Summary:

- Intel Corporation tends to announce dividend increases in January.

- While I expect a token dividend increase, I fear a dividend cut is not out of question.

- COVID highs are unlikely to be revisited, but free cash flow decline is nonetheless alarming.

JasonDoiy

Despite not owning shares right now, Intel Corporation (NASDAQ:INTC) is a stock I’ve followed with interest for more than a decade. I’ve owned it profitably in the past, primarily for dividends and undervaluation thesis. Given its range-bound nature, Intel stock is also one of my favorites to sell puts on, where I agree to buy it at a lower price and collect a premium for doing so.

It is not an overstatement to say Intel had a terrible 2022, as the company saw its fundamentals deteriorate and the stock followed with a nearly 50% fall. The only solace for Intel investors is perhaps the fact that the selloff in semiconductors did not exempt even darlings like NVIDIA Corporation (NVDA), which is off about 40% year-to-date.

Intel tends to announce dividend increases in January, as covered here on Seeking Alpha. I am a value investor who loves dividend-paying stocks. So, why am I worried about Intel’s dividend here if the stock has a forward multiple of 14 while yielding more than 5%? Using projected forward earnings per share (“EPS”) (of $1.96), Intel’s payout ratio is around 75%, which isn’t terrible. What gives? Free cash flow.

Why Free Cash Flow over EPS?

When evaluating dividend coverage, most investors and analysts tend to look at earnings per share (“EPS”). I prefer free cash flow (“FCF”) as a better indicator of financial health for these reasons:

- Earnings tend to be up and down depending on rare events and write-offs.

- Earnings are more prone to GAAP-related fluctuations.

- Cash flow is king.

Intel’s Cash Flow Woes

Let us see how Intel’s dividend coverage looks after its most recent quarterly (Q3) result.

- Total shares outstanding: 4.12 Billion

- Current quarterly dividend per share: $0.37

- Quarterly FCF required to cover dividends: $1.5244 Billion

- FCF in Q3: -$6.269 Billion. Yes, you read that right. Negative $6 Billion in cash flow.

- Payout ratio using FCF: NA

Sometimes, a single quarter’s numbers may be exaggerated on either side. So, let us run the same numbers above based on a 12-month period (October 2021 to September 2022, although that is not Intel’s Fiscal Year).

- Total shares outstanding: 4.12 Billion

- Current annual dividend per share: $1.48

- Annual FCF required to cover dividends: $6.097 Billion

- Total FCF for the last 4 quarters: -$13.315 Billion. Ouch!

- Payout ratio using 4 quarters’ FCF: NA.

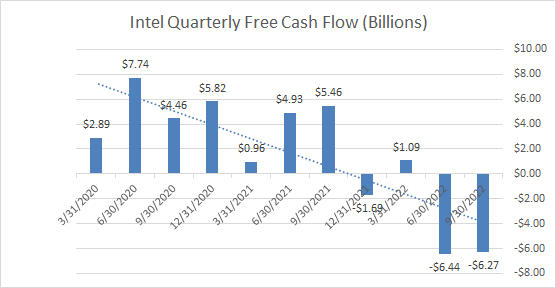

The COVID tailwind is extremely obvious in the chart below. In the first full quarter immediately following the COVID crash, June 2020, Intel recorded its highest FCF dating back to at least 2010. Since that peak, the trend has been down, as shown in the chart below. Granted, Intel has always been a cyclical company even at its peak, with more ebbs and flows than a typical company. But to have four consecutive quarters where the free cash flow did not even meet the dividend payments is cause for concern.

INTC FCF (Compiled by author with data from YCharts.com)

Leaving out the two outliers ($7.74 Billion in June 2020 and -$6.44 Billion in June 2022), the average quarterly free cash flow in the last 5 years works out to about $2.5 Billion. That gives Intel a free cash flow based payout ratio of 60%. So should things revert to some sort of a normal for Intel and semiconductor demand in general, that payout ratio should be comforting. However, just like with weather predictions, you are better off predicting the next quarter (on average) is closer to the current quarter than to the one from 2 years ago. That means, I expect continuing free cash flow weakness well into 2023 before a reversion to the mean (~$3 Billion/quarter).

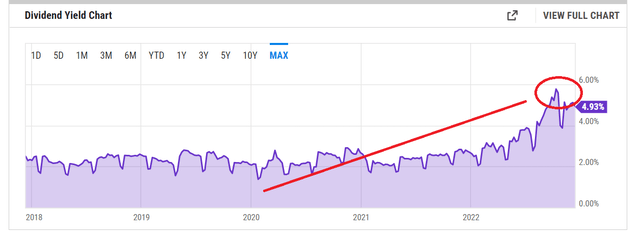

Yield Is Increasing – But Means Matters

An increasing yield is not always good. Declining free cash flow and higher dividends do not make a long-lasting combination that dividend growth investors will appreciate. The increase in yield (shown by the red line) coincides with declining free cash flow and is primarily due to falling share price.

There are only a few ways a company can pay its dividends: by earning (which includes cutting expenses) or by borrowing.

- Earnings are expected to shrink by 4%/yr for the next five years.

- Intel’s long-term debt is already close to five-year highs and in the current high interest rate environment, it is hard to see them borrowing more just to pay dividends.

Business Outlook

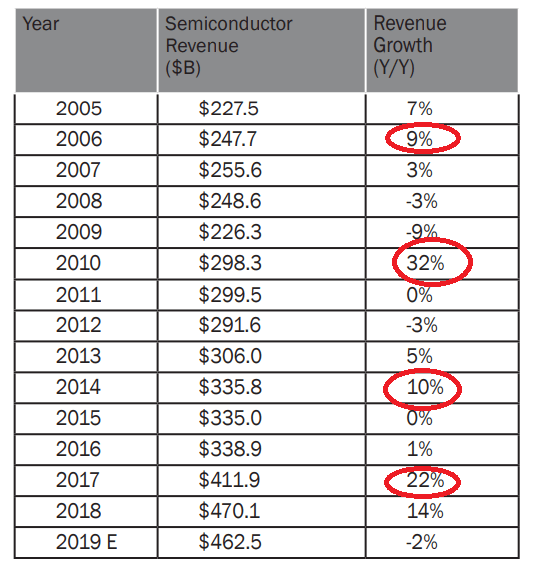

The COVID-infused demand is clearly a thing of the past with demand slumping across the board including PCs and gaming. This is not an Intel-specific situation, which makes it all the more challenging for them to overcome. The semiconductor industry is Cyclical by nature and companies like Intel have been through a lot of cycles as shown in the table below. The typical turn-around period (to return to meaningful positive revenue growth after a recent peak) has generally been about three years (red circles).

This time the challenge is that the demand was fueled by a one-time event (COVID) and almost every company (even outside semiconductor) over-expanded and over-hired. Hence, it won’t be a surprise to see semiconductors return to positive revenue growth well beyond 2023.

Semi Cycles (www.regions.com)

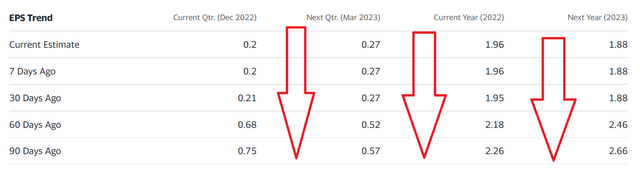

The CFO’s recent comments about estimates being too high do not bode well, as insiders are generally more optimistic on the surface. The seriousness of this comment gets underlined when you see how much estimates have fallen in the last 90 days across the board for Intel.

INTC Estimates (Yahoo Finance)

Conclusion

Putting all these together, it doesn’t appear like Intel is positioned for much dividend growth here, and it may not be a stretch to say Intel is at the risk of reducing its dividend if 2023’s free cash flow does not recover to at least 2019’s levels.

To conclude, below is how I summarize the different odds when it comes to Intel’s dividend announcement in January:

- Small dividend increase: 50%

- Freeze (Same dividend): 40%

- Dividend cut: 10%

- Dividend elimination: 0%

Intel management may not want to press the panic button yet and is likely to take a wait-and-see approach as to how 2023 evolves. Hence, they are likely to offer a small increase in January to not turn away more investors. A middle-of-the-road approach cannot be ruled out, where Intel maintains the same dividend for a couple of years as it did in 2013/2014. A dividend cut is a small risk right now but a risk, nonetheless.

Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.