collapsed toward its December lows and seems to be re-testing its October lows.

However, it seems to be consolidating within a trading range if buyers could return to defend its current levels.

Our assessment suggests that the capitulation move started a few weeks ago, with this week’s selloff simply extending that move. But near-term sellers’ exhaustion could be close, proffering investors waiting for a mid-$20s move to buy more.

Rating: Buy (Reiterated).

Disclosure: I/we have a beneficial long position in the shares of INTC, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!